Selling your St. Louis sleep medicine practice is one of the most significant financial decisions you will ever make. This is not a standard business transaction. It involves unique clinical, operational, and financial considerations. This guide provides a clear overview of the current market, valuation principles, and key steps to help you navigate the process, protect your legacy, and maximize your outcome.

The St. Louis Sleep Medicine Market Overview

The St. Louis healthcare landscape is both mature and dynamic, creating a unique environment for sleep medicine practice owners considering a sale. Understanding these conditions is the first step toward a successful transition.

A Market of Strategic Buyers

Unlike other regions, the St. Louis market is characterized by a strong presence of major health systems like BJC HealthCare, SSM Health, and Mercy. These organizations are frequently looking to expand their specialty service lines, including sleep medicine. This means your potential buyer may not be another independent doctor, but a sophisticated corporate development team. While this presents a significant opportunity for a premium valuation, it also means you will be negotiating with seasoned professionals.

The Information Gap

If you search for recent sales of sleep medicine practices in St. Louis, you will find very little public information. This is not unusual for such a specialized niche. This lack of public data makes it difficult to self-assess your practice’s value or market position. It also makes it critical to have a story that goes beyond the numbersone that highlights your unique strengths to buyers who cannot rely on simple comparisons.

Key Considerations Before You Sell

In a market without clear public comps, buyers will look deeper into the fundamentals of your practice. The strength of your business is in the details you have built over years. Before you begin any process, you must have a clear understanding of these core assets.

- Your Referral Network’s Durability. Where do your patients come from? Buyers will heavily scrutinize your referral relationships. A practice with a diverse and loyal referral base is far more valuable than one dependent on a few sources. Documenting and demonstrating the strength of these relationships is a key part of your story.

- Your Payer Contracts. Favorable reimbursement rates are a major value driver. Are your contracts current? Are they transferable to a new owner? A potential buyer will see your payer mix and contract terms as a direct reflection of your practice’s financial health and stability.

- Your Team’s Future. A skilled team, from sleep technologists to administrative staff, is one of your most valuable assets. A buyer’s biggest fear is that the team that drives the practice’s success will leave after the transition. Planning for staff retention is not just a courtesy; it’s a core component of preserving practice value through a sale.

Your legacy and staff deserve protection during the transition to new ownership.

Understanding Current Market Activity

The overall trend in healthcare is consolidation, and sleep medicine is no exception. Independent practice owners in St. Louis have a unique opportunity to partner with larger, well-capitalized groups, but it requires understanding who these buyers are and what they are looking for.

