If you own a dialysis and nephrology practice in Kansas City, you are likely aware of the significant shifts in the healthcare landscape. The market is active, driven by strong national growth and intense investor interest. But turning that market momentum into a successful sale requires careful preparation and strategy. This guide offers insights into the current market, how your practice is valued, and the key steps to navigate a successful transition.

Thinking about your next steps can feel overwhelming. You might not be sure if selling is the right move or when the right time might be. We find that simply understanding your options is the best place to start.

Not sure if selling is right for you? Our advisors can help you understand your options without any pressure.

Kansas City’s Nephrology Market: An Overview

The nephrology and dialysis sector is experiencing powerful growth. The U.S. dialysis market, valued at over $29 billion in 2024, is projected to grow steadily. This expansion is fueled by an aging population and a rising prevalence of kidney disease, ensuring sustained demand for your services.

In Kansas City, the landscape is competitive, with established practices like Kidney Associates of Kansas City and Midwest Nephrology Consultants. However, this competition is a sign of a healthy, robust market. National players like DaVita and Fresenius also have a significant presence, and an affiliation with them or a strong independent position can be a major asset. For a potential buyer, a practice in this environment represents an opportunity to acquire a strategic foothold in a thriving medical community. The key is to clearly articulate what makes your practice unique within this active market.

Key Considerations for Your Practice

Before you think about putting your practice on the market, it is important to look inward. Buyers are not just acquiring your patient list; they are investing in a well-run clinical business.

Defining Your Competitive Edge

What is your practice’s story? Is it superior patient outcomes, with fewer hospital stays than local averages? Perhaps it’s your deep-rooted referral network with primary care physicians across the metro area. You need a clear and compelling narrative, supported by data, that showcases your unique value.

Navigating the Shift to Value-Based Care

The industry is moving away from fee-for-service and toward models that reward quality outcomes. Buyers, especially private equity groups, are highly focused on practices that are already adapted to or prepared for this shift. Demonstrating how your practice manages patient care efficiently to improve outcomes is no longer a bonus; it is a core part of its value.

Strengthening Your Referral Network

A stable, diverse referral base is one of the most valuable intangible assets your practice has. Documenting where your referrals come from and the strength of those relationships provides buyers with confidence in the practice’s future revenue stability.

Market Activity: A Time of Opportunity

The current M&A market for nephrology is exceptionally active. Private equity (PE) firms, in particular, see tremendous value in the specialty. Since 2023, PE groups have deployed over $8.4 billion into the nephrology space, with a specific focus on acquiring medium-sized practices to build larger platforms.

We see this trend in major national deals, but it is also happening right here in the Midwest. This is not a time of consolidation driven by distress. It is a time of strategic investment driven by growth. For a practice owner in Kansas City, this means there is a large pool of sophisticated, well-funded buyers actively looking for opportunities. They are not looking for bargains. They are looking for quality practices that can serve as a cornerstone for their long-term growth strategy.

The Sale Process: A Structured Journey

Selling your practice is a structured journey, not a single event. While every sale is unique, the process generally follows a clear path that a good advisory partner will manage for you.

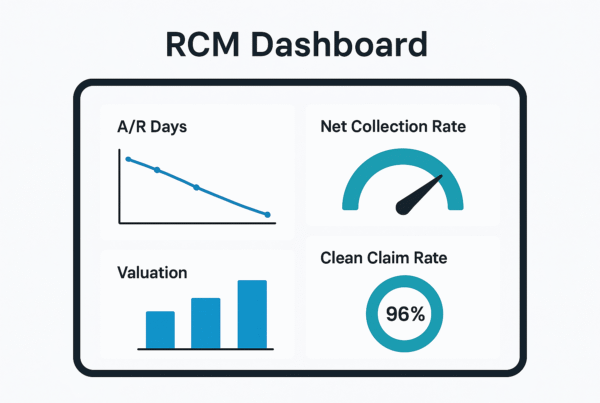

- Preparation and Valuation. This is the foundational step. It involves organizing your financial statements, normalizing your earnings to reflect the practice’s true profitability (Adjusted EBITDA), and preparing a professional valuation.

