Timing Your Exit to Capitalize on a Growing Market

The market for sleep medicine is expanding, with the U.S. market projected to grow at over 8% annually. For sleep medicine practice owners in North Dakota, this presents a significant opportunity. Strong local demand combined with the state’s stable economy creates a favorable environment for sellers. However, turning this market potential into a successful sale requires strategic timing and meticulous preparation. This guide provides insight into navigating the sale of your practice to maximize its value and secure your legacy.

A Strong and Growing Market

Selling your sleep medicine practice is a major decision. The good news is that market conditions are favorable for owners in North Dakota. The confluence of national trends and local dynamics creates a seller’s market for well-prepared practices.

National Tailwinds

The entire U.S. sleep disorder market is on an upward trajectory. Projections show it growing from $9.2 billion in 2021 to nearly $16 billion by 2028. This national boom means more capital is flowing into the specialty, and sophisticated buyers like private equity firms and large health systems are actively looking for acquisition opportunities. They are seeking established, profitable practices to build their platforms.

Local Demand

This national growth is mirrored by strong local demand in North Dakota. A significant portion of the adult population reports getting insufficient sleep, creating a large and underserved patient base. Paired with the state’s stable economy, low unemployment, and rising household incomes, your practice is positioned in a community with the need for your services and the ability to pay for them.

Unique Considerations for North Dakota Practices

Beyond general market health, specific factors in North Dakota can significantly influence your practice’s appeal to buyers. Your ability to highlight these strengths is key. For instance, in a large, rural state, telemedicine is not just a value-add; it is a strategic asset. A practice with established telemedicine capabilities or a clear plan to implement them can command a premium valuation. It demonstrates an ability to serve a wider geographic area efficiently.

Furthermore, North Dakota is actively growing its healthcare infrastructure. With an increase in medical residency slots and new polysomnography programs at local colleges, there is a developing pipeline of talent. For a buyer, this reduces the risk associated with staffing and future growth, making your practice a more stable and attractive investment.

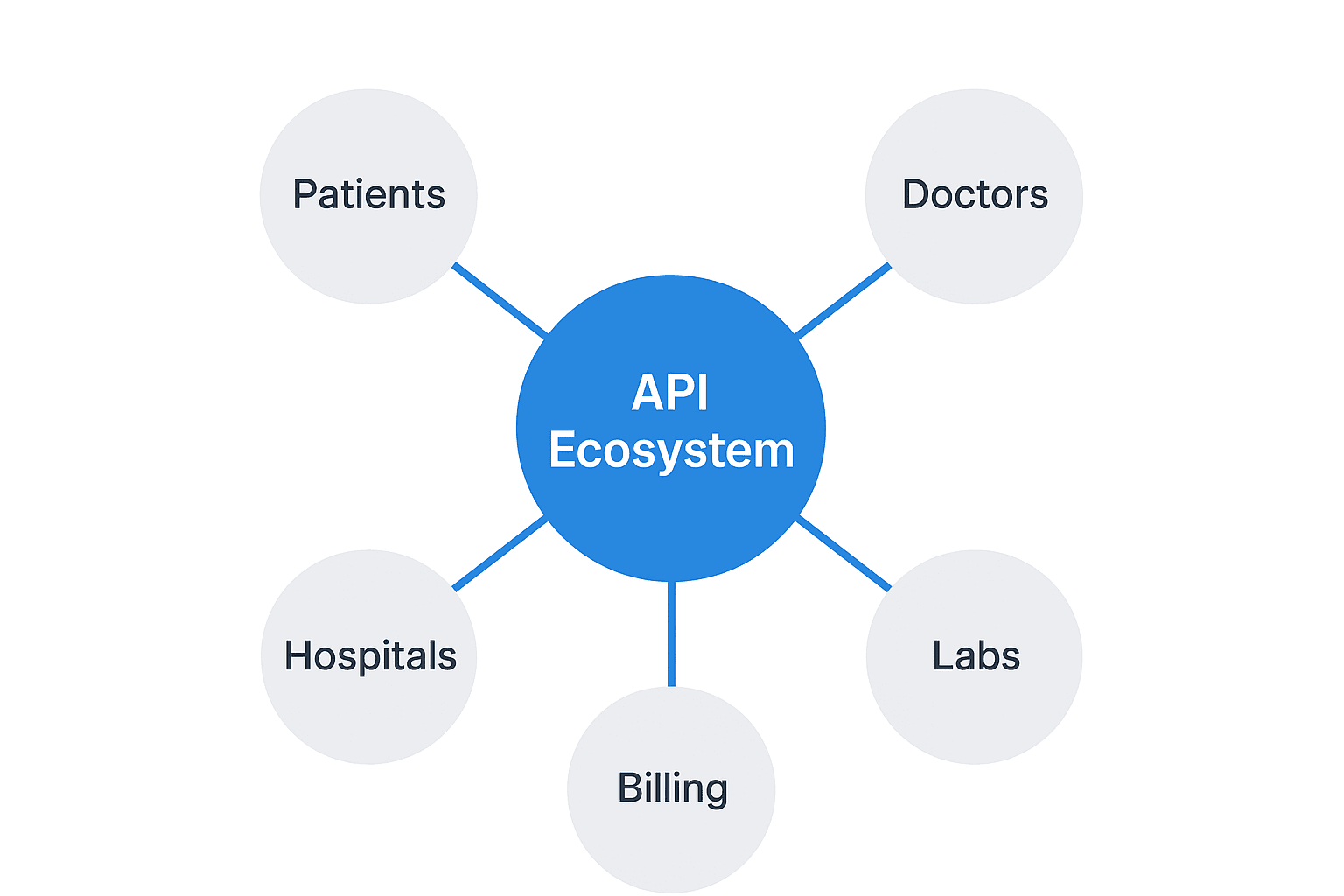

Understanding Today’s Buyers and What They Want

The buyers for sleep medicine practices typically fall into three categories: other physicians, local hospitals expanding their service lines, or corporate entities like private equity-backed groups. Each has different motivations, but they all share a common goal. They want to see a well-run business with a clear path to future success. Before making an offer, they will dig deep into your operations. Being prepared for their questions is not just helpful; it is mandatory.

