The market for Telehealth and Digital Therapy practices has never been more active. For practice owners in Kansas City, this presents a significant opportunity. The city’s growing digital health ecosystem, combined with wide-scale patient adoption, has created a seller’s market for well-positioned practices. This guide provides a high-level overview of the market, key considerations for a sale, and how to navigate the process to achieve your goals.

Curious about what your practice might be worth in today’s market?

Market Overview

The telehealth landscape in Kansas City is strong and expanding. Post-pandemic, virtual care has become a permanent and vital part of the healthcare system, not a temporary solution. This shift is supported by national trends, with nearly 40% of Americans now having used telehealth. This creates a fertile ground for practice owners considering a sale.

Key Market Drivers in Kansas City

- Digital Health Hub: Kansas City is actively cultivating a reputation as a center for digital health innovation. This creates a robust network and attracts buyers looking to enter or expand in a supportive environment.

- Sustained Demand: Local mental health providers report that teletherapy is here to stay. Patients have come to expect the convenience and accessibility it offers, ensuring a stable demand for your services.

- National Growth: The wider digital therapeutics market is projected to grow at a compound annual growth rate of nearly 28% through 2034. Your practice is part of a high-growth national sector, which makes it attractive to investors.

Key Considerations

Beyond market tailwinds, a potential buyer will look closely at your practice’s operational and regulatory standing. Your story becomes much stronger when you can demonstrate solid fundamentals. This includes strict regulatory compliance, such as ensuring all providers are licensed in Missouri and that your technology platform is fully HIPAA compliant. It also means having a clear handle on your payer mix and reimbursement processes, as this is a key challenge and a source of risk for buyers. Demonstrating how you navigate these complexities, or how you address the local digital divide, can turn a potential concern into a key strength.

The structure of your practice sale has major implications for your after-tax proceeds.

Market Activity

If you search for recent telehealth practice sales in Kansas City, you likely will not find much specific data. This is normal. The sale of private medical practices is confidential, and transaction details are rarely made public. This lack of public information makes it impossible to price your practice based on what a competitor may have sold for.

What We’re Seeing in the Market

- Confidentiality is Standard: Valuations and sale prices are kept private to protect the interests of both the buyer and seller. This is why you need a partner with access to private transaction data.

- Increased Buyer Interest: We see strong interest from a range of buyers, including private equity firms and larger strategic health systems. They are actively seeking well-run digital health platforms to serve as a foundation for growth.

- A Formal Process is Key: Because there are no public price tags, the only way to determine your practice27s true market value is to run a structured, confidential process that creates competitive tension among qualified buyers.

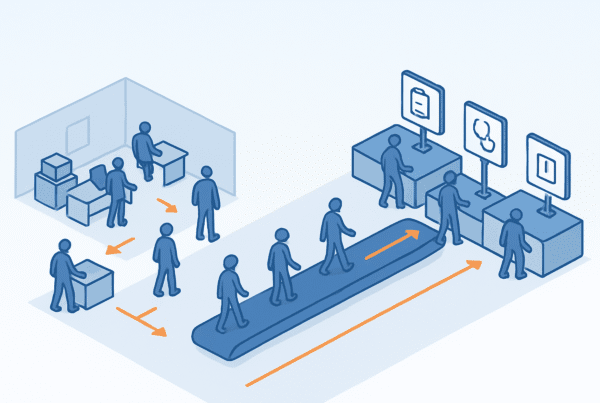

Sale Process

The journey of selling your practice involves several distinct phases, and success often depends on what you do long before a buyer is at the table. The first step is preparation, where you organize your financials, clarify your growth story, and address any operational weaknesses. I tell clients that this is where you build value. The next phase is engaging the market, where potential buyers are confidentially identified and approached. The final stage includes negotiation and due diligence. This is where many deals face challenges, as buyers dig deep into every aspect of your practice. Thorough preparation prevents surprises here and leads to a smoother closing.

Proper preparation before selling can significantly increase your final practice value.

Valuation

Determining your practice’s value is both a science and an art. The basic formula is your Adjusted EBITDA (a measure of your true cash flow) multiplied by a market multiple. However, that multiple is not one-size-fits-all. It is heavily influenced by a buyer27s perception of risk and future opportunity. For a telehealth practice, certain factors are especially important.

| Factor | Why It Matters to a Buyer |

|---|---|

| Technology Stack | A scalable and HIPAA-compliant platform is a major asset. |

| Provider Model | Practices not solely dependent on the owner are seen as less risky. |

| Payer Mix | A healthy mix of stable insurance contracts signals consistent revenue. |

| Growth Profile | A clear, documented plan for acquiring new patients commands a premium. |

Relying on a simple rule of thumb for your specialty can lead to an inaccurate valuation. A professional assessment considers these nuances to tell the full story of your practice’s worth.

A comprehensive valuation is the foundation of a successful practice transition strategy.

Post-Sale Considerations

The closing of the sale is not the end of the story. It is the beginning of your next chapter. Planning for what comes after is just as important as negotiating the deal itself. This involves structuring the sale for optimal tax efficiency to protect your proceeds. It means creating a thoughtful transition planning strategy for your staff and clients to ensure continuity of care and protect the legacy you built. For owners who wish to remain involved, structures like equity rollovers can provide a “second bite of the apple,” allowing you to share in the future success of the new, larger entity. These decisions have long-term personal and financial implications.

Your legacy and staff deserve protection during the transition to new ownership.

Frequently Asked Questions

What is the current state of the Telehealth and Digital Therapy market in Kansas City, MO?

The Telehealth and Digital Therapy market in Kansas City is very active and growing. Kansas City is becoming a hub for digital health innovation, and there is sustained demand for teletherapy services due to patient adoption and convenience. Nationally, the digital therapeutics market is expected to grow significantly, making practices in this sector attractive to buyers.

What operational and regulatory factors should I prepare for when selling my Telehealth practice in Kansas City?

Buyers will look closely at your practice’s operational and regulatory compliance. This means ensuring all providers are licensed in Missouri, your technology platform is HIPAA compliant, and you have clear payer mix and reimbursement processes. Demonstrating how your practice handles these complexities can strengthen your sale proposition.

How are sales and valuations of Telehealth practices in Kansas City typically handled, given the lack of public data?

Sales of Telehealth practices are usually confidential, and details are rarely made public. Valuation is based on a structured and confidential process that creates competitive tension among qualified buyers. Partners with access to private transaction data are essential to accurately price your practice.

What are the key factors influencing the valuation of a Telehealth practice in Kansas City?

Key valuation factors include your technology stack’s scalability and compliance, provider model (especially independence from the owner), payer mix with stable insurance contracts, and a clear growth plan for acquiring new patients. These factors influence buyer perception of risk and opportunity, affecting the market multiple applied to your practice’s Adjusted EBITDA.

What should I consider for after the sale of my Telehealth practice in Kansas City?

Post-sale planning is crucial and involves structuring the sale for tax efficiency, planning for the transition of staff and clients to ensure continuity of care, and protecting the legacy of your practice. For owners wishing to stay involved, options like equity rollovers can allow participation in the future success of the new entity.