- Confidential Marketing. Your advisor will create marketing materials that tell your practice’s story and present them confidentially to a vetted list of potential buyers, including strategic acquirers and private equity groups.

- Buyer Vetting and Negotiation. After receiving initial offers, your advisor helps you vet the best potential partners and negotiates the key terms of the deal, including price, structure, and your future role.

- Due Diligence. This is an intensive phase where the buyer verifies all financial, legal, and operational aspects of your practice. Proper preparation is critical here, as this is where many deals encounter unexpected problems.

- Closing and Transition. Once due diligence is complete and legal documents are finalized, the transaction closes. Your advisor will have already helped you plan for a smooth transition for your staff and patients.

How Your Practice is Valued

A common mistake is to think a practice’s value is simply a multiple of its revenue. Sophisticated buyers look deeper, focusing on a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Think of it this way: we look at your practice’s core profitability, removing any one-time expenses or owner-specific costs to show buyers its true earning power.

This Adjusted EBITDA is then multiplied by a specific number, the “multiple,” to determine the enterprise value. That multiple is not fixed; it rises and falls based on several key factors.

| Factor Increasing Valuation | Factor Decreasing Valuation |

|---|---|

| Multi-provider, associate-driven model | High reliance on a single selling doctor |

| Strong, documented growth | Stagnant or declining revenue |

| Modern facilities and tech (EMR) | Outdated infrastructure |

| Favorable payor mix | Heavy reliance on lower-reimbursing payors |

| Excellent patient outcomes data | Lack of tracked clinical data |

Understanding and improving these factors before a sale can significantly increase the final valuation you receive.

Post-Sale Considerations: Planning Your Next Chapter

The final signature on a sale agreement is not the end of the story. It is the beginning of a new chapter for you, your staff, and your patients. Planning for this phase is just as important as negotiating the deal itself.

Your Role After the Sale

Do you want to retire immediately, or would you prefer to continue practicing for a few years? Perhaps you want to retain some ownership and partner with the new group for future growth. These options are negotiable and should align with your personal and financial goals.

Ensuring Staff and Patient Continuity

A primary concern for any owner is the well-being of their dedicated staff and loyal patients. A key part of the sale process is creating a clear transition plan that ensures continuity of care and provides security for your team. This protects your legacy.

Structuring for Your Financial Future

How your deal is structured has major tax implications. A skilled advisor can help you navigate options like earnouts or equity rollovers, which can provide a “second bite at the apple” when the new, larger entity is sold again in the future. This requires advance planning to maximize your post-tax returns.

Every practice sale has unique considerations that require personalized guidance.

Frequently Asked Questions

What is the current market outlook for selling a Dialysis & Nephrology practice in Kansas City, MO?

The nephrology and dialysis market in Kansas City is very active, driven by strong national growth, an aging population, and increased prevalence of kidney disease. The market is competitive with both established local practices and large national players, making it a robust environment for sellers.

How is a Dialysis & Nephrology practice in Kansas City typically valued?

Valuation focuses on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which reflects the practice’s true profitability by normalizing earnings. Various factors influence the valuation multiple, including the practice model, growth, facilities, payor mix, and clinical outcomes data.

What are the key steps involved in selling a Dialysis & Nephrology practice?

The selling process usually involves five key steps: 1) Preparation and Valuation, 2) Confidential Marketing, 3) Buyer Vetting and Negotiation, 4) Due Diligence, and 5) Closing and Transition. Each step requires careful planning and support from an experienced advisor.

What should I consider about my practice before putting it on the market?

It’s essential to define your practice’s competitive edge, such as patient outcomes or referral networks, and show readiness for value-based care. Strengthening and documenting your referral base and ensuring efficient patient care management are crucial to increasing your practice’s attractiveness to buyers.

What happens after the sale of my Dialysis & Nephrology practice?

Post-sale planning includes deciding your future role (e.g., retirement, continued practice, or partnership), ensuring continuity of care and staff security, and structuring the deal for optimal financial and tax outcomes. A thoughtful transition plan and skilled advisory support help protect your legacy.