Here are four of the first questions you will be asked:

- What is your transition plan? Buyers need assurance that patients won’t leave and staff will stay. They want to see a clear, documented plan for how you will hand over clinical and operational responsibilities.

- Are your referral sources stable? Your practice lives and dies by its referrals. Be ready to provide data on your key referral sources, their consistency, and the health of those relationships.

- How modern is your equipment and tech? They will want to know the age and condition of your sleep study equipment and the functionality of your Electronic Health Records (EHR) system.

- Who is on your team? Details about your key staff members, their roles, their compensation, and their desire to remain with the practice post-sale are critical.

The Path to a Successful Sale

The process of selling your practice is a journey with distinct phases. It begins long before the first conversation with a potential buyer. The first step is preparation, which involves gathering your financial, operational, and clinical data into a clear and compelling story. We find that owners who prepare their documents in advance have smoother, more profitable sales.

Once prepared, the next phase is confidential marketing. This is where a targeted list of qualified buyers is approached without revealing your practice’s identity. This protects your relationships with staff and referring physicians. After initial interest is established through non-disclosure agreements, you move into negotiation, due diligence, and closing. Each stage has its own set of challenges, from structuring the deal as an “asset sale” to benefit the buyer to navigating the buyer’s deep dive into your records. Expert guidance here prevents delays and protects your interests.

How Your Practice Is Valued

One of the biggest mistakes an owner can make is misunderstanding their practice’s true value. While you may have heard of valuation based on a multiple of revenue, sophisticated buyers look deeper. They value your practice based on its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your practice’s true cash flow by adding back owner-specific or one-time expenses to your net income.

An experienced advisor helps you normalize your financials to uncover this hidden value. It is the difference between what your tax returns show and what the business actually generates. For a buyer, this is the most important number.

| Valuation Approach | Reported Net Income | Owner Perks (e.g., car) | Adjusted Profit (EBITDA) | Potential Value (at 6x) |

|---|---|---|---|---|

| Simple View | $300,000 | Ignored | $300,000 | $1,800,000 |

| Buyer’s View | $300,000 | +$50,000 | $350,000 | $2,100,000 |

This adjustment process is where a potential sale gains significant value before it ever goes to market.

Planning for Life After the Sale

A successful transaction is not defined by the final sale price alone. It is also measured by the smoothness of the transition and your financial outcome after taxes and fees. Thinking about these elements from the beginning is critical. Your legacy, your staff’s future, and your personal wealth depend on a well-designed post-sale plan.

Here are three key areas to consider with your advisory team:

- Your Transition Role. Will you retire immediately or stay on for a period of time? Negotiating your role, responsibilities, and compensation during the transition period is a key part of the deal.

- Protecting Your Staff and Legacy. A good deal includes protections for your key employees and a plan to ensure patient care continues seamlessly. This is often a top priority for sellers who have spent a lifetime building their practice.

- Optimizing Your Proceeds. The structure of the sale has major tax implications. Furthermore, components like an earnout (future payments based on performance) or rollover equity (retaining ownership in the new, larger company) can significantly impact your total long-term returns.

Frequently Asked Questions

What is the current market outlook for selling a Sleep Medicine practice in North Dakota?

The market for sleep medicine is expanding rapidly, with the U.S. market projected to grow over 8% annually. North Dakota benefits from strong local demand, a stable economy, low unemployment, and rising household incomes, making it a favorable environment for selling a sleep medicine practice.

What unique factors should a Sleep Medicine practice in North Dakota highlight to attract buyers?

Practices should emphasize telemedicine capabilities, which are strategic assets in North Dakota’s large rural areas, and the growing healthcare infrastructure including medical residency slots and polysomnography programs. These factors reduce staffing risks and show potential for future growth, increasing the practice’s appeal.

Who are the typical buyers of Sleep Medicine practices in North Dakota and what do they want to know?

Typical buyers include other physicians, local hospitals, and corporate entities like private equity groups. They want to see a well-run business with a clear transition plan, stable referral sources, modern equipment and technology, and key staff committed to staying post-sale.

How is the value of a Sleep Medicine practice determined?

The value is primarily based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which represents the true cash flow by adding back owner-specific or one-time expenses to net income. This provides a more accurate valuation than just revenue multiples, making it crucial for sellers to normalize financials to uncover hidden value.

What considerations should a seller have for life after selling their Sleep Medicine practice?

Sellers should plan their transition role (retiring immediately or staying on temporarily), protect their staff and legacy with a plan to maintain patient care, and optimize their financial proceeds by considering tax implications, earnouts, and rollover equity. Working with advisors early can help ensure a smooth transition and maximize long-term returns.