As a physical therapy practice owner, you face a difficult reality. Declining reimbursements and rising operational costs are squeezing your margins. Medicare reimbursements have fallen nearly 30% in two decades. In response, the most successful PT practices are moving beyond the traditional insurance-only model. This allows them to thrive.

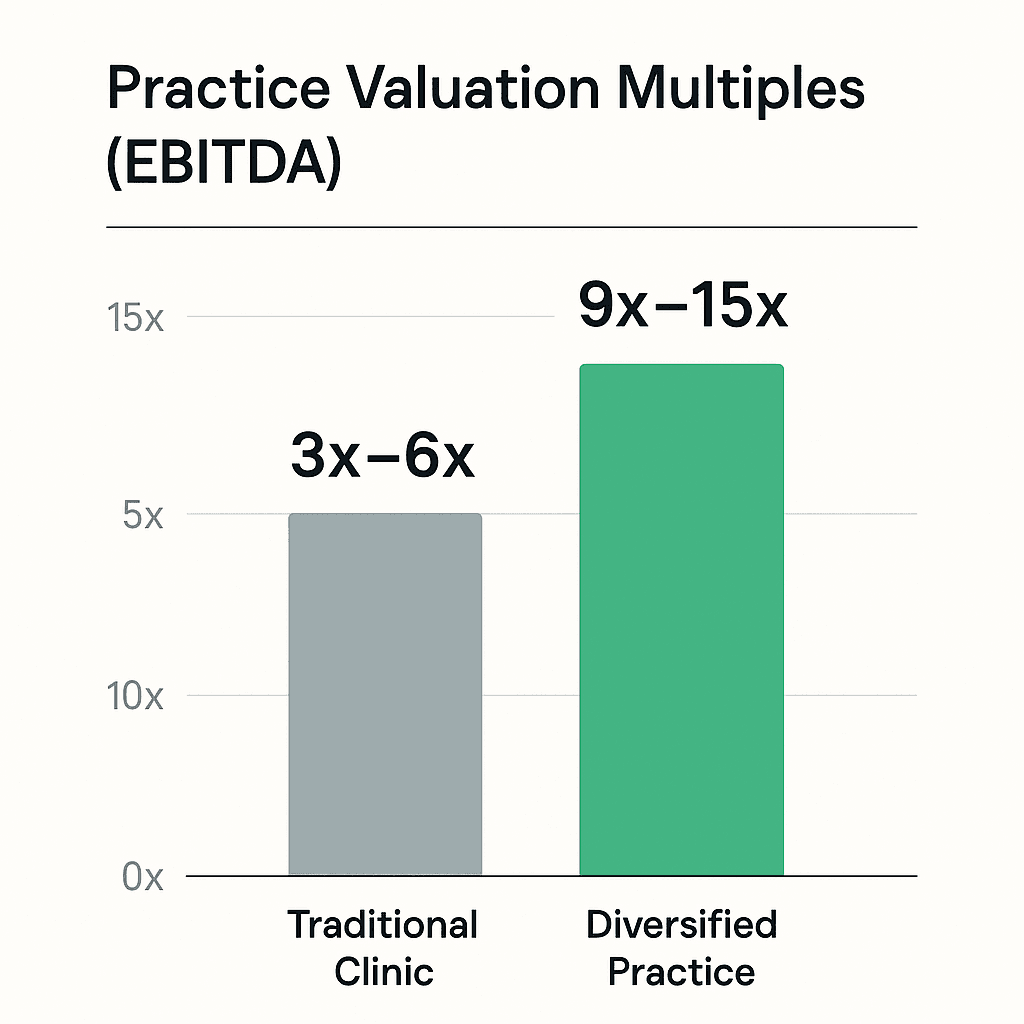

Top-performing practices are achieving 200-300% revenue growth and commanding exit valuations of 9x-15x EBITDA, compared to just 3x-6x for traditional clinics.

This guide outlines the proven strategies to achieve these results, boosting your financial performance and securing a premium valuation when you decide to sell your medical practice.

What Is Revenue Diversification in Physical Therapy?

