Selecting the Right Lender for Your School & Community-Based ABA Practice Transaction

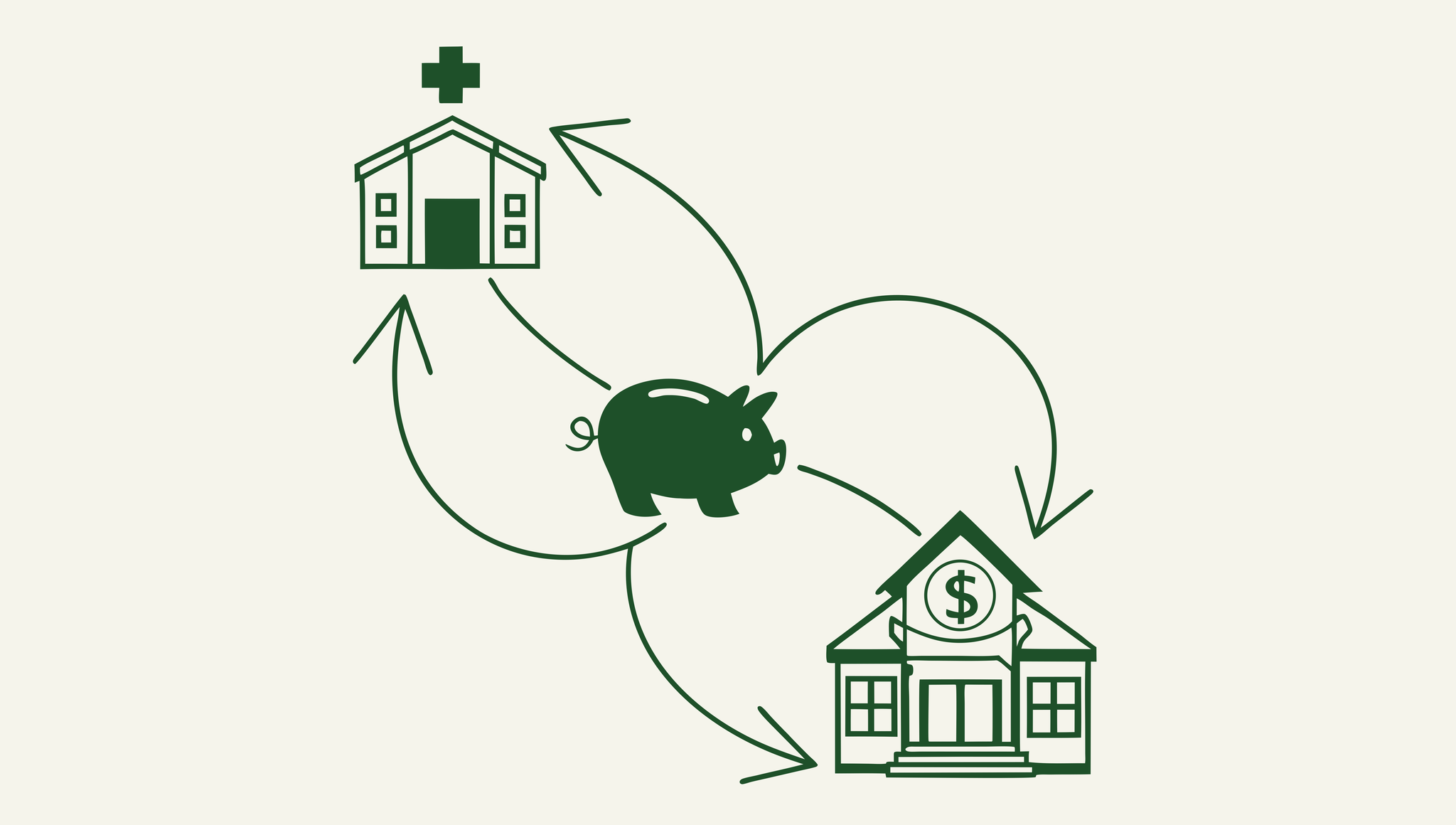

Securing the right financing partner can make the difference between a smooth practice acquisition and a failed transaction. Specialized lenders who understand the unique cash flow models, regulatory requirements, and reimbursement structures of ABA practices offer significantly better terms and approval rates than traditional banks that often undervalue service-based healthcare businesses.

