The market for Fertility and IVF practices is experiencing unprecedented M&A activity. For practice owners in a dynamic healthcare hub like Dallas, this presents a significant opportunity. However, capitalizing on this moment requires more than just a growing practice; it requires informed navigation and strategic preparation to translate your hard work into maximum value. This guide provides a clear overview of the current landscape and key steps for a successful sale.

Curious about what your practice might be worth in today’s market?

Market Overview

Selling a medical practice is a major decision. The good news is that for Fertility & IVF specialists in Dallas, the current market conditions are exceptionally strong. You are positioned at the intersection of a top-tier healthcare destination and a specialty in high demand.

A Thriving Healthcare Hub

Dallas is not just a large city; it is a key destination for advanced healthcare services. Its robust economy, growing population, and pro-business environment create a stable and attractive foundation for medical practices. Buyers recognize this, viewing Dallas as a strategic location for expansion and investment, which increases demand for established, high-performing clinics like yours.

Unprecedented Investor Interest

The fertility sector is a focal point for acquirers. Private equity firms, large national fertility networks, and other strategic buyers are actively seeking to partner with successful practices. They are drawn to the sector’s strong growth and non-discretionary nature. This creates a competitive environment where multiple suitors may be interested in your practice, giving you leverage to secure favorable terms.

Key Considerations

When a potential buyer evaluates your Dallas IVF practice, they look beyond the surface-level financials. They are buying a story of success and a platform for future growth. The most attractive practices can demonstrate strength in several key areas. Your documented success rates, especially SART data that exceeds national averages, provide concrete proof of clinical excellence.

Beyond that, the breadth of your servicesfrom IVF and IUI to donor programs and surrogacyshows a comprehensive and mature operation. The expertise of your board-certified team and the quality of the patient experience are intangible assets that sophisticated buyers value highly. Thinking about these elements now is the first step in crafting a compelling narrative. The structure of the sale itself also has major implications for your final, after-tax proceeds, making early strategic advice critical.

The structure of your practice sale has major implications for your after-tax proceeds.

Market Activity

The current M&A landscape for fertility practices is not just active; it’s thriving. Recent data reveals a seller-friendly market defined by high transaction volume and premium valuations. This momentum provides a clear window of opportunity for owners considering an exit.

-

Robust Deal Flow. The pace of acquisitions is accelerating. At least 25 fertility clinics were sold in 2022, and the first nine months of 2024 saw nearly a dozen major deals in North America. This indicates a sustained and serious interest from buyers.

-

Premium Valuations. The strong demand is reflected in pricing. According to Pitchbook data, successful fertility clinics are commanding valuation multiples between 8.0x and 11.2x Adjusted EBITDA. These are top-tier multiples within healthcare M&A, signaling the high value placed on well-run fertility practices.

-

A Competitive Environment. This activity is driven by a diverse pool of well-capitalized buyers. They are all competing for a limited number of high-quality, independent practices, which gives you the power to choose the right partner and the right deal structure.

The Sale Process

A successful practice sale is a structured process, not a single event. While every transaction is unique, a professional approach generally moves through several key phases. It begins long before the practice is on the market, with deep preparation to organize your financials and operational data. This ensures you are ready for scrutiny and can present your practice in the best possible light.

Next comes a confidential valuation to establish a realistic price range based on market data and your practice’s specific strengths. From there, we identify and discreetly approach a curated list of qualified buyers, creating competitive tension to drive value. The due diligence phase follows, where the buyer verifies all the information you’ve provided. This is where many deals falter, but proper preparation can make it a smooth confirmation rather than a source of stress. The final stage involves negotiating the definitive agreements and moving toward a successful closing.

The due diligence process is where many practice sales encounter unexpected challenges.

