Your medical practice should be profitable. Not just surviving, but thriving financially while delivering excellent patient care.

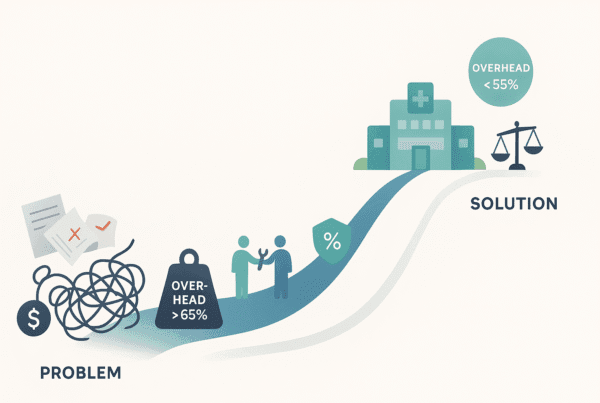

The problem? Most practice owners leave money on the table every single day. Inefficient billing processes drain revenue. Outdated payer contracts cost you thousands monthly. Overhead expenses quietly grow year after year.

This guide shows you proven methods that increase profitability across medical practices. These strategies help practices achieve 20-35% EBITDA margins and command premium valuations when they’re ready to sell.

What Methods Actually Increase Profitability in Your Practice?

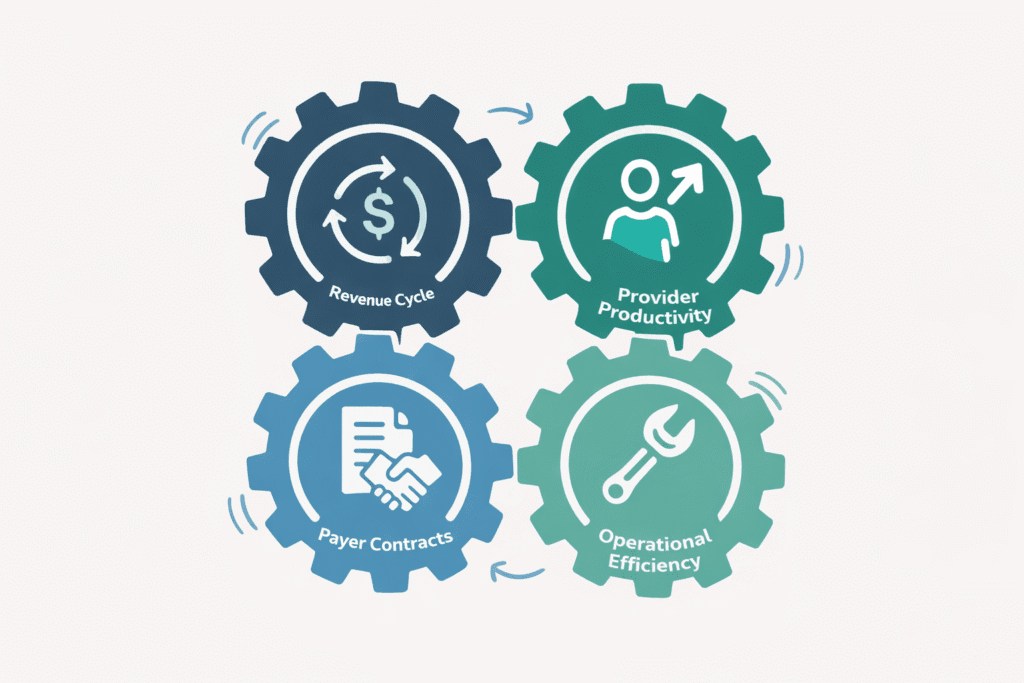

You have four core areas where you can drive real profitability gains. Each one directly impacts your bottom line.

Revenue Cycle Optimization should be your first priority. Most practices lose 2-5% of their gross revenue to preventable billing errors, claim denials, and poor follow-up. By tightening your revenue cycle management, you capture revenue you’re already earning but not collecting.

Provider Productivity determines how much your practice can earn per day. This isn’t about rushing patients or cutting corners on care. It’s about removing administrative obstacles that keep your providers from working at the top of their license. When your physicians spend less time on paperwork and more time seeing patients, everyone wins.

