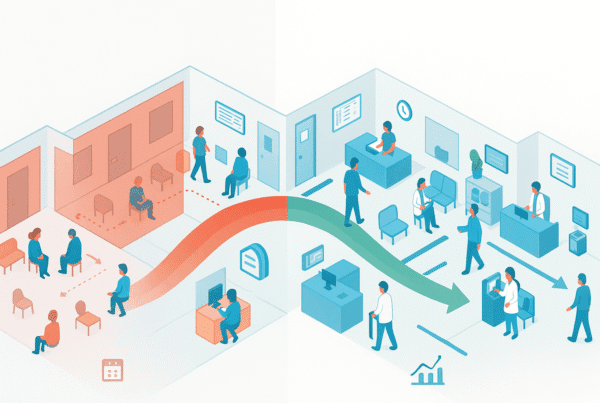

After selling your medical practice, your relationship with the business you built doesn’t just end. It transforms. For many physicians, this new chapter is defined not by a traditional employment contract, but by a Professional Services Agreement (PSA). This document is one of several critical post-acquisition structures that will dictate your role, your compensation, and your day-to-day life after the deal closes.

Understanding how a PSA works is essential. This agreement can offer greater flexibility and tax advantages, but it comes with complexities and compliance risks that demand careful attention. Here, we’ll break down what a PSA is, what to look for in the fine print, and how to negotiate an agreement that works for you.

What is a PSA? And Why Choose It Over Employment?

A Professional Services Agreement is a formal contract between a healthcare entity (like a hospital or MSO) and a physician’s practice. Instead of hiring you as a W-2 employee, the acquirer contracts with your professional corporation (or you as an individual) for the provision of specific clinical and administrative services. You effectively become an independent contractor.

This structure is common in healthcare M&A for several reasons. It can be a practical solution in states with strict corporate practice of medicine restrictions, which limit who can own a medical practice and employ physicians. It also offers physicians a way to maintain their existing business entity, which can offer significant tax and operational benefits.

But how does it really differ from a standard employment contract?

| Feature | Professional Services Agreement (PSA) | W-2 Employment Contract |

|---|---|---|

| Your Status | Independent Contractor | Employee |

| Tax Implications | You receive 1099 income; responsible for your own taxes and withholdings | Employer withholds taxes from your paycheck (W-2 income) |

| Benefits | Typically not included; you pay for your own health insurance, retirement, etc. | Employer-sponsored benefits package (health, 401k, malpractice) |

| Operational Control | Agreement defines services, but you may retain more control over how they are performed | Employer has more direct oversight of work, hours, and methods |

Deciding between these structures is a major decision. For a deeper look into the specifics of direct employment, see our guide to physician employment contracts.

The Anatomy of a Healthcare PSA: Key Clauses to Scrutinize

A PSA is a legally binding document that governs your entire professional relationship with the acquirer. Every clause matters, but you must pay special attention to the following sections.

-

Scope of Services

Your PSA must clearly and specifically list every service you are being paid to provide. These should be broken out, often in an appendix, between “Practitioner Services” (direct patient care) and “Medical Administrative Services” (medical directorships, supervision, committee work). Vague descriptions can lead to scope creep, where you are expected to do more work than you are paid for. -

Compensation and Payment Terms

This section details how much, when, and how you will be paid. The compensation must be set in advance and reflect the Fair Market Value (FMV) of your services. Any formula tied to the volume or value of referrals is a major red flag. -

Term and Termination

Look for the contract’s duration, which is typically one to three years. Pay close attention to the conditions for renewal and, more important, for termination. The agreement should clearly outline the notice period required for either party to end the relationship, both “for cause” (a breach of contract) and “for convenience” (without cause). -

Regulatory Compliance

This section will include representations from both parties that they are in good standing and not excluded from federal healthcare programs. It also codifies the agreement’s adherence to all relevant laws. Failing to structure these agreements correctly can lead to serious Stark Law and Anti-Kickback challenges. -

Performance and Quality Metrics

The acquiring organization will want to measure your performance. The PSA should define the quality metrics, reporting obligations, and patient satisfaction standards you will be held to. Ensure these are clinically relevant and realistically achievable.

Compensation in PSAs: Ensuring Fair Market Value and Compliance

In a PSA, compensation is not just a business term; it’s a legal one. The federal government requires that all payments reflect Fair Market Value (FMV) for the services rendered. This rule is designed to prevent hospitals and MSOs from using inflated PSAs to illegally reward physicians for patient referrals.

