Selling your radiology practice is one of the most significant decisions you will ever make. The North Carolina market is dynamic, shaped by consolidation, regulatory shifts, and active buyers. Navigating this landscape requires more than just finding a buyer. It requires a strategic approach to protect your legacy and maximize your financial outcome. This guide provides an overview of the key factors you should consider as you explore this path.

Curious about what your practice might be worth in today’s market?

Market Overview: A Climate of Consolidation

The market for radiology practices in North Carolina is active and competitive. If you are considering a sale, it is helpful to understand the forces driving this activity. Two key trends define the current landscape.

The Rise of Consolidation

Independent radiology practices are increasingly joining forces or being acquired by larger entities. This trend is driven by the need to gain negotiating power with payors, invest in expensive technology, and create operational efficiencies. Mergers between North Carolina practices have created larger, more dominant regional groups, increasing the pressure on smaller practices to consider their strategic options. This environment creates opportunities for sellers, as both regional and national players are looking to expand their footprint in the state.

Private Equity and Strategic Buyers

Private equity (PE) firms and large health systems are prominent buyers in the market. Since 2012, PE-backed platforms like US Radiology Specialists have been actively acquiring practices to build national networks. At the same time, strategic buyers like North Carolina’s own Novant Health have made significant acquisitions to strengthen their integrated care delivery systems. Each buyer type has a different motivation and structure, which has a direct impact on your role, your staff’s future, and your potential return.

Key Considerations for NC Radiology Owners

Beyond market trends, selling a radiology practice in North Carolina involves navigating unique local and specialty-specific challenges. Buyers will look closely at your practice’s compliance and risk management profile. Three areas deserve your focused attention. Certificate of Need (CON) laws create a regulatory moat around healthcare services, and recent reforms in North Carolina change the game. The diagnostic center CON threshold has been raised to $3 million, and certain MRIs are now exempt in more populated counties. Understanding how these changes affect your practice s value and a buyer s growth plan is critical. Furthermore, cybersecurity is now a core aspect of a practice’s health. A recent cyberattack shut down a local radiology practice for over a month, showing how vital robust data protection is. Buyers will scrutinize your IT infrastructure and your HIPAA compliance record as a measure of risk.

Market Activity: A Snapshot of Recent Deals

The consolidation trends are not just theoretical concepts. They are reflected in significant transactions across North Carolina, signaling a healthy M&A environment. This activity provides a glimpse into the types of deals being made and the potential for sellers.

| Activity Type | Example | Implication for Sellers |

|---|---|---|

| High-Value Strategic Acquisition | Novant Health acquired MedQuest and its 95 imaging centers. | Demonstrates that large health systems are willing to pay a premium for strategic assets that expand their service area. |

| PE-Backed Platform Growth | US Radiology Specialists has actively acquired practices and secured debt to fuel its expansion across the state and country. | PE buyers are well-capitalized and looking for strong practices to serve as “tuck-in” acquisitions to their larger platforms. |

| Strategic Affiliation | Mecklenburg Radiology Associates and Gaston Radiology joined Strategic Radiology, a national coalition of independent practices. | Offers an alternative to a full sale, allowing practices to gain scale and resources while retaining a degree of independence. |

This activity shows that buyers are actively seeking opportunities. For practice owners, this means it is a seller’s market, but only for those who are well prepared.

The Sale Process: It’s a Marathon, Not a Sprint

A successful practice sale is a carefully managed process with distinct phases. Many owners think of selling as a single event, but the highest valuations are achieved through disciplined preparation that often begins years before a transaction. The journey typically starts with organizing your financials and operational data to tell a clear and compelling story. From there, a professional valuation establishes a credible asking price. The next step is a confidential marketing process to identify and engage a curated list of qualified buyers, creating a competitive environment. Once offers are received, you move into negotiation, due diligence, and closing. The due diligence phase is where many deals fall apart due to unforeseen issues. Proper, early preparation can prevent these surprises and keep the process on track.

Unlocking Your Practice’s True Value

How much is your radiology practice actually worth? The answer is more complex than a simple rule of thumb. While you may hear about multiples, professional buyers base their offers on a much deeper analysis.