The Shift from Private Practice to Platform

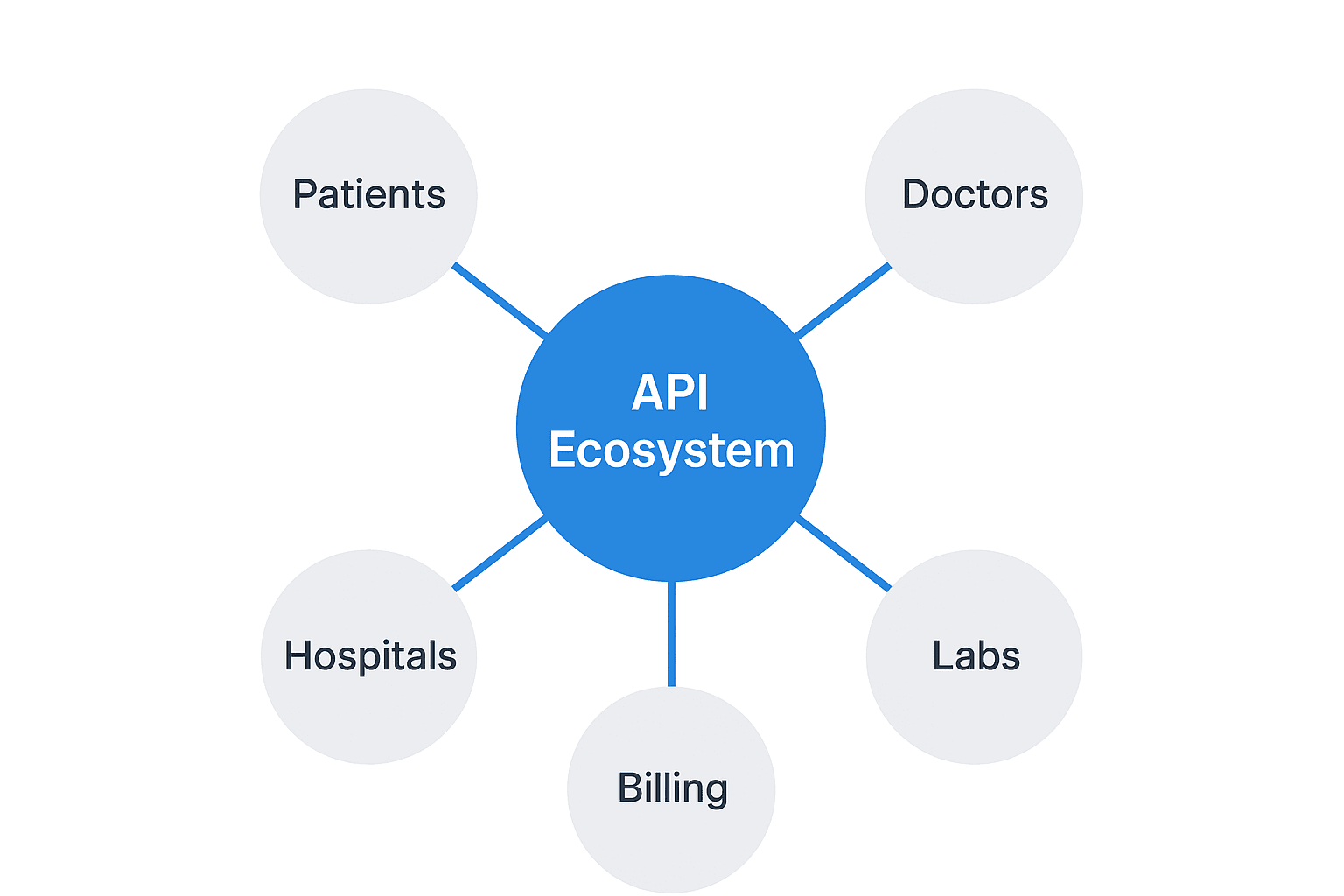

The most active buyers in the market today are often not individual physicians. They are regional health systems or private equity-backed platforms looking to build a network of specialty clinics. These groups bring significant resources, but they also have a specific investment thesis. They are buying for growth and efficiency, and they evaluate practices through that lens.

What Sophisticated Buyers Actually Value

Strategic buyers look past your top-line revenue. They focus on Adjusted EBITDAi a measure of true cash flow after normalizing for owner-specific expenses. We find most practices are undervalued until this number is calculated correctly and the growth story is framed properly. They want to see a well-run business with potential for scale, not just a job for a new doctor.

The Sale Process at a Glance

Selling a medical practice is not like listing a property. It is a strategic project that must be managed carefully to protect confidentiality and create a competitive environment. A well-structured process is what separates an average outcome from a great one.

- Preparation and Valuation. This is the foundation. It involves a deep financial analysis to determine your Adjusted EBITDA and preparing a confidential marketing package that tells your practice’s story and highlights its growth potential.

- Confidential Buyer Outreach. We do not “list” your practice publicly. We run a confidential process, approaching a curated list of vetted strategic and financial buyers who have an interest in sleep medicine in your region.

- Managing Diligence. This is where many deals get into trouble. Buyers will request extensive financial, operational, and clinical information. Managing this process efficiently without distracting you from running your practice is critical.

