Selling your ENT practice in Cleveland represents a major milestone. This guide offers a clear-eyed look at the current market, from valuation drivers to post-sale planning. Understanding these dynamics is the first step toward a successful transition that protects your legacy and financial future. We will walk you through the key factors you need to consider.

The Cleveland ENT Market Landscape

The Cleveland market presents a unique environment for ENT practice owners considering a sale. It is not just another city. It is a nationally recognized healthcare destination, creating a stable and attractive backdrop for a potential transaction. Understanding these local dynamics is the first step in positioning your practice for a successful exit.

A Robust Healthcare Ecosystem

Cleveland is home to over 60 hospitals, anchored by world-renowned systems like the Cleveland Clinic and University Hospitals. For your practice, this means access to a deep, established network of referring physicians and a reputation for medical excellence that attracts talent. Buyers recognize this advantage. They see a built-in infrastructure for growth and collaboration, making practices here particularly appealing compared to those in less concentrated medical communities.

Demographics Driving Demand

With a diverse population and a median age of 36.3, the demand for comprehensive ENT services–from pediatrics to complex head and neck surgery–remains strong. This demographic mix supports a resilient patient base, a key factor that sophisticated buyers look for. A practice that serves this diverse community is seen as less risky and having more stable revenue streams.

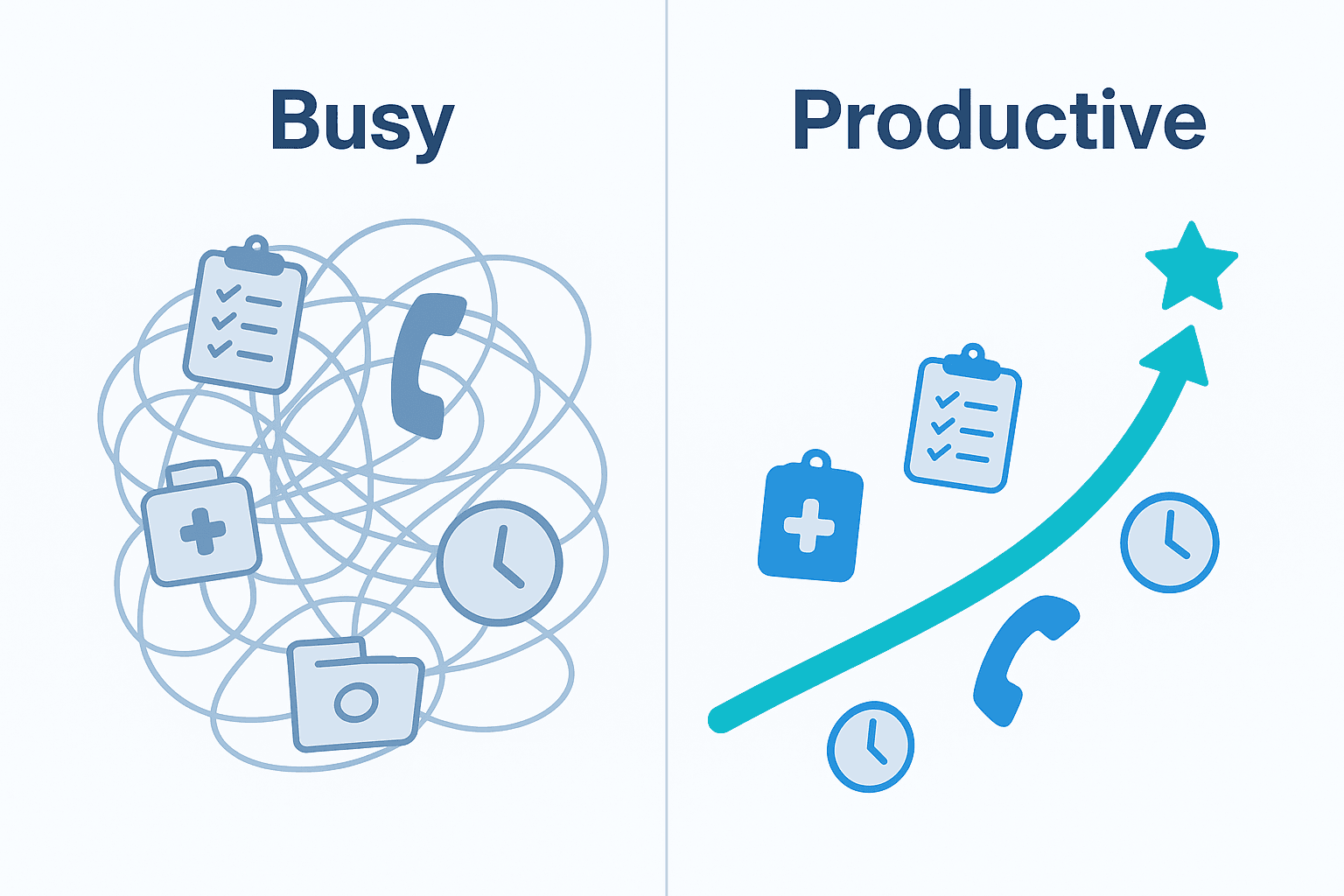

What Buyers Look For in a Cleveland ENT Practice

Beyond the favorable market, a potential buyer will look closely at the inner workings of your practice. They are buying a business, not just a patient list. Your strong relationships with local primary care physicians and pediatricians are a tangible asset. So are your streamlined administrative processes. With overhead costs in healthcare capable of reaching 60% of revenue, demonstrating efficient billing, low accounts receivable, and well-managed patient flow is not just good practice. It is a major selling point. A well-trained, loyal staff can also significantly increase a buyer’s confidence in a smooth transition. Preparing these aspects of your practice ahead of a sale is one of the most effective ways to increase its final value.

