Selling your hospice or geriatric practice is a significant decision. In New Mexico, strong demographic trends are creating a unique window of opportunity for owners. The demand for quality end-of-life and geriatric care is increasing. This guide provides a clear overview of the market, the sale process, and how to position your practice for a successful transition. Proper preparation before the sale can significantly increase your final practice value.

Market Overview

The market for hospice and geriatric care in New Mexico is defined by powerful demographic tailwinds. You are likely seeing this on the ground, but the numbers confirm it. The state s population aged 65 and over grew by nearly 44% in a single decade and now represents a larger share of the population than the national average. This is not a temporary trend. Projections show this segment will continue to expand for the next 20 years.

This sustained growth in the senior population directly fuels demand for your services. It creates a very favorable environment for practice owners considering a sale. Buyers, from private equity groups to larger strategic healthcare systems, are actively seeking opportunities in markets like this.

Key market drivers include:

1. A rapidly aging population, creating a steady, predictable increase in the patient base.

2. Strong national growth in the hospice sector, with buyers confident in the industry’s future.

3. A clear need for quality care providers, making established, reputable practices highly attractive acquisition targets.

Key Considerations for Sellers

Beyond the strong market numbers, sophisticated buyers will look closely at the inner workings of your practice. Getting ahead of their questions is a critical part of the preparation process. A well-prepared practice can command a premium valuation.

Regulatory Cleanliness

Buyers are extremely risk-averse. They will conduct deep diligence on your compliance with all state and federal regulations, especially CMS rules for Medicare and Medicaid. Having your licenses, accreditations, and compliance records perfectly organized is not just a formality. It is a signal of a low-risk, high-quality operation.

Staff and Operations

Your team is one of your most valuable assets. Buyers will want to see strong staff retention and understand the stability of your clinical team. A practice that can demonstrate a loyal, qualified staff and efficient operational workflows is much more attractive than one heavily dependent on the owner.

Referral Network

Where do your patients come from? Documenting your established referral relationships with hospitals, physician groups, and assisted living facilities is key. A diverse and stable referral base proves the sustainability of your revenue and reduces the perceived risk for a new owner.

Market Activity

One of the first things owners do is search online for what similar practices have sold for. In New Mexico’s hospice market, you will likely find that information is difficult to come by. While a few public listings exist, such as an accredited agency in Sunland Park listed for $475,000, these represent only a fraction of the market.

The most significant transactions happen privately. They do not appear on public websites. This creates a challenging environment for owners trying to gauge their practice’s value or the right time to sell. It is a market where inside knowledge is a major advantage.

An effective sale process relies on:

1. Access to private data on comparable sales to ensure accurate pricing.

2. Connections to a curated database of qualified buyers who are actively looking for acquisitions in the region.

3. The ability to create a competitive environment among buyers confidentially, which drives up the final sale price.

The Sale Process

A successful practice sale is not an event. It is a structured process. Understanding the path forward can remove much of the uncertainty and give you control. We see the journey in three main phases.

Preparation and Valuation

This is the most important phase and should begin long before you plan to sell. It involves gathering financial documents, organizing operational information, and getting a clear, professional valuation. This is when you build the story of your practice and prepare it to be presented to discerning buyers. A formal valuation sets a realistic price expectation and forms the foundation of your entire strategy.

Confidential Marketing

Your practice should never be “listed” like a piece of real estate. A professional process involves creating a confidential information memorandum and approaching a pre-vetted list of strategic buyers and investors privately. This protects your staff and patients from uncertainty while creating a competitive dynamic among interested parties to maximize your offers.

Diligence and Closing

Once you accept an offer, the buyer will begin due diligence. This is an intense review of your financials, operations, and legal compliance. Being prepared for this step is critical. Many deals encounter problems here if the initial preparation was not thorough. An advisor’s role is to manage this process, handle negotiations, and guide you and the legal teams to a smooth closing.

