The market for Skilled Nursing Facilities (SNFs) in Salt Lake City is presenting a significant opportunity for practice owners. With strong national growth projections and a supportive local healthcare ecosystem, the environment is favorable for sellers. However, translating this market potential into a premium valuation for your facility requires careful preparation and strategic navigation. This guide provides key insights to help you understand the landscape and prepare for a successful sale.

Market Overview

The timing for considering a sale is supported by strong market dynamics. You are not operating in a vacuum. The decisions you make are influenced by powerful national and local trends.

National Trends, Local Impact

The U.S. skilled nursing market is on a steady growth trajectory, projected to expand by over 3.4% annually through 2030. This growth is driven by an aging population and increasing demand for long-term care. This national tailwind provides a stable and encouraging backdrop for SNF owners in Utah, where the local industry is also poised for expansion.

Salt Lake City’s Healthcare Ecosystem

Locally, the Salt Lake City metropolitan area is home to 36 skilled nursing facilities. The city is actively fostering a supportive environment through its ‘Health Care Innovation Blueprint.’ This initiative encourages growth and collaboration within the healthcare sector, creating a dynamic market for well-run facilities. This means buyers are not just acquiring a facility. They are investing in a growing and supportive healthcare community.

Key Considerations

A favorable market does not guarantee a successful sale. Sophisticated buyers will look past broad trends and scrutinize the specific health of your facility. Before you enter the market, you should assess your readiness across several key areas. Your quality of care is a primary differentiator, with top-tier U.S. News ratings setting the benchmark in Salt Lake City. Equally important are your financials. Buyers demand a clear picture of historical revenue, occupancy rates, and your payer mix (Medicare, Medicaid, private pay). This data reveals the stability and profitability of your operations. Finally, they will evaluate your staffing levels and operational efficiency, as experienced staff and smooth processes are signs of a low-risk, well-managed investment.

Market Activity

The Salt Lake City market is attracting significant attention from a range of motivated buyers. Understanding who is acquiring facilities today can help you position your practice effectively. Here are three key trends we are seeing in the market.

- Rise of Strategic Buyers. Both regional and national healthcare groups are actively looking to expand their footprint in growing markets like Salt Lake City. They seek well-run facilities that can be integrated into their existing network to create operational efficiencies.

- Increased Private Equity Interest. Private equity (PE) firms are drawn to the stable, needs-based demand of the SNF sector. PE buyers look for facilities with strong, consistent cash flow and clear opportunities for growth, either through adding services or improving operations.

- A Premium on Quality and Compliance. All sophisticated buyers are placing a heavy emphasis on facilities with strong compliance histories and high-quality care ratings. A clean regulatory record is not just a plus. It is a prerequisite for a premium valuation.

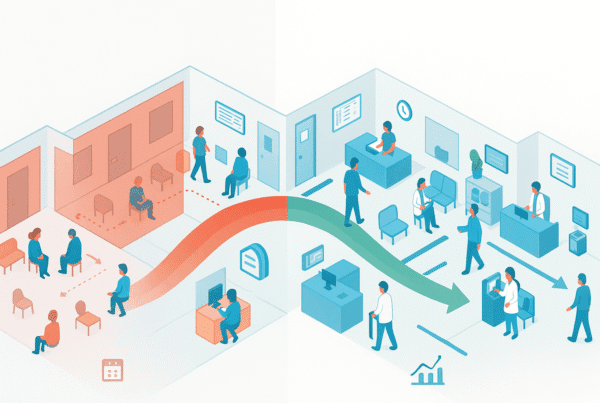

The Sale Process

Selling your facility is not a single event. It is a structured process that unfolds over several months. It begins with thorough preparation, including a professional valuation and the organization of your financial and operational documents into a clear narrative. The next phase involves confidentially marketing your practice to a curated list of qualified buyers to create a competitive dynamic. Once interest is established, you move into negotiation of key terms. This is followed by due diligence, an intensive period where the buyer verifies all information about your business. This stage is where many deals encounter challenges if the initial preparation was not robust. A well-managed process anticipates buyer questions and ensures a smooth path to a successful closing.

How Your Facility is Valued

The most common question from owners is, “What is my facility worth?” The answer is more than just a single number. Sophisticated buyers value your business based on its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your facility’s true cash flow by normalizing for owner-specific expenses or one-time costs. That Adjusted EBITDA is then multiplied by a number, or a “multiple,” which is determined by your facility’s specific risk and growth profile.

Many factors can influence your valuation multiple. Here are a few examples.

| Factor | Impact on Valuation Multiple |

|---|---|

| Facility Scale | Larger facilities with higher EBITDA are seen as less risky and typically receive higher multiples. |

| Payer Mix | A healthy balance with a strong private pay component is often viewed more favorably than heavy Medicaid reliance. |

| Quality Ratings | Consistently high ratings (4 or 5 stars) and a clean compliance record significantly increase value. |

| Staff Stability | Low staff turnover and experienced leadership suggest a stable operation, which reduces buyer risk. |

Understanding your true Adjusted EBITDA and the factors driving your mutliple is the foundation of any successful transition strategy.

Post-Sale Considerations

A successful transaction goes beyond securing a high price. It also involves planning for what comes next. The structure of your sale has major implications for your after-tax proceeds. Planning for this can significantly impact your net financial outcome. At the same time, you have built a legacy of care and a dedicated team. Ensuring a smooth transition for both your residents and your staff is a critical component of a well-executed plan. We help owners navigate these decisions, from structuring a tax-efficient sale to negotiating terms that protect your team and legacy, allowing you to move on to your next chapter with confidence.

Frequently Asked Questions

What are the current market conditions for selling a Skilled Nursing Facility (SNF) in Salt Lake City, UT?

The market for SNFs in Salt Lake City is favorable due to strong national growth projections of over 3.4% annually through 2030, driven by an aging population. Locally, there are 36 SNFs and a supportive healthcare ecosystem encouraged by the city’s ‘Health Care Innovation Blueprint.’ This creates a dynamic environment for well-run facilities to attract buyers.

What key factors influence the valuation of a Skilled Nursing Facility in Salt Lake City?

Valuation is primarily based on Adjusted EBITDA, which reflects the facility’s true cash flow. Important factors affecting the valuation multiple include:

- Facility scale (larger facilities with higher EBITDA get higher multiples)

- Payer mix (private pay is favored over heavy Medicaid reliance)

- Quality ratings (consistently high ratings and compliance records increase value)

- Staff stability (low turnover and experienced leadership reduce buyer risk).

Who are the typical buyers interested in Skilled Nursing Facilities in Salt Lake City?

Buyers include:

- Strategic buyers such as regional and national healthcare groups expanding into the market

- Private equity firms looking for facilities with strong cash flow and growth potential

- Buyers who prioritize quality and compliance, seeking facilities with clean regulatory records and high care ratings.

What should I do to prepare my Skilled Nursing Facility for sale?

Preparation should include:

- Assessing and improving quality of care, aiming for top-tier ratings

- Organizing clear financial records including historical revenue, occupancy rates, and payer mix

- Demonstrating strong staffing levels and operational efficiency

- Obtaining a professional valuation and assembling all key documents into a coherent narrative to aid due diligence.

What post-sale considerations should I keep in mind after selling my SNF in Salt Lake City?

Post-sale planning includes:

- Structuring the sale to maximize after-tax proceeds

- Planning a smooth transition for residents and staff to protect your legacy

- Negotiating terms that safeguard your team

- Consulting experts to ensure confidence and clarity as you move on to your next chapter.