Many healthcare practices are losing significant revenue. This is often caused by small, unnoticed gaps in the revenue cycle. The average practice loses 1-5% of its net patient revenue this way. For a practice generating $10 million annually, that can be up to $500,000 in lost income.

A revenue integrity program is the strategic solution. It ensures you capture all the revenue you have earned while maintaining compliance.

Strong revenue integrity is also critical for your practice’s valuation. Buyers scrutinize this area closely during due diligence. A well-run program directly increases the value of your practice when you decide to sell.

This guide explains how to build a revenue integrity program. We will show you how it protects your bottom line and prepares your practice for a successful exit.

Revenue Integrity Is a Proactive System for Getting Paid Correctly

Revenue integrity is your practice’s system for ensuring you get paid correctly and completely for every service you provide. It’s not just another name for billing. While your billing team fixes problems after they happen, a revenue integrity program prevents problems before a claim ever leaves your office.

Think of it as the difference between constantly patching a leaky roof and building a waterproof one from the start. The process begins when a patient schedules an appointment and continues through documentation, coding, claim submission, and payment posting. Revenue integrity ensures every link in that chain is strong, preventing revenue from leaking out at any point.

Your Practice Should Invest in Revenue Integrity for Strategic Growth

With declining reimbursements and increasing operational costs, you cannot afford to lose revenue you’ve already earned. A strong revenue integrity program typically recovers 2-4% of net patient revenue in the first year alone—that’s $200,000 to $400,000 for a $10 million practice.

A strong revenue integrity program typically recovers 2-4% of net patient revenue in the first year alone.

Beyond the immediate cash flow, a strong program provides critical strategic advantages. It protects your practice from costly audits, as the Office of Inspector General (OIG) increases its fraud investigations. A single coding error can trigger reviews of thousands of claims, but a revenue integrity program catches these mistakes before auditors do.

It also directly increases your practice’s valuation. When buyers evaluate your practice, metrics like a high clean claims rate and a low denial rate signal a well-run, lower-risk business. This operational excellence can command 15-20% higher valuation multiples. Finally, a robust program prepares you for the industry’s shift to value-based care, where accurate data capture is essential for success.