Book a Confidential Strategy Session →

Top Lender Firms Specializing in School & Community-Based ABA

1. ABA Advisors

Headquarters: National Advisory Service

Service Area: Nationwide

Website: abaa.com

2. FNB Small Business Finance

Headquarters: Pittsburgh, PA

Service Area: Nationwide SBA Lending

Website: fnb-online.com

3. Live Oak Bank Healthcare Division

Headquarters: Wilmington, NC

Service Area: Nationwide

Website: liveoakbank.com

4. Huntington Healthcare Finance

Headquarters: Columbus, OH

Service Area: Midwest and Eastern US

Website: huntington.com

5. Wells Fargo Healthcare Financial Services

Headquarters: San Francisco, CA

Service Area: Nationwide

Website: wellsfargo.com

Key Financing Terms for ABA Practice Acquisitions

Understanding typical financing structures helps you evaluate lender proposals effectively. For mid-sized, multilocation ABA practices, current market conditions support:

- Loan-to-Value Ratios: Up to 95% financing available through SBA programs, with some qualified buyers securing even higher ratios

- Interest Rates: Currently ranging from 7% to 10% depending on loan size, borrower qualifications, and market conditions

- Term Length: Standard 10-year terms for practice acquisitions, with 10-25 year options for real estate components

- Additional Costs: Expect origination fees of 1-3% of the loan amount, plus third-party valuation fees and SBA guarantee fees

Specialized ABA lenders like those listed above understand that your practice value extends beyond physical assets. They factor in your established referral networks, trained staff, and recurring revenue from school contracts and insurance reimbursements—elements that generalist banks often overlook or undervalue.

Critical Considerations for ABA Practice Financing

The complexity of ABA practice operations requires lenders who understand several unique aspects:

Regulatory Compliance: Your lender should be familiar with state licensure requirements, BCBA supervision ratios, and insurance credentialing timelines that affect cash flow projections.

Revenue Diversification: School contracts, commercial insurance, and private pay create different risk profiles than traditional medical practices. Lenders experienced with ABA understand these revenue streams provide stability through diversification.

Working Capital Needs: ABA practices often require 60-90 days of working capital due to insurance reimbursement delays and seasonal school contract variations. Experienced lenders build this into their loan structures rather than viewing it as a red flag.

How to Select the Right Lender for Your School & Community-Based ABA Practice Transaction

Start by engaging multiple lenders who specialize in healthcare or have specific ABA experience—generalist banks frequently reject these deals or offer suboptimal terms. Request references from other ABA practice owners they’ve financed, and compare not just rates but their understanding of your business model. The right lender will ask informed questions about your payor mix, referral sources, and staff retention strategies rather than focusing solely on hard assets.

Book a Personalized Exit Planning Session →

Frequently Asked Questions

Why is it important to select a specialized lender for mergers and acquisitions of school and community-based ABA practices?

Specialized lenders understand the unique cash flow models, regulatory requirements, and reimbursement structures of ABA practices, offering significantly better terms and approval rates than traditional banks that often undervalue service-based healthcare businesses.

Who are the top lenders specializing in school and community-based ABA practice mergers and acquisitions?

Top lenders include ABA Advisors, FNB Small Business Finance, Live Oak Bank Healthcare Division, Huntington Healthcare Finance, and Wells Fargo Healthcare Financial Services.

What are the typical financing terms for mid-sized, multilocation ABA practice acquisitions?

Typical financing terms include loan-to-value ratios up to 95% through SBA programs, interest rates ranging from 7% to 10%, standard 10-year loan terms, and additional costs such as 1-3% origination fees plus third-party valuation and SBA guarantee fees.

What critical considerations should lenders have when financing ABA practice acquisitions?

Lenders should understand regulatory compliance like state licensure and BCBA supervision ratios, revenue diversification from school contracts, insurance and private pay, and working capital needs due to insurance reimbursement delays and seasonal variations.

How can ABA practice owners select the right lender for their acquisition transaction?

Owners should engage multiple lenders with healthcare or specific ABA experience, request references from other ABA practice owners, and evaluate lenders on their understanding of the business model, including payor mix, referral sources, and staff retention, rather than only loan rates or hard assets.