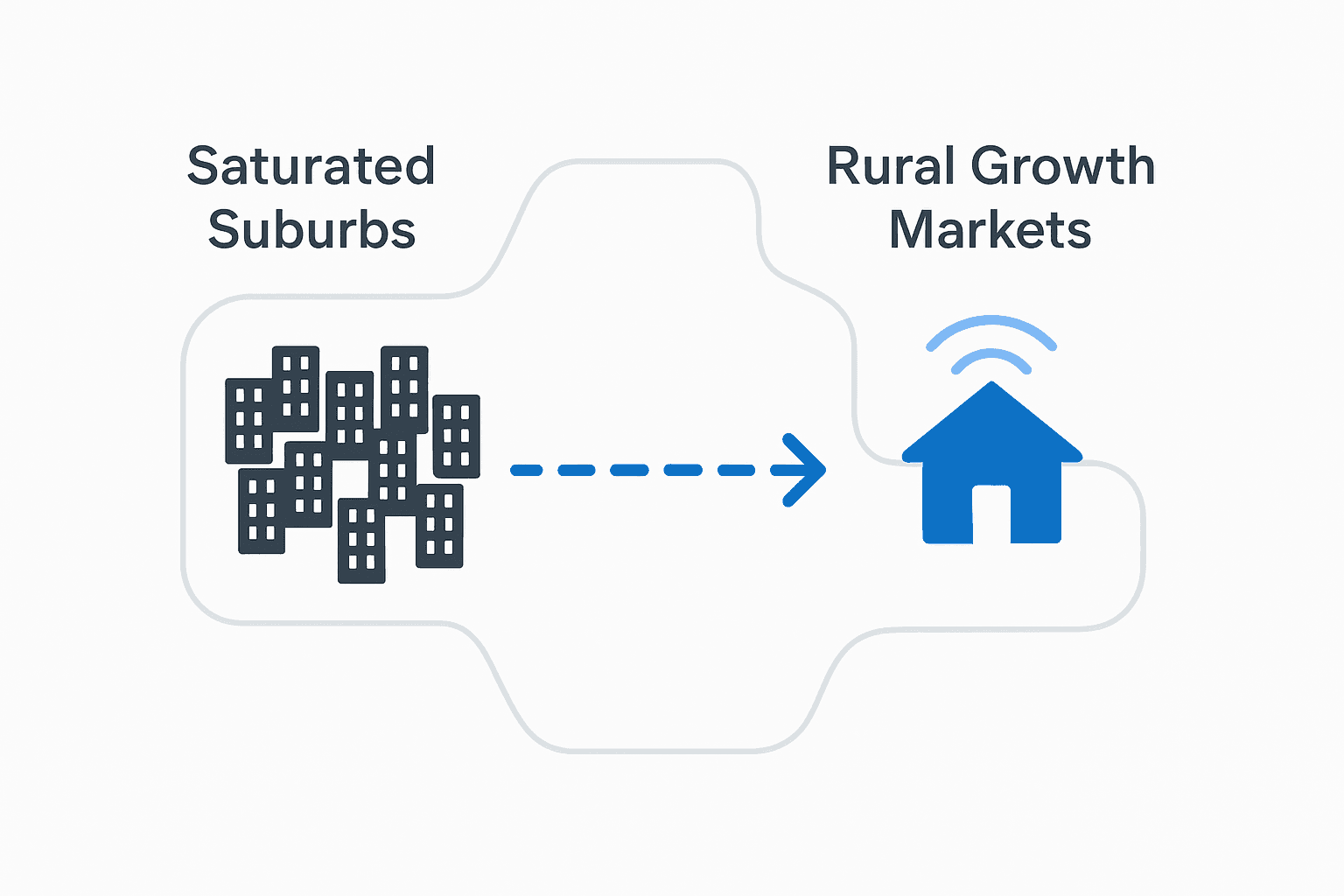

As a practice owner, you know the urgent care market is booming. But the difference between breaking even in six months and struggling for two years now hinges on one factor: location. While the industry is growing, the real opportunity is no longer in saturated suburbs.

