When preparing to sell your medical practice, every line item on your financial statements comes under scrutiny. One of the most critical, and often overlooked, is your own compensation. How you pay yourself directly impacts your practice’s valuation, the final purchase price, and the terms of your post-sale employment. If your compensation doesn’t align with Fair Market Value (FMV), it can create significant hurdles in a transaction.

This guide explains how to use compensation benchmarks to protect your practice’s value and ensure a smoother M&A process.

Why Your Paycheck Matters in a Practice Sale

During due diligence, buyers scrutinize every dollar of executive pay to assess future profitability and risk. First, they need to know if your compensation is sustainable. If you’re paying yourself $800,000 but the market rate is $450,000, a buyer will subtract that $350,000 in “excess” compensation directly from your EBITDA, causing your practice’s valuation to drop. Second, buyers are laser-focused on regulatory compliance.

Stark Law and the Anti-Kickback Statute demand that physician compensation meets Fair Market Value. Finally, they are planning your post-sale role. A large gap between your current salary and a market-appropriate one makes post-sale employment negotiations incredibly difficult.

Key Takeaway: Buyers will subtract any compensation they deem “excess” directly from your practice’s EBITDA. This EBITDA normalization adjustment immediately lowers your valuation.

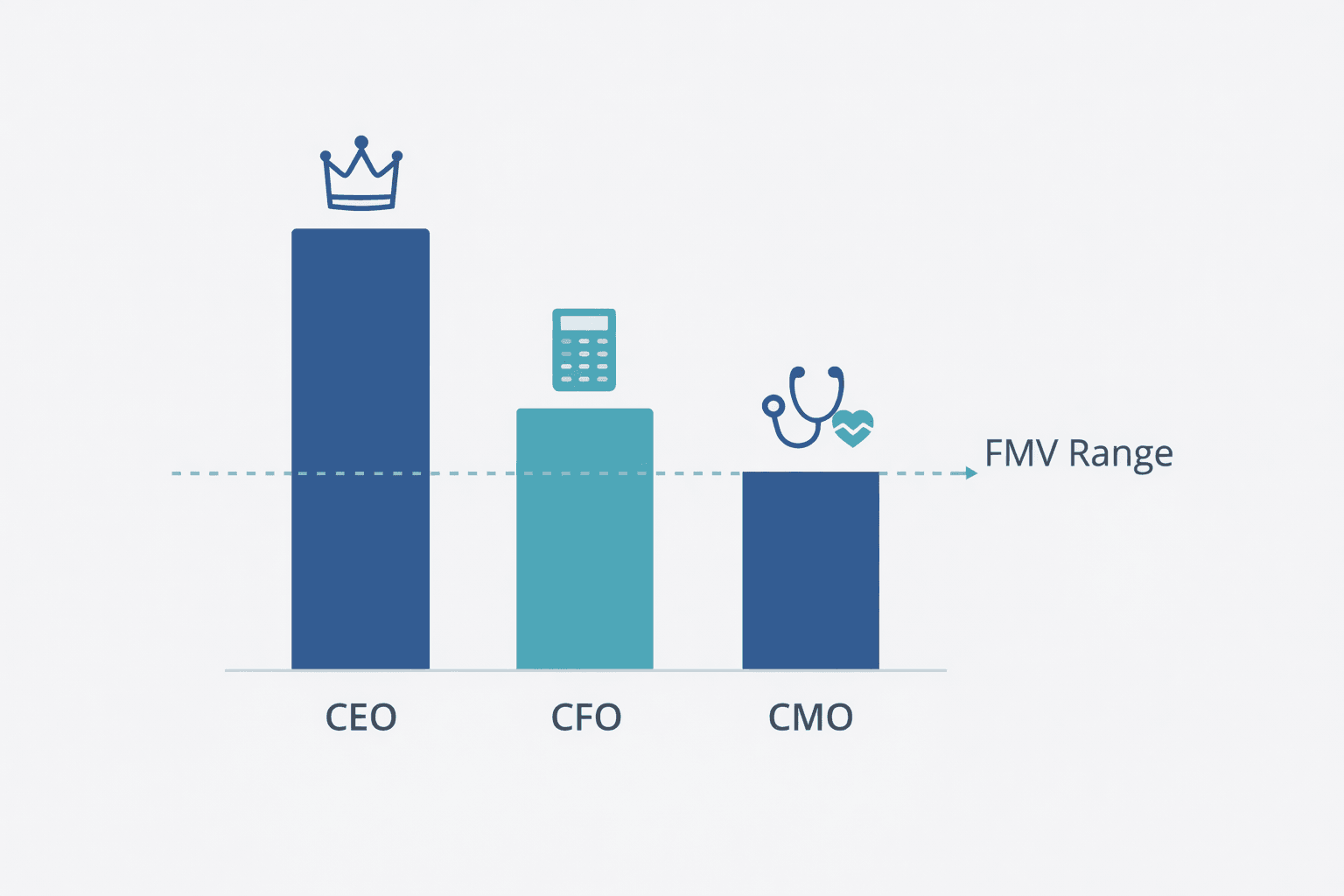

What Healthcare Executives Are Earning in 2026

Buyers analyze your Total Cash Compensation (TCC), which includes your guaranteed base salary plus any performance-based bonuses. They will also factor in the full cost of your employment, including retention bonuses, special retirement contributions, and other executive perks. For physician-owners, this also covers clinical pay and medical director stipends. They add it all up to determine your true annual cost, then compare that number to benchmark data for similar organizations.

Compensation varies dramatically based on your role, practice revenue, and location. The table below provides a snapshot of what the data shows for different leadership roles.

| Executive Role | Practice Revenue | Typical Total Cash Compensation (2026 Estimate) |

| CEO/President | Under $50M | $275,000 – $350,000 |

| $50M – $250M | $350,000 – $650,000 | |

| CFO | Under $50M | $190,000 – $250,000 |

| $50M – $250M | $250,000 – $400,000 | |

| CMO | Varies by Size/Specialty | $330,000 – $635,000 |

| CIO/Tech Leader | Varies by Size/Complexity | 8-12% annual increases, often outpacing other roles |

