If you own a New Hampshire Neurology practice, the idea of selling can feel monumental. This guide is designed to help you navigate the current market. We will walk through the landscape for neurology practices in the Granite State, from understanding your practice’s value to planning for life after the sale. The goal is to give you a clear picture of the opportunities and challenges ahead.

Not sure if selling is right for you? Our advisors can help you understand your options without any pressure.

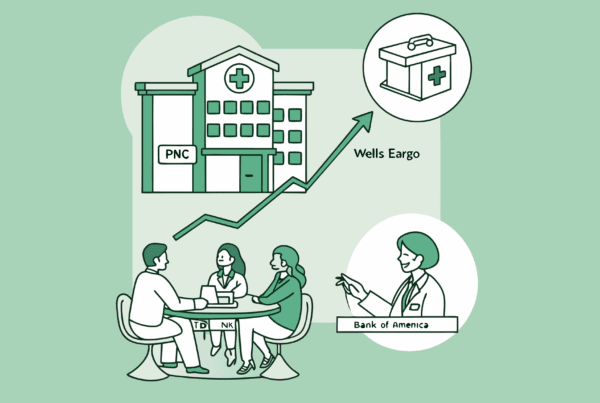

The New Hampshire Market Overview

The healthcare market in New Hampshire presents a unique environment for neurologists. With only 78 practicing neurologists in the state as of 2024, each independent practice represents a valuable and scarce resource. The high average salary for the specialty, around $338,156, confirms the strong revenue potential and demand for neurological services in the region.

However, this opportunity exists within a challenging landscape. Like many physicians, you may be feeling the pressure from rising administrative costs and staffing shortages. A significant trend across the state is the consolidation of healthcare, with larger hospital systems actively acquiring smaller, independent practices. This creates both a clear exit path and a need to act strategically to ensure you receive the best possible outcome.

Key Considerations for Neurology Practice Owners

Before you dive into the process, it is helpful to step back and think about a few key areas. Answering these questions for yourself will build the foundation for your entire exit strategy.

-

Your Personal “Why”. Are you seeking a partner to handle administrative burdens so you can focus on medicine? Are you planning for retirement in the next 2 to 5 years? Or are you looking for access to capital and resources to grow? Your motivation will determine the right type of buyer and deal structure for you. Many a deal has faltered when the seller did not really know what he or she wanted.

-

The Buyer Landscape. Buyers are not one-size-fits-all. A large hospital system has different goals than a private equity-backed group or another neurology practice looking to expand. A hospital may be focused on building a referral network, while a financial buyer will be focused squarely on profitability and growth.

-

Your Practice27s Operational Health. A potential buyer will look past your top-line revenue and dig into your operations. They want to see efficient billing and coding, a strong and stable referral base, and clean financial records. We find that addressing operational weak spots before going to market can significantly impact the final sale price.

Market Activity and Timing

If you browse public business-for-sale websites, you might not see many neurology practices listed in New Hampshire. This does not mean the market is quiet. In fact, it often means the opposite. Most successful medical practice transactions, especially in a specialized field like neurology, are handled privately.

Selling a medical practice is not like selling a house. Confidentiality is critical to protect staff morale, patient relationships, and referral patterns. For this reason, savvy sellers and serious buyers work through advisors who can connect them without a public listing. The key takeaway is that strategic buyers and investment groups are actively looking for profitable, well-run neurology practices to acquire. The demand is there, but it operates outside of the public view.

The Anatomy of a Practice Sale

Selling your practice follows a structured path. While every deal is unique, the journey generally involves a few distinct phases. Understanding them can take much of the anxiety out of the process.

Stage 1: Preparation and Valuation

This is the foundational work. It involves organizing your financial statements, understanding your practice27s true profitability, and getting a professional valuation. This is also the time to identify and fix any operational issues. Buyers pay for proven performance, not potential. The work you do here is what sets the stage for a premium offer.

