Considering the sale of your occupational therapy practice is a major decision. For OT owners in Detroit, the current market presents unique opportunities, but navigating the process requires a clear understanding of your practice’s value, market dynamics, and the steps involved. This guide provides insights to help you prepare for a successful transition, ensuring you protect your legacy and financial future.

Market Overview

The environment for selling an occupational therapy practice in Detroit is shaped by strong demand and a favorable regulatory landscape. The rising need for OT services across the country creates a seller-friendly tailwind. In Michigan, the conditions are especially positive for practice owners looking to transition.

Detroit’s Healthcare Landscape

The Detroit-Warren-Dearborn metropolitan area has a solid foundation of healthcare professionals, including over 500 occupational therapy assistants. This signals a healthy ecosystem for continued growth. While demand is high, the market is not without competition. A potential buyer will look for practices that have a distinct identity and a stable referral base. Understanding how to position your practice within this specific landscape is the first step toward attracting the right interest.

The OT Advantage in Michigan

A significant benefit for practice owners in Michigan is that occupational therapists have direct access. This means you can provide services without a physician’s script, a factor that makes your practice more autonomous and attractive to a wider range of buyers. It expands your potential revenue streams and reduces dependency on physician referrals, which sophisticated buyers see as a major strength.

Key Considerations Before a Sale

Before a buyer ever sees your practice, the work you do behind the scenes will define the outcome. Selling is not just about finding a buyer. It is about building a sellable asset. This process often begins years before you plan to exit and focuses on two key areas: your operations and your story.

Operationally, you must begin to detach the business from yourself. A practice that relies entirely on the owner’s personal relationships and daily efforts is difficult to transfer. By delegating tasks and documenting systems, you demonstrate that the practice can thrive under new leadership. At the same time, tidying up your financial records is critical. Buyers scrutinize financials, so having clear, organized books is non-negotiable.

Your story is just as important. What makes your practice unique in the Detroit market? Is it a specific client demographic, a niche specialty, or a prime location? Highlighting these unique selling points creates a compelling narrative that goes beyond the numbers.

Market Activity

While specific data on the sale of occupational therapy practices is often kept private, the broader healthcare M&A market in Michigan provides clear signals. We see consistent transaction activity across related fields, from physical therapy practices selling for $2 million to smaller home health agencies. This activity shows that buyers are actively seeking opportunities in the region. The key takeaway is that value varies dramatically based on size, profitability, and specialty.

So who is buying in Michigan’s healthcare market?

- Strategic Buyers. These are often larger therapy organizations or regional healthcare systems looking to expand their footprint in Detroit. They are interested in your established patient base and referral networks.

- Private Equity Groups. Investor-backed groups are increasingly active in fields like occupational therapy. They look for well-run practices with strong growth potential that can serve as a “platform” for future acquisitions.

- Individual Practitioners. Other OTs, often with experience in a larger system, may be looking to acquire their own practice. They are buying a job, but also an opportunity to build on your success.

Navigating these different buyer pools requires a tailored approach, as each has different goals and valuation methods.

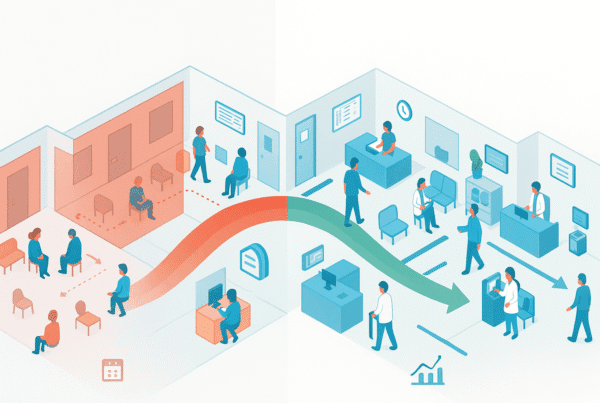

The Sale Process

Selling your practice is a structured journey that typically takes six to twelve months from start to finish. It is not a quick transaction. The process begins long before the “For Sale” sign goes up, starting with Preparation. This phase involves organizing your financials, clarifying your practice’s strengths, and getting a professional valuation. Once prepared, the next step is confidentially marketing the practice to a curated list of potential buyers, all under a strict Non-Disclosure Agreement (NDA) to protect your staff and clients.

