The market for occupational therapy practices in Alabama is active, presenting a significant opportunity for owners considering their next chapter. Selling your practice is more than a transaction. It is the culmination of your life’s work. Success requires strategic preparation, a deep understanding of your practice’s true value, and a clear plan for navigating the complexities of the sale process. This guide provides key insights to help you achieve a successful and profitable exit.

Curious about what your practice might be worth in today’s market?

Alabama’s Occupational Therapy Market Overview

The demand for quality occupational therapy services in Alabama is strong, creating a favorable environment for practice owners looking to sell. Both private equity-backed groups and larger healthcare systems are actively seeking to expand their footprint in the state. They are looking for established, profitable OT practices with solid referral networks and a history of consistent performance.

This is not limited to large, multi-location clinics. We see buyers interested in a wide range of practices, including specialized pediatric clinics and those integrated with physical and speech therapy. The key for a potential buyer is a practice with a stable foundation and clear potential for growth. For you, the seller, this means the opportunity for a premium valuation is real, provided you position your practice correctly.

Understanding your practice’s current market position is the first step toward a successful transition.

Key Considerations for Alabama OT Practice Owners

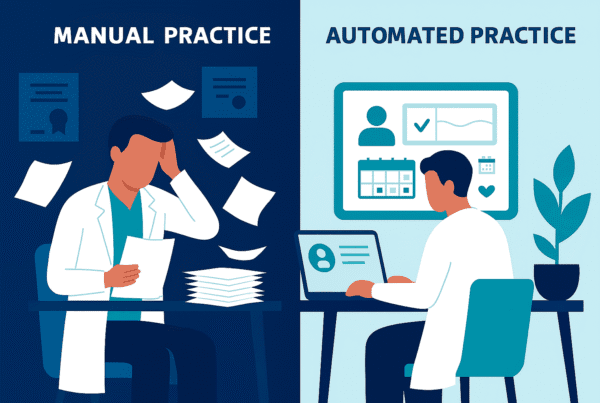

When preparing to sell your practice, buyers will look closely at several key areas. Getting these right from the start is critical.

Regulatory Compliance

Your practice’s standing with the Alabama State Board of Occupational Therapy (ASBOT) is non-negotiable. Buyers will perform due diligence to ensure you are fully compliant with the Alabama Occupational Therapy Practice Act. This includes confirming that all therapists are properly licensed and that supervision structures for OTAs meet state guidelines. Having your compliance records organized and clean inspires buyer confidence and prevents last-minute issues.

Financial Health

Beyond top-line revenue, sophisticated buyers want to see a financially healthy operation. Be prepared to present and discuss metrics like your pre-tax profit percentage, operating expense ratios, and the number of days in accounts receivable (A/R). Consistent, year-over-year revenue growth is a powerful indicator of a stable business. Normalizing your earnings to reflect the true profitability of the practice is one of the most important steps you can take.

Referral and Staff Stability

Who sends you patients, and who treats them? Buyers pay a premium for practices with diverse, long-standing referral sources that are not dependent on a single physician or hospital. They also look for a stable, experienced team of OTs and OTAs. A practice that can continue to thrive after the owner transitions is far more valuable.

Proper preparation before selling can significantly increase your final practice value.

Current Market Activity

The M&A market for therapy practices across the Southeast, including Alabama, is robust. We are seeing a consistent flow of transactions for established OT practices. Buyers are particularly interested in clinics with annual revenues exceeding $500,000, and larger, multi-therapist practices can command valuations well into the seven figures.

Practices that combine occupational therapy with physical or speech therapy are also in high demand, as buyers see value in integrated care models. The key takeaway for owners is that there is an active and competitive pool of buyers looking for good opportunities in Alabama. Timing your entry into this market correctly can have a major impact on the outcome of your sale.

The window of opportunity for optimal valuations shifts with market conditions.

