Selling your ENT practice in Salt Lake City is one of the most significant financial decisions you will ever make. Today’s market presents unique opportunities for prepared owners. This guide provides a clear overview of the current landscape, from understanding your practice’s true value to navigating the sale process and planning for your future. Success depends on having the right information and a sound strategy.

Market Overview

The Salt Lake City area is a vibrant and growing healthcare market. This growth attracts significant attention from buyers, including regional health systems looking to expand their specialist networks and private equity groups seeking to build platforms in desirable specialties like otolaryngology. For an independent ENT practice owner, this means you are likely in a strong negotiating position, provided your practice is properly prepared for a sale.

Many owners think they should only explore a sale when they are 100% ready to exit. The reality is that the best time to start planning is two to three years before your target date. Buyers pay for proven performance, not future potential. The work you do now to optimize operations and financials is what secures a premium valuation down the road.

Key Considerations for Your ENT Practice

Beyond general market trends, buyers will scrutinize factors unique to your ENT practice. Thinking about these areas now is the first step toward positioning your practice for a successful sale.

Ancillary Service Lines

Do you have well-developed ancillary revenues from services like audiology, hearing aid sales, allergy testing and treatment, or in-office procedures? These are significant value drivers as they demonstrate diversified and high-margin income streams.

Provider Makeup

Is the practice’s success heavily dependent on you as the primary surgeon? A practice with multiple providers, including associate physicians or physician assistants, is often seen as less risky and more scalable, which translates to a higher valuation.

Referral Networks

Your referral patterns from primary care physicians and other specialists are a key asset. A buyer will want to understand how stable and defensible these relationships are. Documented, long-standing referral patterns add significant value.

Market Activity and Buyer Types

The consolidation trend in healthcare is very active in the ENT space. In Salt Lake City, we are seeing two main types of buyers. First, there are private equity-backed groups looking for established, reputable practices to serve as a “platform” for future growth or as strategic “add-on” acquisitions to an existing platform. Second, regional health systems are also active, aiming to solidify their specialty care offerings.

Many physicians fear that selling means giving up control. This is no longer a black-and-white issue. The right advisor can structure a deal that aligns with your personal goals, whether that is a full exit or a strategic partnership. Options like minority recapitalizations allow you to take chips off the table while retaining significant ownership and continuing to lead the practice clinically.

The Sale Process De-Mystified

A professional M&A process is not about “listing” your practice and waiting for a call. It is a structured, confidential project designed to achieve your goals and maximize value. Here is a simplified look at the key stages.

| Stage | What It Involves | A Common Challenge |

|---|---|---|

| 1. Preparation & Valuation | Analyzing financials, normalizing EBITDA, and preparing marketing materials. | Understating practice value by using incorrect accounting or missing key “add-backs.” |

| 2. Confidential Marketing | Identifying and discreetly approaching a curated list of qualified buyers. | Breaching confidentiality, which can disrupt staff and referral sources. |

| 3. Buyer Management | Fielding offers, creating competitive tension, and selecting the best partner. | Accepting the first offer without knowing if it represents true market value. |

| 4. Due Diligence | The buyer conducts a deep dive into your clinical, financial, and legal records. | Unorganized records or unexpected findings can delay the deal or reduce the price. |

| 5. Closing | Finalizing legal documents and transitioning ownership. | Poorly negotiated terms can lead to unfavorable post-sale conditions. |

What Is Your Practice Really Worth?

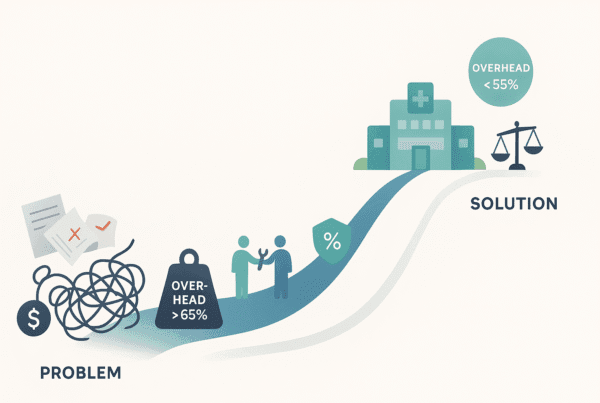

One of the biggest mistakes we see owners make is undervaluing their own practice. They look at their tax return’s net income and think that is the number that matters. Sophisticated buyers, however, look at a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents the true cash flow of your business. We calculate it by taking your net income and adding back things like owner’s salary above market rate, personal expenses run through the business, and other one-time costs. This normalization process almost always reveals a much higher profitability than you might think. Your practice’s final valuation is typically determined by applying a multiple to that Adjusted EBITDA figure. This multiple is influenced by your specialty, scale, and the other key considerations we discussed. Most practices are worth significantly more than their owners believe.

Planning for Life After the Sale

A successful transaction is about more than just the sale price. It is about setting yourself up for the future you want. The best deals are structured with the end in mind, addressing these key areas long before you sign on the dotted line.

-

Your Future Role. Do you want to retire immediately, or would you prefer to stay on and practice medicine without the administrative headaches? Your employment agreement, compensation, and clinical autonomy are all critical points to negotiate.

-

Your Financial Future. The structure of your sale has massive tax implications. Furthermore, partnering with a buyer might involve rolling over a portion of your equity. This gives you a second potential payday when the larger entity sells again in the future. Planning this correctly is key.

-

Your Legacy and Team. A sale affects more than just you. A well-managed transition ensures your staff is taken care of and your patients continue to receive excellent care. Protecting this legacy is a core component of a successful exit plan.

Frequently Asked Questions

What is the best time to start planning for selling my ENT practice in Salt Lake City?

The best time to start planning your sale is two to three years before your target exit date. Buyers pay for proven performance, so optimizing operations and financials ahead of time can secure a premium valuation.

What factors unique to an ENT practice impact its valuation?

Key factors include the presence of ancillary service lines like audiology or allergy treatment, the provider makeup (having multiple providers reduces risk), and stable, well-documented referral networks which add significant value.

Who are the main types of buyers for ENT practices in Salt Lake City?

The main buyers are private equity-backed groups looking for platform or add-on acquisitions, and regional health systems aiming to strengthen specialty care offerings. Both are active in the market and offer different deal structures.

What does the typical sale process for an ENT practice involve?

The sale process involves several stages: preparation and valuation, confidential marketing, buyer management, due diligence, and closing. Each step requires careful handling to avoid common pitfalls like undervaluation or confidentiality breaches.

How is an ENT practice’s value usually determined?

Value is typically based on Adjusted EBITDA—cash flow normalized for non-market expenses—and then multiplied by a factor influenced by specialty, scale, and other practice specifics. This often results in a valuation higher than owners expect.