Selling your nephrology practice in North Dakota presents a unique window of opportunity. The state’s significant physician shortage creates high demand for established specialty practices like yours. However, navigating the state’s specific regulatory landscape and preparing for a successful transition requires strategic planning. This guide provides insights into the current market, key valuation drivers, and the steps involved in achieving your ideal exit.

Market Overview

The market for nephrology practices in North Dakota is shaped by a fundamental imbalance between supply and demand. This creates a favorable environment for practice owners who are considering a sale.

High Demand for Specialists

North Dakota is facing a notable physician shortage, with a projected shortfall of 260 to 360 physicians across all specialties by 2025. While nephrology-specific numbers are not isolated, this trend signifies a strong, underlying demand for specialist physicians. A turnkey practice with an established patient base is an attractive asset for hospitals, health systems, or private equity groups looking to expand their footprint in a market with high barriers to entry.

A Stable Patient Foundation

The need for kidney care is consistent. National data shows 1 in 7 adults are affected by CKD, and North Dakota’s own health statistics indicate a persistent need for nephrological services. This stable and predictable patient population reduces risk for a potential buyer and supports a stronger valuation. Your practice represents a solution to a clear and ongoing healthcare need in the community.

Key Considerations

While the demand is strong, a successful sale depends on anticipating and addressing specific challenges. We see owners who prepare for these issues achieve much smoother transactions.

Here are three key factors to consider:

-

Future Staffing and Recruitment. A national trend shows declining interest in nephrology among new physicians. A potential buyer will scrutinize your practice’s ability to retain and recruit talent. Highlighting a strong team culture, competitive compensation, and a manageable work-life balance becomes a critical part of your practice’s story.

-

The Broader Workforce. Beyond physicians, North Dakota faces general healthcare workforce shortages. Demonstrating stable, long-term non-physician staff is a significant value-add. This shows a buyer they are acquiring a well-run operation, not just a patient list.

-

North Dakota’s Regulatory Scrutiny. The state has a history of scrutinizing healthcare mergers to prevent anti-competitive behavior. Any potential sale must be structured to comply with both state and federal regulations. This isn’t a DIY task. It requires careful planning to avoid legal hurdles that can kill a deal late in the process.

The structure of your practice sale has major implications for your after-tax proceeds.

Market Activity

Specific details on private nephrology practice sales in North Dakota are rarely made public. This is common in healthcare M&A. True market intelligence comes from proprietary transaction data and direct relationships with active buyers.

However, we can see the broader trends. Consolidation continues to be the dominant force, with regional health systems and private equity-backed platforms actively seeking to enter or expand in markets like North Dakota. They are drawn to the state’s stable economics and the clear need for specialty care. Understanding what these buyers look for is key to positioning your practice.

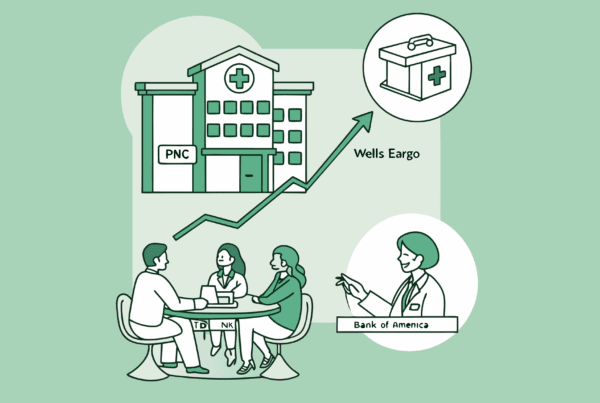

| Market Snapshot: North Dakota Healthcare | Data Point |

|---|---|

| Average Nephrologist Salary | ~$291,983 / year |

| Healthcare Spending Per Resident (2020) | $13,204 |

| Total Active Specialty Physicians (May 2024) | 1,106 |

This data shows a financially healthy environment for specialists. Buyers see this as a strong foundation for growth. Your practice isn’t just an operational asset; it’s a strategic entry point into a lucrative market.

The Sale Process

Selling your practice is a structured process, not a single event. A well-managed process protects your confidentiality, creates competitive tension among buyers, and maximizes your final value. Most owners find that starting the preparation 1-2 years before their target sale date yields the best results.

Your journey will typically follow these five phases:

- Preparation and Valuation. This is the foundational phase where we work with you to analyze your financials, normalize your EBITDA, and build a compelling narrative about your practice’s growth potential to establish a defensible valuation.

