The market for veterinary practices in Tampa is strong. If you are a practice owner, this presents a significant opportunity. But realizing the full value of your life’s work requires more than just a willing buyer. It demands careful preparation, strategic positioning, and a deep understanding of what sophisticated buyers are looking for today. This guide will walk you through the key factors shaping the Tampa market.

Tampa Market Overview

The Tampa Bay area represents a robust and expanding market for veterinary services. The region’s consistent population growth and strong pet ownership trends create a high-demand environment for quality animal healthcare. This drives interest from a wide range of potential buyers, making it an attractive time for practice owners to consider their exit strategy.

Strong Local Demand

Recent transactions in and around Tampa show healthy valuations for established practices. We27ve seen a well-established, multi-doctor practice in the area with over $2.2 million in gross revenue attract significant interest. Another local practice with over $1 million in gross revenue was noted for its 5,000 sq. ft. facility and room for expansion, a key feature for growth-oriented buyers. This activity signals a competitive landscape where well-run practices are prized assets.

A Mix of Potential Buyers

The Tampa market attracts both individual veterinarians looking to own their first practice and large corporate groups funded by private equity. An individual buyer might mean a simpler transition, but a corporate buyer can often offer a significantly higher purchase price and more sophisticated deal structures. Understanding the motivations and constraints of each buyer type is critical to navigating the market effectively.

Key Considerations for Tampa Sellers

When you prepare to sell, buyers will scrutinize every aspect of your business. Focusing on a few key areas beforehand can dramatically impact your final valuation. Here are three critical points for any Tampa veterinary practice owner to consider:

-

Your Financial Story. Buyers look past simple revenue. They want to see healthy client spending, reflected in an Average Transaction Charge (ATC) ideally over $150. More importantly, they will calculate an Adjusted EBITDA to understand the practice27s true profitability. This means normalizing expenses like your personal salary or one-time equipment purchases.

-

The Real Estate Factor. If you own your practice’s property, the rent you pay yourself is a major consideration. If you are paying below-market rent, a buyer will adjust this expense upwards, which lowers your practice’s profitability and, therefore, its valuation. It is important to assess this from a buyer’s perspective.

-

Operational Strength. Is your practice dependent on you alone, or do you have associate veterinarians who will stay through a transition? A practice that can run successfully without its owner is a less risky, and therefore more valuable, asset.

Current Market Activity

The national trend of consolidation in the veterinary industry is very active in Florida. We are seeing private equity groups and large strategic buyers compete for well-run practices, which has pushed valuations to historic highs. This competition creates a seller’s market, but only for those who are properly prepared.

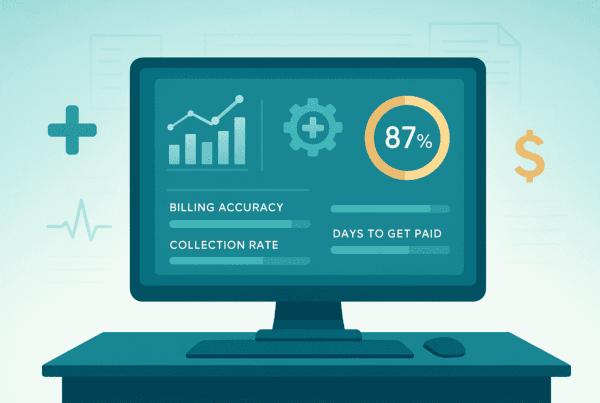

Buyers are not using simple rules of thumb, like a percentage of gross revenue. Instead, they are using a multiple of Adjusted EBITDA. The strength of your practice determines the multiple.

| Practice Profile | Typical EBITDA Multiple |

|---|---|

| Smaller, Solo-Doctor Practice | 4.0x – 6.0x |

| Multi-Doctor, Established Practice | 6.0x – 9.0x |

| Platform-Ready, High-Growth Practice | 9.0x – 13.0x+ |

This data shows that a practice’s value is heavily tied to its scale, staff structure, and growth potential. Understanding where your practice fits is the first step toward a successful sale.

The Path to a Successful Sale

Selling a practice isn’t an event. It’s a structured process that unfolds over several months. While every deal is unique, the journey generally follows a clear path. Running this process correctly protects your confidentiality and creates the competitive tension needed to achieve a premium valuation.

