Selling your Ortho & MSK practice in South Carolina is a major decision. The current market presents a lucrative opportunity, but realizing your practice’s full value requires more than just finding a buyer. It demands strategic preparation and a clear understanding of the unique factors that make your specialty so attractive. This guide provides the initial insights you need to navigate the process with confidence.

Market Overview

The market for Ortho & MSK practices is active, and South Carolina is no exception. Unlike other specialties that are heavily consolidated, orthopedics remains a fragmented field. This presents a significant opportunity for practice owners.

A Fragmented, High-Potential Landscape

Sophisticated buyers, especially private equity firms and large strategic groups, see this fragmentation as a major runway for growth. They are actively seeking to partner with well-run practices to build regional and national platforms. Your independent practice is not just a local clinic; it’s a valuable building block in a much larger strategic picture. This dynamic creates healthy competition among buyers, which can lead to premium valuations for sellers who are properly prepared.

Resilience in the Palmetto State

Orthopedic services are essential and often non-discretionary. This makes the specialty highly resilient to economic shifts. While other industries may worry about interest rates or recession potential, the demand for orthopedic care remains strong. This stability makes your practice a lower-risk, higher-reward investment in the eyes of a buyer, giving you a strong negotiating position from the start.

Key Considerations for a High-Value Sale

For a South Carolina Ortho & MSK practice, your valuation goes far beyond patient volume. Sophisticated buyers look for specific indicators of profitability, stability, and growth. Focusing on these areas before you go to market is one of the most effective ways to maximize your exit value.

-

The Power of Your Ancillary Services. This is where Ortho & MSK practices truly shine. An Ambulatory Surgery Center (ASC), in-house physical therapy, imaging (MRI/X-ray), and DME services are not just add-ons. They are powerful revenue engines that can dramatically increase your valuation multiple. Buyers pay a premium for practices with well-run ancillaries because they represent diversified, high-margin income streams.

-

Your Technology and Systems. A modern practice runs on efficient technology. Buyers will scrutinize your EMR system, online booking capabilities, and patient engagement tools. A well-integrated tech stack signals an efficient, scalable business. A clunky or outdated system, on the other hand, can be seen as a liability that requires future investment, potentially lowering an offer.

-

Your Transition and Legacy Plan. Who runs the practice if you leave? A practice heavily dependent on a single owner is riskier than one with a strong team of associate providers. A clear plan for transitioning staff and patient relationships is also critical. Buyers want to see continuity, and demonstrating a thoughtful plan protects the legacy you’ve built.

Market Activity and Buyer Landscape

The interest in orthopedic practices is not just theoretical. It is translating into real market activity. The consolidation wave is still in its early stages, meaning there is intense competition for high-quality practices, which helps support strong valuations for sellers.

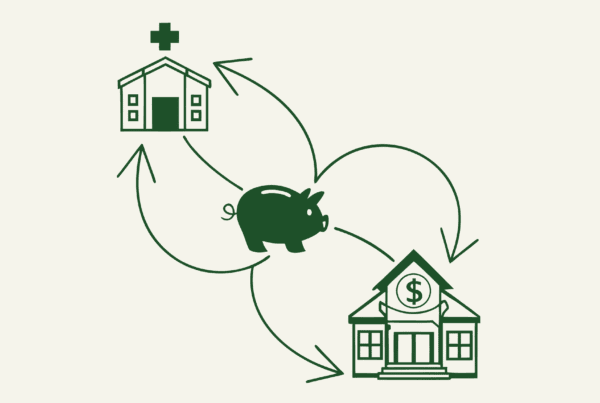

The Rise of Private Equity

Private equity (PE) firms are the most active buyers in the space. They see Ortho & MSK as a profitable, resilient specialty perfect for a “buy and build” strategy. They partner with a strong practice to create a “platform” and then acquire smaller “tuck-in” practices to grow its regional footprint. For a seller, a PE partnership can provide significant capital, operational resources, and the potential for a “second bite of the apple” if the larger platform is sold again years later.

Strategic Partnerships and Alliances

PE is not the only option. We are also seeing the growth of large, physician-led supergroups and alliances. These models allow practice owners to pool resources, benefit from shared administrative services, and gain negotiating power with payors, all while retaining a greater degree of clinical independence compared to a traditional sale. Finding the right fit depends entirely on your personal and financial goals.

The Path to a Successful Sale

Selling your practice is a structured process, not a single event. While every deal is unique, the journey generally follows a clear path from preparation to closing. Understanding these stages is the first step to taking control of the outcome. We find that preparation started 2-3 years in advance yields the best results.