Data synthesized from Healthcare Finance News, SullivanCotter, and Healthstaffinggroup reports.

As a physician-owner, your specialty also matters. A Chief Medical Officer with a cardiology background will typically earn more than one from primary care. Furthermore, the growing demand for tech leadership means roles like CIO are seeing the fastest pay increases, as buyers value strong IT infrastructure and cybersecurity.

Does Practice Size and Location Justify Your Salary?

Yes, significantly. Buyers expect compensation to scale with complexity. Larger organizations with more revenue, locations, and employees naturally pay their executives more. Location also creates major pay differences. Practices on the coasts often pay 25-40% more than those in the Midwest or South for the same role, driven by a higher cost of living and greater competition for talent. This can work for or against you. If you’re in a lower-cost market selling to a private equity-backed MSO, your pay might increase post-sale. However, if you’re in a high-cost market, be prepared for buyers to scrutinize your salary closely.

Navigating the Fair Market Value Compliance Trap

In healthcare, Fair Market Value isn’t just a business concept—it’s a legal requirement. FMV is the price that would be paid in a fair, arm’s-length transaction. If your compensation as a physician-owner exceeds FMV, you could be violating Stark Law. This is a deal-killing liability for a buyer. Deals collapse over the risk of having to repay Medicare funds and face massive fines. Even if a violation isn’t a deal-breaker, the perceived risk will lead to a significant discount on your purchase price.

Compliance Alert: In healthcare M&A, Fair Market Value (FMV) isn’t just a business term—it’s a legal requirement. A buyer will walk away from a deal with potential Stark Law violations.

To avoid this, you must benchmark your pay against similar roles and clearly separate compensation for administrative duties versus clinical work.

How Your Compensation Directly Impacts Valuation

This is where your salary hits your bottom line. Buyers determine your practice’s value by calculating a multiple of its EBITDA. If your pay is above the market rate, they will subtract the “excess” amount from your earnings, which directly lowers your valuation. For example, consider a practice with a reported EBITDA of $2,000,000. If you, the owner, draw a salary of $800,000 but the market rate for your role is only $500,000, a buyer will identify $300,000 in “excess compensation.” They will then adjust your EBITDA down to $1,700,000. Applying a standard 6x multiple, this single adjustment drops your practice’s valuation from $12 million to $10.2 million.

