The Denver urgent care market is active, presenting a significant opportunity for practice owners considering a sale. This guide offers insight into the current market dynamics, key valuation drivers, and the strategic process for selling your practice. Understanding these elements is the first step toward a successful transition that realizes the full value of the business you have built. If you are thinking about your options, it is a good time to get informed.

Market Overview

The decision to sell your urgent care practice is grounded in market realities. Right now, the national market is exceptionally strong. This creates a favorable environment for practice owners in metro areas like Denver.

National Tailwinds

The U.S. urgent care sector has nearly doubled its footprint in the last decade, growing to over 14,000 centers. Projections show the market size expanding to $40.7 billion by 2027. This national boom is driven by patient demand for convenience and accessibility. It fuels buyer and investor appetite for well-run practices. This high level of interest means more potential buyers for your practice.

Denver’s Local Opportunity

In Denver, your practice meets a clear local need by treating common conditions like upper respiratory infections, UTIs, and other viral illnesses. The rising cost of private health insurance in Colorado, which jumped 20% recently, also pushes more patients toward efficient, lower-cost settings like yours. Your practice is positioned as a solution in the local healthcare landscape.

Key Considerations

A strong market is a great starting point. However, a buyer will look deeper than just location and revenue. They will analyze how you manage patient flow to keep capacity optimized and how you navigate changing reimbursement rates from payers. Your approach to the growing Medicaid population and how you differentiate from other local clinics are also important parts of your practice’s story. Preparing to articulate your strategy in these areas is just as important as having clean financial statements. A well-told story can significantly impact your final valuation.

Every practice sale has unique considerations that require personalized guidance.

Market Activity

The national growth in urgent care directly translates into an active mergers and acquisitions market. While every deal is private, we see clear trends that are relevant for any owner in Denver thinking about a sale.

Here are three key trends we are seeing right now:

-

A Diverse Buyer Pool. It is not just hospitals acquiring practices anymore. Private equity groups, national urgent care chains, and even other large physician groups are actively looking to acquire well-run practices. Each buyer type has different goals, which impacts the kind of deal they will offer.

-

Focus on Profitability. Buyers are looking beyond top-line revenue. They want to see healthy, consistent profitability. We often see small centers listed for 0.7x to 1.3x revenue. However, sophisticated buyers value practices on a multiple of Adjusted EBITDA, which can result in a much higher valuation.

-

The Importance of Timing. With high interest from buyers, the market is competitive. This can work in your favor. Running a structured process to create competitive tension between multiple interested parties is the best way to ensure you get the best price and terms.

Timing your practice sale correctly can be the difference between average and premium valuations.

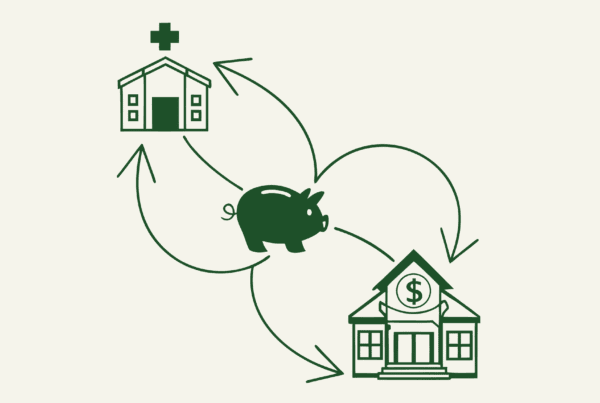

The Sale Process

Selling your practice is a structured process, not a single event. It begins long before the “for sale” sign goes up. The first phase is preparation, where you organize your financial and operational documents to tell a clear and compelling story. Next comes a formal valuation to establish a credible asking price. With a valuation in hand, the marketing phase begins, where your practice is confidentially presented to a curated list of qualified buyers. This leads to negotiations and the selection of a final buyer. The last stage is due diligence, where the buyer verifies all the information you have provided. Proper guidance through each step is key to preventing unexpected issues and keeping the process on track toward a successful closing.

Preparing properly for buyer due diligence can prevent unexpected issues.

Understanding Your Practice’s Value

Your practice is likely worth more than you think, but its value is not based on revenue alone. Sophisticated buyers use a formula: Adjusted EBITDA x a Market Multiple. Adjusted EBITDA starts with your profit but adds back owner-specific expenses like excess salary and other one-time costs to show the practice’s true earning power. This number is then multiplied by a factor that reflects your practice’s quality and risk. A professional valuation is key to defending your price.

Many factors influence your valuation multiple, including:

| Valuation Factor | Why It Matters to a Buyer |

|---|---|

| Scale of Operations | Higher profitability (e.g., over $1M in EBITDA) signals lower risk and fetches a higher multiple. |

| Provider Model | A practice that is not dependent on a single owner is more stable and therefore more valuable. |

| Payer Mix | A healthy mix of commercial insurance and private pay is often viewed as more stable than heavy reliance on one source. |

| Growth Potential | Demonstrable opportunities for growth, such as adding services or opening new locations, can increase the multiple. |

Curious about what your practice might be worth in today’s market?

Post-Sale Considerations

Closing the sale is a milestone, not the finish line. Your role in the transition is a key part of the deal structure and should be negotiated carefully. You may stay on for a period to ensure a smooth handover, or you might transition into a new role. The financial structure also extends beyond the closing day. Many deals include an “earn-out,” where you receive additional payments for hitting performance targets post-sale. Some owners also choose to “roll over” a portion of their equity, retaining a minority stake in the new, larger company. This provides a chance for a second financial win when that larger entity is sold in the future. Planning for these post-sale realities is critical to protecting your legacy and financial outcome.

Your legacy and staff deserve protection during the transition to new ownership.

Frequently Asked Questions

What are the current market conditions for selling an urgent care practice in Denver?

The Denver urgent care market is currently very active and favorable for sellers. The national urgent care sector has nearly doubled in size over the past decade, with the market projected to grow significantly. Locally, rising healthcare costs in Colorado are driving more patients to efficient urgent care settings, creating strong demand for well-run practices.

What factors do buyers consider when valuing a Denver urgent care practice?

Buyers look beyond revenue to factors such as patient flow management, reimbursement navigation, Medicaid population approach, and local differentiation. The valuation typically uses Adjusted EBITDA multiplied by a market multiple, considering scale of operations, provider model, payer mix, and growth potential.

Who are the typical buyers for urgent care practices in the Denver area?

Buyers include hospitals, private equity groups, national urgent care chains, and large physician groups. Each buyer type has different objectives, which affects the deal terms and valuation offered.

What is the typical process for selling a Denver urgent care practice?

The process involves preparation (organizing documents and developing a compelling story), formal valuation, confidential marketing to qualified buyers, negotiations, buyer selection, and due diligence. Proper guidance throughout the process helps prevent issues and ensures a smooth closing.

What should sellers consider for the post-sale phase of their urgent care practice?

Sellers should negotiate their transition role carefully, which might include staying on temporarily or moving to a new role. Financial arrangements can include earn-outs for performance targets and equity rollovers for future gains. Planning for these aspects is important to protect the seller’s legacy and financial interests.