The market for selling School & Community-Based ABA practices in Washington is currently very active. For practice owners, this presents a significant opportunity. However, navigating this landscape requires careful preparation to achieve the best possible outcome. Rushing the process can mean leaving money on the table or choosing the wrong partner for your practice’s future. This guide provides a starting point for understanding the key steps and considerations for a successful sale.

A Strong Market for Washington ABA Practices

If you own a school or community-based ABA practice in Washington, you should know that the current M&A market is strong. Buyers, from large strategic partners to smaller, growing groups, are actively looking for well-run practices in the Pacific Northwest. This demand is driven by the recognized need for ABA services and the stable, reputable practices that have been built here. The high level of interest means owners have a real opportunity for a successful exit. It also means you need a plan to stand out and attract the right kind of partner who aligns with your goals for your clients, your staff, and your legacy.

Key Considerations Before a Sale

Moving from “thinking about selling” to “preparing to sell” involves a shift in focus. Buyers will look closely at every part of your practice. It is wise to review these areas well in advance of a potential sale.

Your Operational Health

Buyers want to see a practice that runs smoothly. This means having a strong clinical structure, qualified and stable staff, and efficient systems for billing and scheduling. They also look for a good reputation in your community and valid contracts with key insurance companies. Addressing any operational bottlenecks now will make your practice more attractive.

Your Financial Story

Organized financial records are non-negotiable. You should have several years of financial statements and tax returns ready for review. More importantly, buyers want to see consistent revenue and a clear understanding of your profitability. A potential buyer will analyze your numbers to understand the core health of your business.

Your Future Role

Think about what you want to do after the sale. Many buyers prefer the seller to stay involved, perhaps in a clinical or business development role. If you want a clean break, that is also possible. But you need to be clear about your intentions, as this will influence negotiations and the structure of the deal. Preparing for these discussions is a critical part of the process.

Market Activity in Action

To understand what this looks like in the real world, consider a recent ABA practice for sale in King County. This community-based practice was providing 2,500-3,000 ABA hours per month, with gross revenue around $1.1 million. The asking price was over $395,000. What made it appealing? It had a diverse mix of payment sources, including private pay, major health insurers like Premera and Optum, and contracts with local school districts. The practice was well-staffed with BCBAs, program managers, and administrative support. The owner was also willing to stay on for a transition period, giving the buyer confidence in a smooth handover. This is the kind of well-structured practice that attracts serious attention in today’s market.

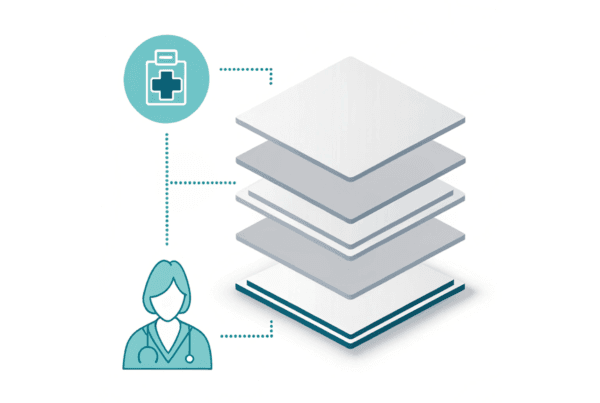

Understanding the Sale Process

Selling a practice is not a single event. It is a process with distinct stages that unfolds over several months. Understanding these steps can help you prepare for the journey ahead. A rushed process often leads to a lower value, so starting early is key.

| Stage | What It Involves | The Main Challenge |

|---|---|---|

| Preparation | Gathering financial documents, clarifying your goals, and getting a professional valuation. | Accurately assessing your practice’s true worth and organizing years of information. |

| Marketing | Confidentially presenting your practice to a curated list of qualified buyers. | Reaching the right buyers without alerting staff, clients, or competitors. |

| Negotiation | Evaluating offers, structuring the terms of the deal, and signing a Letter of Intent (LOI). | Comparing different deal structures (cash, earnouts, equity) to find the best fit. |

| Due Diligence | The buyer conducts a deep investigation (4-6 weeks) to verify everything about your practice. | Responding to extensive requests for data under tight deadlines. This is where many deals fail. |

| Closing | Finalizing legal documents, transferring ownership, and receiving payment. | Navigating the complex legal and financial steps to make the sale official. |

How Your Practice is Valued

Determining the value of your ABA practice is about more than just looking at your revenue. Professional buyers use a method that focuses on your actual cash flow, known as Adjusted EBITDA. This stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is then adjusted for any personal expenses run through the business or an owner’s salary that is above or below the market rate. This adjusted number gives a true picture of the practice’s profitability. That number is then multiplied by a figure called a “multiple.” This multiple is influenced by factors like your practice’s size, your payor mix, your staff stability, and your growth potential. Getting this calculation right is the foundation of a successful sale. It is how you ensure you are not leaving value on the table.

Thinking About Life After the Sale

A successful transaction is about more than the final price. It is also about setting yourself, your staff, and your clients up for a smooth future. Thinking through these elements early can make a major difference in your final satisfaction with the deal.

Planning Your Transition

The new owner will need your help to ensure a steady handover. This often involves introducing them to key staff and referral sources. A transition plan outlines how this will happen. It provides security for both you and the buyer and ensures the continuity of care for your clients.

Protecting Your Legacy

You have spent years building your practice and its reputation. The transition to new ownership is a critical moment for that legacy. Your plan should consider how to communicate the change to your team and the community in a positive way. This helps maintain the culture and quality that made your practice successful.

Optimizing Your Financial Outcome

The way your sale is structured has major tax implications. An asset sale is taxed differently than a stock sale. Understanding these differences can significantly impact your net proceeds. Getting advice on the right structure for your specific situation is a critical step in maximizing what you take home. Thoughtful planning here is just as important as negotiating the sale price.

Frequently Asked Questions

What is the current market like for selling School & Community-Based ABA practices in Washington?

The market for selling School & Community-Based ABA practices in Washington is very active, with high demand from various buyers, including large strategic partners and smaller groups. This creates a strong opportunity for practice owners to achieve a successful exit.

What operational aspects should I improve before selling my ABA practice?

Before selling, ensure your practice runs smoothly with a strong clinical structure, qualified and stable staff, efficient billing and scheduling systems, a good community reputation, and valid contracts with key insurance companies. Addressing bottlenecks will make your practice more attractive to buyers.

How is the value of an ABA practice determined in Washington?

The value is based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), adjusted for personal expenses and owner salary variations, then multiplied by a factor influenced by practice size, payor mix, staff stability, and growth potential. This gives a true picture of profitability and market value.

What are the typical stages in the process of selling an ABA practice?

The stages include Preparation (gathering documents, valuation), Marketing (confidential presentations to buyers), Negotiation (evaluating offers and signing LOI), Due Diligence (buyer investigation), and Closing (finalizing documents and ownership transfer). Each stage presents unique challenges.

What should I consider about my role after selling my practice?

Consider whether you want to stay involved post-sale—many buyers prefer sellers to stay during transition, but a clean break is possible. Being clear about your intentions early influences deal negotiations and structure, and helps plan for a smooth handover and continued care quality.