At its core, valuation begins with Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure normalizes your net income by adding back owner-specific personal expenses and any above-market owner compensation. For a radiology practice, several other factors heavily influence the final number.

- Capital Expenditures: Buyers will closely examine the age of your equipment. A practice with new or recently updated scanners requires less immediate investment and will command a higher value than one facing a multi-million-dollar replacement cycle.

- Cash Flow Projections: Sophisticated buyers use a Discounted Cash Flow (DCF) model. This projects your future earnings and is more accurate than a simple multiple because it accounts for expected changes in reimbursement, patient volume, and operating costs.

- Certificates of Need (CONs): Holding a CON is a valuable asset, as it creates a barrier to entry for competitors. The value of these certificates is a key part of your practice s overall worth.

- Provider Dependence: A practice that relies on a team of associates is typically more valuable than one dependent on a single owner-operator, as it represents lower transition risk for the buyer.

A meticulous valuation process is the foundation of any successful exit strategy.

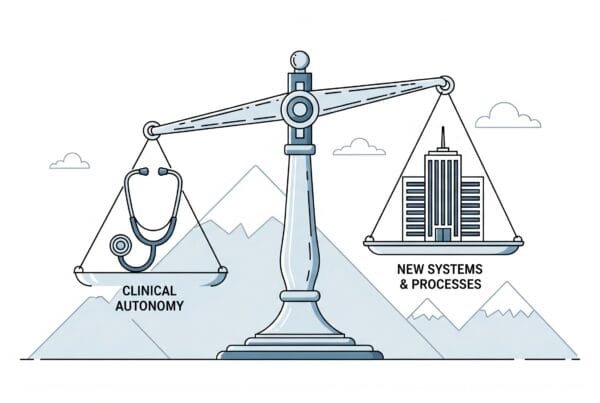

After the Sale: Planning for Your Next Chapter

The day you sign the deal is not the end of the story. It is the beginning of a new chapter for you, your finances, and your team. Thinking through post-sale scenarios before you even go to market is one of the most important parts of the planning process. You will need to consider your future role. Do you want to continue practicing for a few years, or are you ready to retire immediately? The structure of the deal can accommodate either path. You also need to plan for the financial aftermath. The structure of the sale, whether as an asset or entity sale, has massive implications for your tax burden. In many deals, a portion of your proceeds may come as an earnout or rolled equity in the new company. Understanding these components is key to knowing your true take-home value. Finally, protecting what you ve built, including the careers of your loyal staff, is often a primary goal for physician owners. The right partner will share this priority.

Frequently Asked Questions

What are the main market trends affecting the sale of radiology practices in North Carolina?

The North Carolina radiology market is characterized by consolidation among independent practices joining larger entities to gain negotiating power and operational efficiencies. There is strong activity from private equity firms and large health systems acquiring practices to expand their networks and integrated care delivery.

How do North Carolina’s Certificate of Need (CON) laws impact the sale of a radiology practice?

CON laws create a regulatory barrier around healthcare services. Recent reforms in North Carolina raised the diagnostic center CON threshold to $3 million and exempt certain MRIs in populated counties. These changes can affect your practice’s value and how attractive it is to buyers planning growth strategies.

What are key factors buyers evaluate during due diligence when purchasing a radiology practice?

Buyers closely examine your practice’s compliance with regulations, cybersecurity preparedness including HIPAA compliance, financial records, capital expenditures especially the age of your equipment, cash flow projections, CON holdings, and provider dependence. Proper preparation in these areas is essential to avoid deal disruptions.

How is the valuation of a radiology practice typically determined?

Valuation centers on Adjusted EBITDA, which normalizes net income by adjusting for owner-specific expenses. Buyers also consider capital expenditures (equipment age), projected cash flows using discounted cash flow models, CON certificates as competitive barriers, and the presence of a stable team to lower transition risks.

What should a seller consider regarding their future role and financial planning after selling their radiology practice?

Sellers should plan whether they wish to remain practicing post-sale or retire immediately, as sales can be structured to accommodate either. Financially, understanding the deal structure—asset vs. entity sale, earnouts, and equity rollovers—is critical as these impact tax burdens and the true take-home value. Protecting staff careers is also a common priority.