Selling your Gastroenterology and Hepatology practice is one of the most significant financial decisions of your career. In Utah’s active healthcare market, understanding the landscape is the first step toward a successful transition. This guide offers insights into the current M&A climate, key valuation drivers for your specialty, and the strategic preparation needed to maximize your practice’s value and protect your legacy. The process is complex, but informed navigation can make all the difference.

Market Overview

Utah presents a uniquely attractive environment for specialty medical practices. The state’s combination of strong population growth and a robust economy fuels consistent demand for healthcare services, including specialized GI and hepatology care. This creates a seller-friendly market where well-run practices are in high demand.

A Favorable Economic Climate

Utah s demographic trends mean a growing patient base for years to come. This predictable growth is very appealing to buyers who are looking for stable, long-term returns. They see Utah not just as a location, but as a strategic investment in a healthy, expanding community.

The Buyer Landscape

The market is not limited to one type of buyer. We see active interest from several groups:

* Private Equity-backed Platforms: These buyers are often looking to establish or expand a regional presence and value practices with strong operations and growth potential.

* Large Health Systems: Local and regional hospitals are often motivated to acquire successful GI practices to secure their gastroenterology service lines and referral streams.

* Multi-Specialty Groups: Larger independent groups may look to add a GI service line to offer more comprehensive care.

Key Considerations

When selling a GI and hepatology practice, buyers look beyond simple revenue and profit. Your practice’s value is deeply tied to specific assets that are unique to your specialty. The ownership structure and profitability of your ambulatory surgery center (ASC) is a massive value driver. Similarly, the strength and diversity of your referral networks demonstrate the stability of your patient pipeline. Buyers also place a premium on practices with a healthy mix of ancillary services, such as in-house pathology, infusion services for biologics, or advanced hepatology care, as these create multiple revenue streams.

Market Activity

The M&A market for GI practices in Utah is active, but many transactions remain confidential. This privacy is a hallmark of a competitive environment where strategic buyers prefer to operate quietly. For practice owners, this means the best offers often come through a structured, confidential process rather than a public listing.

Three currents are shaping the Utah GI market:

- The Push for Platforms: Private equity groups are not just buying single practices. They are acquiring “platform” practices with the goal of building a larger, dominant regional group. If your practice has multiple providers and efficient operations, you could be a prime target.

- Consolidation Continues: As in other specialties, GI is seeing a steady trend toward consolidation. Independent physicians are joining larger entities to gain administrative support, better payer rates, and capital for growth. This trend creates opportunity for sellers.

- Ancillaries Drive Premiums: Buyers are paying top-dollar for practices with integrated ancillary services. A practice with a profitable, well-run endoscopy center is valued much higher than one that refers procedures out.

The Sale Process

Many physicians think selling a practice is like listing a property. In reality, a successful sale is a multi-stage project that begins long before a buyer is ever contacted. The first phase, Preparation, is where we help owners professionalize their financial reporting and optimize operations. This ensures their practice s story is clear and compelling. The next phase involves confidential outreach to a curated list of qualified buyers to create competitive tension. Once interest is established, the process moves into Due Diligence, where the buyer verifies all aspects of the business. This is where many deals fail without proper guidance. The final stage is negotiating the definitive agreements and structuring a close that meets your personal and financial goals.

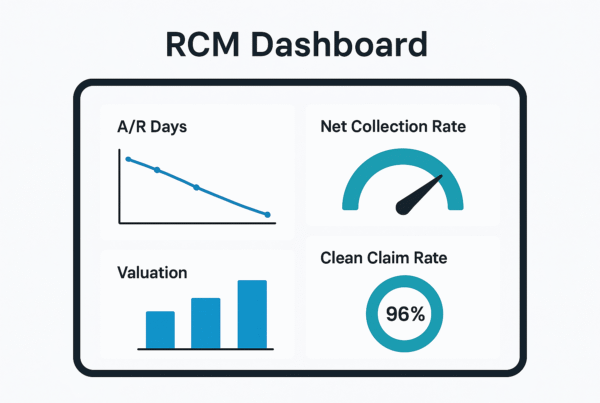

Valuation

What is your practice actually worth? The answer starts with a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your practice’s true cash flow by normalizing for owner-specific expenses and other one-time costs. This Adjusted EBITDA is then multiplied by a specific number, or “multiple,” which is determined by market conditions and factors unique to your practice.

Factors like practice size, reliance on a single physician, and growth trajectory heavily influence the multiple. A multi-provider GI practice with a certified ASC will command a significantly higher multiple than a solo practice.

| Metric | Example Practice A (Solo MD) | Example Practice B (Multi-Provider w/ ASC) |

|---|---|---|

| Annual Revenue | $2,000,000 | $6,000,000 |

| Adjusted EBITDA | $500,000 | $1,500,000 |

| Valuation Multiple | 4.5x | 7.0x |

| Enterprise Value | $2,250,000 | $10,500,000 |

As you can see, proper positioning and preparation can change your valuation outcome.

Post-Sale Considerations

The final sale price is only one part of a successful transition. It is important to consider what your life and career will look like after the closing. Many physicians fear a loss of control, but modern deal structures are designed to prevent this. We focus on finding partners who respect clinical autonomy and want the physicians to continue leading the practice. It is also possible to structure a deal that includes an equity rollover, where you retain a stake in the larger new company. This gives you a “second bite of the apple” and allows you to share in the future success you help create, protecting both your financial future and the legacy you have built for your staff and community.

Frequently Asked Questions

What makes Utah a favorable market for selling a GI & Hepatology practice?

Utah is attractive due to its strong population growth and robust economy, which fuel consistent demand for healthcare services including specialized GI and hepatology care. This creates a seller-friendly market with high demand for well-run practices.

Who are the typical buyers interested in acquiring GI & Hepatology practices in Utah?

Buyers typically include Private Equity-backed platforms looking to expand regionally, large health systems aiming to secure GI service lines, and multi-specialty groups wanting to offer comprehensive care by adding GI services.

What are the key factors that influence the valuation of a GI & Hepatology practice?

Valuation is driven by Adjusted EBITDA multiplied by a market-determined multiple. Important factors include practice size, ownership structure, presence of an ambulatory surgery center (ASC), strength of referral networks, and ancillary services like in-house pathology or infusion services.

How does the sale process for a GI & Hepatology practice typically work in Utah?

The sale process includes Preparation (professionalizing financial reporting, optimizing operations), Confidential Outreach to qualified buyers, Due Diligence (verification of business details), and Negotiation of definitive agreements. A structured, confidential process often leads to the best offers.

What should I consider about my role and financial interests after selling my GI & Hepatology practice?

Post-sale, consider structures that protect clinical autonomy and allow you to continue leading the practice. An equity rollover enables you to retain a stake in the new company and share future success, protecting your financial future and legacy.