Here is a simplified look at the key phases:

| Stage | Key Actions | Where Expert Guidance is Critical |

|---|---|---|

| Preparation | Gather and organize financial statements, tax returns, and asset lists. Address any known operational or legal issues. | Normalizing your financials (Adjusted EBITDA) to reveal the true profitability that buyers will pay for. |

| Positioning & Marketing | Develop a confidential summary that tells your practice’s story. Identify and discreetly approach a curated list of qualified buyers. | Creating a competitive environment with multiple bidders, not just listing your practice and waiting for a call. |

| Due Diligence | Provide detailed information to the prospective buyer and their team. This is the most intensive phase of the sale. | Managing the flow of information to prevent deal fatigue and navigating the tough questions that will inevitably arise. |

| Negotiation & Closing | Finalize the purchase price, deal structure (cash, equity, earnouts), and legal agreements. Plan the transition. | Structuring the sale to be as tax-efficient as possible, which can have a major impact on your net proceeds. |

What Is Your Practice Really Worth?

Many practice owners mistakenly believe their practice’s value is tied to revenue or the number on their profit and loss statement. Sophisticated buyers, however, use a more precise method. They calculate a figure called Adjusted EBITDA and apply a multiple to it.

Beyond Profit: Calculating Adjusted EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a measure of pure operational cash flow. Adjusted EBITDA goes one step further. It normalizes your financials by adding back owner-specific expenses (like a vehicle lease run through the business) and adjusting the owner’s salary to a fair market rate. A practice with $500k in net income might have an Adjusted EBITDA of $700k or more once these changes are made. This figure is the true baseline for your valuation.

The Multiplier Effect in Orthopedics

The multiple applied to your Adjusted EBITDA depends on factors like size, location, provider team, and, most importantly for ortho, your ancillary services. While a small practice might get a 4x-6x multiple, a larger South Carolina practice with an ASC and in-house PT could command a multiple in the high single digits or even low double digits. This is why properly calculating your Adjusted EBITDA and telling the story of your growth potential is so critical. A small adjustment can lead to a huge difference in your final sale price.

Life After the Sale: Post-Sale Considerations

The work isnt over once the sale agreement is signed. A successful transition requires careful planning for your personal, financial, and professional future. Thinking about these elements early in the process ensures you structure a deal that aligns with your long-term goals.

-

Define Your Future Role. Do you want to retire immediately, or do you see yourself continuing to practice for a few more years? Your new partner may want you to stay on to ensure a smooth handover. Deciding what you want ahead of time allows you to negotiate terms, compensation, and a timeline that works for you.

-

Understand Your Deal Structure. Very few deals are 100% cash at closing. You will likely encounter structures like an equity rollover, where you retain a minority stake in the new, larger company, or an earnout, where a portion of your payment is tied to the practice hitting performance targets post-sale. These can be powerful wealth-creation tools, but you need to understand the potential risks and rewards.

-

Communicate to Ensure a Smooth Transition. Your staff and patients are the heart of your practice. A clear communication plan is needed to reassure your team about their future and ensure patients that their quality of care will continue. This protects your legacy and is a top priority for any quality buyer.

Frequently Asked Questions

What makes the Ortho & MSK practice market in South Carolina a good place to sell?

South Carolina’s Ortho & MSK market is attractive due to its fragmentation, which creates opportunities for practice consolidation by private equity firms and strategic groups. This competitive environment can lead to premium valuations for sellers with well-prepared, independent practices.

How important are ancillary services in determining the value of my practice?

Ancillary services such as Ambulatory Surgery Centers (ASC), in-house physical therapy, imaging, and durable medical equipment (DME) dramatically increase your practice’s valuation multiple. These services provide diversified, high-margin income streams that buyers highly prize.

What role does technology play in the sale of an Ortho & MSK practice?

Buyers scrutinize your practice’s technology systems including EMR, online booking, and patient engagement tools. Efficient and modern technology indicates a scalable and well-run practice, increasing attractiveness and potentially the sale price. Outdated tech may reduce offers due to anticipated future investment needs.

Who are the typical buyers interested in South Carolina Ortho & MSK practices?

The most active buyers are private equity firms aiming to build regional or national platforms through acquisitions. Physician-led supergroups and alliances also represent viable alternatives, offering sellers options to retain clinical independence while gaining resources and negotiating power.

What are key stages in preparing my practice for sale?

The sale process includes several phases: Preparation (organizing financials and legal issues), Positioning & Marketing (creating buyer interest), Due Diligence (supplying buyer information), and Negotiation & Closing (finalizing terms and transition plans). Early and thorough preparation, ideally 2-3 years ahead, leads to the best outcomes.