Rural markets are showing 40% faster growth, creating a strategic opening for savvy operators looking for strong growth strategies for independent practices.

This guide details the framework successful groups use to select locations, navigate regulations, and build profitable centers that command premium valuations.

Why Does Urgent Care Expansion Make Financial Sense Now?

The urgent care industry nearly doubled to over 14,000 centers in the last decade, with the most profitable growth now in underserved markets. Rural areas account for 26% of new facilities, led by the Southeast due to favorable regulations.

Market forces confirm the timing is right. Patients prefer urgent care to ERs 3:1, and the cost is a fraction of an emergency visit. Powerful demographic trends, including an aging population and a physician shortage, guarantee sustained demand. However, with suburban supply now outpacing demand, a targeted expansion strategy is crucial to avoid margin compression.

How Should I Choose the Right Location for My Urgent Care Center?

Successful site selection is a data-driven process that predicts profitability. Your analysis must start with a demographic profile of the target market. A profitable center needs a population with a median household income above the national average and at least 70% private insurance coverage. A strong payer mix is critical to valuation and healthy margins. The ideal age distribution includes over 30% in the 25-44 demographic and over 35% households with children.

Your physical location is just as important. Your primary trade area (5-10 minute drive) will capture 60-70% of patients, so visibility is key. The site must be on a road with daily traffic counts over 20,000 vehicles. Use professional tools like ESRI Business Analyst or SiteZeus to validate your findings.

Treat your urgent care expansion like a retail launch. Convenience and accessibility matter more than proximity to a hospital.

The optimal facility is 3,000-3,700 square feet with a high parking ratio. Former retail spaces, like bank branches, are often ideal. Avoid sites with poor signage or second-floor locations.

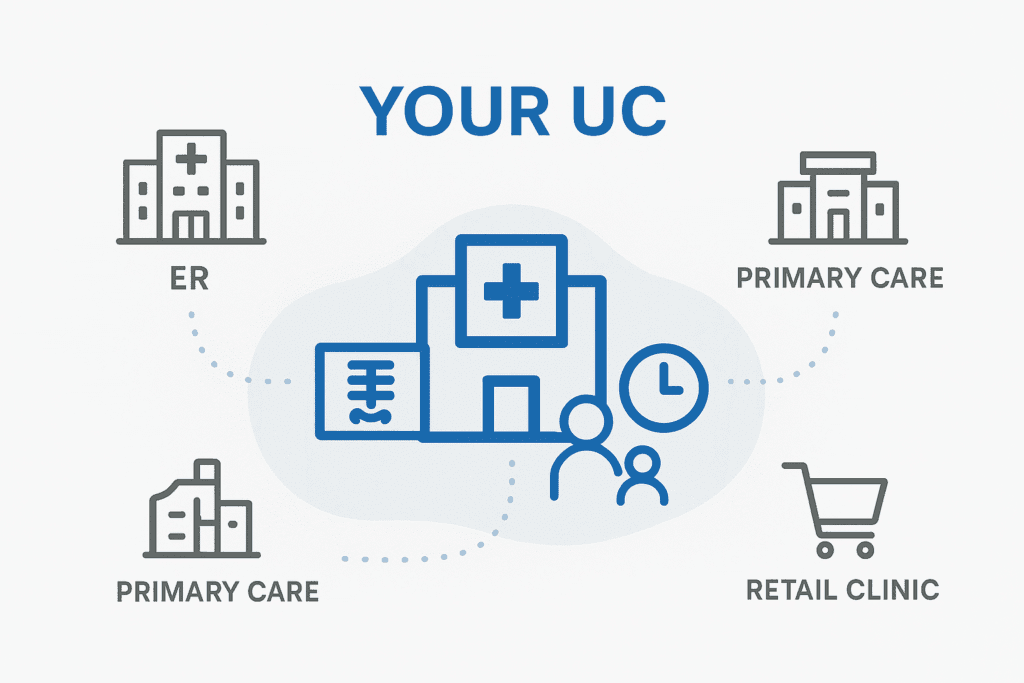

What Competitive Factors Must I Analyze Before Expanding?

