Selling your integrated Speech and Occupational Therapy practice is one of the most significant decisions you will make. For practice owners in Minneapolis, the current market presents a unique combination of strong demand and sophisticated buyers. This guide offers insights into the local market dynamics, the sale process, and how to strategically position your practice to achieve its maximum value. True preparation begins long before you decide to sell.

Market Overview

The therapy landscape in Minneapolis is robust. This creates a compelling environment for practice owners who are considering an exit. Understanding this environment is the first step toward a successful sale.

A Competitive and Thriving Market

Minneapolis is home to major healthcare systems and a high concentration of families seeking pediatric services. Providers like Children’s Minnesota and Fraser have established a strong regional demand for speech and occupational therapy. While this means there is competition, it also signals to buyers that this is a lucrative and stable market to invest in. A practice that has built a strong reputation and deep community ties is a highly valuable asset here.

The Integration Advantage

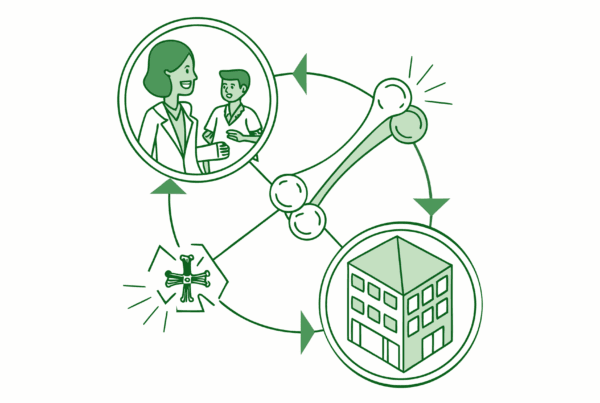

For a potential buyer, an integrated practice that combines Speech and Occupational Therapy is particularly attractive. It represents operational efficiency, a comprehensive care model, and multiple, interwoven revenue streams. This built-in synergy is a powerful selling point that sets your practice apart from single-specialty clinics. Highlighting this integrated approach is key to telling your value story.

Key Considerations

When preparing for a sale, buyers in a competitive market like Minneapolis will look past the surface. They focus on the underlying risks and strengths of the business. We find that a successful sale often rests on three pillars you should address proactively.

- Your Team’s Future. A buyer’s biggest concern is continuity. They will want assurance that your skilled therapists will remain after the transition. Demonstrating a loyal, well-compensated team is critical. Minneapolis has competitive salaries, with SLPs earning around $105,924 and pediatric OTs around $90,461 annually. Showcasing that your compensation is in line with the market can ease buyer fears about staff retention.

- Your Referral Network. Where do your patients come from? A savvy buyer will scrutinize your referral sources. A practice with a diverse mix of referrals from local pediatricians, schools, and other community providers is far more stable than one relying on a single source. Documenting these relationships demonstrates the durability of your revenue.

- Your Financial Story. Buyers require clean, transparent financials. This means more than just a profit and loss statement. They will want to see clear documentation of your payer contracts, billing systems, and reimbursement rates. Preparing your financial records for this level of scrutiny is not something to do at the last minute.

Market Activity

You won’t see billboards announcing the sale of a private therapy practice. These transactions are confidential and happen behind the scenes. However, the trend is clear. The market is active, driven by larger, well-funded organizations and private equity groups looking to acquire established practices. These groups are not just looking for a “fixer-upper.” They are searching for well-run, profitable platforms like an integrated Speech and OT practice. They see the Minneapolis market’s strong demand and view a practice like yours as a strategic entry point or a valuable addition to their existing network. This means your potential buyer is likely to be a sophisticated operator who has done this before.

The Sale Process

Selling your practice is a structured process, not a single event. Each stage has its own challenges, and preparing for them is what separates a smooth transaction from a stressful one. Understanding the road ahead helps you maintain control.

| Stage | Where Expert Guidance Matters |

|---|---|

| 1. Preparation & Valuation | Accurately calculating your true earnings (Adjusted EBITDA) to set a credible price from the start. |

| 2. Confidential Marketing | Reaching a curated network of qualified buyers without alerting your staff, patients, or competitors. |

| 3. Buyer Negotiation | Structuring a deal that protects your interests, from the purchase price to your transition role. |

| 4. Due Diligence | Organizing your financial, clinical, and operational data to survive intense buyer scrutiny without delays. |

| 5. Closing & Transition | Managing the legal and financial complexities to ensure a clean closing and a smooth handover. |

Valuation

“What is my practice worth?” is the first question every owner asks. Many have heard of simple valuation rules, like a multiple of annual revenue. While therapy practices nationally may sell for 0.5x to 2.5x revenue, this method fails to capture the real value of your business. Sophisticated buyers don’t use it. They value your practice based on its profitability, specifically its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). We help owners calculate this by taking your net income and adding back expenses a new owner wouldn’t incur, like your personal auto lease or an above-market salary. This adjusted number reveals your true cash flow and is what buyers are willing to pay a multiple on. The final multiple depends heavily on your practice’s size, growth trajectory, and provider mix.

Post-Sale Considerations

The day you sign the closing documents is not the end of the journey. A successful exit strategy includes a clear plan for what comes next, both for you and for the practice you built. Thinking about these factors ahead of time gives you more control over the final outcome.

- Orchestrating the Transition. You will likely be involved for a period post-sale to ensure a smooth handover of relationships with staff and key referral sources. Defining the length and terms of this role upfront is a critical part of the negotiation.

- Structuring Your Financial Future. The sale proceeds have significant tax implications. Furthermore, parts of your payment may come in the form of an earnout (tied to future performance) or rollover equity (retaining a minority stake). Understanding these structures is vital for your long-term financial security.

- Protecting Your Legacy. You have built more than a business; you have built a team and a community resource. A key part of the sale process is finding a buyer who will be a good steward of that legacy and continue to provide excellent care for your patients and stability for your staff.

Frequently Asked Questions

What makes Minneapolis a unique market for selling an integrated Speech and Occupational Therapy practice?

Minneapolis has a robust therapy landscape with strong demand driven by major healthcare systems and a high concentration of families seeking pediatric services. This creates a competitive but lucrative and stable market that appeals to sophisticated buyers looking for well-run, profitable platforms.

Why is an integrated Speech and Occupational Therapy practice particularly valuable to buyers in Minneapolis?

An integrated practice offers operational efficiency, a comprehensive care model, and multiple, interwoven revenue streams. This synergy differentiates it from single-specialty clinics and represents a compelling value story that appeals to buyers seeking comprehensive pediatric therapy services.

What are the key considerations buyers in Minneapolis focus on when evaluating a Speech & Occupational Therapy practice for sale?

Buyers focus on three pillars: 1) Continuity of the skilled therapy team, demonstrated by competitive salaries and staff retention; 2) A diverse and stable referral network from pediatricians, schools, and community sources; 3) Transparent and well-organized financial records, including detailed documentation of payer contracts and billing systems.

How is the valuation of a Speech and Occupational Therapy practice typically determined in Minneapolis?

Valuation is based on the practice’s profitability measured by Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This calculation adjusts net income by adding back expenses a new owner wouldn’t incur. Buyers then pay a multiple on Adjusted EBITDA, with the multiple depending on factors like practice size, growth trajectory, and provider mix.

What should a practice owner expect during and after the sale process of their Speech and Occupational Therapy practice?

The sale process includes stages such as preparation and valuation, confidential marketing, buyer negotiation, due diligence, and closing and transition. After the sale, the owner often helps orchestrate a smooth transition, deals with financial and tax implications, and ensures their legacy and staff stability by finding a buyer committed to maintaining high-quality care.