The market for memory care centers in Tampa is strong, fueled by Florida’s demographic trends and a national market projected to grow 5.6% annually. For practice owners, this presents a significant opportunity. Selling your facility is more than just a transaction. It is a complex process involving careful financial preparation, operational assessment, and strategic market timing. Successfully navigating this landscape is key to realizing the full value of your life’s work. This guide provides a clear overview of what you need to know.

Curious about what your practice might be worth in today’s market?

Tampa’s Favorable Market for Memory Care

You are operating in a seller’s market. The demand for quality memory care in Florida continues to outpace supply, and the Tampa area is a focal point for this growth. Nationally, the memory care market was valued at $6.3 billion in 2023 and is expected to expand steadily. This trend is reflected locally. We see high investor interest and improving facility performance, with average memory care occupancy climbing back to over 81%. For you, this means there is a pool of motivated buyers, from private equity groups to larger strategic operators, actively looking for well-run facilities in prime locations like Tampa. This environment creates a competitive tension that can drive premium valuations for prepared sellers.

What Buyers Look for in a Tampa Facility

A strong market doesn’t guarantee a top-dollar sale. Sophisticated buyers will look past the surface and scrutinize the core of your operation. Getting these details right before you go to market is critical.

Operational Excellence

Your day-to-day operations will be under a microscope. Buyers want to see a stable, well-run facility. Key areas of focus include your staffing levels, employee qualifications and turnover rates, the quality of your specialized care programs, and impeccable fire safety and compliance records. A facility that runs smoothly demonstrates lower risk and higher future potential.

Financial Health

Buyers purchase future cash flow. It’s important to present clean, clear financials. They will analyze your revenue streams, particularly private pay rates, which in Tampa can average around $5,000 per month. They will also look at your expense management. Note that Medicare generally does not cover memory care, so a strong private-pay census is very attractive. Proving consistent profitability is how you justify a premium valuation.

Every practice sale has unique considerations that require personalized guidance.

Deals Are Happening in Tampa

The theoretical opportunity in the market is backed by real-world transactions. The Tampa region is an active M&A environment. For example, a local 46-bed memory care facility recently sold for $3.58 million. Another nearby 79-unit community, combining assisted living with memory care, also changed hands. These sales are not isolated events. They are indicators of a dynamic market where both regional and national buyers are deploying capital. For owners, this activity signals that the window of opportunity is open. Understanding the specifics of these deals, such as the valuation multiples paid, is the first step in positioning your own practice for a similar successful outcome.

Timing your practice sale correctly can be the difference between average and premium valuations.

The Path to a Successful Sale

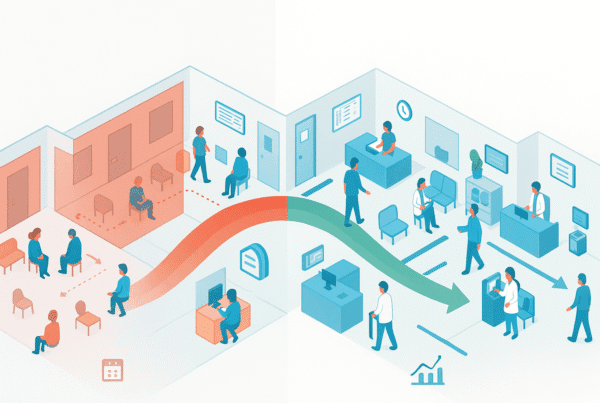

Selling your practice follows a structured path. While every deal is unique, the journey generally involves a few key stages. Proper guidance can help you navigate each step and avoid common pitfalls.

- Preparation and Valuation. This is the foundational stage. We help you clean up your financials, calculate a realistic Adjusted EBITDA, and gather all the documents a buyer will want to see. This stage concludes with a comprehensive valuation that sets the stage for negotiations.

- Confidential Marketing. Your practice is presented, without revealing its identity, to a curated list of qualified buyers. The goal is to create a competitive environment to generate strong initial offers.

- Negotiation and Due Diligence. After selecting the best offer, you enter a period where the buyer verifies every aspect of your business. This is often the most challenging phase, where deals can fall apart if you are not prepared.

- Closing. Once due diligence is complete, final legal documents are drafted and signed. The funds are transferred, and the transition to new ownership begins.

The due diligence process is where many practice sales encounter unexpected challenges.

How Your Practice is Valued

Understanding your practice’s value is the first step in any sale. It is not just one number. A buyer determines value based on a simple formula: Adjusted EBITDA x a Valuation Multiple. While the math is simple, the inputs are complex.

Adjusted EBITDA is your facility27s true cash flow, calculated by taking your net income and adding back interest, taxes, depreciation, amortization, and any one-time or owner-specific expenses.

The Multiple is a reflection of your practice’s risk and future growth potential. Two facilities with the same EBITDA can receive very different multiples based on their specific characteristics.

| Factors That Increase Your Multiple | Factors That Decrease Your Multiple |

|---|---|

| High percentage of private-pay residents | Reliance on a few key referral sources |

| Strong, stable management team in place | High staff turnover or unfilled positions |

| Consistent, documented profitability | Outdated facility needing capital upgrades |

| Diverse and modern care programs | Inconsistent or messy financial records |

A comprehensive valuation is the foundation of a successful practice transition strategy.

Planning for Life After the Sale

The deal is not done when the papers are signed. A successful exit strategy includes a clear plan for what comes next, both for you and for the practice you built. Thinking about these elements early in the process ensures your goals are met.

- Your Legacy and Staff. The right buyer will not only pay a fair price but will also be a good steward for your facility’s reputation and, most importantly, for your dedicated staff. This is often a key point in negotiations.

- Your Financial Future. The structure of the sale has major implications. We help you understand the after-tax proceeds. We also help you evaluate complex deal structures like earnouts (future payments based on performance) or equity rollovers (retaining a minority stake), which can provide future upside.

- The Transition. A detailed transition plan ensures a smooth handover of operations and relationships. This protects the continuity of care for residents and provides stability for staff, securing the legacy you worked so hard to build.

Your legacy and staff deserve protection during the transition to new ownership.

Frequently Asked Questions

What is the current market outlook for selling a memory care center in Tampa, FL?

The market for memory care centers in Tampa is strong due to favorable demographic trends in Florida and a national market expected to grow 5.6% annually. Tampa’s market favors sellers with high demand and limited supply, attracting motivated buyers and potentially premium valuations.

What operational factors do buyers consider when purchasing a memory care facility in Tampa?

Buyers scrutinize operational excellence including staffing levels, employee qualifications, turnover rates, quality of specialized care programs, and fire safety and compliance records. A well-run, stable facility suggests lower risk and higher future potential, which is attractive to buyers.

How do buyers value a memory care center practice in Tampa?

Valuation is based on Adjusted EBITDA (true cash flow) multiplied by a valuation multiple that reflects risk and growth potential. Factors increasing the multiple include a high percentage of private-pay residents, strong management, consistent profitability, and modern care programs. Factors decreasing it include reliance on a few referral sources, high staff turnover, outdated facilities, and messy financial records.

What are the key steps involved in selling a memory care center in Tampa?

Selling typically involves: 1) Preparation and valuation including financial cleanup and document gathering, 2) Confidential marketing to qualified buyers, 3) Negotiation and due diligence, and 4) Closing with legal documents and ownership transition.

What should practice owners plan for after selling their Tampa memory care center?

Owners should plan for their legacy and staff protection, ensuring the buyer maintains the facility’s reputation and care quality. They should also consider the financial future, understanding tax implications and deal structures like earnouts or equity rollovers. A detailed transition plan ensures smooth handover, resident care continuity, and staff stability.