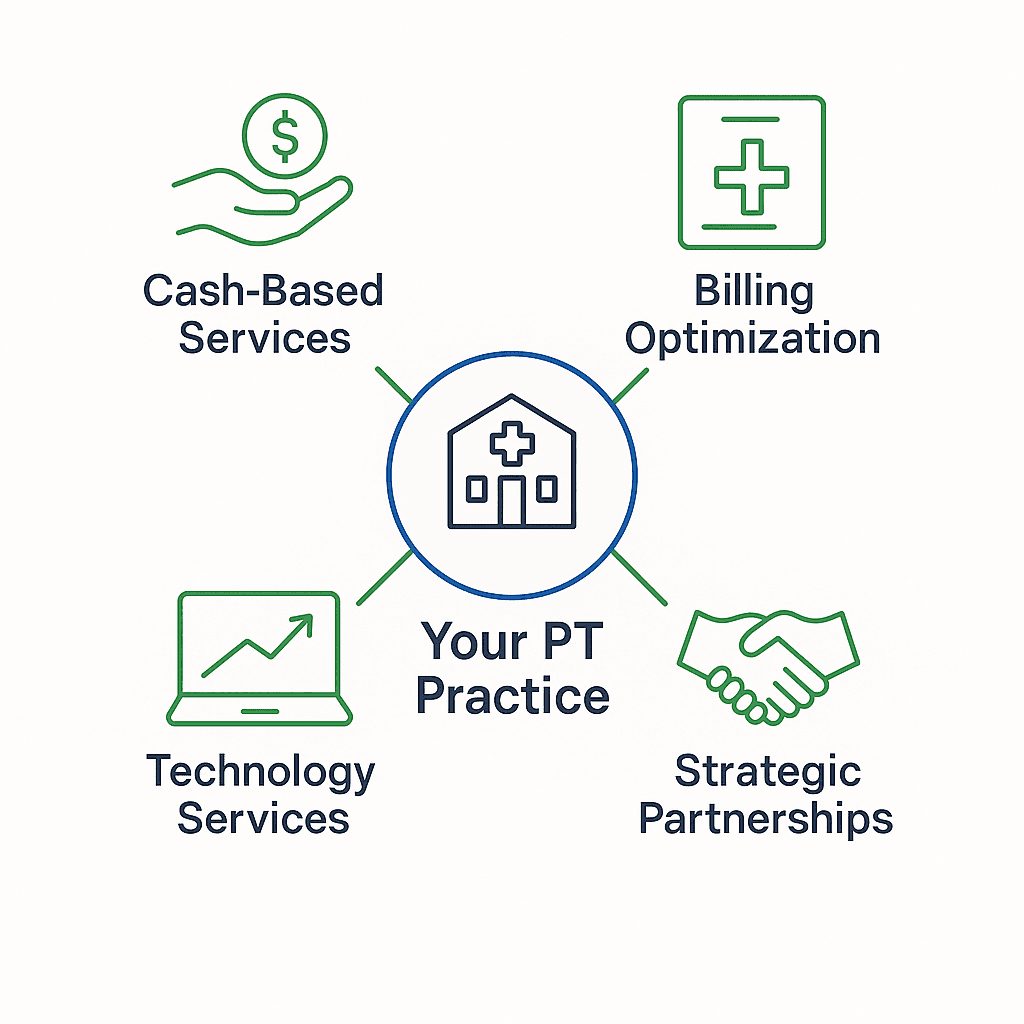

Revenue diversification means creating multiple income streams to reduce your dependence on insurance billing. Instead of being vulnerable to payer rate cuts and administrative burdens, you build a more resilient and profitable practice. The most successful approaches combine three core growth strategies: offering premium cash-based services, optimizing billing from current operations, and leveraging technology for scalable income.

Nearly half of all therapy leaders planned to add or increase cash-based services in recent years, citing immediate improvements in both profitability and patient satisfaction. The key is to start with a single, high-impact strategy. This allows you to build momentum and reinvest your profits into the next phase of growth.

How Can Cash-Based Services Boost Your Profitability?

Cash-based services offer the fastest path to higher profits. By bypassing insurance, you can set your own premium pricing while delivering the high-value, personalized care that patients are willing to pay for directly. For example, dry needling offers an exceptional return on investment, with sessions averaging $60. The success of this model is proven by practices like Carter Physiotherapy in Austin, which built a full patient schedule within six months as a fully cash-based clinic.

You can introduce a variety of high-margin cash services to build recurring income and create a more holistic patient experience. The most effective approach is to start small by adding one service, testing market demand, and then expanding based on what works for your patient population.

| Cash-Based Service Example | Typical Price / Structure |

| Manual Therapy & Specialized Techniques | $80 – $120 per session |

| Wellness & Fitness Programs | $99 – $199 monthly membership |

| Telehealth Consultations | $75 – $150 per session |

| Custom Orthotics & Therapeutic Products | 40% – 60% markup |

| Nutrition Counseling & Lifestyle Coaching | $100 – $150 per session |

How Can You Maximize Billing Revenue Without Adding Services?

Before adding new services, ensure you are capturing all the revenue you’re entitled to from your current operations. You should also focus on billing high-value CPT codes, such as therapeutic exercise (97110), neuromuscular re-education (97112), and manual therapy (97140), which command premium reimbursements.