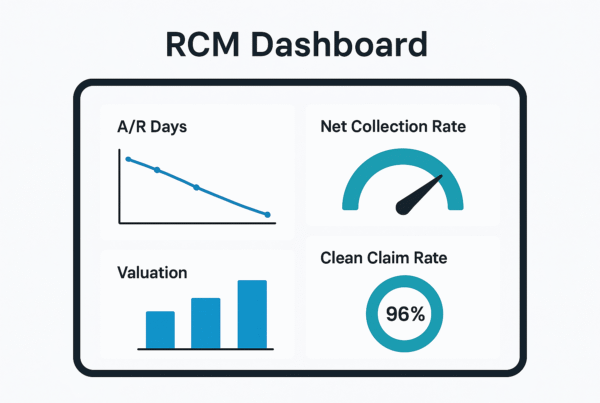

Valuation

Understanding what your practice is truly worth is the foundation of a successful sale. Sophisticated buyers don’t look at your tax returns; they look at your practice’s true cash flow. The key metric they use is Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

We calculate this by starting with your reported net income and adding back non-operational or owner-specific expenses to reveal the practice’s core profitability. This process often uncovers significant value that isn’t obvious on standard financial statements.

| Financial Item | Example Amount | Explanation |

|---|---|---|

| Reported Profit | $500,000 | The bottom line on your P&L statement. |

| Add back: Owner Excess Salary | $150,000 | The portion of your salary above a fair market rate. |

| Add back: One-Time Expenses | $50,000 | Personal travel or other non-recurring costs. |

| Adjusted EBITDA | $700,000 | The true cash flow a new owner could expect. |

This Adjusted EBITDA figure is what buyers will apply a multiple to (like the 8.0x-11.2x seen in the market) to determine the enterprise value of your practice.

A comprehensive valuation is the foundation of a successful practice transition strategy.

Post-Sale Considerations

The day the transaction closes is not the end of the journey. In fact, the decisions you make during the sale process will shape your personal and financial future for years to come. It s important to think about what comes next. A well-structured deal protects not only your financial interests but also your legacy and the team you built.

Many owners are concerned about losing control or what will happen to their staff. These are valid concerns that can be addressed through strategic deal structuring. Options like retaining equity in the new, larger company (an “equity rollover”) allow you to benefit from future growthgiving you a potential second, larger payday down the road. This also often ensures you maintain clinical autonomy and a voice in the practice’s future. Planning for these elements upfront is the key to a transition that truly meets all of your goals.

Your legacy and staff deserve protection during the transition to new ownership.

Frequently Asked Questions

What is the current market outlook for selling a Fertility & IVF practice in Dallas, TX?

The market for Fertility and IVF practices in Dallas is exceptionally strong due to Dallas being a thriving healthcare hub with a robust economy and pro-business environment. This has resulted in high demand from buyers, including private equity firms and large fertility networks, creating a competitive environment and strong valuation multiples between 8.0x and 11.2x Adjusted EBITDA.

What key factors do buyers look for when evaluating a Dallas IVF practice?

Buyers look beyond financials and focus on documented clinical success rates that exceed national averages, the breadth of offered services (such as IVF, IUI, donor programs, and surrogacy), the expertise of a board-certified team, and the quality of the patient experience. These factors combine to tell a compelling story of clinical excellence and future growth potential.

How is the value of a Fertility & IVF practice determined in Dallas?

The primary valuation metric is Adjusted EBITDA, which adjusts net income by adding back non-operational expenses like excess owner salary and one-time costs to reflect the true cash flow. Buyers apply a multiple (currently between 8.0x and 11.2x) to this figure to calculate the enterprise value of the practice.

What are the important steps in the sale process of a Fertility & IVF practice in Dallas?

The sale process includes thorough preparation of financial and operational data, obtaining a confidential valuation, approaching qualified buyers to create competitive tension, conducting due diligence to verify information, and finally negotiating definitive agreements towards a successful closing. Proper preparation is key to a smooth due diligence phase.

What post-sale considerations should practice owners keep in mind?

Owners should plan for their personal and financial future after the sale, considering deal structures that protect their legacy and staff. Options like equity rollover allow owners to retain a stake in the new company and potentially benefit from future growth while maintaining clinical autonomy and influence over the practice’s future.