The market for selling dermatology practices in Kentucky is more active than ever. National consolidation trends and private equity interest have reached the Bluegrass State, creating significant opportunities for practice owners. If you are considering your future, understanding this landscape is the first step. Navigating the process correctly can protect your legacy and financial future when dealing with sophisticated buyers.

Market Overview

The national trend of practice consolidation is here. For years, states like Florida and Texas were the hotspots for private equity (PE) groups acquiring dermatology practices. That wave has now expanded, and Kentucky is firmly on the map for these buyers. We are seeing a clear shift away from solo practices toward larger, professionally managed groups. This means there is a growing and well-funded pool of potential buyers looking for quality practices like yours. This is not a fleeting trend. The continued investment in these dermatology-focused groups suggests this market activity will persist, making it a seller’s market for those who are well prepared.

Key Considerations for Kentucky Owners

Selling your practice goes beyond the financial offer. It’s a decision that impacts your legacy, your staff, and your patients. As you think about a sale, you should weigh these critical aspects.

Your Clinical Future and Practice Culture

A primary concern for many physicians is losing control over clinical decisions. Who will run the practice day-to-day? It is important to find a partner who respects your clinical autonomy and is committed to maintaining the quality of care and work culture you have built. The right deal structure can protect these values.

Operational and Asset Strategy

Your practice’s structure also plays a big role. Do you own your building or have a long-term lease? A favorable real estate situation can increase your practice’s value. Your mix of medical, surgical, and cosmetic services also makes you more or less attractive to different types of buyers.

Market Activity in Kentucky

These are not just abstract trends. Real transactions are taking place right here in Kentucky, showing a clear path for practice owners. For example, a significant deal happened in September 2024 when Lexington’s Dermatology Consultants, a respected practice with 12 providers across three locations, partnered with a major group. This transaction shows that large, established Kentucky practices are finding attractive partnership opportunities. It also proves that buyers are willing to invest substantial capital in the state. The fact that an M&A advisor guided this deal highlights that a professional process is becoming the standard for achieving the best outcomes in these complex sales. This kind of activity creates momentum and competitive interest, which can benefit you as a seller.

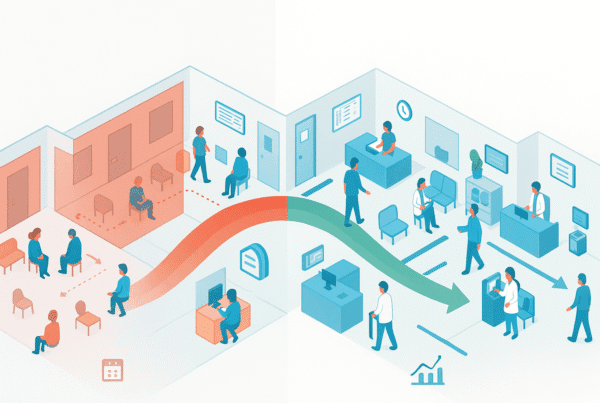

The Four Stages of a Practice Sale

Selling a practice is a structured journey. When managed correctly, the process protects your confidentiality and creates competition to maximize your outcome. It generally follows four main stages.

-

Valuation and Preparation. This is the foundation. It starts with a deep financial analysis to understand your practice’s true earning power (Adjusted EBITDA). We also help you prepare your documents and craft the story that shows buyers your future growth potential.

-

Finding the Right Partner. We don’t just “list” your practice. We run a confidential process, approaching a curated list of qualified buyers who are the best fit for your goals.

-

Negotiation and Due Diligence. After receiving offers, we help you negotiate the best terms. The due diligence phase is next. This is where the buyer verifies all the information. Many deals fail here because of poor preparation.

-

Closing and Transition. The final stage involves legal documentation and planning for a smooth handover. Our goal is to ensure a successful transition for you, your staff, and your patients.

What Is Your Practice Really Worth?

Understanding your practice’s value is not about a simple rule of thumb. Sophisticated buyers use a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This number represents your practice’s true profitability. We calculate it by taking your net income and adding back things like owner’s discretionary spending, one-time expenses, and above-market owner salary. For example, if your net income is $500,000 but you run a $50,000 car lease through the business, your Adjusted EBITDA is at least $550,000. Buyers then apply a ‘multiple’ to this number. A practice with a $1M+ Adjusted EBITDA will get a much higher multiple than a smaller one. Your service mix, provider team, and growth profile all influence that multiple.

Planning Your Future After the Sale

The sale of your practice is not just an exit. It is the beginning of your next chapter. What that chapter looks like depends on the type of deal you structure. Selling does not always mean walking away immediately. Many owners choose a path that allows for a gradual transition or continued participation in the practice’s growth. Thinking about your personal goals is the most important part of the entire process. Here are a few common paths.

| Your Post-Sale Path | What It Looks Like | Who It Is For |

|---|---|---|

| Clean Exit | You sell 100% of the practice and transition out over an agreed-upon period. | The owner who is ready for full retirement or a new venture. |

| Gradual Transition | You sell the practice but agree to stay on as a clinician for 1 to 3 years. | The owner who wants to ensure a smooth handover and continue seeing patients. |

| Growth Partnership | You sell a majority stake but ‘roll over’ some of your equity into the new parent company. | The owner who wants to reduce administrative burdens but share in the future success. |

Frequently Asked Questions

What is the current market trend for selling dermatology practices in Kentucky?

The market for selling dermatology practices in Kentucky is highly active due to national consolidation trends and private equity interest. Kentucky has become a hotspot for buyers looking for quality dermatology practices, following trends seen in states like Florida and Texas.

What key factors should I consider before selling my dermatology practice in Kentucky?

Before selling, consider your clinical future and practice culture, ensuring the buyer respects your clinical autonomy and maintains care quality. Also, evaluate your practice’s operational and asset strategies, such as ownership of real estate and the mix of medical, surgical, and cosmetic services, as these affect your practice’s attractiveness and value.

How is the value of a dermatology practice determined?

Practice value is determined primarily by Adjusted EBITDA, which reflects your practice’s true profitability by adjusting net income for discretionary spending and one-time expenses. Buyers apply a multiple to this figure; practices with higher EBITDA and strong service mixes typically receive higher multiples.

What are the typical stages involved in selling a dermatology practice in Kentucky?

Selling a practice usually involves four stages: 1) Valuation and Preparation – analyzing finances and preparing documents, 2) Finding the Right Partner – confidentially approaching qualified buyers, 3) Negotiation and Due Diligence – negotiating terms and verifying information, and 4) Closing and Transition – finalizing legal documents and planning smooth handover.

What options do I have for my future after selling my dermatology practice?

Post-sale options include:

– Clean Exit: Selling 100% and exiting completely, suitable for those retiring or pursuing new ventures.

– Gradual Transition: Selling but continuing as a clinician for 1-3 years to ensure smooth transition.

– Growth Partnership: Selling majority stake but keeping some equity to reduce administrative duties while sharing in future growth.