Selling the speech and occupational therapy practice you built is a major life decision. In Virginia, the current market presents a significant opportunity for owners, driven by strong national growth and increasing interest from sophisticated buyers. However, achieving your practice’s true potential value is a complex process. This guide provides a clear overview of the market, key steps, and critical factors to help you navigate your transition with confidence.

Market Overview: A Favorable Climate for Virginia Sellers

You have likely noticed the increased demand for therapy services. This is not just a local trend. The entire U.S. therapy market is experiencing robust growth, projected to expand at over 10% annually for the next several years. This strong national tailwind makes well-run Virginia practices particularly attractive.

New Types of Buyers

This growth has not gone unnoticed. Beyond traditional individual buyers, a new class of strategic and private equity-backed groups are actively looking to acquire or partner with successful therapy practices. These groups are drawn to the stable, essential nature of speech and occupational therapy. For you, this means more potential buyers and different types of deal structures, but it also means you will be negotiating with experienced teams who perform deep analysis before making an offer.

Key Considerations Before a Sale

Before a buyer ever sees your financials, they are buying your story. What makes your integrated speech and occupational therapy practice unique? Is it a specialized pediatric program, a strong physician referral network, or an exceptionally skilled team? Defining this unique selling proposition is the first step.

From there, preparation is everything. Buyers expect clean, verifiable financial records and up to date legal documents, from state licenses to payer contracts. Just as important is your plan for transitioning patients and retaining your valuable staff. Answering these questions proactively demonstrates a well managed practice and builds a buyer’s confidence, directly impacting your final valuation.

Market Activity and Buyer Focus

You cannot simply search online for what practices like yours have sold for. Specific transaction data for integrated therapy practices in Virginia is private. This makes it difficult for owners to know the true market rate. It also means that sophisticated buyers, who have access to this data, have an information advantage.

They come to the table with a specific checklist. To understand the current market, it helps to understand what a buyer is focused on right now:

- Referral Stability. They will want to see proof that your patient flow is consistent and comes from diverse sources, not just one or two key physicians who might leave.

- Team Cohesion. They are acquiring your talented therapists and administrative staff. They will look closely at staff longevity and the likelihood they will remain after the sale.

- Payer and Service Mix. A healthy mix of insurance payers and a clear summary of services offered shows resilience. They will analyze this to project future revenue.

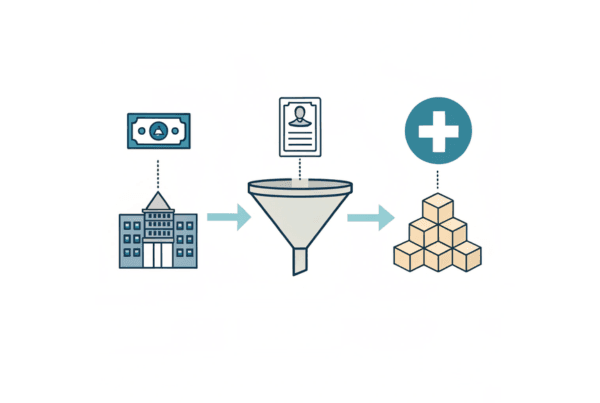

The Sale Process Unpacked

Selling a medical practice follows a clear path, but it contains critical junctures where deals often face challenges. The journey typically begins with a comprehensive valuation to set a realistic price expectation. Next comes preparing a confidential marketing package that tells your practice’s story and showcases its strengths.

The marketing phase involves discreetly reaching out to a curated list of potential buyers. Once interest is established, negotiations begin, leading to a letter of intent (LOI). The most intensive phase is due diligence, where the buyer examines every aspect of your operations, from billing codes to employee contracts. Many promising deals falter here due to poor preparation. A successful process concludes with the final legal agreements and a smooth transition to the new owner.

How Your Practice is Valued

A practice valuation is more than a simple formula. It is about determining your practice’s true earnings power and its future potential. The core of most valuations is a metric called Adjusted EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is calculated by taking your net profit and adding back owner specific expenses to find the true cash flow of the business.

That Adjusted EBITDA figure is then multiplied by a “multiple” to arrive at your practice’s Enterprise Value. The multiple is not a fixed number. It changes based on risk and opportunity, which we can see in a few key areas.

| Factor Driving Value UP | Factor Driving Value DOWN |

|---|---|

| Multiple therapists and diverse referral sources | High dependence on the owner for patients and operations |

| A strong, stable mix of insurance and private payers | Outdated or inefficient billing and admin processes |

| A documented plan and clear opportunities for growth | Inconsistent profitability year to year |

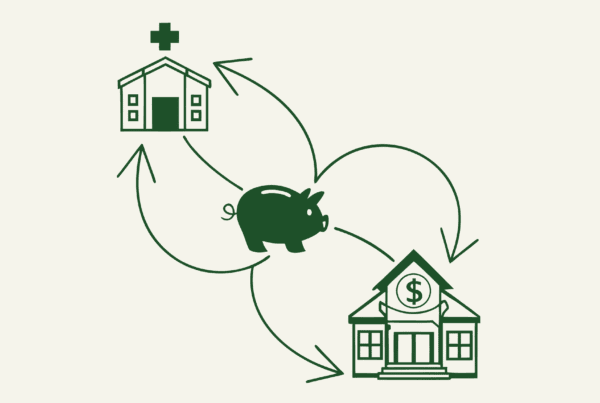

Planning for Life After the Sale

The day you close the deal is not the end of the story. A successful transition requires planning for what comes next, both for the practice and for you personally. A key part of any negotiation involves ensuring a seamless handover of patient care and creating a plan that encourages your staff to stay and thrive under new ownership.

Financially, the structure of the sale has major implications. You may encounter terms like earnouts, where a portion of the sale price is tied to future performance, or equity rollovers, where you retain a stake in the larger new company. These structures can be beneficial, but they require careful consideration. Planning for your post sale role and managing the tax implications are critical steps to protecting your legacy and financial future.

Frequently Asked Questions

What are the current market trends for selling a Speech & Occupational Therapy practice in Virginia?

The market for selling a Speech & Occupational Therapy practice in Virginia is favorable, driven by strong national growth in therapy services projected to expand over 10% annually. There’s increasing interest from sophisticated buyers including strategic groups and private equity-backed firms, making well-run practices particularly attractive.

What should I do before listing my Speech & Occupational Therapy practice for sale?

Before selling, define your practice’s unique selling proposition such as specialized programs or strong referral networks. Prepare clean, verifiable financial records and up-to-date legal documents including state licenses and payer contracts. Develop a transition plan for patients and staff retention to build buyer confidence and impact your valuation positively.

How do buyers in Virginia evaluate Speech & Occupational Therapy practices?

Buyers focus on referral stability, ensuring patient flow is consistent and from diverse sources; team cohesion, evaluating staff longevity and retention likelihood; and payer and service mix, analyzing the insurance mix and offered services to project future revenue. These factors influence their offers and due diligence process.

What is the typical process involved in selling a Speech & Occupational Therapy practice?

The process includes conducting a valuation, preparing a confidential marketing package, discreet outreach to potential buyers, negotiating an LOI, followed by an intensive due diligence phase where all operations are examined. The sale concludes with legal agreements and transition planning to ensure a smooth handover to the new owner.

How is the value of my Speech & Occupational Therapy practice determined?

Practice valuation is based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) representing true cash flow, multiplied by a variable multiple reflecting risk and opportunity. Factors increasing value include multiple therapists and diverse referrals, a strong payer mix, and growth opportunities. Dependence on the owner and inconsistent profitability lower value.