Simply mastering Medicare’s 8-minute rule can increase your revenue per visit by 15-25% without adding a single new patient or service.

Top clinics consistently achieve 95-98% net collection rates by implementing systematic processes. This includes automating claim submissions to reduce delays, using real-time eligibility verification to prevent denials, and improving cash flow with point-of-service collections. A key metric to track is keeping your days in accounts receivable (A/R) below 35 days. Furthermore, strategic use of modifiers can significantly impact reimbursement. However, remember that compliance is critical, as improper documentation is a leading cause of claim denials and can trigger costly audits.

What Technology Services Generate the Most Revenue?

Remote Therapeutic Monitoring (RTM) is one of the biggest new revenue opportunities for PT practices. RTM utilizes specific CPT codes that cover initial setup (98975), device supply (98977), and monthly monitoring (98980, 98981). Practices implementing RTM report profit increases between 49% and 139%, with platforms like MovementRX offering turnkey solutions.

Remote Therapeutic Monitoring (RTM) can generate an additional $150-$250 in high-margin revenue per patient, every month.

Telehealth also offers new revenue streams, with cash-pay sessions ranging from $75-$150. For larger practices, corporate telehealth contracts can generate substantial recurring revenue. Adopting these technologies gives you a competitive advantage in a digital PT software market projected to grow from $1.39 billion to $3.82 billion by 2034. You can also monetize your expertise by creating passive income through online courses or certification programs.

Why Do Strategic Partnerships Multiply Your Practice Value?

Strategic partnerships create powerful referral networks and stable, predictable revenue. Direct-to-Employer (D2E) programs, for instance, allow you to tap into the massive market of employed individuals with workplace injury prevention services, operating on contractual payments that eliminate insurance complexity.

Integrating with local healthcare systems can accelerate growth through a steady stream of referrals, as demonstrated by Professional Physical Therapy’s 200+ clinic network. Similarly, partnerships with sports teams, like those managed by Athletico, build brand recognition while generating contract revenue. You can also create a comprehensive care center by integrating complementary services like massage therapy or nutrition, which boosts patient retention and average revenue per patient.

How Does Revenue Diversification Impact Your Practice Valuation?

In the physical therapy M&A market, diversified practices are in high demand. The industry remains highly fragmented, creating significant opportunities for consolidation. Buyers pay a premium for diversified businesses because they are more stable and have greater growth potential. While a small, traditional clinic might receive a 3x-6x EBITDA multiple, a diversified practice can command 9x-15x.

Diversification increases your practice valuation by demonstrating a de-risked and professionalized business. A healthy payer mix reduces dependency on any single insurance source. Expanded service lines show a strong market position, and a professional management structure reduces the practice’s dependence on you as the owner. With the M&A market expected to rebound, practices with documented revenue diversification and strong EBITDA margins are the most attractive acquisition targets for M&A advisors like SovDoc.

For M&A advisors like SovDoc, practices with documented revenue diversification, strong EBITDA margins, and growth-oriented management are the most attractive acquisition targets.

What Is a Realistic Implementation Roadmap?

Successful revenue diversification happens in phases. This systematic approach, outlined below, maximizes your return on investment while minimizing operational disruption.

| Phase | Timeframe | Key Actions | Estimated Investment | Expected Return |

| Phase 1: Optimize Your Foundation | Months 1-6 | Implement systematic billing optimization (e.g., 8-minute rule).Improve collection processes to reduce A/R.Add one high-ROI cash service (e.g., dry needling). | $25,000 – $50,000 | 15-25% increase in revenue per visit. |

| Phase 2: Add Technology Services | Months 7-12 | Launch a Remote Therapeutic Monitoring (RTM) program.Implement telehealth services for cash-pay and existing patients.Begin developing online content or a simple course. | $15,000 – $30,000 | $150-250 additional monthly revenue per RTM patient. |

| Phase 3: Build Strategic Partnerships | Months 13-18 | Establish corporate wellness or D2E contracts.Develop referral relationships with local hospital systems.Add complementary services through partners or new hires. | $50,000 – $100,000 | 20-35% increase in total practice revenue. |

Why Diversification Matters Now

Physical therapy practice owners are at a crossroads. You can continue to rely on declining insurance reimbursements or take control of your financial future through strategic diversification. The PT market is growing, but that growth is concentrating among practices that have already diversified.

Practices that implement these strategies gain two critical advantages: immediate financial improvement through higher margins and a premium exit valuation that can be two to three times higher than traditional clinics. As M&A advisors specializing in healthcare, SovDoc helps practice owners implement these strategies to improve both immediate performance and long-term acquisition value. The opportunities are significant for those who act. The only remaining question is which strategy you will implement first.