The market for School & Community-Based ABA practices in San Diego is active and attracting significant buyer interest. For practice owners, this presents a unique window of opportunity. Navigating a sale, however, requires careful preparation, from understanding your practice’s true value to managing the transition. This guide provides key insights into the current landscape and the steps involved in achieving a successful exit.

San Diego’s Thriving ABA Market

If you own an ABA practice in San Diego, you are in a strong position. The region is a focal point for buyers, from private equity groups to larger strategic providers looking to expand their footprint in Southern California. They are not just looking for any practice; they are seeking established, well-run operations with deep community roots.

A Magnet for Growth

San Diego’s growing population and well-regarded school districts make it a prime territory for ABA services. Buyers understand this. They are actively seeking practices with strong ties to local schools and a proven track record within the community, as these represent stable, defensible market share.

Sophisticated Buyer Appetite

Today s buyers are interested in more than just revenue. They are looking for practices with a strong clinical reputation, efficient operational systems, and clear potential for growth. An established brand in the San Diego area is a significant asset that buyers are willing to pay a premium for.

What Buyers Look for in Your Practice

Beyond the market trends, a buyer’s decision comes down to the quality of your specific practice. Your financials are the starting point, but the story they tell is what drives value. What makes your practice unique? It could be your dedicated, experienced clinical team, your exclusive relationships with certain school districts, or your reputation for achieving outstanding client outcomes. It is also important to have a clear picture of your payer mix and the strength of your insurance contracts. Articulating these strengths in a way that sophisticated buyers understand is a critical part of the sale process. It’s about showing them a stable operation with clear potential for the future.

The Proof Is in the Transactions

The interest in San Diego ABA practices is not just talk. We see it happening in real-time. For instance, the recent acquisition of San Diego ABA by a private-equity-backed provider shows that well-funded buyers are making strategic moves in this exact market. For an owner like you, this activity is a clear signal.

Here is what recent transactions tell us:

- Buyer Demand Is High. Strategic and financial buyers are actively competing for quality ABA practices to gain a foothold or expand in San Diego.

- Reputation Is Currency. Buyers acquire local practices not just for their clients but for their brand recognition and community trust.

- Timing Is Favorable. This level of M&A activity often leads to stronger valuations for sellers who are properly prepared to enter the market.

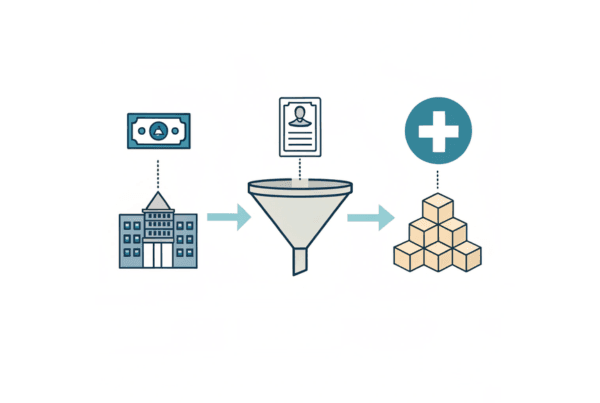

What to Expect in the Sale Process

A successful practice sale is a marathon, not a sprint. The process typically takes several months and requires significant preparation well before your practice is presented to buyers. It starts with organizing your financial house, including at least three to five years of clean profit and loss statements, balance sheets, and tax returns. You will also need to compile operational data, from your client census to your staff roster and key contracts. The most intense phase is often due diligence, where the buyer scrutinizes every aspect of your business. This is where many deals encounter unexpected challenges. Proper preparation with an advisor ensures you are ready for this scrutiny, which helps the process run smoothly and keeps you in control.

Understanding Your Practice’s True Value

Determining what your ABA practice is worth is more than a simple calculation. Buyers start with a key metric called Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This reflects your true cash flow by adding back owner-specific or one-time expenses to your reported profit. That number is then multiplied by a figure based on market demand and risk. While every practice is unique, we find that buyers focus on a few key areas to determine that multiple.

| Valuation Factor | Why It Matters to a Buyer |

|---|---|

| Profit & Scale | Larger, more profitable practices are seen as less risky and command higher multiples. |

| Staff Structure | Practices that do not rely solely on the owner are more attractive and transferable. |

| Payer Mix | A healthy mix of strong, in-network insurance contracts signals revenue stability. |

| Community Integration | Deep roots in local schools show a defensible market position and a loyal client base. |

Planning Your Life After the Sale

Your role does not necessarily end the day the deal closes. It is important to think about your goals for the future. Do you want to continue working in a clinical or leadership role for a transition period? Or are you ready to exit completely? Buyers often prefer the owner to stay on for a period to ensure a smooth transition for staff and clients. The structure of your deal can be designed to match your goals. This can include taking some of your proceeds as equity in the new, larger company, giving you a potential “second bite of the apple” when that company sells again. Planning this early ensures your personal and financial objectives are at the heart of the negotiation.

Frequently Asked Questions

What makes the San Diego market attractive for selling a School & Community-Based ABA practice?

San Diego’s growing population, reputable school districts, and an active buyer market including private equity and strategic providers make it a prime location. Buyers value practices with strong community ties and established operations, seeing them as stable and defensible market share.

What key factors do buyers consider when evaluating an ABA practice in San Diego?

Buyers look beyond revenue to clinical reputation, operational efficiency, and growth potential. Important factors include a dedicated clinical team, exclusive school district relationships, strong client outcomes, insurance contract strength, and a stable payer mix.

How should I prepare my practice financially and operationally before selling?

Ensure you have organized financial records including 3-5 years of profit and loss statements, balance sheets, and tax returns. Prepare operational data such as client census, staff roster, and key contracts. Proper due diligence preparation with an advisor is critical to smooth the sale process.

How is the value of my ABA practice determined?

Value is primarily based on Adjusted EBITDA, reflecting true cash flow. This figure is multiplied by a market-driven multiple influenced by profitability, practice scale, staff structure, payer mix, and community integration. Larger and more profitable practices with strong community ties command higher valuations.

What options do I have for my involvement after selling the practice?

You can choose to stay on in a clinical or leadership role during a transition period or exit completely. Buyers often prefer owner involvement post-sale for continuity. Deal structures can also include taking equity in the acquiring company, offering potential future financial benefits. Early planning aligns this with your personal and financial goals.