The Denver Med Spa market is one of the most dynamic in the country. This creates a significant opportunity for practice owners like you. However, capitalizing on this market requires more than just listing your practice for sale. It requires strategic preparation, accurate valuation, and expert navigation through a complex transaction process. This guide provides the insights you need to begin the journey toward a successful and profitable exit.

A Booming Market, Both Nationally and Locally

You are in the right specialty at the right time. The medical spa industry is experiencing explosive growth, with projections showing the market growing at over 15% annually. This national trend is clearly reflected in Colorado, making it a prime seller’s market for well-run practices.

The Denver Advantage

Denver stands out as a particularly robust market. We see this in the data from local practices on the market, with some reporting annual revenues well over $1.5 million and strong profitability. This high performance attracts a wide range of sophisticated buyers, from private equity firms to multi-state operators (MSOs), all looking for a foothold in a thriving metropolitan area. This level of interest is great for valuations, but it also raises the stakes for how you prepare and present your practice.

Key Considerations for Denver Owners

Selling your Med Spa goes far beyond your patient list and revenue. Buyers, especially private equity groups, will scrutinize your operational and legal structure. In Colorado, this means ensuring you are fully compliant with a unique set of state laws governing who can own a practice and how you can advertise. A buyer will want to see that your business is perfectly organized and ready for a seamless transition. Beyond compliance, you need to consider what kind of buyer you want. A sale to a private equity firm looks very different from a sale to another practitioner. Your personal goals for the future will determine which path is right for you.

What We’re Seeing in the Denver Market

The transaction landscape in Denver is active and competitive. It is not just about individual buyers anymore. Sophisticated, well-funded groups are aggressively seeking to acquire high-quality practices. Here s a snapshot of the activity:

- High-Value Practices Attract Top Dollar: We see practices led by top injectors with massive personal production attracting premium interest. One such Denver practice boasted over $3 million in consistent annual production, making it a prime target for a strategic buyer.

- Legacy Practices Show Proven Value: A long-established Med Spa in the Denver metro with over 25 years of history showed sales of nearly $1.5 million and Seller’s Discretionary Earnings (SDE) of almost $600,000. This demonstrates the value buyers place on stability and a loyal client base.

- Owner Involvement is Key: A common thread, especially with private equity buyers, is the requirement for the selling owner to remain involved. You should be prepared to stay on for 3 to 5 years post-sale to ensure a smooth transition and help execute the buyer’s growth plan.

Understanding the Sale Process

A successful practice sale is a structured project, not a single event. It begins long before a buyer is involved, starting with deep preparation of your financials and operations. The first step is a comprehensive valuation to establish a credible asking price. From there, your advisor will confidentially market the opportunity to a curated list of qualified buyers, managing inquiries and negotiating initial offers. Once an offer is accepted, you enter the most critical phase: due diligence. This is where the buyer inspects every aspect of your business. Many deals fail here due to poor preparation. A smooth due diligence leads to the final legal negotiations and, ultimately, a successful closing.

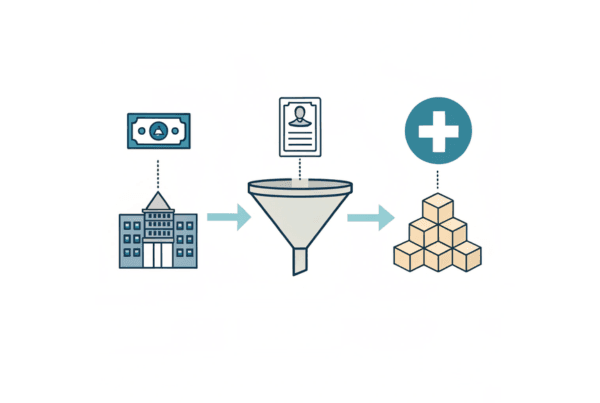

How Your Med Spa is Valued

One of the biggest mistakes owners make is confusing profit with value. Sophisticated buyers value your practice based on a metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). We start with your net income and add back personal expenses run through the business, one-time costs, and any owner salary that is above a reasonable market rate. This gives a true picture of the practice’s profitability. This Adjusted EBITDA figure is then multiplied by a specific number, the “multiple,” to determine your practice’s enterprise value. That multiple is not random. It is heavily influenced by factors that increase or decrease a buyer’s perceived risk.

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Reliance | Dependent on owner | Associate-driven revenue |

| Service Mix | Lower margin services | High-margin fillers & injectables |

| Client Base | Inconsistent new clients | Strong recurring client database |

| Systems | Manual operations | Documented, scalable processes |

Understanding and optimizing these factors before a sale is how we help owners turn “fine” practices into premium acquisition targets.

Planning for Life After the Sale

Closing the deal is a major milestone, but it is not the end of the road. For most Med Spa owners selling to a larger group, the transaction marks the beginning of a new chapter as a key employee. Buyers will typically require you to continue working in the practice for three to five years. This is done to ensure continuity for patients and staff and to help them realize their growth plans. It’s critical to negotiate the terms of this employment agreement carefully. Furthermore, the way your deal is structured has massive implications for your final, after-tax proceeds. Planning this structure in advance, with an eye toward tax efficiency, can be the difference between a good outcome and a great one.

Frequently Asked Questions

What makes the Denver Med Spa market attractive for sellers?

The Denver Med Spa market is dynamic and growing, reflecting national trends with over 15% annual growth. Denver’s robust market features high revenue practices attracting sophisticated buyers like private equity firms and multi-state operators, creating strong selling opportunities.

What legal and operational factors should Denver Med Spa owners consider before selling?

Owners must ensure compliance with Colorado’s unique state laws governing practice ownership and advertising. Buyers will scrutinize operational and legal structures, so the business must be well-organized and ready for a smooth transition. Owners should also consider their personal goals to decide the ideal type of buyer‚Äîprivate equity firms or practitioners.

How are Med Spa practices in Denver typically valued?

Valuation is based on Adjusted EBITDA, which considers net income adjusted for personal expenses, one-time costs, and owner salary above market rate. This adjusted figure is multiplied by a ‘multiple’ influenced by factors such as provider reliance, service mix, client base consistency, and operational systems.

What should sellers expect during the Med Spa sale process in Denver?

The sale process involves early preparation of financials and operations, a comprehensive valuation, confidential marketing to qualified buyers, managing inquiries, negotiating offers, and a critical due diligence phase where buyers inspect every aspect of the business. A well-prepared due diligence leads to successful closing and legal negotiations.

What happens after selling a Med Spa practice in Denver?

Most sales require the owner to remain involved for 3 to 5 years to ensure continuity and help execute growth plans. Negotiating employment terms is essential. Additionally, the deal structure significantly affects after-tax proceeds, so planning for tax efficiency before closing is vital for maximizing outcomes.