Selling your nephrology practice is one of the most significant financial and professional decisions you will ever make. For practice owners in San Diego, a dynamic and competitive healthcare market, understanding the specific landscape is not just an advantage. It is a necessity. This guide provides a clear overview of the market, key steps in the process, and how to position your practice for a successful transition. Proper preparation is the key to a successful outcome.

Market Overview

The San Diego healthcare market is robust, driven by strong demographics and a high demand for specialized medical services. For nephrologists, this presents a unique opportunity. The region’s aging population ensures a consistent and growing need for renal care, making established nephrology practices attractive acquisition targets for a variety of buyers.

Regional Dynamics

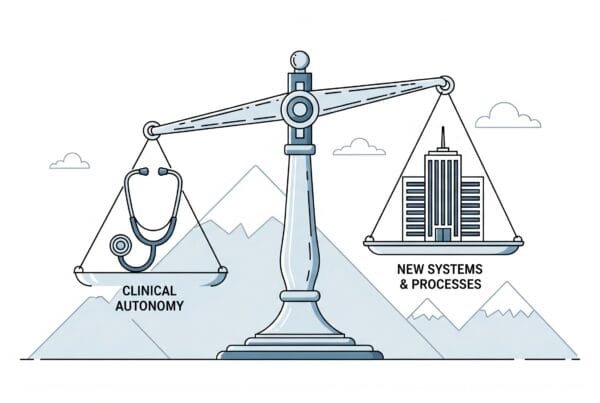

San Diego’s market is characterized by a mix of large hospital systems, integrated delivery networks, and a growing presence of private equity-backed platforms. This creates a competitive environment where well-run practices can command premium attention. However, navigating this landscape requires a deep understanding of who the buyers are and what they are looking for.

Specialty-Specific Trends

Consolidation is a major trend in nephrology nationwide, and San Diego is no exception. Buyers are seeking practices with stable referral sources, efficient operations, and opportunities for growth, such as in-house dialysis services or strong chronic kidney disease (CKD) management programs. Timing your entry into this active market can have a significant impact on your final valuation.

Key Considerations

Beyond the top-line revenue and patient numbers, several critical factors determine the success and value of your practice sale. Sophisticated buyers will scrutinize every aspect of your operations, and being prepared is your greatest asset. They look closely at your referral relationships with primary care physicians and hospitals. The durability of these relationships is a key indicator of future stability.

Your payer contracts and mix also play a large role. Practices with favorable, long-term contracts with a diverse set of payers are viewed as less risky and more valuable. Finally, the strength of your clinical team and their commitment to stay post-transaction can significantly influence a buyer’s confidence. Overlooking these details is a common mistake that we see owners make, often leaving value on the table.

Market Activity

While specific transaction data for San Diego nephrology practices is not always public, the market is active. We see consistent interest from different types of buyers, each with their own strategic goals. Understanding this buyer landscape is the first step toward finding the right partner for your practice, your staff, and your legacy. Creating a process that generates interest from multiple buyer types is the best way to ensure you receive a competitive, market-driven offer.

| Buyer Type | Primary Motivation | What This Means for You |

|---|---|---|

| Hospital System | Expand referral network, secure patient flow for inpatient services. | Focus on integration, potential for continued employment with a large organization. |

| Large Nephrology Group | Increase geographic density, achieve economies of scale. | Partnership with fellow clinicians, focus on maintaining clinical best practices. |

| Private Equity Platform | Build a regional or national platform, drive operational efficiencies and growth. | Opportunity for significant financial upside through equity rollover, focus on business metrics. |

The Sale Process

A successful practice sale follows a structured, confidential process designed to protect your interests and maximize value. It begins long before the practice is ever presented to a buyer. The first step is deep preparation, where we work with you to analyze financials, normalize expenses, and craft a compelling narrative. Once prepared, we confidentially market the opportunity to a curated list of qualified buyers.

This leads to receiving initial offers, or Indications of Interest, which allows us to negotiate the key terms of a deal. After a Letter of Intent (LOI) is signed, the buyer begins a formal due diligence process. This is the most intensive phase and where many deals falter without expert management. Our role is to manage this process seamlessly, leading to a smooth closing that achieves your personal and financial goals.

Valuation

Determining your practice’s true worth is more complex than applying a simple industry rule of thumb. It is a blend of financial analysis and strategic positioning. The foundation of any credible valuation is a clear understanding of your practice’s real earning power.

Calculating Your True Earnings

The most important metric is Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This is not the profit you see on your tax return. We calculate it by taking your stated profit and adding back owner-specific expenses like an above-market salary, personal auto leases, or family members on payroll. This “normalized” figure reflects the true cash flow available to a new owner and is the basis for your valuation.

Determining the Multiple

Your Adjusted EBITDA is then multiplied by a specific number, a “multiple,” to arrive at your practice’s enterprise value. This multiple is not static. It can vary significantly based on factors like the size of your practice, your reliance on a single physician, your payer mix, and your documented growth trajectory. Practices with multiple providers and ancillary services, like a dialysis access center, often command higher multiples.

Post-Sale Considerations

The day you sign the closing documents is not the end of the story. It is the beginning of a new chapter for you, your staff, and your patients. Planning for this transition is just as important as negotiating the deal itself. A key consideration is your personal role after the sale. Do you want to continue practicing for a few years, or are you ready to retire immediately? This should be defined early in the process.

Protecting your team’s future is also a priority for most owners. We help structure agreements that secure employment and benefits for your key staff, ensuring continuity of care and preserving the culture you built. Furthermore, the deal structure, including elements like an earnout or retained equity, will have a major impact on your financial future and tax liabilities. Thinking through these elements ensures your legacy is not only protected but continues to thrive under new ownership.

Frequently Asked Questions

What are the current market conditions for selling a nephrology practice in San Diego, CA?

The San Diego healthcare market is robust with strong demographics and a high demand for specialized medical services like nephrology. An aging population drives consistent growth in renal care demand, making nephrology practices attractive to buyers including hospital systems, large nephrology groups, and private equity platforms.

What key factors do buyers consider when purchasing a nephrology practice in San Diego?

Buyers look beyond just revenue and patient numbers; they assess referral relationships with primary care physicians and hospitals for stability, payer contracts and mix for risk evaluation, and the strength and commitment of the clinical team post-sale. Strong operational efficiency and growth opportunities like in-house dialysis also enhance value.

Who are the typical buyers for a nephrology practice in San Diego and what motivates them?

The typical buyers include hospital systems seeking to expand referral networks, large nephrology groups aiming for geographic density and operational scale, and private equity platforms looking to build regional or national platforms and improve operational efficiencies. Each buyer type offers different benefits and strategic alignments to the seller.

How is the valuation of a nephrology practice in San Diego determined?

Valuation is based on the practice’s Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which normalizes true earnings by adding back owner-specific expenses. This figure is multiplied by a variable multiple influenced by practice size, payer mix, physician dependency, and growth. Practices with multiple providers or ancillary services often receive higher multiples.

What should sellers expect during and after the sale process of their nephrology practice?

The sale process involves deep preparation, confidential marketing to qualified buyers, negotiation of key deal terms, and a rigorous due diligence phase. Post-sale, sellers must consider their ongoing role, staff employment safeguards, and deal structures like earnouts or retained equity, which affect financial outcomes and legacy continuity.