The Bottom Line: An above-market salary of $300,000 can reduce your practice’s valuation by $1.8 million at a 6x multiple. This is a direct, quantifiable loss.

The goal is not to be high or low—it’s to be market-appropriate and defensible.

What to Expect for Your Post-Sale Paycheck

Your compensation structure will almost certainly change after the sale. As an owner, your pay was a mix of salary and practice profits. As an employee, you will be paid a market-rate salary for the work you perform. Buyers normalize your pay by asking, “What would we pay a non-owner to do this job?” Expect your new compensation to be structured as a fixed salary, a productivity-based model (like a percentage of collections or payment per wRVU), or a combination. Buyers may also offer an income guarantee for 1-3 years to ease the transition, along with retention bonuses or performance-based earnouts to keep you engaged post-sale.

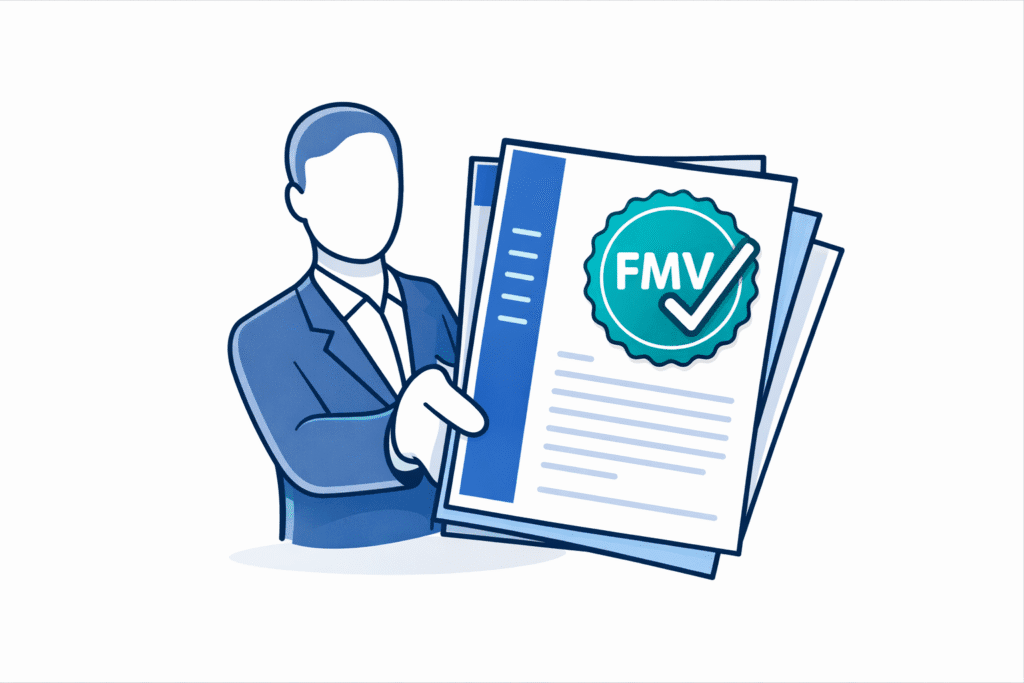

How to Defend Your Salary to a Buyer

Smart owners prepare their compensation story 12-18 months before going to market. Start by gathering data from surveys like MGMA and SullivanCotter to benchmark your pay against similar practices. Create a formal document that justifies your compensation with this data and details the specific responsibilities that warrant your pay level. For all physician executive compensation, hire a professional valuation firm. Finally, ensure any payments to family members or leases with entities you own are at FMV and have clear business justifications, as buyers view these with skepticism during due diligence.

Pro Tip: An independent Fair Market Value (FMV) opinion is your best defense against valuation adjustments. This third-party validation is a powerful tool during due diligence.

How SovDoc Can Help

Navigating compensation issues in an M&A transaction is complex. At SovDoc, we help practice owners protect their value every step of the way. We provide robust compensation benchmarking and coordinate with qualified firms to secure the FMV opinions you need to defend your pay. When buyers start asking tough questions, we help you provide documented, defensible answers. We also guide you through negotiating your post-sale employment contract, retention bonuses, and earnouts to ensure the final deal meets your financial goals.

Your years of hard work built your practice’s value. Don’t let a poorly structured salary put that value at risk. Getting your compensation right is one of the most important steps in preparing for a successful sale.