If you own a dermatology practice in Birmingham, Alabama, you are likely aware of the dynamic and evolving healthcare market. Deciding to sell is a major step, one that requires careful planning to protect your legacy and maximize your financial outcome. Understanding the current buyer landscape, your practice’s true value, and the key steps in the sale process is the foundation for a successful transition. This guide provides the insights you need to navigate this journey.

Birmingham Market Overview

The market for dermatology practices in Birmingham is robust. The city’s-established patient base and regional draw make it an attractive location for buyers seeking to enter or expand in the Southeast. We see consistent interest from both strategic acquirers looking to grow their footprint and private equity groups searching for strong platform practices.

A Mix of Medicine and Aesthetics

Birmingham s demand for both medical and cosmetic dermatology creates a resilient business model. Practices that offer a healthy blend of insurance-based medical treatments (like eczema and surgical dermatology) and cash-pay cosmetic services (like body sculpting and injectables) are particularly appealing to buyers. This diversity provides stable revenue and high-growth potential, a combination that sophisticated investors value highly.

Signs of an Active Market

While individual practice sales are confidential, recent activity in healthcare real estate provides a strong signal. The high-profile sales of medical office buildings and ambulatory surgery centers dedicated to dermatology in the Birmingham area indicate that acquirers are actively investing capital. They are not just buying buildings; they are securing strategic locations for practice operations and expansion.

Key Considerations for a Successful Sale

When preparing to sell, it is important to view your practice through the eyes of a potential buyer. Today s buyers are financially sophisticated. They look beyond top-line revenue to understand the core profitability and operational health of your practice. Here are the main areas they will analyze:

-

Financial Performance. The primary metric used to value a practice is now Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), not a percentage of collections. Buyers will normalize your earnings by adding back personal expenses or above-market owner salaries to see the true cash flow. For practices with an Adjusted EBITDA under $3 million, we often see valuation multiples in the 5-7x range.

-

Practice Structure. Whether you are a solo physician or part of a small group, buyers are interested. They want to see a well-run operation with efficient revenue cycle management. A practice that does not depend entirely on the owner for its success and has a clear path to a smooth transition will command a higher value.

-

Revenue Streams. A healthy mix of medical and cosmetic dermatology revenue is a significant strength. Consistent, predictable revenue from insurance-based services combined with high-margin, private-pay aesthetic procedures demonstrates stability and growth potential.

Understanding Current Market Activity

The current M&A market for dermatology is competitive. This high level of buyer interest creates a favorable environment for practice owners who are prepared to sell. Strategic buyers and investors are actively seeking well-run practices in strong markets like Birmingham to build regional density. This competition can help drive premium valuations for sellers who run a structured sale process.

However, these optimal conditions do not last forever. Market dynamics, interest rates, and buyer priorities can shift. We often speak with physicians who plan to sell in a few years. Our advice is always the same: the preparation for a successful sale should start now. Buyers pay for proven performance, not future potential. Taking the time today to optimize your operations and financials ensures you will be ready to sell on your terms when the time is right, capturing the best possible value in the market.

Navigating the Sale Process

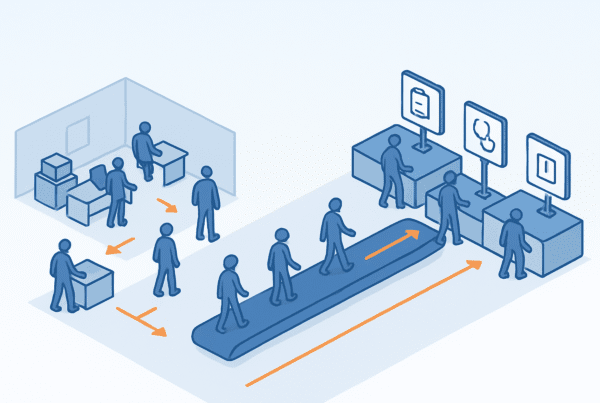

A practice sale is a complex project, but it can be managed effectively through a structured process. A professional, confidential approach protects your staff and patient relationships while ensuring you are engaging with only qualified, serious buyers. We do not just “list” your practice. We run a discreet, competitive process designed to achieve your specific goals. Here are the typical stages:

