As a bariatric practice owner in North Dakota, you are positioned in a unique market. Rising obesity rates create strong, localized demand for your specialized services, presenting a significant opportunity for a strategic exit. However, realizing your practice’s full value requires a deep understanding of market trends, valuation nuances, and the complex sale process. This guide provides the initial insights you need to navigate this landscape and plan your next steps with confidence.

Market Overview

The market for bariatric and obesity practices in North Dakota is defined by a clear and compelling need. Understanding the dynamics at play is the first step toward a successful sale.

A Market of High Need

Demand for your services is fundamentally strong. North Dakota s adult obesity rate reached 35.2% in 2021, a figure that continues to trend above the national average. In some counties, the rate exceeds 40%. This creates a large and sustained patient base for surgical intervention, a fact that sophisticated buyers and investors find very attractive. While general “weight loss services” may see shifts, the demand for specialized bariatric procedures remains robust and distinct.

Evolving Patient Preferences

The types of procedures in demand are also changing. Your practice’s value is influenced by its alignment with current clinical trends. Nationally, gastric sleeve surgeries have grown significantly in popularity, while gastric band procedures have seen a sharp decline. A practice that has adapted to these patient and referrer preferences is in a much stronger position when it comes to valuation and buyer interest.

Key Considerations

Beyond market conditions, a successful sale depends on careful management of specific practice details. Buyers look closely at your operational and regulatory standing. Navigating North Dakota’s healthcare laws, managed by the state’s Board of Medicine, requires careful attention to detail during a transaction. Handling patient notifications correctly is also a critical step to ensure a smooth transition and preserve the goodwill you have built over years. An experienced team, modern facilities, and a strong community reputation are not just assets for patient care. They are key drivers of your practice’s final sale price. Preparing these elements for buyer scrutiny is a critical part of the process.

Market Activity

The healthcare M&A landscape is active, and bariatrics is a specialty of high interest for buyers. For a practice owner in North Dakota, this activity presents a clear window of opportunity. Understanding the key trends can help you time and position your exit for maximum value.

Three major trends are defining the current market:

1. Increased Private Equity Interest. Private equity groups are actively seeking to build regional and national bariatric platforms. They are attracted to the strong, non-discretionary demand and the opportunity to improve operational efficiencies.

2. Strategic Hospital Acquisitions. Local and regional health systems often look to acquire successful bariatric practices to round out their service lines, secure referral pathways, and expand their continuum of care for metabolic diseases.

3. A Focus on Growth Potential. Buyers are not just acquiring your current cash flow. They are paying a premium for a clear story about future growth. This could involve adding ancillary services, expanding to new locations, or optimizing patient funnels.

Sale Process

Selling your practice is a structured process, not a single event. While every transaction is unique, the journey typically follows a clear pathway from preparation to closing. We find that owners who understand these stages can navigate them more effectively and with less stress. It begins with a thorough preparation phase, including a comprehensive valuation to set a realistic baseline. This is followed by confidentially marketing the practice to a curated list of qualified buyers. Once interest is established, the process moves into negotiation and due diligence, a critical period where buyers verify every aspect of your practice. This is often where unexpected challenges arise. The final stage involves legal documentation and closing the transaction. Starting this process well in advance is the key to selling on your terms.

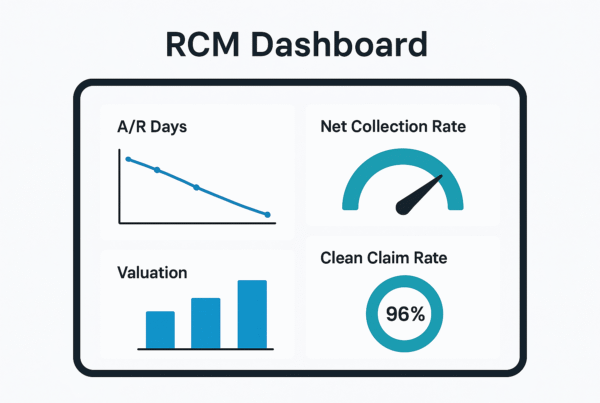

Valuation

One of the first questions any owner asks is, “What is my practice actually worth?” The answer is more complex than a simple rule of thumb. Sophisticated buyers value your practice based on its risk and future potential, which are captured in a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure normalizes your financials by adding back personal or one-time expenses to show the true, sustainable cash flow. This Adjusted EBITDA is then multiplied by a number (a multiple) to determine the Enterprise Value. The multiple itself is not fixed. It is influenced by several key factors.

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Model | Solo-physician dependent | Associate-driven, low owner reliance |

| Services | Standard surgical procedures only | Diverse services (e.g., medical weight loss) |

| Growth | Stable, but stagnant patient numbers | Clear path for expansion or new services |

| Operations | Basic, manual processes | Efficient, systemized operations |

Properly calculating your Adjusted EBITDA and telling the story that justifies a higher multiple can dramatically increase your practice’s final value. Many owners are surprised by what their practice is worth after this process.

Post-Sale Considerations

The day you close the sale is a beginning, not an end. Your role, your financial outcome, and your legacy are all shaped by the structure of the deal. Many transactions today are not a simple cash payment. They can include an earnout, where a portion of your proceeds is tied to the practice’s future performance, or rollover equity, where you retain a stake in the new, larger company. This gives you a “second bite at the apple” but requires careful planning. Thinking about how to protect your dedicated staff and ensure your clinical legacy continues under new ownership is also a critical part of the process. These considerations should be addressed early to ensure the transition aligns with your personal and financial goals.

Frequently Asked Questions

What is the current market demand for bariatric and obesity practices in North Dakota?

North Dakota has a high adult obesity rate of 35.2% as of 2021, exceeding the national average. This creates a strong, localized demand for specialized bariatric services, making it an attractive market for buyers and investors.

How do patient preferences affect the value of a bariatric practice?

The types of procedures in demand are shifting, with gastric sleeve surgeries growing in popularity while gastric band procedures decline. A practice aligned with these current clinical trends and patient preferences typically has a higher valuation and buyer interest.

What are the key factors buyers consider when valuing a bariatric practice?

Buyers look at the practice’s Adjusted EBITDA, provider model, diversity of services, growth potential, and operational efficiency. Practices with associate-driven models, diverse services, growth opportunities, and systemized operations tend to receive higher valuation multiples.

What are the major trends in the healthcare M&A market for bariatric practices in North Dakota?

Three major trends include increased private equity interest aiming to build bariatric platforms, strategic hospital acquisitions to expand service lines and referral pathways, and a focus on future growth potential through ancillary services or new location expansion.

What should sellers prepare for during the sale process of their bariatric practice?

Sellers should expect a structured process starting with thorough preparation and valuation, followed by confidential marketing, negotiation, due diligence, and final transaction closing. Legal documentation and careful management of regulatory compliance and patient notifications are also crucial for a smooth transition.