- Confidential Marketing. We identify and confidentially approach a curated list of qualified strategic and financial buyers from our proprietary database. This is not about “listing” your practice; it’s about running a discreet and competitive process.

- Negotiation and Offer Selection. We help you evaluate offers, which often include more than just a price. We compare cash at close, rollover equity, earnout potential, and cultural fit to find the right partner for you.

- Due Diligence. The buyer will conduct a deep dive into your financials, operations, and legal compliance. This is where most deals face challenges. Being thoroughly prepared is the key to a smooth process.

- Closing. The final phase involves legal documentation and the official transfer of ownership. Our role is to ensure the deal closes on the terms that were agreed upon.

The due diligence process is where many practice sales encounter unexpected challenges.

Valuation

Understanding what your nephrology practice is truly worth is the foundation of a successful exit strategy. Buyers do not value your practice based on revenue or net income. They use a specific metric to see the true cash flow of the business.

The Core Metric: Adjusted EBITDA

The most important number in your valuation is Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). We take your reported profit and “adjust” it by adding back expenses that will not continue under a new owner. These can include your above-market salary, personal vehicle leases, or other discretionary owner perks. This adjusted figure shows a buyer the true earning power of the practice. What you think is a $500K profit practice might actually be a $700K EBITDA practice in the eyes of a buyer.

Beyond the Numbers: The Multiple

Your Adjusted EBITDA is then multiplied by a numberthe “multiple”to determine the enterprise value. This multiple is not arbitrary. It is influenced by several factors:

* Scale: Practices with higher EBITDA command higher multiples.

* Provider Model: Is the practice dependent on you, or does it have associate physicians driving revenue? Less owner-dependency means higher value.

* Growth Story: Can a buyer easily expand services or open a new location? A clear growth path earns a premium.

A comprehensive valuation tells this complete story, moving beyond simple rules ofthumb to reflect what sophisticated buyers are willing to pay right now.

A comprehensive valuation is the foundation of a successful practice transition strategy.

Post-Sale Considerations

The transaction is not the end of the journey. A successful exit involves careful planning for what comes next, both for you and for the practice you built. Thinking about these issues during negotiations is key to protecting your legacy.

Here are three critical post-sale areas to consider:

-

Your Evolving Role. Many transactions require the selling physician to continue working for a period of 1-3 years. It is important to clearly define your new role, responsibilities, compensation, and schedule in the employment agreement before you close the deal. This prevents future misunderstandings.

-

Staff and Patient Transition. Your staff and patients are the heart of your practice. A well-structured transition plan, communicated clearly, is important for retention and continuity of care. The right buyer will see your team as a valuable asset and will want to work with you to ensure a smooth handover.

-

Regulatory Compliance. Your obligations do not end the day you sell. North Dakota law, for example, requires that patient medical records be retained for at least seven years. Your sale agreement should clearly outline who is responsible for the cost and management of maintaining these records.

Your legacy and staff deserve protection during the transition to new ownership.

Frequently Asked Questions

What factors create a favorable market for selling a nephrology practice in North Dakota?

North Dakota is experiencing a significant physician shortage and a strong demand for specialty practices like nephrology. The stable patient base with consistent need for kidney care and the state’s healthcare market dynamics make it favorable for selling a nephrology practice.

What are the key challenges to consider when selling a nephrology practice in North Dakota?

Key challenges include ensuring future staffing and recruitment due to declining interest in nephrology among new physicians, demonstrating stable long-term non-physician staff, and navigating North Dakota’s regulatory scrutiny on healthcare mergers to avoid anti-competitive issues.

How is the valuation of a nephrology practice determined in North Dakota?

Valuation is primarily based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which adjusts profit by removing non-recurring or personal expenses. This adjusted EBITDA is multiplied by a market multiple influenced by factors like practice scale, provider model, and growth potential.

What are the typical phases involved in selling a nephrology practice?

The sale process generally follows these phases: Preparation and Valuation, Confidential Marketing, Negotiation and Offer Selection, Due Diligence, and Closing. Starting preparation 1-2 years before the intended sale date is recommended for best results.

What post-sale considerations should a seller be aware of after selling their nephrology practice in North Dakota?

Post-sale considerations include defining the seller’s evolving role and employment terms, managing staff and patient transition for continuity of care, and ensuring compliance with state laws such as the retention of patient medical records for at least seven years.