A Strong Program Has Three Core Components

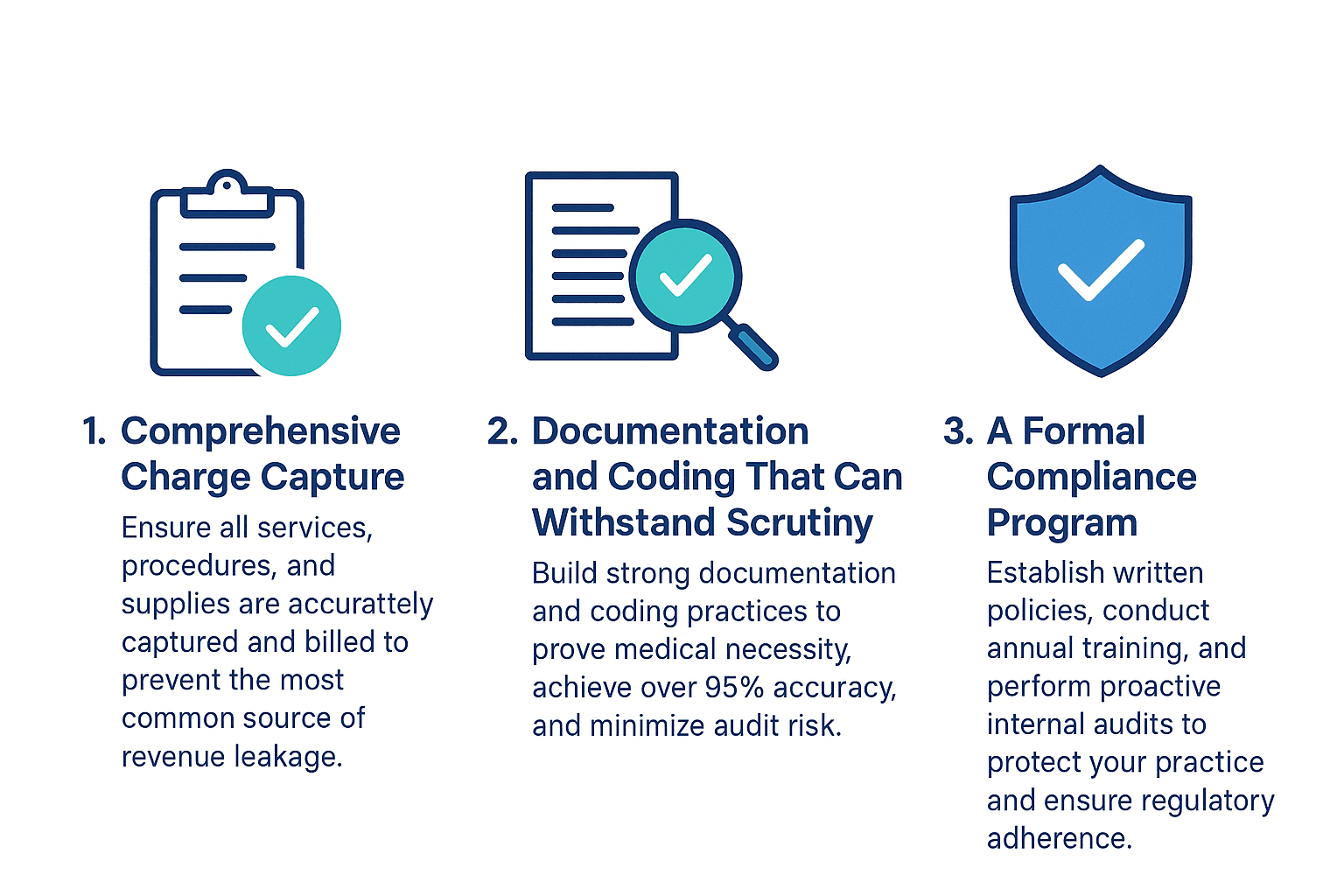

A successful program isn’t about fixing one piece of your revenue cycle. It integrates three core components that work together.

1. Comprehensive Charge Capture

This is where most practices lose money, often when supplies are used but not billed. Start by reviewing your chargemaster—your master price list—at least quarterly for high-volume services. Outdated codes or missing charges for new procedures are common issues that lead to automatic rejections. Technology can help automate this process. Charge capture software that integrates with your EHR can flag missing charges in real-time, often paying for itself by recovering just a fraction of missed revenue.

2. Documentation and Coding That Can Withstand Scrutiny

Payers frequently deny claims when documentation fails to prove medical necessity. A Clinical Documentation Improvement (CDI) program addresses this by having specialists review records concurrently. They work with clinicians to clarify diagnoses and justify services, which can have an immediate and substantial ROI. Equally important is investing in certified coders and conducting regular internal coding audits. Your goal should be an accuracy rate above 95% to minimize both undercoding (lost revenue) and overcoding (audit risk).

3. A Formal Compliance Program

This component keeps you out of trouble. You need written policies covering billing, coding, documentation, and HIPAA. These policies are only effective with annual, documented training for every employee who touches the revenue cycle. The program should also include proactive internal audits focused on high-risk areas like E&M coding levels and modifier usage. Self-disclosing and correcting an issue is far less costly than having an external auditor discover it.

The Revenue Integrity Process Follows the Patient Journey

Revenue integrity is a continuous process that turns a reactive billing cycle into a proactive system for capturing revenue at every stage of the patient journey. A well-structured process prevents errors at each step.

| Revenue Cycle Stage | Key Revenue Integrity Activities | Primary Goal |

| Pre-Visit | Verify insurance, secure prior authorizations, and estimate patient responsibility. | Prevent back-end denials and create a clean financial slate from the start. |

| During Visit | Perform concurrent documentation review (CDI) and ensure accurate, real-time charge capture. | Prevent revenue leakage as it happens and ensure services are compliant and billable. |

| Post-Service | Use automated claim scrubbers for pre-bill audits and analyze denial patterns to find root causes. | Achieve a >95% clean claim rate and shift from reactive denial management to proactive prevention. |