- Preparation and Strategy. This is where we work with owners 1-2 years before a sale. We analyze financials, operations, and market positioning to build a compelling growth story. This directly addresses the objection, “I don’t want to sell right now.” The best time to prepare is when you are not in a rush.

- Valuation. We conduct a thorough valuation to establish a clear understanding of your practice’s worth based on its Adjusted EBITDA and current market multiples.

- Confidential Marketing. We identify and approach a curated list of qualified buyers without revealing your practice’s identity. We frame the opportunity in a way that attracts the right kind of interest.

- Negotiation and Offers. We manage initial offers, facilitate negotiations, and help you select a partner who aligns with your financial and personal goals.

- Due Diligence and Closing. This is where many deals face challenges. We manage the flow of information, anticipate buyer requests, and work with your legal team to navigate the final steps toward a smooth closing.

How is a Practice Really Valued?

A practice27s valuation is not based on what you have put into it. It is based on its future potential in the hands of a new owner. Sophisticated buyers look at one primary metric to determine value: Adjusted EBITDA.

Beyond the Formula

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. But Adjusted EBITDA is the number that truly matters. It normalizes your financials by adding back owner-specific perks (like a vehicle lease) and adjusting your salary to a market rate. This calculation reveals the true cash flow of the business, which is what a buyer is purchasing. A practice with messy books or unadjusted financials is often significantly undervalued.

What Buyers Look For

The final valuation is your Adjusted EBITDA multiplied by a number, the “multiple.” Several factors influence this multiple:

* Scale: Practices with higher EBITDA are less risky and command higher multiples.

* Provider Reliance: A practice driven by associate vets is more valuable than one dependent on a single owner.

* Growth Profile: Demonstrating a clear path for future growth, like space for expansion or opportunities for new services, will earn a premium valuation.

Life After the Sale

The closing of the sale is not the end of the story. It is the beginning of your next chapter. Planning for your transition is just as important as planning for the sale itself. A well-structured deal protects not only your financial future but also your legacy.

- Protecting Your Team. For many owners, ensuring their long-time staff is taken care of is a top priority. This can be written into the purchase agreement, ensuring job security and a smooth cultural transition.

- Defining Your New Role. Do you want to walk away completely, or do you want to continue practicing for a few more years without the stress of management? Structuring the right post-sale role is key to your happiness.

- The Second Bite of the Apple. Many deals, especially with private equity, involve “rolling over” a portion of your sale proceeds into equity in the new, larger company. This allows you to benefit from the company’s future growth and get a second payout when the larger entity is sold again.

- Managing Your Proceeds. The structure of your sale has major implications for your after-tax proceeds. Planning ahead with an advisor can help you choose a structure that maximizes what you keep.

Frequently Asked Questions

What makes the Tampa Vet & Animal Health market attractive for practice owners looking to sell?

The Tampa Bay area has a robust and expanding veterinary market driven by population growth and strong pet ownership trends. This creates high demand for quality animal healthcare, attracting diverse buyers and making it an opportune time for owners to consider selling.

Who are the typical buyers for veterinary practices in Tampa, FL?

Buyers range from individual veterinarians wanting to own their first practice to large corporate groups funded by private equity. Individual buyers may offer simpler transitions, while corporate buyers often propose higher purchase prices and complex deal structures.

How is a veterinary practice valued in Tampa?

Valuation primarily depends on Adjusted EBITDA, which normalizes earnings by adjusting owner perks and salaries to market rates. The multiple applied to EBITDA varies by practice scale and characteristics, usually ranging from 4.0x to over 13.0x for high-growth, platform-ready practices.

What key factors should Tampa veterinary practice owners focus on before selling to maximize their valuation?

Owners should focus on three main areas:

– Financial health with strong client spending and adjusted EBITDA

– Real estate considerations, particularly the impact of rent paid if the property is owner-owned

– Operational strength including presence of associate vets and ability to run practice without the owner, reducing transition risk.

What should sellers expect during and after the sale process of a Tampa veterinary practice?

The sale is a multi-stage process including preparation and strategy, valuation, confidential marketing, negotiation, and due diligence. After closing, sellers often focus on protecting their team, defining post-sale roles, managing proceeds tax efficiently, and may have opportunities for equity rollover in the new ownership company.