The market for clinic-based ABA therapy practices in New Mexico is active. Private equity interest is strong, and valuations can be high for well-run clinics. However, navigating a sale requires understanding specific local regulations, market trends, and valuation drivers. This guide provides a clear overview to help you understand the landscape and position your practice for a successful transition.

Market Overview

If you are considering selling your ABA therapy practice, the timing may be right. The national market is thriving, with a 9.6% annual growth rate over the past five years, now reaching an estimated $28.5 billion. This national momentum is creating significant interest in local markets like New Mexico. We’ve seen reports of well-positioned practices in the state attracting premium valuations, sometimes in the range of 12.0x EBITDA. This tells us that buyers, especially private equity groups, are actively looking for quality ABA providers in the region. The demand is there. The key is understanding how to leverage this favorable climate to your advantage.

Key Considerations for New Mexico Sellers

A strong market is only one part of the equation. Buyers will look closely at the specific risks and strengths of your practice. For ABA clinic owners in New Mexico, success often comes down to managing these three areas:

- State Regulatory Compliance. Your practice’s adherence to New Mexico’s specific Medicaid (MAD FFS) reimbursement rates and Human Services Department rules is not just a checkbox. It is a core part of your value. Buyers need to see a clean and consistent history of compliance.

- Staff Stability. The ABA industry struggles with high therapist turnover, which averaged 65% in 2022. A practice that can show low turnover rates, experienced BCBAs, and strong staff retention strategies stands out immediately. This is a powerful signal of a healthy culture and stable operations.

- Operational Strength. Beyond compliance, buyers want to see efficient billing, a strong referral network, and documented positive client outcomes. These are the engines of your practice’s profitability and future growth.

Market Activity and Buyer Interest

The “market buzz” in the ABA space is real, and it is largely driven by private equity. Since 2012, PE firms have become major players, seeking to partner with and acquire well-run practices. They are not just looking for large platforms; they see value in successful one or two-clinic operations that can serve as a foundation for growth. For you, this means there is a pool of sophisticated, well-funded buyers actively looking for acquisition opportunities in New Mexico. They are drawn to the industry’s consistent growth and recurring revenue models. This trend puts prepared sellers in a strong negotiating position, but it also means you will be dealing with experienced buyers who expect a professional process.

Navigating the Sale Process

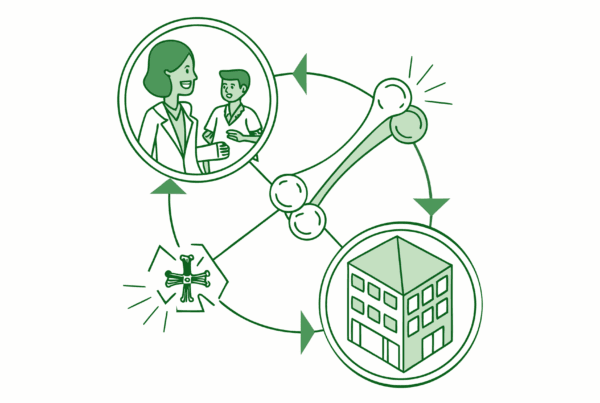

Selling your practice is not a single event. It is a multi-stage process that requires careful management from start to finish. While every deal is unique, the journey generally follows a clear path.

Preparation and Valuation

This is the foundational stage. It involves gathering your financial and operational documents, normalizing your earnings to reflect the true profitability of the clinic, and receiving a comprehensive valuation. This is where you prepare your story for the market.

Marketing and Buyer Engagement

Here, your advisor confidentially presents the opportunity to a curated list of qualified buyers. The goal is to create a competitive environment to generate strong initial offers (Letters of Intent).

Due Diligence and Negotiation

Once you accept an offer, the buyer begins an in-depth review of your practice. This is the most intensive phase, where they verify financials, compliance, contracts, and operations. Any issues that were not addressed during preparation can cause delays or jeopardize the deal.

Closing

After a successful due diligence period, the final legal documents are drafted and signed, and the transaction is officially closed.

What Is Your ABA Practice Really Worth?

Valuing your ABA practice is not as simple as looking at last year’s profit. Sophisticated buyers use a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure normalizes your financials by adding back one-time costs and personal owner expenses to show the clinic’s true cash flow. That Adjusted EBITDA is then multiplied by a number (the “multiple”) to determine the practice’s enterprise value.

That multiple is not fixed. It changes based on risk and opportunity. Below are a few factors that can dramatically impact your valuation:

| Factor | Standard Practice (Lower Multiple) | Premium Practice (Higher Multiple) |

|---|---|---|

| Staffing | High turnover, reliant on one BCBA | Stable team, low turnover, multiple providers |

| Client Base | Concentrated referrals, inconsistent intake | Diverse referral sources, steady waitlist |

| Operations | Inefficient billing, messy financials | Clean books, clear reporting, strong compliance |

| Growth | Limited to one location, no clear plan | Plan for new services or locations |

This is why two clinics with the same revenue can receive very different offers. A professional valuation uncovers the “hidden” value in your operations and frames it in a way that buyers are willing to pay for.

Planning for Life After the Sale

The day you sign the papers is a new beginning, not an end. Thinking about your goals for after the sale is a critical part of the process itself, because it helps define what a “successful” outcome looks like for you personally and professionally.

- Protecting Your Legacy and Staff. For many owners, the top concern is what happens to their team and the culture they built. The right deal structure and the right partner can ensure continuity of care for clients and job security for your dedicated staff.

- Defining Your Future Role. Selling does not always mean walking away. Many deals, especially with private equity, involve the owner staying on for a period of time. Some structures, like minority recapitalizations, allow you to take cash off the table while retaining significant ownership and control.

- Understanding Your Payout. Not all of the money may arrive at once. Deals often include an “earnout,” where part of the price is tied to future performance, or an “equity rollover,” where you retain a stake in the new, larger company. Understanding these structures is key to maximizing your long-term financial outcome.

Planning for these post-sale realities from the beginning ensures you find a partner whose vision aligns with your own.

Frequently Asked Questions

What is the current market outlook for selling a clinic-based ABA therapy practice in New Mexico?

The market for clinic-based ABA therapy practices in New Mexico is active with strong private equity interest. Practices with solid operations and compliance can attract high valuations, sometimes around 12.0x EBITDA. The national market is growing at about 9.6% annually, which boosts local demand.

What key factors do buyers consider when evaluating an ABA therapy practice in New Mexico?

Buyers focus on three main areas: 1) State regulatory compliance with Medicaid and Human Services Department rules, 2) Staff stability, including low turnover and experienced BCBAs, and 3) Operational strength such as efficient billing, strong referral networks, and positive client outcomes.

How is the value of an ABA therapy practice in New Mexico typically determined?

Value is often based on Adjusted EBITDA, which normalizes earnings by adding back one-time and personal expenses. This is multiplied by a market multiple that varies with risk and opportunity. Premium factors like stable staff, diverse client bases, and clean operations can increase the multiple and thus the valuation.

What is the typical process for selling an ABA therapy practice in New Mexico?

The sale process usually includes: Preparation and valuation to normalize earnings and gather documents; Marketing and buyer engagement to generate offers; Due diligence for buyer reviews of finances and compliance; and Closing where legal documents are signed and the sale finalized.

What should sellers consider regarding their future after selling their ABA therapy practice?

Sellers should plan for protecting their legacy and staff continuity, consider their future role which may involve staying on during a transition or retaining ownership, and understand payment structures like earnouts or equity rollovers to maximize financial outcomes post-sale.