Stage 2: Confidential Marketing

Here, your advisor confidentially presents the opportunity to a curated list of qualified buyers. This is not a public listing. It is a discreet and targeted process designed to create a competitive environment among potential acquirers who have been vetted for strategic fit and financial capability.

Stage 3: Due Diligence and Negotiation

Once you select a preferred buyer, you enter a period of due diligence. The buyer will verify all the information about your practice, from financial records to contracts. This is often where deals encounter unexpected hurdles. Preparing for this scrutiny in advance is critical. With a solid foundation, this stage transitions smoothly into finalizing the legal agreements.

What Is Your Practice Really Worth?

One of the most common questions we hear from physicians is, “What is my practice worth?” The answer is more complex than a simple rule of thumb. Sophisticated buyers do not value your practice based on revenue. They value it based on its demonstrated, sustainable cash flow.

In the world of M&A, this is measured by a metric called Adjusted EBITDA. Think of this as the true profit your practice generates before any owner-specific expenses, like a personal car lease or an above-market salary, are factored in. We start by calculating this true cash flow, then apply a valuation multiple based on current market data for neurology practices. We have seen neurology practices unlock significant value by optimizing their operations before a sale, in one case increasing profit by 60%. Your practice is likely worth more than you think, but its value must be professionally framed.

Planning for Life After the Sale

The day the deal closes is a beginning, not an end. A successful transition protects your financial future, your staff, and the legacy you have built. Planning for these elements from the start is as important as negotiating the price.

| Post-Sale Factor | Why It Matters |

|---|---|

| Your Transition Role | Most buyers will want you to stay on for a period of 6 months to 3 years. It is critical to clearly define your role, responsibilities, schedule, and compensation during this time to ensure a smooth handover. |

| Staff & Patient Continuity | Your staff is one of your practice27s greatest assets. A thoughtful communication and retention plan for key employees is vital for a stable transition and for protecting patient care. |

| Tax Implications | How your sale is structured (an asset sale vs. an entity sale) has massive implications for your final, after-tax proceeds. This decision must be made with expert guidance before the deal is finalized, not after. |

The journey of selling your practice is a significant one. With the right preparation and guidance, it can be a rewarding process that secures your financial future and ensures your practice continues to thrive.

Every practice sale has unique considerations that require personalized guidance.

Frequently Asked Questions

What is the current market landscape for selling a Neurology practice in New Hampshire?

The New Hampshire healthcare market is unique with only 78 practicing neurologists as of 2024, making independent practices valuable. The market is characterized by high revenue potential with an average salary around $338,156 but also faces challenges like rising administrative costs and staffing shortages. Larger hospital systems are consolidating healthcare by acquiring smaller practices, creating exit opportunities for sellers.

How can I determine the value of my Neurology practice before selling?

Practice value is based on sustainable cash flow measured by Adjusted EBITDA, not just revenue. You’ll need a professional valuation after organizing financial statements and optimizing operations. Buyers look for proven performance and operational health, so fixing any weak spots before marketing your practice can significantly increase its sale price.

What types of buyers should I expect in the Neurology practice market in New Hampshire?

Buyers vary from large hospital systems focused on building referral networks, to financial buyers like private equity groups aiming for profitability and growth, and even other neurology practices seeking expansion. Understanding your own goals will help match you with the right type of buyer and deal structure.

Why is confidentiality important in selling a Neurology practice, and how is the sale typically handled?

Confidentiality protects staff morale, patient relationships, and referral patterns. Most neurology practice sales are handled privately through advisors who discreetly connect sellers with vetted buyers rather than public listings. This targeted marketing ensures a competitive and strategic sale process.

What should I plan for after selling my Neurology practice in New Hampshire?

Post-sale planning includes defining your transition role for 6 months to 3 years ensuring a smooth handover, creating a staff and patient continuity plan to retain key employees, and understanding tax implications of the sale structure. Early planning in these areas is crucial for protecting your financial future and preserving your practice’s legacy.