Selling your nephrology practice in Pennsylvania presents a significant opportunity, but navigating the process requires a clear strategy. The market is active, with growing demand meeting new economic pressures. This guide offers insights into the current landscape, from valuation to post-sale planning, helping you understand how to prepare for a successful transition. Proper preparation is the key to maximizing your practice’s value in a changing healthcare environment.

Curious about what your practice might be worth in today’s market?

Market Overview

The market for nephrology practices in Pennsylvania is at a unique intersection of challenge and opportunity. A national shortage of nephrologists means that established, well-run practices like yours are in high demand. At the same time, the healthcare landscape is consolidating. We see a steady trend of acquisitions by both regional health systems and private equity firms looking to build specialty platforms. For an independent practice owner, this environment can feel uncertain. However, it also means there are more potential buyers and exit paths available than ever before. Understanding these dynamics is the first step toward positioning your practice for a premium outcome. It is not just about finding a buyer. It is about finding the right one.

Key Considerations

When preparing to sell, buyers will look closely at several areas specific to nephrology in Pennsylvania. Your readiness in these key areas will directly impact your valuation and the smoothness of the transaction.

Three Pillars of a Sellable Practice

- Regulatory Adherence: Beyond standard physician licensing, buyers will scrutinize your compliance with state-specific rules, such as Pennsylvania’s regulations for renal dialysis services (55 Pa. Code Chapter 1128). A clean compliance record is non-negotiable and demonstrates low risk.

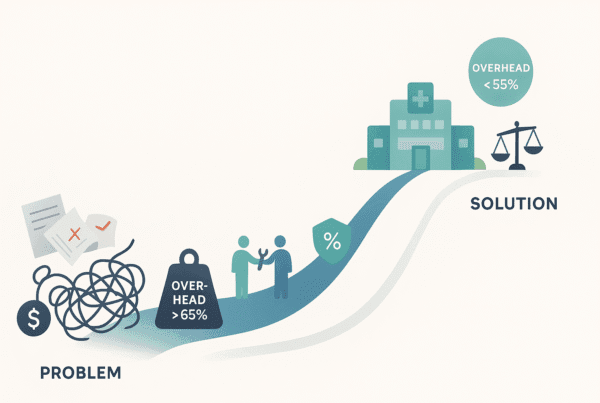

- Financial Model Fitness: Are you positioned for the future? Buyers are wary of practices entirely dependent on the old fee-for-service model. Demonstrating how your practice is adapting to value-based care, where payments are linked to quality outcomes, makes you a much more attractive acquisition target.

- Operational Health: The story your numbers tell is critical. This goes beyond simple revenue. We help owners look at their practice through a buyer’s eyes, focusing on profit margins, overhead control, and the stability of your patient base and referral network.

Every practice sale has unique considerations that require personalized guidance.

Market Activity

Activity in the Pennsylvania healthcare market is strong. We are seeing a clear acceleration of acquisitions, particularly in specialized fields like nephrology. Hospitals and large physician groups are actively seeking to expand their service lines and geographic footprint. Private equity firms are also major players, viewing nephrology as a field ripe for investment and operational improvement. For practice owners, this means you are likely selling in a competitive environment. This is good news. Competition among buyers can drive up value. However, it is important to understand that these sophisticated buyers are not just purchasing a job. They are investing in a strategic asset. Preparing your practice well in advance ensures you are ready when the ideal opportunity arises, allowing you to sell on your terms, not theirs.

The Sale Process

Selling a practice is not a single event but a multi-stage process. Each phase requires careful attention to detail to protect your interests and maximize value. While every sale is unique, most follow a similar path from preparation to closing. A disorganized process can lead to mistakes, lower offers, and deals that fall apart at the last minute. We run a structured process to prevent these issues.

| Sale Phase | What It Involves | Where a SovDoc Advisor Helps |

|---|---|---|

| Preparation | Financial analysis, valuation, and creating marketing materials. | We normalize your financials and craft a compelling story. |

| Marketing | Confidentially identifying and contacting potential buyers. | We access our proprietary database of qualified buyers. |

| Negotiation | Managing offers and negotiating key terms of the deal. | We create competitive tension to drive up the price and terms. |

| Due Diligence | The buyer conducts a deep review of your practice. | We help you prepare for scrutiny to ensure a smooth process. |

| Closing | Finalizing legal documents and transferring ownership. | We coordinate with attorneys to get the deal across the finish line. |

The due diligence process is where many practice sales encounter unexpected challenges.

Valuation

Many practice owners mistakenly believe their practice’s value is just a percentage of annual revenue. The truth is more complex. Sophisticated buyers value your practice based on its Adjusted EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization. Think of this as the true cash flow your practice generates. We calculate this by taking your net income and adding back owner-specific perks, non-recurring expenses, and any above-market owner salary. This number is then multiplied by a market “multiple.” This multiple can range widely based on factors like your payer mix, provider team stability, and growth potential. Most practices are worth significantly more than their owners think once their financials are properly normalized and their story is framed for buyers.

A comprehensive valuation is the foundation of a successful practice transition strategy.

Post-Sale Considerations

A successful transaction is about more than just the sale price. It is about your future and your legacy. Thinking through your post-sale goals early in the process is critical for structuring the right deal.

Planning Your Next Chapter

Your Role After the Sale

Many owners want to continue practicing for a few years, while others seek an immediate exit. Your preference will shape the deal structure. Partnerships can be structured where you retain significant clinical autonomy and even equity in the larger company. This “second bite at the apple” can often be more lucrative than the initial sale itself.

Protecting Your Team and Legacy

You have spent years building a dedicated team and a reputation for quality care. The right buyer will recognize this value and seek to preserve it. We help you negotiate terms that protect your staff’s future and ensure the clinical culture you built continues to thrive under new ownership. Thinking about these issues upfront ensures your transition is not just financially rewarding, but personally satisfying as well.

Your legacy and staff deserve protection during the transition to new ownership.

Not sure if selling is right for you? Our advisors can help you understand your options without any pressure.

Frequently Asked Questions

What is the current market environment for selling a nephrology practice in Pennsylvania?

The market is active with high demand due to a national shortage of nephrologists and increased interest from regional health systems and private equity firms. This creates more potential buyers and exit paths than ever before, offering a compelling opportunity for practice owners.

What regulatory aspects are important when selling a nephrology practice in Pennsylvania?

Buyers closely examine compliance with Pennsylvania-specific regulations, such as those for renal dialysis services (55 Pa. Code Chapter 1128). Maintaining a clean compliance record is essential to demonstrate low risk and attract buyers.

How is the value of a nephrology practice determined?

Value is based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), reflecting the true cash flow of the practice. This figure is adjusted for owner perks, non-recurring expenses, and above-market salaries, then multiplied by a market multiple influenced by factors like payer mix and provider stability.

What are the key phases in the sale process of a nephrology practice?

The process includes preparation (financial analysis and marketing), marketing (confidential buyer contact), negotiation (handling offers and terms), due diligence (buyer review), and closing (finalizing legal documents). Structured management of each phase is critical for success.

What should practitioners consider about their post-sale plans?

Owners should decide if they want to continue practicing or exit immediately, as this affects deal structure. They should also plan to protect their staff’s future and maintain the practice’s clinical culture, ensuring a transition that is financially rewarding and personally satisfying.