Selling your Wound Care practice is a significant decision. The current Indiana market presents unique opportunities for owners, but navigating the process requires a clear understanding of your practice’s value and the motivations of today’s buyers. This guide provides a straightforward look at the key factors you should consider, from valuation to post-sale planning, to help you prepare for a successful transition. Proper preparation is the first step toward achieving your personal and financial goals.

The Indiana Wound Care Market Overview

The market for Wound Care practices in Indiana is strong. An aging population and the increasing prevalence of chronic conditions like diabetes and vascular disease are driving consistent demand for specialized wound management. This reality has not gone unnoticed. We see active interest from two main groups: regional health systems aiming to complete their continuum of care, and private equity investors looking to build specialized healthcare platforms. This creates a competitive landscape for well-run practices. For you, this means there are likely multiple types of motivated buyers, but each comes with different goals and visions for your practice’s future.

Key Considerations for Your Practice

Before you engage with any potential buyer, it’s wise to look inward at your own operations. A buyer will scrutinize these areas to determine risk and value. Optimizing them beforehand puts you in a much stronger negotiating position.

Referral Network Stability

How dependent are you on a few key referral sources? A diversified and loyal referral base from various physicians, hospitals, and long-term care facilities is a significant asset. A buyer sees this as predictable revenue.

Provider Dependency

Is the practice’s success tied entirely to you, the owner? Practices with associate physicians or nurse practitioners who have strong patient relationships command higher valuations. It demonstrates that the business can thrive beyond your direct involvement, which is a major point for any new owner.

Payer Mix and Reimbursement

A healthy mix of Medicare, Medicaid, and commercial insurance payers shows stability. We often help owners analyze their reimbursement rates and contracts before a sale. Sometimes, a simple renegotiation can significantly lift profitability and, therefore, the final sale price.

Understanding Current Market Activity

Activity in the Indiana M&A space is brisk, but strategic. Buyers are not just looking for any practice; they are looking for practices that fit a specific need. Hospitals often acquire wound care centers to prevent patient leakage to other systems and to support their surgical and inpatient services. Private equity buyers, on the other hand, are often executing a “buy and build” strategy. They seek a strong initial practice to serve as a “platform” and then acquire smaller practices to expand their geographic footprint and operational efficiency. Understanding which type of buyer you are talking to is critical because it shapes the entire negotiation and the future of your legacy.

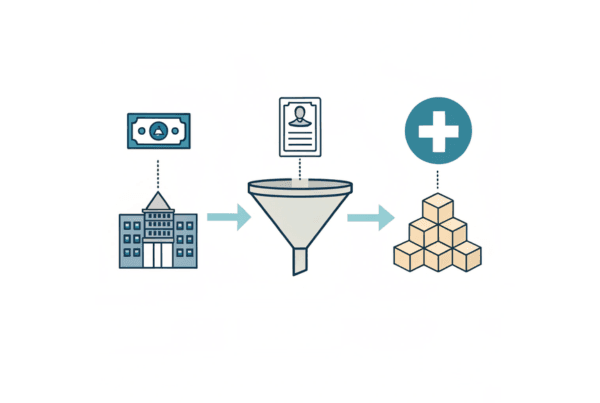

The 4 Stages of the Sale Process

Many owners feel the sale process is a mysterious black box. It s not. It s a structured journey that can be managed smoothly with proper guidance. Most successful transactions follow four distinct stages.

- Preparation and Valuation. This is the most important phase. It involves organizing your financial records, normalizing your earnings to calculate a true Adjusted EBITDA, and getting a comprehensive, market-based valuation. This is also when you start thinking about your personal goals for the sale. Many sale-process issues can be avoided with good work here.

- Confidential Marketing. Your advisor confidentially presents the opportunity to a curated list of qualified buyers. This process is designed to create competitive tension and generate multiple offers without your staff or competitors knowing you are exploring a sale.

- Negotiation and Due Diligence. After selecting the best offer, you move into a formal due diligence period. The buyer will verify all financial, clinical, and operational information. This is where unorganized records or unprepared answers can cause delays or even kill a deal.

- Closing and Transition. Once due diligence is complete, lawyers finalize the legal agreements. The deal is signed, funds are transferred, and you begin the transition to new ownership according to the plan you established.

How Your Practice is Valued

One of the first questions every owner asks is, “What is my practice worth?” It s a common mistake to use a simple rule of thumb, like a percentage of revenue. Sophisticated buyers don t do that. They value your practice based on its risk and cash flow, primarily using a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your practice’s true earning power by adding back personal expenses or one-time costs. Your Adjusted EBITDA is then multiplied by a market-based multiple. This multiple is influenced by factors like your practice’s size, growth rate, and the key considerations we mentioned earlier. A smaller practice might see a 4-5x multiple, while a larger, multi-provider group could command 7x or more.

Planning for Life After the Sale

A successful exit is not just about the price. It is about structuring a deal that aligns with your long-term personal and financial goals. The work does not end when the check clears. Planning for the post-sale period during the negotiation is one of the most important things you can do. It’s important to think about these things early in the process.

| Consideration | Why It Matters for You |

|---|---|

| Your Future Role | A key part of the deal is deciding what you will do next. You can retire completely, stay on as a practicing physician for a few years, or roll over some of your equity and partner with the new owner for future growth. |

| Staff & Legacy | You have likely spent years building a dedicated team. A good transition plan ensures your staff is treated fairly and your patients continue to receive excellent care, protecting the legacy you built. |

| Deal Structure | The structure of your sale has major tax consequences. A mix of cash at close, a potential earnout based on future performance, and retained equity can significantly change your net proceeds. |

Frequently Asked Questions

What are the main market trends affecting the sale of Wound Care practices in Indiana?

The market is strong due to an aging population and increased chronic conditions like diabetes. Two main buyer groups are active: regional health systems and private equity investors, creating a competitive marketplace.

How is the value of a Wound Care practice in Indiana determined?

Value is mainly based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which reflects true earning power. This figure is multiplied by a market-based multiple influenced by practice size, growth rate, and operational factors. Smaller practices get a 4-5x multiple, larger groups 7x or more.

What should I consider about my referral network before selling?

Diversifying your referral sources across physicians, hospitals, and care facilities increases the practice’s appeal, as buyers value a stable and predictable revenue stream from a loyal referral base.

What are important factors related to staff and provider dependency when selling?

Having associate physicians or nurse practitioners who maintain strong patient relationships enhances valuation by showing the practice can thrive beyond just the owner’s involvement, reducing risk for buyers.

How should I plan for life after selling my Wound Care practice?

Consider your future role (retirement, staying on, or partnering), ensure fair treatment of your staff and continuity of patient care, and carefully structure the deal for tax and financial benefits, possibly mixing cash, earnouts, and equity.