Your compensation through a PSA arrangement can take many forms:

– Flat Fee: A fixed monthly or annual stipend, common for medical directorships.

– Per Service or Hourly: A set rate for each service performed or hour worked.

– Collections-Based: A percentage of the revenue collected for your specific services.

– Blended Model: A combination of the above, such as a base stipend plus productivity incentives.

Industry data shows that FMV for clinical services in 2024 averaged between $110 to $160 per RVU for specialties like family practice and internal medicine. Administrative medical director stipends often range from $30,000 to $75,000 annually, depending on the scope of duties. Any compensation package must be commercially reasonable and justifiable. The best way to ensure this is with a third-party valuation from a reputable firm.

A Practical Checklist for PSA Negotiation

Never accept a boilerplate PSA at face value. Use this checklist as a guide to negotiate an agreement that secures your interests.

- [ ] Define All Services in an Exhibit: Insist on a detailed exhibit that lists every clinical and administrative duty. This prevents future disputes over your responsibilities.

- [ ] Validate Compensation with an FMV Opinion: Do not guess at Fair Market Value. Engage a third-party expert to analyze and certify that your compensation is compliant.

- [ ] Scrutinize Termination Clauses: Ensure you have a reasonable “without cause” termination clause that gives you a viable exit strategy.

- [ ] Clarify Performance Metrics: Make sure you understand how your performance will be measured and that the metrics are fair and transparent.

- [ ] Confirm Insurance and Indemnification: The PSA should specify who is responsible for malpractice insurance (tail coverage included) and provide indemnification for liabilities arising from your duties.

- [ ] Get Everything in Writing and Signed: All terms must be documented in a written agreement signed by both parties. Verbal promises are unenforceable.

SovDoc Pro Tip: Acquirers often present their standard PSA template as a take-it-or-leave-it document. It never is. Every clause can and should be reviewed by your legal counsel to fit your specific role and protect your interests.

Making Your PSA Work for You

A Professional Services Agreement can be an excellent tool for structuring your post-sale relationship with an acquirer, offering flexibility and autonomy that a W-2 role might not. However, its value depends entirely on the quality of the agreement itself. A poorly drafted PSA can expose you to significant financial and legal risk.

This is not a process you should handle alone. The complexities of FMV, Stark Law, and contract negotiation require specialized expertise.

If you are navigating a practice sale and need to structure a PSA that protects your financial interests and professional autonomy, contact the SovDoc team. We ensure your post-close agreements are as strong as the deal itself.

Frequently Asked Questions

What is a Professional Services Agreement (PSA) in healthcare practice sales?

A Professional Services Agreement (PSA) is a business-to-business contract where a physician’s practice or the individual physician acts as an independent contractor providing clinical and administrative services to a healthcare entity, such as a hospital or MSO. It defines the new working relationship post-practice sale, offering flexibility beyond a standard employment contract.

How does a PSA differ from a traditional W-2 employment contract?

In a PSA, the physician is an independent contractor receiving 1099 income and responsible for their own taxes and benefits, retaining more operational control. In contrast, a W-2 employment contract makes the physician an employee with employer-tax withholding, benefits, and greater employer oversight over work hours and methods.

What key clauses should I look for in a healthcare PSA?

Important clauses include Scope of Services (being specific about clinical and administrative duties), Compensation and Payment Terms (must reflect Fair Market Value and avoid referral-based formulas), Term and Termination (contract length and exit terms), Regulatory Compliance (including adherence to Stark Law and Anti-Kickback statutes), and Performance and Quality Metrics (realistic and clinically relevant standards).

How is compensation structured in a PSA, and what ensures it is fair?

Compensation must reflect Fair Market Value (FMV) to comply with federal law. Payment models include flat fees, per-service rates, collections-based shares, or blended approaches. FMV rates vary by specialty and service. Engaging a third-party valuation expert is crucial to validate that compensation is commercially reasonable and compliant.

What practical steps should I take to negotiate a PSA effectively?

Before signing, use a checklist: define all services in a detailed exhibit, obtain a third-party FMV analysis, scrutinize termination clauses for fair exit options, clarify performance metrics, confirm insurance and indemnification responsibilities, and ensure all terms are in a signed written agreement. Legal counsel should review the entire agreement to protect your interests.