| Stage | Key Objective |

|---|---|

| 1. Preparation & Valuation | We work with you to analyze financials, normalize EBITDA, and establish a data-backed valuation. |

| 2. Confidential Marketing | We prepare a confidential information memorandum and approach a curated list of vetted buyers. |

| 3. Offer Management | We solicit and evaluate offers, creating a competitive environment to drive the best terms. |

| 4. Due Diligence | We manage the buyer’s deep dive into your financials, operations, and legal documents. |

| 5. Closing | We coordinate with legal counsel to finalize agreements and ensure a smooth transition of ownership. |

The due diligence phase is often where sales encounter challenges. Proper preparation is key to preventing surprises and keeping the transaction on track.

What is Your Practice Really Worth?

Determining the value of your dermatology practice is more than just a formula. It is about telling the right story with your numbers. While many owners are accustomed to looking at their net income, sophisticated buyers value your practice based on its Adjusted EBITDA. This figure represents the true, ongoing cash flow of the business.

We calculate this by taking your reported profit and adding back items like owner compensation that is above fair market salary, personal expenses run through the business, and other one-time costs. For example, a practice with $500,000 in net income could have an Adjusted EBITDA of $700,000 or more after these adjustments. This is the number that matters.

This EBITDA figure is then multiplied by a valuation multiple. That multiple is not fixed. It is influenced by your practice’s size, reliance on the owner, payer mix, and growth prospects. A multi-provider practice with strong cosmetic revenue will command a higher multiple than a solo practice nearing retirement. Understanding this math is the first step to unlocking your practice’s maximum value.

Planning for Life After the Sale

A successful transaction is about more than just the price. It is about ensuring the deal structure aligns with your personal, financial, and professional goals for the future. Selling your practice does not have to mean losing control or walking away completely.

Protecting Your Legacy and Staff

For many physicians, their practice is their life’s work, and their staff is like family. A key part of our process is finding a buyer whose culture and vision align with yours. We help structure the transition plan to ensure continuity of care for your patients and stability for your dedicated team.

Structuring Your Future Role

Control is not an all-or-nothing concept. Many transactions are structured to keep the selling physician in a leadership role with full clinical autonomy. We can design partnerships that allow you to offload administrative burdens while focusing on medicine, or structure an equity rollover where you retain a minority stake. This “second bite of the apple” can lead to another significant financial event when the larger platform is sold again in the future. Your personal goals drive the strategy.

Frequently Asked Questions

What is the current market like for selling dermatology practices in Birmingham, AL?

The market for dermatology practices in Birmingham is active and robust, driven by a strong patient base and regional appeal. Buyers include strategic acquirers and private equity groups looking for practices with a mix of medical and cosmetic dermatology services. Recent high-profile sales of medical office buildings dedicated to dermatology indicate strong investment interest.

How is the value of a dermatology practice in Birmingham typically determined?

Practice value is primarily based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which reflects true cash flow. Adjustments are made to add back personal expenses and above-market owner salaries. Valuation multiples typically range from 5 to 7 times EBITDA for practices with less than $3 million in EBITDA, influenced by factors like practice size, payer mix, and growth prospects.

What factors make a dermatology practice more attractive to buyers?

Buyers look for well-run operations with efficient revenue cycle management, a healthy mix of insurance-based medical dermatology and cash-pay cosmetic services, and a practice that is not overly dependent on the owner. A clear transition plan and operational stability increase value in the eyes of buyers.

What are the key stages in the sale process of a dermatology practice in Birmingham?

The sale process includes several stages: Preparation & Valuation, Confidential Marketing, Offer Management, Due Diligence, and Closing. Proper preparation, including financial analysis and marketing to vetted buyers, helps create a competitive environment and ensures a smooth transition.

How can a selling physician plan for life after selling their dermatology practice?

Physicians can structure deal terms to maintain clinical autonomy or leadership roles if desired, and even retain minority equity stakes through partnerships. The transition plan also includes aligning with a buyer who shares the seller’s culture and vision to protect staff and patient care continuity. This approach helps meet personal, financial, and professional goals post-sale.