The market for physical therapy in Las Vegas is experiencing strong growth and high demand, creating a valuable window of opportunity for practice owners considering a sale. This guide provides a direct overview of the current market, valuation principles, and the steps involved in a successful transition. Proper strategic preparation is the key to maximizing your practice’s value and achieving your personal and financial goals.

Market Overview

The Las Vegas physical therapy market is not just stable. It is expanding. Projections show the physical therapy industry in Nevada growing toward $467.2 million, supported by powerful tailwinds. Nationally, the demand for physical therapists is expected to increase by 14% between 2023 and 2033, and Nevada’s growth often outpaces the national average. This high demand from an active, growing population makes Las Vegas a prime location for practice owners. For you, this means there is significant buyer interest from both local competitors and larger, well-capitalized groups looking to enter or expand in a thriving market. It’s an active and competitive landscape.

Key Considerations for Selling Your Practice

A strong market is a great start, but the highest valuations go to owners who prepare. Many owners tell us they plan to sell in 2-3 years. That is the perfect time to begin the process, as buyers pay for proven performance, not just potential. Focusing on a few key areas now can unlock significant value later.

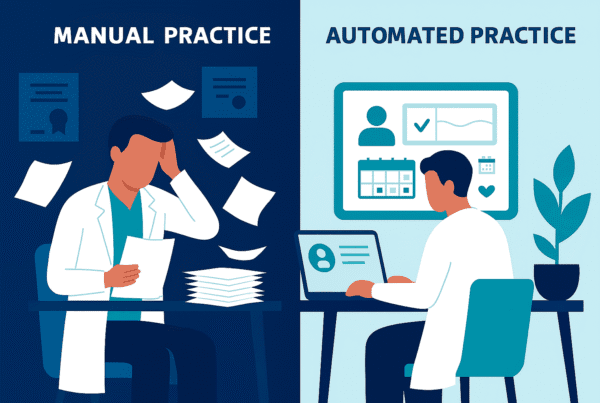

Operational Health

Is your billing clean and your documentation in order? Sophisticated buyers perform deep due diligence. They look for organized, efficient practices. Cleaning up your financial reporting and operational systems before a sale is not just good practice. It directly impacts your valuation and the smoothness of the transaction.

Owner Dependence

If you went on vacation for a month, would your practice’s revenue decline? Many physical therapy practices are heavily reliant on the owner’s personal relationships and clinical skills. To a buyer, this is a risk. Building up your team and implementing systems that allow the practice to thrive without your daily presence is one of the most effective ways to increase its value.

Strategic Positioning

What makes your practice different? Perhaps you have a strong niche in sports rehabilitation, a favorable payer mix, or a great location in a growing Las Vegas suburb. We help owners identify and frame this narrative. It helps a buyer see your practice not just as it is, but what it can become.

Market Activity and Buyer Trends

The type of buyer interested in a Las Vegas physical therapy practice has changed. While local sales still happen, the most significant activity we see comes from two groups: regional therapy platforms and private equity investors. These groups are actively consolidating the market, seeking well-run practices to serve as a foundation for growth. They bring capital and operational expertise, but they also have rigorous criteria. Selling to them is not like selling to a colleague. It requires a formal process designed to create competitive tension and ensure you are negotiating from a position of strength, not reacting to a single unsolicited offer. Timing the market correctly is crucial.

The Sale Process Distilled

Selling a practice is a structured project, not a single event. Each stage has its own purpose and potential pitfalls. When owners try to manage this alone, we often see the most trouble arise during due diligence, where a lack of preparation can cause delays or even kill a deal. Understanding the path forward helps you stay in control.

Here is a simplified look at the key stages:

| Stage | Key Focus | Where Owners Face Challenges |

|---|---|---|

| Preparation | Financial cleanup, building a growth story. | Underestimating the work needed to become “buyer-ready.” |

| Valuation | Establishing true profitability (Adjusted EBITDA). | Using outdated “rules of thumb” that undervalue the practice. |

| Marketing | Confidential outreach to qualified buyers. | Lacking access to the right network of buyers. |

| Due Diligence | Responding professionally to buyer requests. | Unprepared financials lead to deal delays or renegotiations. |

| Closing | Finalizing legal terms and planning the transition. | Navigating complex legal documents without experience. |

How Your Practice is Valued

Your practice is not valued on its revenue or what is left in the bank account at the end of the year. Sophisticated buyers use a formula: Adjusted EBITDA x a Market Multiple. Understanding this is the first step to getting the right price. First, we find your true earning power (Adjusted EBITDA) by taking your stated profit and adding back expenses a new owner would not have, like your personal car lease or a one-time equipment purchase. A practice with $300,000 in reported profit could have an Adjusted EBITDA of $450,000 or more. This adjusted number is then multiplied by a figure based on market demand, growth potential, and risk. Two practices with the same revenue can have vastly different valuations based on these factors.

Planning for Life After the Sale

The deal is not done when the check clears. A successful transition is defined by what happens next. Many owners worry about losing control or what will happen to their team. These are valid concerns that should be addressed long before closing. The right deal structure protects your interests and your legacy.

Here are three key things to plan for:

- Your Future Role. Do you want to leave immediately, or stay on for a few years in a clinical or leadership role? This is a critical point of negotiation. Control isn’t all or nothing. We can structure deals that allow you to maintain clinical autonomy while shedding administrative burdens.

- The Financial Structure. Not all proceeds may be paid in cash at closing. Many deals include an “earnout” (additional payments for hitting performance targets) or “rollover equity” (retaining ownership in the larger new company). These can create significant future wealth, but they need to be structured carefully.

- Your Team and Legacy. You have built more than a business. You have built a team and a reputation in the Las Vegas community. A core part of our process is finding a buyer whose culture aligns with yours and who is committed to taking care of your employees.

Frequently Asked Questions

What is the current market outlook for selling a Physical Therapy practice in Las Vegas?

The Las Vegas physical therapy market is experiencing strong growth and high demand. The industry in Nevada is projected to grow toward $467.2 million, supported by an expanding population and increasing demand for physical therapists. This creates significant buyer interest locally and from larger groups looking to expand.

How is a Physical Therapy practice valued when selling in Las Vegas?

Valuation is based on Adjusted EBITDA multiplied by a market multiple. Adjusted EBITDA is the true earning power of the practice after adding back non-recurring or personal expenses. Market multiples consider demand, growth potential, and risk. This method often reveals a higher value than just looking at revenue or profit.

What key steps should I take to prepare my practice for sale?

Preparation involves financial cleanup, organizing operations, building a growth narrative, and reducing owner dependence. Buyers expect clean billing and documentation, an operational system that doesn’t rely solely on the owner, and a clear strategic positioning of the practice‚Äôs strengths and niche.

Who are the typical buyers for a Physical Therapy practice in Las Vegas?

Buyers include local competitors, regional therapy platforms, and private equity investors. Regional platforms and private equity groups are increasingly active, consolidating the market with capital and operational expertise. Selling to them requires a formal process to create competitive tension and negotiate effectively.

What should I plan for after selling my Physical Therapy practice in Las Vegas?

Post-sale planning includes deciding your future role (whether to leave immediately or stay involved), understanding the financial structure of the deal (such as earnouts or rollover equity), and ensuring the buyer aligns with your team and legacy to protect your employees and reputation.