Selling your New Hampshire ENT practice is a major decision. Whether you plan to sell next year or in the next five, the time to start preparing is now. Buyers value proven performance, not just potential. Starting the process early allows you to organize your financials, optimize operations, and fix issues that could lower your value. This preparation ensures you are in control and can sell on your terms, not a buyer’s.

The New Hampshire ENT Market Landscape

The market for medical practices in New Hampshire is active. Like in many places, there is a trend toward consolidation. Independent practices are increasingly being acquired by larger health systems, multi-specialty groups, and private equity-backed platforms. For an ENT specialist in the Granite State, this presents both challenges and opportunities. The state’s demographics, particularly its aging population, help create a steady demand for otolaryngology services, making established practices an attractive asset.

Buyers today are sophisticated. They are not just looking for a patient list. They are looking for well-managed businesses with clean financial records, stable referral patterns, and potential for growth. Whether the potential buyer is a local hospital system seeking to expand its specialty network or a national group entering the region, they will conduct thorough due diligence. Being prepared for this scrutiny is the key to a smooth process and achieving a premium valuation.

Key Questions to Answer Before You Sell

A successful sale starts with clarity long before you ever speak to a buyer. It begins with an honest assessment of your own goals and your practice’s health. Answering these questions will provide a solid foundation for your exit strategy.

-

Why am I really selling? Are you ready for retirement, feeling burnt out, or seeking a strategic partner to handle the business side of medicine? Your motivation will shape the type of buyer and deal structure that is best for you.

-

Is my house in order? Buyers will perform a deep dive into your practice. You should first. This means having at least three years of clean profit and loss statements and tax returns, resolving any outstanding legal issues, and ensuring all your corporate documents are current.

-

What happens to my staff? Your team has been a large part of your success. You need to consider their future. Thinking through who is critical to the practice’s continued success can be a factor in negotiations.

-

What is my ideal role after the sale? Do you want to walk away completely? Or would you prefer to stay on for a transition period, or even continue practicing as an employee of the new entity? Defining this early helps narrow down the right buyers.

Understanding Current Market Activity

Right now, the M&A market for strong specialty practices is competitive. In New Hampshire, you are likely to see interest from two main types of buyers. The first are strategic buyers, such as local hospitals or larger regional physician groups, who want to integrate your ENT practice into their existing network. The second are financial buyers, like private equity groups, who see your practice as a platform for future growth. These buyers often bring significant business resources to the table.

This level of interest is good news for sellers. It creates a competitive environment that can lead to higher valuations and better deal terms. However, many owners who fear losing control are surprised to learn that a sale is not an all-or-nothing event. Many modern deals, especially with financial partners, are structured to keep physicians in leadership roles with significant clinical autonomy. The key is to run a confidential, structured process that brings multiple qualified buyers to the table, rather than just reacting to a single, unsolicited offer.

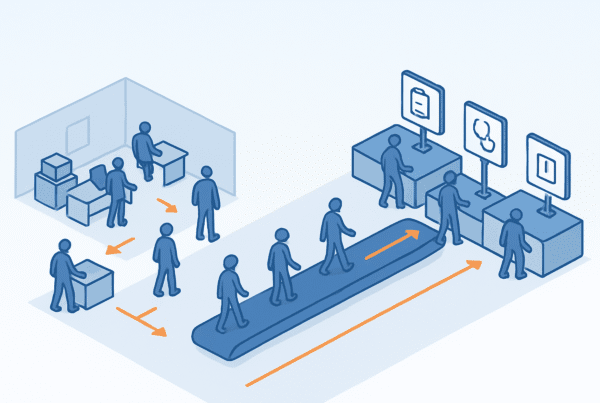

A Map of the Sale Process

While every practice sale is unique, the journey follows a proven path. Understanding these stages helps you prepare for what is ahead and avoid common pitfalls.

1. Strategic Preparation

This is the work you do before going to market. It involves cleaning up your financial statements, organizing key documents, and getting a clear, objective understanding of your practice’s value. This stage sets the foundation for everything that follows.