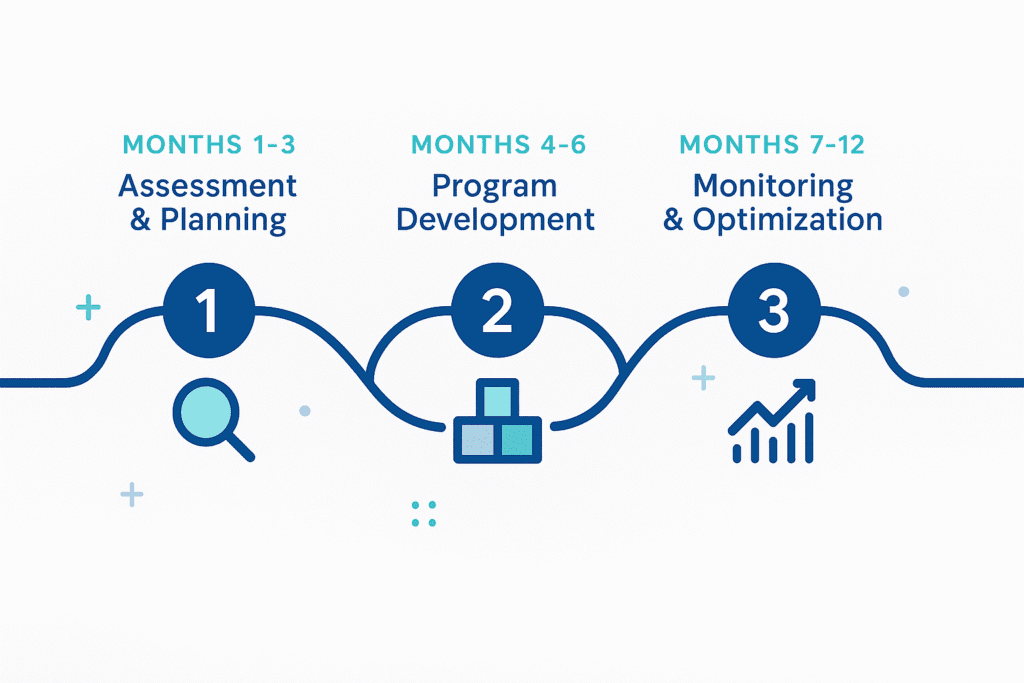

You Can Implement a Program in Manageable Phases

Building a program from the ground up can seem daunting, but a phased approach makes it manageable.

The first three months focus on assessment and planning: Start by understanding your current performance. Pull 12 months of data on your net collection rate, days in A/R, and denial rates. Identify the top issues driving revenue leakage and prioritize them based on financial impact to score quick wins.

Months four to six are for building the foundation: Now, tackle the highest-impact problem you identified. If it’s charge capture, implement a daily reconciliation process. If it’s medical necessity denials, start a pilot CDI program. During this phase, draft your core compliance policies and conduct initial training for all revenue cycle staff.

The second half of the year is for optimizing with technology: Now you can layer in tools. If you don’t have claims scrubbing software, implement it—the ROI is almost immediate. Look at integrating your EHR and practice management systems to eliminate manual data entry. Use data from your first six months to map and improve your workflows.

Your goal after the first year is to scale and sustain the program: With the program running, focus on sustainability. Establish a formal revenue integrity committee to review metrics and set priorities. Expand your internal audit program and use analytics to flag potential issues before they result in lost revenue.

You Can Expect a Significant Return on Your Investment

Most practices see a meaningful financial return within the first year. This typically includes a 2-4% increase in net patient revenue, a 5-10% reduction in denial rates, and a 5 to 10-day reduction in days in A/R. After accounting for staff and technology costs, this results in a 2:1 to 4:1 return on investment.

For a $10 million practice, a revenue integrity program can translate to $200,000-$400,000 in additional collections annually.

Beyond the numbers, you gain invaluable protection against regulatory risk, where avoiding a single major audit can save your practice hundreds of thousands of dollars.

Revenue Integrity Directly Increases Your Practice’s Valuation

If you plan to sell your practice in the next 3-5 years, revenue integrity is one of the most effective ways to increase its value. During due diligence, buyers and investors scrutinize revenue cycle performance to assess risk.

A practice with clean metrics is seen as a well-run, lower-risk asset. Demonstrating a clean claim rate above 95%, a denial rate below 5%, and a documented compliance program proves operational excellence. This reduced risk perception translates directly to higher valuation multiples—often 15-20% higher than comparable practices with weak revenue cycle management.

Every $100,000 in additional earnings from revenue integrity can add $600,000 to your practice’s sale price at a 6x multiple.

Furthermore, revenue integrity adds to the “E” in EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). If your practice is valued at a 6x multiple, every $100,000 in additional earnings from your revenue integrity program adds $600,000 to your practice’s sale price.

Is Your Practice Ready for Due Diligence?

At SovDoc, we specialize in helping healthcare practice owners prepare for M&A transactions. Our revenue integrity assessments identify leakage sources, quantify their financial impact, and provide a clear roadmap for improvement. We help you strengthen your operations so you can enter due diligence with confidence and command the highest possible valuation.

The improvements you make today translate directly to a more profitable and valuable practice tomorrow. Revenue integrity is no longer just an operational task—it is a foundational strategy for growth and a successful exit.