The Path to Selling Your Practice

A successful practice sale follows a structured and confidential process. While every deal is unique, the journey typically involves several key phases. Understanding these steps helps you prepare for what lies ahead.

| Phase | Key Actions for the Seller | The Advisor’s Role |

|---|---|---|

| 1. Preparation | Gather financial records, review legal/corporate documents, and address any operational weaknesses. | Conduct a professional valuation, normalize financials, and prepare a confidential marketing package. |

| 2. Marketing | N/A (Handled by advisor to maintain confidentiality). | Confidentially approach a curated list of vetted, qualified buyers. Manage all communications and initial inquiries. |

| 3. Negotiation | Review and consider offers (Letters of Intent). | Create competitive tension between buyers to secure the best price and terms. Advise on deal structure. |

| 4. Due Diligence | Provide requested documents to the chosen buyer in a secure data room. | Manage the entire due diligence process to prevent delays and protect your interests. |

| 5. Closing | Review final legal documents (e.g., Asset Purchase Agreement) with your attorney. Plan for transition. | Coordinate with legal and accounting teams to ensure a smooth and timely closing. |

The due diligence process is where many practice sales encounter unexpected challenges.

How Buyers Determine Your Practice’s Value

Many owners think their practice’s value is a simple multiple of its annual revenue. While that’s a starting point, sophisticated buyers look deeper. The most important metric in a sale is your Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents the true cash flow of your business by adding back owner-specific and one-time expenses to your net income.

Your final valuation is this Adjusted EBITDA number multiplied by a specific “multiple.” This multiple isn’t fixed. It is influenced by many factors: your payer mix, your location in Alabama, your reliance on any single therapist (including yourself), and your documented opportunities for growth. We find that many practices are undervalued until a professional helps reframe the narrative and normalize the financials. A thorough valuation is the foundation of any successful sale strategy.

Valuation multiples vary significantly based on specialty, location, and profitability.

Planning for Life After the Sale

Closing the deal is a major milestone, but the journey isn’t over. A successful transition requires careful planning for what comes next.

Here are three key areas to consider with your advisor long before you sign the final papers:

- Your Transition Role. Will you leave immediately, or stay on for a period of months or years to ensure a smooth handover? This is a key point of negotiation. Structuring this role correctly allows you to protect your legacy while meeting the buyer’s need for continuity.

- Staff and Culture. The new owner will be acquiring your most valuable asset: your team. A well-designed transition plan is critical for staff retention and for preserving the patient-focused culture you worked so hard to build.

- Your Financial Future. The structure of your sale has massive implications for your after-tax proceeds. Decisions about how the deal is structured as an asset or stock sale, and whether it includes an earnout can significantly impact your net take-home amount.

The right exit approach depends on your personal and financial objectives.

Frequently Asked Questions

What is the current market demand for occupational therapy practices in Alabama?

The demand for occupational therapy services in Alabama is strong, with active buyers including private equity-backed groups and larger healthcare systems seeking established, profitable OT practices with stable referral networks and consistent performance.

What are the key factors buyers consider when evaluating an occupational therapy practice in Alabama?

Buyers focus on regulatory compliance with the Alabama State Board of Occupational Therapy, financial health including profitability and revenue growth, and referral and staff stability ensuring diverse referrals and a stable, experienced team.

How is the value of an occupational therapy practice in Alabama typically determined?

Practice value is commonly based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiplied by a multiple. This multiple varies based on factors such as payer mix, location, reliance on specific therapists, and growth opportunities.

What are the main steps involved in selling an occupational therapy practice in Alabama?

The sale process includes five phases: Preparation (gathering records and valuation), Marketing (confidential outreach to buyers), Negotiation (review offers and deal structure), Due Diligence (document review), and Closing (final legal review and transition planning).

What should sellers consider about their role and transition after selling their occupational therapy practice?

Sellers should plan their transition role (immediate departure or extended handover), ensure staff and culture continuity, and consider the financial structure of the deal for optimal after-tax proceeds, as these impact legacy preservation and financial outcomes.