Selling your practice is one of the most significant professional decisions you will ever make. For owners of home-based ABA service practices in Georgia, the current market presents a unique window of opportunity. This guide offers insights into the market, key buyer considerations, and the steps involved in navigating a successful sale. It is designed to help you understand your options and prepare for a rewarding transition.

Market Overview

The environment for selling an ABA practice is strong, both nationally and here in Georgia. Understanding these trends is the first step in timing your exit strategy.

A Growing National Demand

The entire ABA therapy market is experiencing significant growth. Projections show the industry expanding to nearly $2.5 billion by 2025. This national trend creates a favorable backdrop for sellers, as more buyers, including private equity groups and strategic competitors, are actively looking to enter or expand in the ABA space. This high demand directly translates to stronger interest in well-run practices like yours.

Georgia’s Active Landscape

Georgia is not just following the national trend; it is an active hub for M&A in the behavioral health sector. The recent acquisition of a local provider, Magnolia Behavior Therapy, by the Georgia-based Regency ABA shows that buyers are specifically targeting opportunities within the state. For a practice owner, this means you are operating in a market with proven buyer interest, which can create a competitive environment to drive value.

Key Considerations for Your Home-Based Model

A home-based ABA practice has unique strengths and challenges that buyers will scrutinize. Your close client relationships are a major asset, but a buyer will want to know that value can be transferred. They will look closely at staff stability, given the industry’s high therapist turnover rate of around 65%. They will also assess the efficiency of your operational model, from scheduling and billing to client management. Answering these questions upfront with clear data and well-documented processes is not just helpful. It is how you build buyer confidence and protect your practice’s valuation from being discounted due to perceived risks.

What Buyers in Georgia Are Looking For

The increased market activity means more buyers, but they are not all the same. Many are sophisticated operators, including private equity firms, who look beyond simple revenue figures. When they evaluate a home-based ABA practice in Georgia, they are looking for specific indicators of a healthy, scalable business.

An attractive practice typically demonstrates:

- A Stable and Growing Client Base. Buyers want to see consistent client numbers and a reliable system for new referrals, such as strong relationships with pediatricians or schools.

- A High-Quality Clinical Team. The credentials, experience, and retention rates of your BCBAs and RBTs are a core component of your practice’s value.

- Efficient Operations. Clean financials, organized scheduling, and streamlined billing are signs of a well-managed practice that can be smoothly integrated.

- A Clear Growth Story. Buyers invest in the future. They want to see the potential for expansion, whether it’s serving a new geographic area in Georgia or adding service lines.

The Path to a Successful Sale

The process of selling a practice follows a general path, but navigating it effectively can prevent deals from stalling. It begins with professional preparation and a confidential valuation to understand what your practice is worth. Next, we would discreetly market the opportunity to a curated pool of qualified buyers. After initial offers are received, the process moves to negotiation, where the deal structure is defined. The most intensive phase is often due diligence, where the buyer verifies every aspect of your business. Many sales encounter unexpected challenges here. Proper preparation can make this step a smooth confirmation rather than a painful discovery. The process concludes with the final legal agreements and closing the transaction.

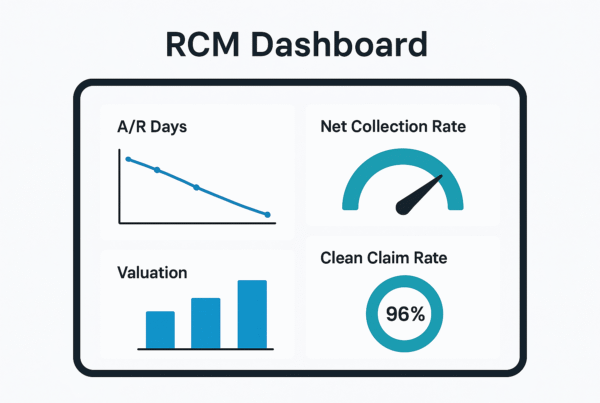

How Your Practice is Valued

Many owners believe their practice’s value is a simple multiple of its revenue. Sophisticated buyers, however, value it based on a multiple of its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). At SovDoc, we start by calculating this figure, which normalizes for owner-specific expenses to show the true cash flow of the business. From there, a valuation multiple is applied. This multiple is not fixed; it shifts based on several factors.

| Factor | Impact on Valuation Multiple |

|---|---|

| Scale of EBITDA | Higher earnings reduce perceived risk, increasing the multiple. |

| Staff Model | Practices less reliant on a single owner command higher multiples. |

| Growth & Reputation | A strong growth history and reputation in Georgia add a premium. |

| Payer Mix | Stable, in-network contracts are typically valued more highly. |

Understanding these drivers is the first step toward maximizing your final offer.

Life After the Sale

Closing the deal is not the end of the story. It is the beginning of a transition. Your role after the sale is a key point of negotiation. You might stay on for a defined period to ensure a smooth handover of client relationships, or you may seek a structured partnership that allows you to retain some ownership. Deal structures like earnouts (where you receive additional payments for hitting performance targets) or an equity rollover (where you keep a stake in the new, larger company) are common. Planning for these post-sale scenarios is a critical part of the process. It helps protect your legacy, ensure continuity for your staff, and align your personal financial goals with the future of the practice you built.

Frequently Asked Questions

What is the current market demand for selling a home-based ABA practice in Georgia?

The market for selling ABA practices is strong nationally and in Georgia specifically, driven by the growing ABA therapy industry, projected to reach nearly $2.5 billion by 2025. Georgia is an active hub for M&A in behavioral health, with strong buyer interest from private equity groups and strategic competitors.

What key factors do buyers consider when evaluating a home-based ABA practice in Georgia?

Buyers look for a stable and growing client base, a high-quality clinical team with strong retention rates, efficient operational systems including scheduling and billing, and a clear growth story that demonstrates potential for expansion within Georgia or service diversification.

How is the value of a home-based ABA practice in Georgia typically determined?

Valuation is based on a multiple of Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which reflects true cash flow after normalizing for owner expenses. The multiple varies depending on factors like EBITDA scale, staff model, growth and reputation, and payer mix.

What steps are involved in selling a home-based ABA practice in Georgia?

The process includes: professional preparation and confidential valuation, discrete marketing to qualified buyers, negotiation and deal structuring, buyer due diligence, and final legal agreements and closing. Proper preparation, especially for due diligence, is key to preventing deal delays.

What options should an owner consider regarding their role after selling their home-based ABA practice?

Post-sale roles can include staying on temporarily for client and staff transition, structured partnerships retaining some ownership, or deal features like earnouts for performance targets or equity rollovers to keep a stake in the new entity. Planning these scenarios helps protect the legacy and align financial goals.