After you receive interest, the Negotiation and Due Diligence phases begin. This is often the most intense part of the process. Buyers will pour over your financial statements, client contracts, and operational procedures. Many deals encounter unexpected challenges here. Having an experienced advisor to manage this stage is critical to keeping the transaction on track. Finally, with a lawyer’s help, you will finalize the legal agreements and plan for a smooth transition of ownership.

Understanding Your Practice’s Valuation

One of the first questions owners ask is, “How much can I sell my practice for?” While some use a simple multiple of revenue, sophisticated buyers look deeper. They value your practice based on its profitability, specifically its Adjusted EBITDA. This measure is more telling than simple revenue or profit.

Adjusted EBITDA starts with your net income and adds back interest, taxes, depreciation, and amortization. Then, it normalizes the figure by accounting for owner-specific expenses a new owner would not incur. This process uncovers the true cash flow of the business, which is what a buyer is purchasing. A practice s story, growth potential, and reliance on the owner also heavily influence the final multiple.

| Metric | What It Means for a Buyer |

|---|---|

| Revenue | Shows the top-line activity and market reach. |

| Reported Profit | A starting point, but can be misleading due to owner salary and perks. |

| Adjusted EBITDA | The key metric. It reveals the true, ongoing profitability of the practice. |

Getting this calculation right is not just an accounting exercise. It is the foundation of your entire negotiation strategy.

Post-Sale Considerations

The journey does not end when the sale documents are signed. Planning for what comes next is crucial for both your peace of mind and your financial outcome. The decisions you make here will impact your future for years to come.

First, consider your role. Will you retire completely, or will you stay on for a transition period? This is a key negotiation point that impacts the practice’s continuity and the buyer’s confidence. Second is your finances. The structure of the sale, whether it is an asset sale or an entity sale, has massive tax implications. Planning this with an advisor can significantly increase your net proceeds. Finally, think about your legacy. A well-managed transition ensures your staff is cared for and your clients continue to receive excellent service, protecting the reputation you worked so hard to build.

Frequently Asked Questions

What makes Detroit a unique market for selling an occupational therapy practice?

Detroit’s healthcare landscape includes a solid foundation of healthcare professionals and over 500 occupational therapy assistants, signaling a healthy ecosystem for growth. The rising demand for OT services and the direct access benefit in Michigan make it a seller-friendly environment. Unique positioning and a stable referral base are key to attracting buyers in this competitive market.

What operational steps should I take to prepare my occupational therapy practice for sale?

You should start detaching the business from yourself by delegating tasks and documenting systems to show that the practice can operate independently of the owner. Additionally, tidying up financial records and maintaining clear, organized books are essential since buyers scrutinize financials closely.

Who are the typical buyers interested in purchasing an occupational therapy practice in Detroit?

There are three main types of buyers: 1) Strategic Buyers such as larger therapy organizations or healthcare systems looking to expand, 2) Private Equity Groups seeking well-run practices with growth potential for future acquisitions, and 3) Individual Practitioners who want to own and grow their own practice.

How is the valuation of an occupational therapy practice typically determined?

Valuation largely depends on Adjusted EBITDA, which reveals the true profitability of the practice by adjusting net income for interest, taxes, depreciation, amortization, and owner-specific expenses. While revenue and reported profit are considered, adjusted EBITDA provides the clearest picture of ongoing cash flow and is critical for negotiation.

What are important post-sale considerations for an occupational therapy practice owner?

Post-sale planning should include deciding your role post-transition, whether to retire or stay on temporarily, as this impacts continuity and buyer confidence. Financial planning is crucial, especially in choosing the sale structure (asset vs. entity sale) due to its tax implications. Protecting your legacy through a smooth transition ensures your staff and clients continue to be cared for effectively.