The market for Orthopedic and Post-Surgical Rehab practices in Portland is exceptionally strong. For practice owners, this presents a significant window of opportunity. Selling your practice is a major decision, and success depends on a strategic approach grounded in current market realities. This guide provides key insights into the Portland market, what drives practice value, and how to navigate the sale process to achieve your personal and financial goals.

Market Overview: A Growing Demand in Portland

Your practice operates in a thriving sector. The demand for skilled orthopedic and post-surgical rehabilitation is not just growing; it’s accelerating. This creates a favorable environment for practice owners considering a transition.

Statewide Growth

The numbers confirm the trend. The physical therapy industry in Oregon is on a path to exceed $691 million by 2025. More importantly, the demand for physical therapy services is projected to grow nearly twice as fast as the state’s population over the next decade. This fundamental imbalance between supply and demand makes established, reputable practices in a prime location like Portland very attractive to potential buyers.

Key Market Drivers

Beyond simple demand, the nature of care is evolving. Buyers are actively seeking practices that embrace modern approaches. This includes the integration of new technology, telehealth capabilities for follow-up care, and highly personalized rehabilitation programs. Practices that can demonstrate these forward-thinking attributes are not just selling a business; they are selling a platform for future growth, which buyers will pay a premium for.

Key Considerations for Portland Practice Owners

While the market is strong, a successful sale depends on the specific strengths of your practice. Buyers in the Portland area look closely at several key factors that go beyond revenue and profit.

Here are four areas that require your attention:

-

Your Referral Network Strength. How dependent is your practice on your personal relationships with local surgeons and health systems like OHSU or Providence? Buyers will scrutinize the diversity and defensibility of your patient referral sources. We help owners document and build systems around these networks to prove their value is transferable.

-

Operational and Staffing Model. An efficient practice with a well-trained, independent team is more valuable than one reliant solely on the owner. Buyers want to see a smooth-running operation with low provider turnover. The goal is to show that the practice’s success will continue after you transition out.

-

Your Physical Location and Lease. Real estate in Portland is a significant factor. A favorable, long-term lease in a desirable location is a major asset. Conversely, an upcoming lease expiration can be a liability. Addressing your lease situation early is a critical step.

-

Payor Mix and Specialization. Orthopedic and post-surgical rehab is a high-value specialty. Your mix of commercial payors versus government payors will heavily influence profitability and, therefore, your valuation. Demonstrating a healthy payor mix is key.

Proper preparation before selling can significantly increase your final practice value.

Market Activity: Who is Buying Practices Like Yours?

You will not find a public list of recent orthopedic rehab practice sales in Portland. These transactions are almost always confidential. However, we see the activity happening behind the scenes. The buyers are typically not solo practitioners. Instead, they are larger, well-capitalized groups. These include established regional therapy companies looking to expand their footprint in the Pacific Northwest and private equity platforms seeking to build a network of high-performing clinics. These buyers are sophisticated. They move quickly and know exactly what they are looking for. Selling to them without an equally structured and competitive process on your side means you are likely leaving money on the table.

The Sale Process: From Preparation to Closing

A successful practice sale is not an event; it’s a process. Each stage has a clear objective and potential challenges. Understanding this roadmap is the first step toward controlling the outcome. We manage this process to protect your confidentiality and create a competitive environment designed to maximize your final value.

| Sale Stage | Key Objective & Potential Pitfall |

|---|---|

| 1. Preparation & Valuation | Objective: Establish a clear, defensible valuation based on normalized financials and a compelling growth story. Pitfall: Using messy QuickBooks data or “rule of thumb” numbers that buyers will easily pick apart. |

| 2. Confidential Marketing | Objective: Present the opportunity to a curated list of qualified buyers without alerting staff, patients, or competitors. Pitfall: Uncontrolled leaks of information that can damage staff morale and practice operations. |

| 3. Negotiation & Due Diligence | Objective: Secure multiple competitive offers and manage the buyer’s intensive review of your finances and operations. Pitfall: Being unprepared for due diligence requests, which can lead to delays, renegotiations, or a collapsed deal. |

| 4. Closing & Transition | Objective: Finalize legal documents and ensure a smooth handover of operations that protects your legacy and team. Pitfall: Poorly structured terms that create future liabilities or a difficult transition period for you and your staff. |

The due diligence process is where many practice sales encounter unexpected challenges.

