You’re a successful practice owner. You’re clearing $2 million in revenue, you have seven physicians, and you just hired your second administrator. But when it comes to making big decisions, nobody is clear on who actually decides what.

Who approves the $300K equipment purchase? Who has the final say on hiring a new cardiologist? When physicians disagree on opening a second location, how do you break the deadlock?

This is the stage where most growing practices stall. You’ve outgrown handshake agreements and informal “we’ll figure it out” meetings, but you haven’t replaced them with a real system. The cost of this ambiguity is partnership disputes, strategic paralysis, and operational friction. Worse, this ambiguity can directly impact your bottom line when you decide to sell.

When potential buyers start their due diligence, dysfunctional governance can knock 15-20% off your valuation before negotiations even begin.

What Exactly Is Practice Governance (And Why Should You Care)?

Medical practice governance is your rulebook for decision-making. It defines who makes decisions, how they make them, and who is accountable. It’s not your org chart or the partnership agreement collecting dust since 2015, it’s the real system that dictates how your practice operates day-to-day.

Effective governance provides clarity on three critical areas, decision authority (who approves budgets or hires?), accountability structure (who reports to whom and how are leaders chosen?), and the line between clinical control and business management.

For years, informal governance works. Three founding partners who trained together can decide everything over lunch. But this system breaks down when you add a seventh physician who wasn’t part of the original deal, or when a $500K MRI purchase is on the table and no one knows the approval process. When a buyer asks, “Who has approval authority for capital expenditures over $100K?” and the answer is “it depends,” you have a problem.

Strong governance prevents expensive failures like partnership blow-ups, strategic indecision, and a significant hit to your practice’s valuation. Buyers see unclear governance as a major risk and will discount their offer accordingly.

Which Governance Model Is Right for Your Practice?

There is no one-size-fits-all structure, but most successful medical groups adopt one of four primary models. The right choice depends on your practice’s size, complexity, and growth ambitions.

| Governance Model | Best For | Key Challenge |

| Physician Partnership | Single-specialty groups with 3-15 physicians where partners want direct control and are willing to engage in business matters. | Can be slow and inefficient. Decision-making requires consensus from busy clinicians, not all of whom are interested in business strategy. |

| Corporate Board | Larger groups (20+ physicians), multi-specialty practices, or any group planning for significant growth or a future M&A transaction. | Physicians can feel disconnected from strategic decisions. Requires mechanisms to ensure the board doesn’t lose touch with clinical realities. |

| Hybrid Model | Mid-stage groups (10-30 physicians) that have outgrown a simple partnership but aren’t ready for a full corporate structure. | The line between clinical and business authority can become blurry. Requires very clear, documented decision rights to avoid conflict. |

| MSO (Management Services Organization) | Practices seeking growth capital, navigating corporate practice of medicine laws, or where physicians want to focus entirely on clinical work. | Adds a layer of complexity. You are managing a contractual relationship between two entities, and incentives must be carefully aligned. |