How Your Practice is Valued

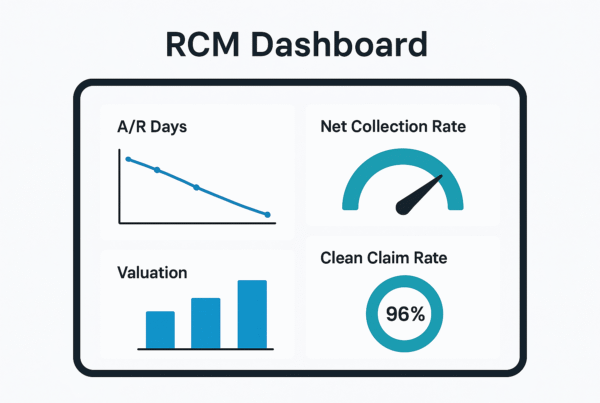

Valuing a hospice or geriatric practice is more than plugging numbers into a formula. While industry rules of thumb, like $60,000 per patient, can provide a starting point, sophisticated buyers base their offers on a multiple of your Adjusted EBITDA.

Adjusted EBITDA is a measure of your practice’s true cash flow. We calculate it by taking your net income and adding back interest, taxes, depreciation, amortization, and any owner-specific or one-time expenses. This presents the clearest picture of the business’s profitability to a new owner.

The valuation multiple applied to that EBITDA is not fixed. It is influenced by several factors. A higher quality practice commands a higher multiple.

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Model | Owner-dependent | Associate-driven clinical team |

| Referral Sources | Concentrated on 1-2 sources | Diverse, stable relationships |

| Compliance | Disorganized records | Meticulous, audit-ready files |

| Growth | Stagnant patient census | Verifiable growth trajectory |

An expert valuation uncovers the true earnings potential and frames the narrative to achieve the highest possible multiple.

Planning for Life After the Sale

The transaction is not the finish line. A successful transition is one where you are prepared for what comes next. Thinking about these issues early in the process ensures the final deal structure aligns with your personal and financial goals. For a smooth transition, you should consider:

First, your future role. Do you want to retire immediately, or would you prefer to continue practicing for a few years? Your desired path will influence the type of buyer and deal structure that is right for you. Some partners may want you to stay on to ensure a smooth transition.

Second, the future of your team. You have built a dedicated team, and their well-being is important. The right buyer will share your commitment to quality care and provide a stable, supportive environment for your staff. This is a key point of negotiation.

Finally, your financial outcome. The deal structure has major tax implications. How the deal is classified, whether as an asset or entity sale, can significantly change your net proceeds. Planning for a tax-efficient sale structure from the beginning is one of the most important forms of a financial advisor’s guidance.

Frequently Asked Questions

What are the key market trends influencing the sale of hospice and geriatric practices in New Mexico?

The market in New Mexico is driven by a rapidly aging population, with the 65+ demographic growing by nearly 44% in a decade and a demand increase in quality end-of-life and geriatric care. This demographic trend is expected to continue for 20 years, creating a favorable environment for sellers as buyers actively seek opportunities.

What do buyers focus on when evaluating a hospice or geriatric practice for purchase in New Mexico?

Buyers prioritize regulatory cleanliness, including compliance with CMS Medicare and Medicaid rules, as well as proper licensure and accreditation. They also value strong staff retention, an efficient operational workflow, and a diverse, stable referral network that demonstrates sustainable revenue.

How is a hospice or geriatric practice valued when considering a sale?

Valuation is typically based on a multiple of Adjusted EBITDA rather than just a simple per-patient formula. Factors influencing the multiple include the provider model (owner-dependent vs. associate-driven), referral source diversity, compliance organization, and growth potential. A high-quality practice with solid metrics commands a higher multiple.

What are the main phases of the sale process for a hospice or geriatric practice in New Mexico?

The sale process includes three main phases: 1) Preparation and valuation, where financial and operational information is gathered and a professional valuation is conducted; 2) Confidential marketing, where a private memorandum is shared with vetted buyers to maintain confidentiality and competition; and 3) Due diligence and closing, involving in-depth buyer review and negotiation to finalize the sale.

What should sellers consider for life after the sale?

Sellers should plan their future role—whether retiring immediately or continuing practice for a time—as it affects buyer type and deal structure. Consideration for the team’s future care and stability is essential, as is financial planning for tax-efficient deal structuring. Aligning the sale outcome with personal and financial goals ensures a smoother transition.