The market for selling an Orthopedic & Post-Surgical Rehab practice in New York City is more active than ever. Private equity firms and health systems are aggressively seeking profitable, well-run practices, creating a prime opportunity for owners considering an exit. This guide provides the insights you need to understand the current landscape, from valuation to navigating New York’s specific regulations, so you can make an informed decision about your future and your legacy.

Market Overview

Your Orthopedic and Rehab practice sits at the intersection of high demand and high profitability. This unique position has not gone unnoticed by sophisticated buyers. Understanding these market dynamics is the first step toward a successful sale.

An Inherently Valuable Specialty

Orthopedic practices are known for their strong financial performance. The ability to offer ancillary services, from post-surgical rehabilitation to imaging, creates multiple revenue streams. This built-in profitability makes practices like yours a top-tier asset for buyers looking for stable, scalable investments. It is not just a clinic they see. It is a robust business with significant growth potential.

The Influx of Private Equity and Health Systems

The biggest trend shaping your opportunity is the aggressive acquisition of practices by private equity (PE) firms and large hospital systems. These groups are looking for established platforms to build upon, and they have the capital to make competitive offers. PE buyers, in particular, are motivated by high returns, which means they are searching for well-managed practices with strong patient outcomes and referral networks. This creates a competitive environment that can drive up practice valuations for prepared sellers.

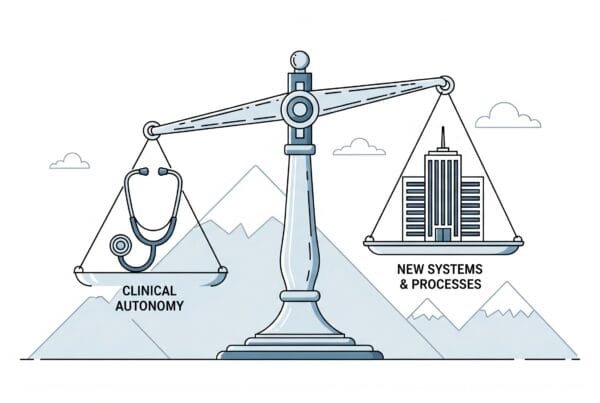

Key Considerations

Selling a practice in New York City involves more than just finding a buyer and agreeing on a price. The regulatory environment here is unique and requires careful navigation. For instance, New York’s Corporate Practice of Medicine doctrine restricts who can own a medical practice, influencing how a deal must be structured. Furthermore, as of 2023, sellers must navigate the new **

material transaction

notice requirement

. This rule mandates a 30-day pre-closing disclosure to the Department of Health for significant deals. Failing to manage these state-specific rules, along with patient record transfer regulations, can delay or even derail a sale. These are not minor details. They are critical gating items that demand expert attention from the very beginning.

Market Activity

The M&A market for orthopedic and rehab practices in New York is not just theoretical. It is active. We are seeing deals get done, but buyers are more sophisticated than ever. They are not just buying a location; they are investing in a business. To engage with them successfully, you need to understand what they are looking for.

Here are three things that define current market activity:

- Data-Driven Decisions. Buyers are making decisions based on numbers, not just potential. The standard request is for three years of detailed financial data. They use this to analyze trends in revenue, patient volume, and profitability. If your books are not clean and ready for this level of scrutiny, the process stops before it can even begin.

- Strategic Recapitalizations. It is not always about a 100% sale. We are seeing many transactions structured as recapitalizations, where a larger partner (like a PE-backed platform) buys a majority stake. This often allows the physician-owner to take significant cash off the table while retaining equity and continuing to lead clinically.

- The Power of a Process. The most successful sales do not come from a single, unsolicited offer. They come from a confidential, structured process where multiple qualified buyers are brought to the table. This competitive tension is what drives valuations from “good” to “premium.”

The Sale Process

A practice sale is a structured project, not a single event. It begins long before you speak to a potential buyer. The first phase is preparation. This involves a comprehensive valuation to understand what your practice is truly worth and organizing your financial and operational data. Once prepared, the next step is confidentially marketing the practice to a curated list of strategic buyers. After initial interest, you enter the critical due diligence stage. This is an intense period where the buyer verifies every aspect of your practice. It is also where many unprepared sellers run into trouble. With proper guidance, this stage can be managed smoothly, leading to final negotiations and the legal work required to close the transaction.

Valuation: Understanding Your Practice’s Worth

Determining the purchase price of your practice is the foundation of a successful sale. Sophisticated buyers do not look at your net income. They look at your Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure normalizes your profits by adding back owner-specific costs like excess salary or personal expenses. This Adjusted EBITDA is then multiplied by a number the

multiple

to arrive at your practice

s value. That multiple is not random. It is based on risk and opportunity. A practice that can run without its founding owner is less risky and gets a higher multiple.

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Model | Owner is the primary producer | Associate-driven, multi-provider |

| Annual EBITDA | Under $500,000 | Over $1,000,000 |

| Growth Profile | Flat or declining revenue | Consistent year-over-year growth |

| Referral Sources | Rely on 1-2 key sources | Diverse, established network |

An accurate valuation is part art, part science. It requires deep market knowledge to assign the right multiple and financial expertise to frame your story.

Post-Sale Considerations

The transaction is not the end of the story. It is a new beginning, and what that looks like depends on the planning you do today. A key part of any negotiation is defining your role after the sale. Will you continue to work clinically for a transition period? Will you take on a leadership role in the new, larger organization? Protecting your dedicated staff and ensuring a smooth continuation of care for your patients are also critical components that must be thoughtfully structured into the sale agreement. Your legacy is more than just the final price.

Furthermore, the structure of your payment has major implications. Many deals include an equity rollover, where you retain a stake in the new company, giving you a potential second payout when that larger entity sells. Others may include an earnout, where part of your payment is tied to the practice

s future performance. Understanding these structures is key to maximizing your financial outcome and aligning your goals with your new partner.

Frequently Asked Questions

What makes an Orthopedic & Post-Surgical Rehab practice in New York City valuable to buyers?

Orthopedic practices are inherently valuable due to their strong financial performance and multiple revenue streams such as post-surgical rehabilitation and imaging services. Buyers see these practices not just as clinics but as robust businesses with significant growth potential.

Who are the primary buyers interested in acquiring Orthopedic & Post-Surgical Rehab practices in NYC?

The primary buyers are private equity (PE) firms and large hospital systems. PE firms are particularly motivated by high returns and seek well-managed practices with strong patient outcomes and referral networks, making the market highly competitive.

What are some unique regulatory considerations when selling a practice in New York City?

New York’s Corporate Practice of Medicine doctrine restricts ownership of medical practices, influencing deal structures. A new material transaction notice requirement mandates a 30-day pre-closing disclosure to the Department of Health for significant deals. Proper handling of these regulations and patient record transfer rules is critical.

How is the valuation of an Orthopedic & Post-Surgical Rehab practice determined?

Valuation is based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which normalizes profits by adding back owner-specific costs. This figure is multiplied by a multiple reflecting factors like provider model, EBITDA size, growth profile, and referral diversity. Higher multiples are given to practices with multi-provider models, higher EBITDA, consistent growth, and diverse referral sources.

What should sellers consider regarding their roles and payments after selling their practice?

Sellers should define their post-sale roles, such as continuing clinical work or taking leadership roles in the new organization. The payment structure may include equity rollover (retaining a stake for potential future payouts) or earnouts (payments tied to future practice performance). Planning these details thoughtfully maximizes financial outcomes and protects staff and patient care continuity.