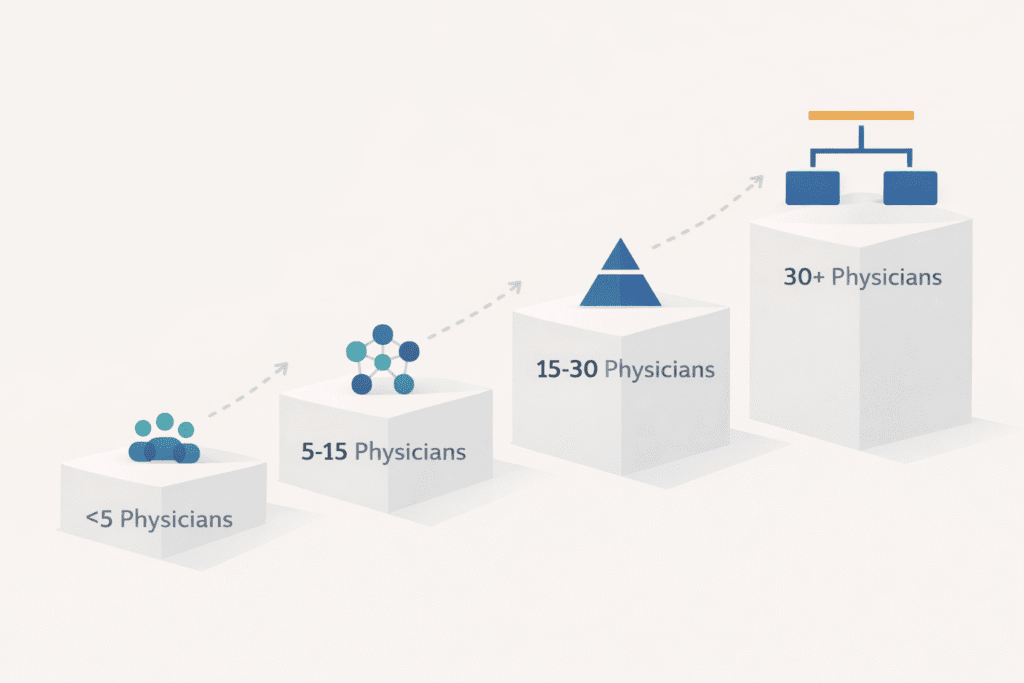

Does Your Governance Need to Evolve as You Grow?

Yes. A structure that works for a 3-physician practice will fail a 30-physician group. Your governance must mature alongside your practice.

A governance structure that works for a 3-physician practice will fail a 30-physician group. Your framework must evolve as you grow.

For practices with fewer than 5 physicians, informal governance usually works, as long as key agreements like compensation and buy-in/buy-out terms are documented. Formal boards are likely overkill.

As you grow to 5-15 physicians, you need a defined structure. This means a strong operating agreement with clear decision authorities, a designated managing partner or medical director, and documented voting procedures for major decisions.

Once you cross the 15-30 physician threshold, it’s time for a formal board model. The complexity of the business demands a separation between strategic oversight and daily operational management.

For groups with 30+ physicians, professional corporate governance becomes essential. This includes a board providing oversight, a clear separation between strategy and operations, and defined executive management roles.

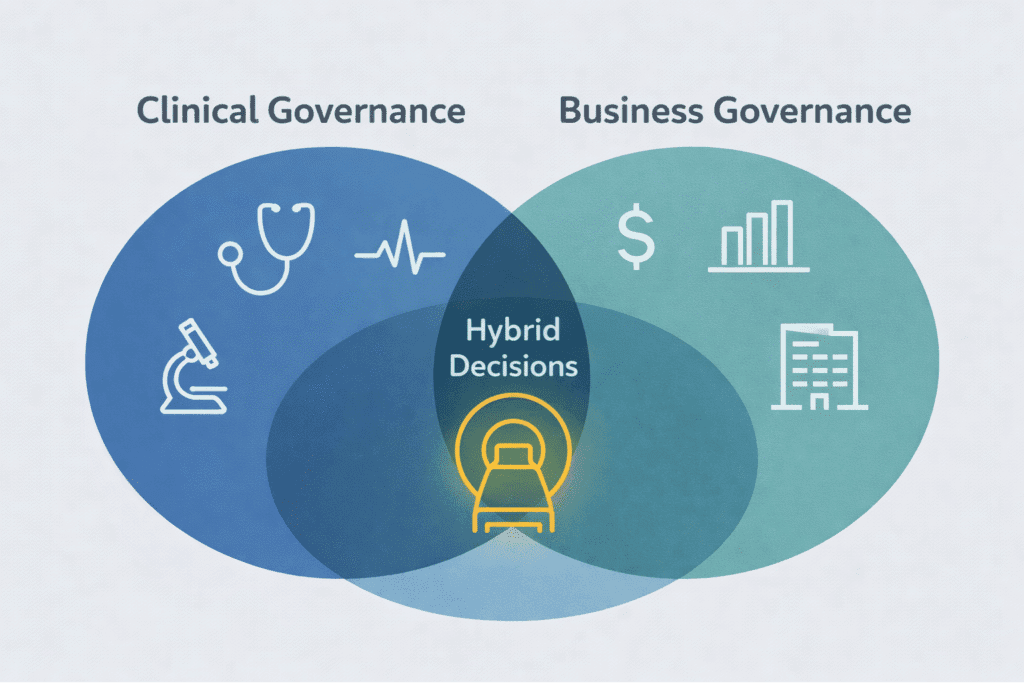

How Do You Separate Clinical Decisions from Business Decisions?