Your competition is any alternative a patient might consider. Map all local options, including other urgent care centers, ERs, primary care offices, retail clinics, and telehealth providers. Analyze their services and wait times to identify market gaps.

Differentiate your services to build a sustainable advantage. Offer on-site X-rays, extended hours, or specialized care like pediatrics. Top-performing centers keep door-to-door times under 47 minutes. In urgent care, convenience and quality build loyalty, not pre-existing relationships.

What Is the True Cost of Opening an Urgent Care Center?

A successful launch requires a total investment of $750,000 to $1.5 million. Securing adequate funding is a critical first step, often requiring guidance from the best lenders for urgent care.

| Cost Category | Estimated Investment |

| Real Estate / Buildout | $200,000 – $500,000 |

| Medical Equipment | $150,000 – $300,000 |

| Technology & Systems (EHR) | $50,000 – $100,000 |

| Working Capital (6-12 mos.) | $200,000 – $400,000 |

| Total Estimated Investment | $750,000 – $1,500,000 |

A mature center can generate $1.5 to $3.5 million in annual revenue, with a target operating margin of 7-15%. A well-positioned center can break even in 6-12 months.

Undercapitalization kills more centers than poor locations. Plan for 12-18 months of operating expenses, a process where expert financial planners for urgent care can provide crucial guidance.

Which States Offer the Best Regulatory Environment?

Your speed to market depends on state regulations. Most states regulate urgent care as physician practices, simplifying entry. Texas, California, and Illinois have minimal barriers.

Conversely, states like Arizona and Florida have specific licensing requirements. It is also crucial to monitor emerging trends and a state’s Nurse Practitioner (NP) practice authority, as full NP independence enables lower-cost staffing models. Navigating these rules often requires help from the best compliance lawyers for urgent care.

How Can I Staff My Urgent Care Center for Maximum Efficiency?

Your staffing model is the largest driver of profitability. The benchmark is 4.3-4.5 support FTEs per physician. Scale your team with patient volume: a lean team for under 35 patients daily, adding a PA/NP as you approach 60.

Your labor model determines profitability more than any other factor. Optimize staffing based on actual patient volume, not projections.

Technology is essential for efficiency. Leading EHRs streamline workflows, a process where the best IT/EHR specialists for urgent care are invaluable. The goal is a door-to-door time under 45 minutes for most visits.