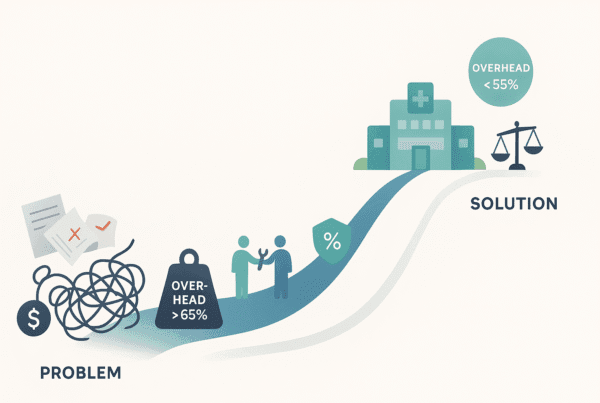

How Your Practice is Valued

Practice owners often ask, “What is my practice worth?” The answer is based on a straightforward concept: Adjusted EBITDA multiplied by a valuation multiple.

Your Adjusted EBITDA is the true measure of your practice’s annual profitability. We find it by taking your reported profit and adding back owner-specific expenses that a new owner would not incur. This could include things like personal vehicle leases, excess owner salary, or other non-operational costs. This single number is the foundation of your valuation.

The Valuation Multiple is what a buyer is willing to pay for each dollar of your EBITDA. This is not a fixed number. It’s influenced by the specific strengths and risks of your practice.

Factors That Drive Your Multiple Higher:

* A strong, non-owner-dependent clinical team

* A diverse and stable referral base

* Modern facilities and technology

* A history of consistent revenue and profit growth

* A strategic location within the Portland metro area

A proper valuation is not just about the math. It’s about telling a convincing story about your practice’s future potential, backed by clean, credible data.

Curious about what your practice might be worth in today’s market?

Planning for Life After the Sale

The day you close the sale is not the end of the journey. The best transactions are structured with your future in mind. What will your role be? Many owners choose to stay on for a period, focusing on patient care without the burdens of administration. Others seek a clean break. The structure of the deal is flexible. We can negotiate terms that protect your team, preserve the culture you built, and ensure your financial legacy. This often involves more than just a cash payment at close. It can include equity rollovers or earnouts, which allow you to share in the future success of the practice. Thinking about these goals now is the key to designing an exit that truly works for you.

Frequently Asked Questions

What is the current market outlook for Orthopedic and Post-Surgical Rehab practices in Portland, OR?

The market for Orthopedic and Post-Surgical Rehab practices in Portland is exceptionally strong, with a growing and accelerating demand for skilled rehabilitation services. The physical therapy industry in Oregon is projected to exceed $691 million by 2025, making it a favorable environment for selling a practice.

What are the key factors that buyers consider when valuing an Orthopedic & Post-Surgical Rehab practice in Portland?

Buyers consider several key factors including the strength and diversity of your referral network, the operational and staffing model, the location and lease terms of your practice facility, and your payor mix and specialization. Practices that demonstrate modern approaches and a strong, non-owner-dependent clinical team tend to receive higher valuations.

Who typically buys Orthopedic & Post-Surgical Rehab practices in Portland, OR?

The typical buyers are larger, well-capitalized groups such as established regional therapy companies expanding in the Pacific Northwest and private equity platforms looking to build a network of high-performing clinics. These buyers are sophisticated and move quickly in their acquisitions.

What does the sale process for a practice in Portland look like?

The sale process includes four main stages: (1) Preparation & Valuation, where you establish a defensible value for your practice; (2) Confidential Marketing, presenting your practice to qualified buyers discreetly; (3) Negotiation & Due Diligence, managing offers and thorough buyer reviews; and (4) Closing & Transition, finalizing legal documents and ensuring smooth operational handover.

How is the value of an Orthopedic & Post-Surgical Rehab practice determined?

The practice value is based on your Adjusted EBITDA multiplied by a valuation multiple. Adjusted EBITDA reflects your true profitability after removing owner-specific expenses. The valuation multiple depends on factors like your team, referral network, facilities, and consistent financial performance. This approach helps tell a convincing story about the future potential of your practice.