One of the biggest mistakes practice owners make is mixing up clinical and business governance. Confusing the two creates conflict and inefficiency.

Clinical governance is the domain of physicians. It focuses on the quality and safety of patient care, covering areas like clinical protocols, peer review, quality standards, and credentialing. These decisions require medical judgment.

Business governance, in contrast, focuses on the health of the practice as a business entity. This includes strategic planning, financial management, payer negotiations, and non-clinical staffing. While physicians should have input, these decisions benefit from professional management expertise, and it is possible to maintain clinical autonomy post-sale.

The challenge lies where these two areas intersect. For example, purchasing an expensive MRI is both a clinical capability decision and a major capital expenditure. A strong governance framework defines how these hybrid decisions are made, typically requiring both clinical input and business analysis before a final decision.

How Does Governance Directly Impact Your Practice’s Valuation?

If you are considering a sale or merger, your governance structure is a critical factor that directly influences your practice’s valuation and your role after the transaction. Buyers evaluate governance as a primary risk factor. A practice with clear decision-making processes, documented policies, and a stable leadership team signals a well-run organization that can function beyond its founders. This stability commands a premium.

Your pre-transaction governance structure is your strongest negotiating tool for determining your post-transaction role and influence.

Furthermore, your pre-transaction governance structure is your strongest negotiating tool for determining your post-transaction role. If you can demonstrate that your leadership team effectively manages the practice, you are far more likely to retain board seats, medical director roles, or other influential positions. If your governance is chaotic, the buyer will insist on replacing it entirely with their own structure, leaving you with little to no control.

Are You Seeing These Red Flags of Governance Failure?

How do you know it’s time for a change? The signs of failing governance are often dismissed as “growing pains,” but they are symptoms of a deeper structural problem. Do any of these sound familiar?

Major decisions stall in endless meetings with no resolution. You might find out about significant hires or contracts only after the fact. More time is spent arguing about how to decide than actually making a decision. A few partners carry all the administrative weight, breeding resentment. Your administrator is frustrated, constantly hitting invisible walls of authority. Ultimately, the practice feels like it’s drifting without clear goals because no one is empowered to set a strategy and execute it.

If you recognize these patterns, your governance structure is holding your practice back.

What’s a Practical Plan to Implement Stronger Governance?

Fixing your governance doesn’t have to be overwhelming. Follow this practical roadmap:

- Assess and Diagnose. Start by documenting how decisions are actually made today, not what your old operating agreement says. Identify the real-world gaps, conflicts, and points of friction.

- Design and Document. Based on your size and goals, choose the right model. Then, create a clear decision rights matrix that specifies who has the authority to decide, who must be consulted, and who is simply informed for every major decision category. Update your operating agreements and bylaws to reflect this new reality.

- Implement and Communicate. This is more than filing paperwork. Hold meetings to ensure every physician and key administrator understands the new structure, their roles, and what has changed. Appoint leaders to their new roles, whether it’s a formal board, a managing partner, or a CEO.

- Review and Refine. Governance is not static. Plan to review your structure annually to see what’s working and what isn’t. Be prepared to adapt the structure as your practice continues to evolve.

For this process, consider bringing in outside expertise. A healthcare attorney or an M&A advisor who understands practice governance can help you avoid costly mistakes and design a structure that truly fits your needs.

Protecting and Maximizing Your Practice’s Value

The right governance structure won’t solve every problem, but it creates a durable framework for solving problems effectively. It replaces chaos with clarity and positions your practice for sustainable growth.

Most importantly, strong governance is a direct driver of your practice’s value. It demonstrates to buyers that you have built an organization, not just a job for its founders. That stability is worth a premium, and implementing these value enhancement strategies can significantly improve your final outcome.

Ready to get a clear picture of how your governance structure is impacting your practice’s value? SovDoc specializes in helping medical practice owners strengthen their governance to prepare for growth and maximize value in M&A transactions. Connect with our team for a confidential discussion about your practice.