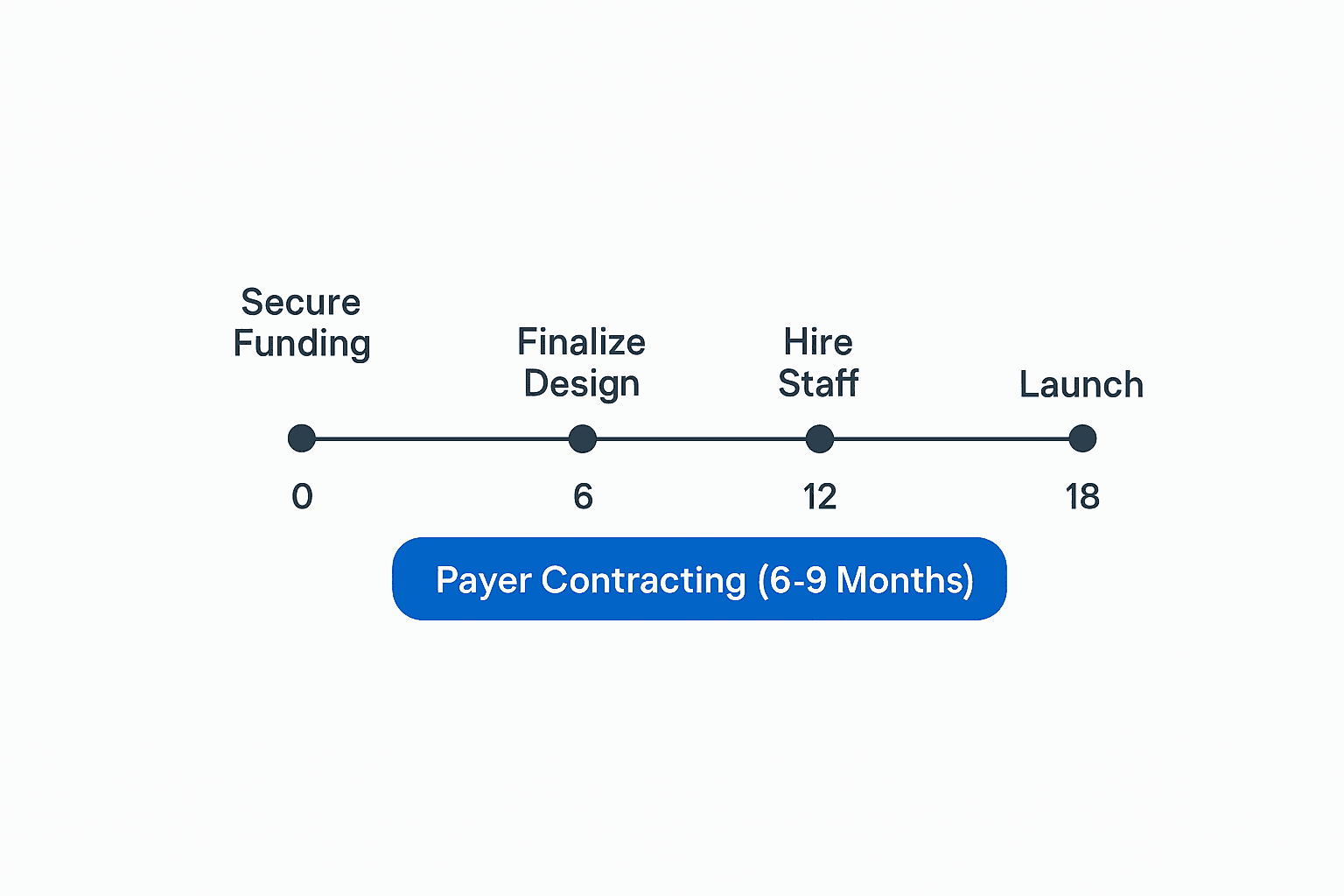

What Is the Timeline for Opening a New Urgent Care Center?

A typical launch takes 18 months. The most common delays are payer contracting and permitting.

- Conduct market analysis and secure funding.

- Finalize designs and, critically, begin the 6-9 month payer contracting process immediately.

- Install equipment, hire staff, and launch marketing.

- Start with a soft opening, then launch full operations and monitor performance.

How Do I Position My Center for Maximum Valuation?

In the M&A market, your practice’s valuation depends on scale and sophistication. A single location may sell for 3.0x to 7.0x EBITDA, while a regional group can achieve 6.0x to 11.0x. The highest valuation multiples, often 10.0x to 15.0x, are reserved for large, tech-enabled platforms. Buyers pay for strong and consistent EBITDA performance and a management team that can support growth.

Scale and operational sophistication drive premium multiples. Single-location operators face significant valuation discounts compared to multi-site platforms.

Your Next Steps for a Profitable Expansion

The urgent care opportunity is real, but the window for strategic entry is narrowing. Success is earned through sophisticated business execution.

Your immediate actions should be a data-driven market analysis, securing full capitalization, and adopting a “retail first” mindset. The practices that dominate the next decade will master both clinical quality and operational excellence. By focusing on these principles from day one, you build an asset that generates significant enterprise value, making it an attractive candidate for a future sale with the help of top medical business brokers for urgent care.