Current M&A Trends for ENT Practices

The market for medical practices is dynamic, and ENT is no exception. In Cleveland, we are seeing several key trends that create a favorable environment for practice owners who are well-prepared.

-

Strategic Buyers are Active. Both large health systems and private equity-backed groups are looking to expand their footprint in strong medical communities like Cleveland. They are seeking well-run, profitable ENT practices to serve as cornerstones for regional growth. This means you are not just waiting for a solo practitioner to buy your practice. You have multiple types of potential partners.

-

Competition for Quality Practices. Because of this buyer interest, practices with a history of profitability, a strong staff, and efficient operations are attracting significant attention. This competition can lead to premium valuations, but only if the sale process is managed to create that competitive tension.

-

The Window of Opportunity. With ENT physician salaries in Cleveland reaching upwards of $428,000, the underlying profitability of the specialty is clear to investors. Current market conditions are strong, but these windows do not stay open forever. Understanding the timing is a key part of strategy.

Navigating the Practice Sale Process

Selling your practice is a multi-stage journey, not a single event. It begins long before a buyer is involved, starting with an objective valuation and the preparation of all financial and operational documents. From there, the process moves into a confidential marketing phase, where we identify and approach a curated list of qualified buyers without disrupting your practice. Once interest is established, we manage negotiations to secure the best possible terms. The most intensive phase is often due diligence, where the buyer verifies every aspect of your business. Many sales encounter trouble here if the practice is not prepared. A well-managed process anticipates buyer questions and organizes information ahead of time, leading to a smoother path to closing the deal and transitioning your legacy.

How Your ENT Practice is Valued

A common question we hear is, “What is my practice worth?” The answer is more than a simple rule of thumb. Sophisticated buyers value your practice based on a multiple of its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Adjusted EBITDA is your true cash flow, calculated by taking your net income and adding back non-cash expenses and owner-specific costs like a high salary or personal car lease. This adjusted number gives a clearer picture of profitability. That number is then multiplied by a factor based on risk and growth potential. The higher the quality of your practice, the higher the multiple.

| Valuation Factor | Why It Matters for Your Cleveland ENT Practice |

|---|---|

| Practice Scale | Larger practices with higher EBITDA are seen as less risky and command higher multiples. |

| Provider Reliance | A practice with multiple associate providers is more valuable than one dependent on a single owner. |

| Service & Payer Mix | Offering a range of services (audiology, allergy) and having stable insurance contracts increases value. |

| Growth Potential | Your location in a healthcare hub like Cleveland is a narrative of future growth potential. |

Life After the Sale: Planning Your Transition

The deal is not done when the papers are signed. A successful transition requires careful planning for what comes next. For many owners, this involves a period of continued work to ensure a smooth handover of patient relationships and clinical duties. Structuring this transition period to match your personal goals is a key part of the negotiation. It is also a time to ensure your dedicated staff is taken care of, as their continued presence is valuable to the new owner. Finally, how the sale is structured has major tax implications. Thinking through these elements beforehand ensures the outcome you receive aligns with the future you have worked so hard to build. Creating a clear plan protects your legacy, your team, and your financial well-being.

Frequently Asked Questions

What makes the Cleveland market attractive for selling an ENT practice?

Cleveland is a nationally recognized healthcare destination with over 60 hospitals including world-renowned systems like Cleveland Clinic and University Hospitals. This creates a stable and attractive environment with a strong network of referring physicians and medical excellence that appeals to buyers.

What do buyers typically look for in a Cleveland ENT practice?

Buyers look for strong relationships with primary care physicians and pediatricians, efficient billing and administrative processes, low accounts receivable, well-managed patient flow, and a loyal, well-trained staff to ensure a smooth transition and lower risk.

How is an ENT practice in Cleveland typically valued?

Valuation is based on a multiple of the practice’s Adjusted EBITDA, which reflects true cash flow after adding back non-cash expenses and owner-specific costs. Factors affecting the multiple include practice scale, provider reliance, service and payer mix, and growth potential in the Cleveland healthcare market.

What are the key trends affecting ENT practice sales in Cleveland?

Key trends include active strategic buyers like health systems and private equity groups competing for quality practices, high competition leading to premium valuations, and a current window of opportunity driven by strong ENT physician salaries and profitability in the local market.

What should physician-owners consider in planning the transition after selling their ENT practice?

Owners should plan for a transition period to ensure smooth handover of patient relationships and clinical duties, protect their dedicated staff’s continued role, and carefully consider the tax implications of the sale structure to align with their personal and financial goals.