Selling your Ortho & MSK practice is a major milestone. For owners in South Dakota, the current market presents unique opportunities driven by strong demand for musculoskeletal care. Navigating the sale requires more than just finding a buyer. It means understanding your practice’s true value, preparing for buyer scrutiny, and structuring a deal that protects your financial future and legacy. This guide provides a clear overview of the market, the process, and what you need to consider for a successful transition.

Curious about what your practice might be worth in today’s market?

Market Overview

The market for orthopedic and MSK practices in South Dakota is healthy. This strength comes from a few key trends that work in a seller’s favor. It’s an environment where well-run practices attract significant interest from a variety of buyers.

Driven by Demographics

A key driver is the aging population. As more people require joint replacements, sports medicine, and other musculoskeletal services, the demand for established orthopedic practices grows. This demographic tailwind makes practices like yours valuable assets for buyers looking to expand their footprint in a growing healthcare sector.

The Buyer Landscape

Interest isn’t just local. Buyers include regional health systems looking to broaden their specialty care networks and, increasingly, private equity-backed platforms seeking to enter or grow in the Dakotas. This competition can create favorable conditions for sellers who are properly prepared for a sale.

Key Considerations

Beyond broad market trends, a buyer will look closely at the specific operations of your practice. For an Ortho & MSK practice in South Dakota, certain factors have a large impact on your valuation and the smoothness of the sale. Your provider reliance is a major factor. A practice that depends entirely on the owner is seen as riskier than one with associate physicians who will remain after the sale. Additionally, your mix of ancillary services, like in-house physical therapy or imaging, adds significant value and makes your practice more attractive as a comprehensive platform for buyers. Your payer contracts and referral patterns are also critical pieces of the puzzle.

Market Activity

The consolidation trend seen in other medical specialties is active in the orthopedic space. Buyers are looking for well-managed practices to serve as anchors for regional growth. Understanding who these buyers are is the first step in positioning your practice effectively.

The primary buyers in the market today include:

1. PE-Backed Orthopedic Platforms: These groups are sophisticated buyers focused on acquiring practices to build a larger, integrated network. They often bring operational resources and capital for growth but require a professionalized sales process.

2. Regional Health Systems: Local and regional hospitals are often looking to expand their orthopedic service lines. They may prioritize community integration and patient continuity.

3. Large Independent Practices: Other successful orthopedic groups, from within South Dakota or neighboring states, may look to acquire your practice as a strategic expansion.

The Sale Process

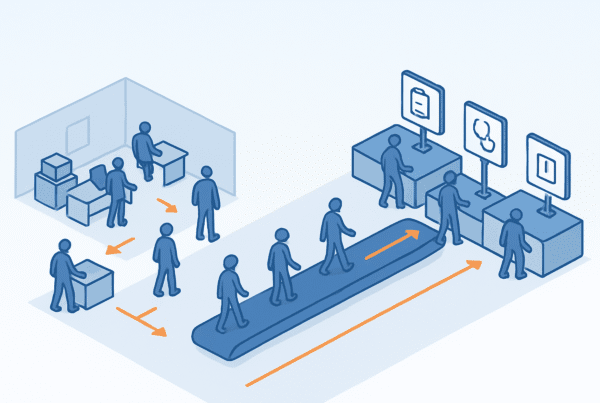

A practice sale is a structured journey, not a single event. Preparing long before you plan to sell is the best way to maximize your outcome. The process generally begins with Preparation, which includes a professional valuation and organizing your financial and operational documents. This is where you build the story of your practice. The next stage involves confidentially marketing the practice to a curated list of qualified buyers. After initial offers, you move into negotiation and signing a Letter of Intent (LOI). The most intensive phase is Due Diligence, where the buyer verifies every aspect of your business. Many deals falter here without proper preparation. The process concludes at Closing, when the contracts are signed and funds are transferred.

Valuation

Determining what your practice is truly worth is a complex analysis. It goes far beyond a simple rule of thumb. The foundation of a professional valuation is Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your practice’s true cash flow by normalizing for owner-specific expenses and one-time costs. This adjusted profit is then multiplied by a figure that reflects your practice’s risk and growth profile. Factors like those below heavily influence the multiple a buyer is willing to pay.

| Factor | Impact on Valuation |

|---|---|

| Multiple Providers | Higher Multiple |

| Strong Ancillary Revenue | Higher Multiple |

| High Owner Reliance | Lower Multiple |

| Documented Growth | Higher Multiple |

A comprehensive valuation is the foundation of a successful practice transition strategy.

Post-Sale Considerations

The transaction closing is not the end of the road. It’s the beginning of a new chapter for you, your staff, and your patients. Your role after the sale is a key point of negotiation. You may continue working under an employment agreement for a set period. In many private equity transactions, you will have the opportunity for rollover equity, where you retain a minority stake in the new, larger company. This provides a “second bite of the apple” if that company is sold again later. It is also important to consider the tax implications of the deal structure to maximize your net proceeds. A well-planned transition ensures your legacy is protected and your team is set up for continued success.

Every practice sale has unique considerations that require personalized guidance.

Frequently Asked Questions

What are the key market trends impacting the sale of Ortho & MSK practices in South Dakota?

The market for orthopedic and MSK practices in South Dakota benefits from strong demand driven by an aging population needing musculoskeletal services. Buyers include regional health systems, PE-backed platforms, and large independent groups, creating competitive conditions that favor sellers.

How does provider reliance affect the valuation of an Ortho & MSK practice in South Dakota?

Higher owner reliance typically lowers the valuation because buyers see it as riskier. Practices with multiple providers or associate physicians who stay post-sale are valued higher as they represent more stability and reduced risk for the buyer.

What role do ancillary services play in the sale of an Ortho & MSK practice?

Ancillary services like in-house physical therapy or imaging increase a practice’s attractiveness by offering comprehensive care. These services generate additional revenue streams, thereby increasing the practice‚Äôs valuation.

What are the main types of buyers interested in Ortho & MSK practices in South Dakota?

Buyers include PE-backed orthopedic platforms aiming to create integrated networks, regional health systems expanding their specialty services, and large independent orthopedic groups looking for strategic growth.

What should owners expect during the sale process of their Ortho & MSK practice?

The sale process is structured and includes preparation, marketing to qualified buyers, negotiation and signing a Letter of Intent, thorough due diligence, and finally closing. Proper preparation and professional valuation are crucial to a successful sale.