- Negotiation and Closing. The final stage involves negotiating not just the price, but also the terms of the deal, the transition plan, and your future role, if any. Professional guidance here ensures your interests are protected through the final legal documents.

Preparing properly for buyer due diligence can prevent unexpected issues.

How is a Sleep Medicine Practice Valued?

There is no simple “rule of thumb” for valuing a sleep medicine practice. Sophisticated buyers use a formula: Adjusted EBITDA x a Valuation Multiple. While the math seems simple, determining the correct inputs is where expertise matters. Your Adjusted EBITDA reflects your true profitability, and the Multiple reflects the market’s perception of your practice’s quality and risk.

The multiple is not a fixed number. It is a range influenced by several specific factors. Below are some of the key drivers we analyze to determine where a practice falls on the valuation spectrum.

| Factor | Drives Multiple Lower | Drives Multiple Higher |

|---|---|---|

| Provider Model | Dependent on a single physician | Associate-driven and scalable |

| Referral Sources | Concentrated in a few networks | Diverse and integrated |

| Technology / Labs | Older or leased equipment | Modern, accredited facilities |

| Payer Mix | Heavily reliant on Medicare | Strong commercial contracts |

Curious about what your practice might be worth in today’s market?

Planning for Life After the Sale

The final purchase agreement is not the end of the story. A successful transition is planned long before the closing date and has major implications for your final take-home value and your peace of mind. Thinking about these elements early is critical.

- Defining Your Transition Role. Do you want to leave immediately, or are you willing to stay on for a period to ensure a smooth handover? A clear transition plan is often a key requirement for buyers and can be a major negotiating point.

- Structuring Your Proceeds. A sale is rarely 100% cash at close. Buyers often use tools like earnouts (future payments tied to performance) or equity rollovers (retaining a minority stake) to align incentives. Understanding these structures is key to maximizing your long-term financial outcome.

- Ensuring a Smooth Handover for Your Team. A well-managed transition addresses staff concerns and provides clarity on their future roles and opportunities with the new owner. Securing a good home for your team is often one of the most important non-financial goals for selling owners.

Every practice sale has unique considerations that require personalized guidance.

Frequently Asked Questions

What makes the St. Louis sleep medicine market unique for sellers?

The St. Louis sleep medicine market is unique due to its mature and dynamic healthcare landscape, with major health systems like BJC HealthCare, SSM Health, and Mercy actively looking to expand specialty services. This means sellers often negotiate with sophisticated corporate development teams rather than individual doctors, presenting opportunities for premium valuations but also requiring careful preparation.

What key factors do buyers in St. Louis consider when valuing a sleep medicine practice?

Buyers in St. Louis focus on Adjusted EBITDA as a true measure of cash flow after normalizing owner-specific expenses. They also evaluate the practice’s referral network durability, payer contracts, team stability, and scalable growth potential rather than just top-line revenue. Factors influencing the valuation multiple include provider model, referral source diversity, technology and facility quality, and payer mix.

How should a practice owner prepare for selling their sleep medicine practice?

Preparation involves a deep financial analysis to determine Adjusted EBITDA, creating a confidential marketing package that highlights the practice’s unique strengths and growth potential, and documenting core assets like referral networks, payer contracts, and team composition. Planning for staff retention and understanding the transition process are also critical to protect the practice’s value.

What is the typical sale process for a sleep medicine practice in St. Louis?

The sale process includes preparation and valuation, confidential outreach to vetted strategic and financial buyers, managing extensive buyer due diligence, and negotiating deal terms including price, transition plans, and future roles. This strategic project requires confidentiality and professional management to achieve the best outcome.

What should a seller consider about life after the sale?

Sellers should define their desired transition role, whether immediate departure or staying on for a smooth handover. Understanding deal structures such as earnouts or equity rollovers can maximize financial outcomes. Ensuring a smooth transition for staff and securing their future roles is a key non-financial goal for many selling owners.