Selling your radiology practice is one of the most significant financial and professional decisions you will ever make. For owners in a unique market like Boston, navigating this process requires more than a standard approach. This guide provides insight into the current landscape, valuation drivers, and key steps for a successful transition, helping you understand the specialized dynamics at play and how to prepare for your next chapter.

Market Overview

The Boston market for radiology practices is active and complex. As a major hub for healthcare, technology, and finance, the city attracts a diverse range of buyers. We are seeing continued interest from hospital systems looking to expand their imaging capabilities and a growing presence of private equity groups seeking to build regional platforms. This competition creates significant opportunities for practice owners. However, it also means buyers are more sophisticated than ever. They are not just acquiring assets. They are investing in well-run businesses with stable referral patterns, modern technology, and clear growth potential. For a seller, this environment demands a strategic approach to properly position the practice and engage the right type of partner.

Key Considerations for Boston Radiology Practices

When preparing to sell your radiology practice, success depends on understanding what buyers in the Boston market value most. Beyond the financials, several specific areas require your attention. Thinking through these points now can directly impact your final valuation and the smoothness of the transition.

Technology and Infrastructure

Your practice’s technology is not just an operational tool. It is a core asset. Buyers will scrutinize your PACS/RIS systems for their efficiency, interoperability with major EMRs, and cybersecurity protocols. Practices that have invested in modern, streamlined technology are viewed as lower risk and easier to integrate, often commanding a premium.

Referral and Payer Relationships

The stability of your practice is built on its relationships. Documented, long-term referral patterns from a diverse base of providers are critical. In the competitive Boston area, strong contracts with key payers like Blue Cross Blue Shield of Massachusetts, Tufts Health Plan, and Harvard Pilgrim are equally important. Weaknesses in either area can be a major red flag for acquirers.

Clinical and Staffing Model

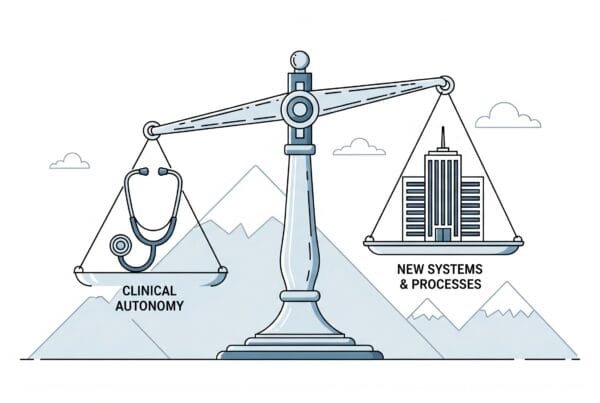

Buyers look for practices that are not dependent on a single person. A practice with multiple radiologists, skilled technologists, and a strong management team is far more attractive than one reliant solely on the owner. We help owners think about how to structure roles and incentives to demonstrate a durable, scalable business model that can thrive after the transition.

Market Activity

The current market for radiology practices in Boston is robust. While specific transaction details are confidential and held within private databases, the trend is clear: well-positioned practices are in high demand. We are seeing both large, established healthcare systems and specialized private equity funds actively seeking acquisitions. These buyers are looking for different things. Some want a “platform” practice to serve as a foundation for future growth in New England, while others are making “tuck-in” acquisitions to expand their existing network. Running a process that creates competitive tension between these different buyer types is the key to unlocking the true value of your practice. A single, unsolicited offer is rarely the best offer you can achieve.

The Sale Process: 4 Key Phases

Selling your practice is a structured process, not a single event. Understanding the key phases helps you prepare for the journey and avoid common pitfalls along the way. We guide owners through a professional process designed to maximize value and minimize disruption to your practice.