2. Confidential Marketing

Finding the right buyer is not about putting a “for sale” sign on the door. It is a targeted and confidential process. We work with owners to identify an ideal buyer profile and then approach a curated list of potential partners without revealing the practice’s identity until a confidentiality agreement is in place.

3. Negotiation and Due Diligence

Once offers are received, the negotiation phase begins. This covers not just the price, but also the structure of the deal, your future role, and employee considerations. After a letter of intent is signed, the buyer conducts formal due diligence, where they verify all the information you have provided. Proper preparation makes this step much smoother.

4. Closing and Transition

The final stage involves working with attorneys to finalize the sales contract and planning for a smooth handover. This ensures your patients and staff are cared for and your legacy is protected.

How Your ENT Practice is Valued

Many physicians believe their practice is not worth enough to sell, or they rely on simple rules of thumb. The reality is often much better. Sophisticated buyers do not look at your net income. They look at a figure called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This metric adds back owner-specific perks and non-recurring costs to show the true cash flow of the business. Most practices are undervalued until this is done correctly.

Your final valuation is typically this Adjusted EBITDA number multiplied by a “multiple.” That multiple is not fixed. It changes based on several factors, as different practice attributes can increase or decrease perceived risk and growth potential for a buyer.

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Model | Solo / Owner Reliant | Associate-Driven |

| Growth | Stagnant / Flat | Consistent YOY Growth |

| Ancillary Services | Few or None | Allergy, Audiology, etc. |

| Scale / Revenue | Under $1M | Over $3M |

A comprehensive valuation is the foundation of a successful sale. It is about more than math. It is about telling the story of your practice in a way that buyers understand and value.

Planning for Life After the Sale

The day you close the deal is a beginning, not an end. A successful transition protects your financial outcome, your legacy, and the people who depend on your practice. Planning for these post-sale realities should happen long before you sign the final papers.

-

Ensuring a Smooth Transition. Your top priority after a sale is retaining patients and staff. A well-designed communication plan is key. This involves how and when you inform patients, employees, and your key referral sources about the change in ownership. A good plan can mean the difference between retaining 90% of your patient base versus 60%.

-

Understanding Your Tax Consequences. How the sale is structured has a major impact on your net proceeds. An “Asset Sale” versus an “Entity Sale” can mean a significant difference in your tax bill. Understanding these structures and negotiating the one that is best for your financial situation is a critical, and often overlooked, part of the deal.

-

Defining Your Non-Compete Agreement. Nearly every sale includes a non-competition agreement. It is important that this agreement is clearly defined and reasonable. It should specify a fair geographic area and time period, allowing you to pursue other interests without being unfairly restricted. This is a key point of negotiation.

Frequently Asked Questions

Why should I start preparing to sell my New Hampshire ENT practice early?

Starting early allows you to organize your financials, optimize operations, and fix issues that could lower your practice’s value. Buyers value proven performance, so early preparation ensures you can sell on your terms, not just the buyer’s.

What types of buyers are interested in New Hampshire ENT practices?

There are typically two types of buyers: strategic buyers such as local hospitals or physician groups looking to expand their specialty network, and financial buyers like private equity groups seeking growth platforms. Understanding these buyer types helps tailor your sale approach.

How is the value of my ENT practice determined?

Valuation is based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which reflects true cash flow by adding back owner-specific perks and non-recurring costs. This figure is multiplied by a variable “multiple” depending on factors like provider model, growth, ancillary services, and revenue size.

What are the key steps in the ENT practice sale process in New Hampshire?

The sale process includes four main stages:

- Strategic Preparation: Organizing financials and documents.

- Confidential Marketing: Targeting ideal buyers discreetly.

- Negotiation and Due Diligence: Agreeing on terms and verifying practice details.

- Closing and Transition: Finalizing the sale and ensuring smooth handover for patients and staff.

What should I plan for life after selling my ENT practice?

Post-sale planning is crucial. Focus on:

- Ensuring a Smooth Transition: Communicate carefully to retain patients and staff.

- Understanding Tax Consequences: Know how sale structure affects your taxes.

- Defining Non-Compete Agreements: Negotiate fair terms regarding geographic and time restrictions to protect your future interests.