For owners of Outpatient Physical Therapy practices in Delaware, the decision to sell is one of the most significant in your professional career. The current market is active, driven by national growth and strategic buyer interest. However, navigating this strong but complex landscape to achieve your practice’s maximum value requires careful planning and a clear understanding of the process. This guide provides a strategic overview to help you begin that journey.

Market Overview

The market for outpatient physical therapy is robust. Nationally, the industry is projected to grow at over 8% annually, and buyers are actively seeking well-run practices to acquire. Clinics often demonstrate healthy net profit margins, typically between 14-20%, which is very attractive to both strategic acquirers and private equity groups. For you as an owner in Delaware, this means there is a significant opportunity. Buyers are not just looking for practices in major metropolitan hubs. They are looking for stable, profitable clinics with a solid track record, and practices in Delaware fit that profile perfectly. The key is no longer if there is a market, but how you position your practice to capture its full value within it.

Key Considerations for Delaware Practices

Buyers look deeper than just your top-line revenue. For a Delaware physical therapy practice, they will heavily scrutinize a few key areas that tell the true story of your business’s health and future potential.

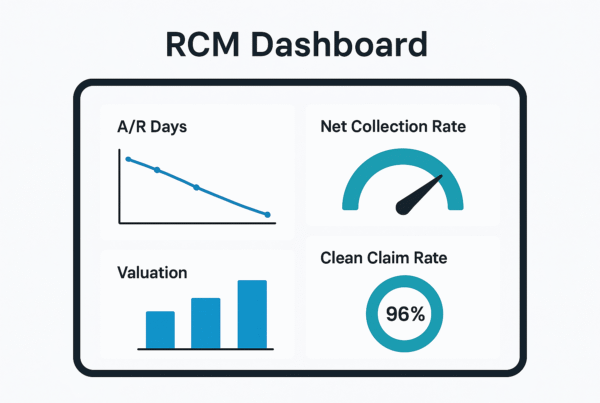

Financial Health and Story

Your financial statements must be clean and easy to understand. More importantly, we help you prepare a narrative around them. This means calculating your Adjusted EBITDA, a figure that shows your true profitability by adding back owner-specific expenses. This single metric can dramatically change your valuation.

Operational Strength

How dependent is the practice on you, the owner? Buyers pay a premium for clinics with a strong team of therapists who are likely to stay and a diverse, reliable network of patient referral sources. A “complete book of business” is a powerful asset.

Regulatory Compliance

Delaware has specific licensing requirements and regulations. Demonstrating a history of clean compliance with both state rules and Medicare conditions of participation reduces the perceived risk for a buyer and smooths the path to a successful closing.

Market Activity

The market is not just theoretical. Right now, outpatient physical therapy practices are being bought and sold. You can see listings on platforms like BizBuySell, with asking prices that show a wide range of valuations. Recent sales data shows that practices can command multiples anywhere from 0.5x to over 2.5x their annual revenue. The final number depends heavily on factors like profitability, location, and growth potential. We see both larger physical therapy groups (strategic buyers) and private equity firms actively looking to acquire practices in the region. This creates a competitive environment for well-prepared sellers, but it also means finding the right buyer for your specific goals is critical.

The Sale Process at a Glance

Selling your practice follows a structured path. While every deal is unique, the journey generally involves these key phases. Understanding them is the first step to taking control of your exit.

- Valuation and Preparation. It starts with a comprehensive valuation to understand what your practice is truly worth. This is followed by preparing all financial and operational documents for buyer review. Many owners are surprised to learn that waiting until you are ready to sell is too late. The best time to start preparing is 1-2 years in advance.

- Confidential Marketing. Your advisor will create marketing materials and confidentially approach a curated list of qualified buyers without revealing your practice’s identity.

- Negotiation. Once interest is established, offers are solicited and negotiated to secure the best possible terms, not just the best price.

- Due Diligence. The selected buyer will conduct a deep dive into your financials, operations, and legal compliance. This is often the most challenging phase where deals can fall apart if you are not prepared.

- Closing. Final legal documents are signed, funds are transferred, and the transition of ownership begins.

Understanding Your Practice’s Value

A common mistake is valuing a practice based on a simple multiple of revenue. Sophisticated buyers do not do this. They value your practice based on its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your practice’s normalized annual cash flow and is the true indicator of its earning power. That EBITDA figure is then multiplied by a number (the “multiple”) that reflects your practice’s quality and risk profile. Higher quality practices command higher multiples.

What drives your multiple up or down?

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Model | Highly owner-dependent | Associate-driven team |

| Referral Sources | Concentrated in 1-2 places | Diverse, stable network |

| Financials | Messy or inconsistent | Clean, growing EBITDA |

| Growth Path | Limited expansion options | Clear opportunities |

An expert valuation is not just about the math. It’s about telling the story of your practice in a way that justifies the highest possible multiple.

Post-Sale Considerations

The day you close the deal is not the end of the story. It is the beginning of a new chapter for you, your staff, and your patients. Planning for this transition is just as important as negotiating the price. You need to consider what your role, if any, will be after the sale. Protecting your staff and ensuring a smooth handover for your patients is key to preserving the legacy you built. Furthermore, the structure of the deal has massive tax implications. How it is structured can significantly change your net, after-tax proceeds. Advanced options like earnouts or rolling over a portion of your equity into the new company can provide future upside, but they also come with their own risks and rewards. Thinking through these outcomes in advance ensures your exit aligns with your personal and financial goals.

Frequently Asked Questions

What is the current market outlook for selling an Outpatient Physical Therapy practice in Delaware?

The market for outpatient physical therapy practices is robust and growing nationally at over 8% annually. Buyers, including strategic groups and private equity firms, are actively seeking well-run practices, including those in Delaware, which are attractive due to their stability and profitability.

What financial metrics are most important when selling a Delaware physical therapy practice?

A key financial metric is Adjusted EBITDA, which shows the practice’s true profitability by adding back owner-specific expenses. Buyers focus on clean and easy-to-understand financial statements and the story these figures tell about the business’s health and future potential.

How does being owner-dependent affect the valuation of a Delaware physical therapy practice?

Practices that are highly dependent on the owner tend to receive a lower valuation multiple. Buyers pay a premium for clinics that have a strong, associate-driven team likely to stay and a diverse, stable network of referral sources, which reduces risk and supports growth prospects.

What are the regulatory considerations for selling a physical therapy practice in Delaware?

Demonstrating a consistent history of compliance with Delaware’s specific licensing requirements and Medicare conditions of participation is crucial. This reduces the perceived risk for buyers and facilitates a smoother closing process.

What are the key steps in the sale process of an outpatient physical therapy practice in Delaware?

The sale process typically includes: 1) Valuation and preparation including starting 1-2 years in advance, 2) Confidential marketing to qualified buyers, 3) Negotiation of terms and price, 4) Due diligence where the buyer reviews financials and operations, and 5) Closing with legal formalities and ownership transfer.