-

Preparation and Strategy

This is the most important phase and should begin 12-24 months before you plan to sell. It involves cleaning up financial records, optimizing operations, and developing a compelling growth story. This is when we work with owners to normalize financials and address any potential issues before they can be uncovered by a buyer. -

Valuation and Marketing

Once your practice is ready, a formal valuation is conducted to establish a credible asking price. We then create confidential marketing materials and present the opportunity to a curated list of qualified buyers from our proprietary database. Your identity remains completely confidential throughout this stage. -

Negotiation and Due Diligence

After receiving initial offers, we manage negotiations to improve terms and select the best partner for your goals. The chosen buyer will then conduct a deep dive into your practice’s finances, operations, and legal standing. Proper preparation is critical here, as the due diligence process is where many practice sales encounter unexpected challenges. -

Closing and Transition

The final phase involves finalizing legal agreements, securing funds, and officially closing the transaction. We also help structure a thoughtful transition plan to ensure a smooth handover for you, your staff, and your patients.

What Is Your Radiology Practice Worth?

A professional valuation goes far beyond a simple rule of thumb. The most common method used by sophisticated buyers is a multiple of Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Adjusted EBITDA represents your practice’s true cash flow by adding back owner-specific and one-time expenses to your net income.

Your practice’s value is then calculated as: Adjusted EBITDA x Valuation Multiple.

While Adjusted EBITDA is a science, the Multiple is an art. It is influenced by dozens of qualitative factors.

| Factor | Impact on Valuation Multiple |

|---|---|

| Scale of Practice | Higher EBITDA generally commands a higher multiple. |

| Provider Model | Associate-driven models are valued more highly than solo-owner-dependent practices. |

| Growth Profile | A clear path to future growth increases the multiple. |

| Payer Mix | Stable, in-network contracts are less risky than high cash-pay. |

| Technology | Modern, integrated systems are a significant positive factor. |

Multiples can range from 3.0x for smaller practices to over 8.0x for larger, strategic platforms. Understanding where your practice fits and how to improve these factors is the foundation of a successful exit strategy.

Post-Sale Considerations

Successfully closing the deal is just the beginning of your transition. What happens next has major implications for your financial future and your legacy. Planning for the post-sale period should be a core part of the negotiation process, not an afterthought. You need to consider how the deal is structured. For example, tax-efficient structures can dramatically increase your net proceeds. Many owners also choose to roll over a portion of their equity into the new, larger entity, giving them a “second bite at the apple” when that entity is sold again in the future. This can create life-changing wealth far beyond the initial sale price. Finally, protecting your legacy and ensuring continuity of care for your patients and staff requires a carefully managed transition plan. The right partner will work with you to ensure the values and quality you established are carried forward.

Frequently Asked Questions

What is the current market like for selling radiology practices in Boston, MA?

The Boston market for radiology practices is active and complex, with a diverse range of buyers including hospital systems and private equity groups. Buyers are sophisticated, looking for well-run businesses with stable referral patterns, modern technology, and growth potential, which creates competitive tension and opportunities for sellers.

What technology considerations are important when selling a radiology practice in Boston?

Buyers scrutinize the PACS/RIS systems for efficiency, interoperability with major EMRs, and cybersecurity protocols. Practices with modern, streamlined technology are considered lower risk, easier to integrate, and often command a premium in valuation.

How do referral and payer relationships affect the sale of a Boston radiology practice?

Strong, documented long-term referral patterns and contracts with major payers like Blue Cross Blue Shield of Massachusetts, Tufts Health Plan, and Harvard Pilgrim are critical. These relationships indicate stability and are key factors buyers look for. Weak paying or referral relationships can be a major red flag.

What phases are involved in the sale process of a radiology practice?

The sale process consists of four key phases: 1) Preparation and Strategy – cleaning up records and optimizing operations; 2) Valuation and Marketing – setting a credible asking price and finding qualified buyers; 3) Negotiation and Due Diligence – managing offers and thorough buyer examination; and 4) Closing and Transition – finalizing agreements and ensuring a smooth handover.

How is the valuation of a radiology practice determined in Boston?

Valuation is typically based on a multiple of Adjusted EBITDA, which represents true cash flow. The valuation multiple is influenced by factors like practice scale, provider model, growth profile, payer mix, and technology. Multiples can range from 3.0x for smaller practices to over 8.0x for larger platforms.