Payer Contract Negotiation represents your biggest missed opportunity. You signed those contracts years ago. Your patient volume has grown. Your quality metrics have improved. But you’re still accepting the same reimbursement rates.

Renegotiating contracts every 2-3 years can increase revenue by 5-15% without seeing a single additional patient.

Quick Win: Schedule a contract review with your top three payers this quarter. Most practice owners haven’t renegotiated in 3+ years and are leaving significant money on the table.

Operational Efficiency cuts costs without cutting quality. Better supply chain management, smarter staffing, and improved workflows create compound margin improvements across multiple areas.

What Are the 4 Methods to Increase Revenue?

You can grow practice revenue through four distinct approaches. The best strategy for your practice depends on your current capacity and market position.

Can You Expand Your Patient Volume?

Growing your patient base works when you have existing capacity in your schedule. Focus on marketing that actually works through SEO and local search to bring patients actively looking for your services. Patient experience that drives referrals turns happy patients into your best marketing channel. Reduced wait times prevent patients from going to your competitors when they can’t get timely appointments.

Should You Add New Service Lines?

Adding complementary services lets you capture more revenue from your existing patient base. Look for services that meet three criteria. Your patients actually need them, your providers have the expertise to deliver them, and they integrate smoothly into your current workflows. Whether it’s adding imaging capabilities, offering specialty procedures, or developing a concierge option, the right service line can boost revenue by 15-25%.

Are You Maximizing Reimbursement for Current Services?

This is the fastest way to increase revenue. You’re already providing the services. You just need to get paid properly for them. Coding accuracy ensures you capture all billable elements of each visit. Documentation completeness prevents downcoding and lost revenue. Contract optimization ensures you’re being paid fairly compared to market rates. Practices that implement systematic coding audits and documentation training typically see 5-15% revenue increases.

What Revenue Sources Beyond Patient Care Make Sense?

Diversifying revenue protects you from reimbursement cuts in any single area. Value-based care contracts reward outcomes rather than volume. Clinical research participation, telemedicine services, and retail offerings like medical-grade products create multiple revenue streams that deliver higher margins than traditional fee-for-service care.

What Are the 4 Levels of Profitability?

Understanding where profit shows up in your practice helps you identify the highest-impact improvement opportunities.

| Profitability Level | What It Shows | Healthy Range | What It Reveals |

| Gross Revenue | What you charge before adjustments | Varies by specialty | Starting point only |

| Net Revenue | What you actually collect | 40-60% of gross charges | Contract effectiveness |

| Operating Profit (EBITDA) | True operational performance | 20-35% margins | Management quality |

| Net Profit | Bottom line after all expenses | Varies significantly | Actual ownership return |

Gross Revenue is your starting point but matters less than you think. It doesn’t account for what you actually collect or what it costs to run your practice.

Net Revenue shows what you actually collect after contractual adjustments and write-offs. The gap between gross and net revenue reveals how well you’re managing payer contracts and how effective your revenue cycle process is.

Operating Profit (EBITDA) shows your practice’s operational profitability before interest, taxes, depreciation, and amortization. This number determines your practice valuation if you ever decide to sell. Healthy practices achieve EBITDA margins of 20-35%. Understanding EBITDA explained for physicians helps you optimize this critical metric.

Important: EBITDA below 20% suggests serious operational inefficiencies. Above 35% positions you for premium valuations when selling.

Net Profit accounts for everything including debt service, taxes, and depreciation. This is the actual financial return you get from practice ownership.

How Do You Improve Margins Without Hurting Patient Care?

The best profitability strategies enhance both financial performance and patient care. They’re not mutually exclusive.

Technology investment pays off through reduced costs and improved care quality. EHR systems with coding assistance reduce documentation time and improve coding accuracy. Automated appointment reminders cut no-show rates by 20-30%. Practice management software streamlines billing and reduces claim denials. The right technology requires upfront investment but typically delivers 3-5x ROI through ongoing efficiency gains.

Staff optimization means everyone works at their highest level. When medical assistants handle rooming and basic documentation, nurses focus on clinical support, and administrative staff manages scheduling and billing, your providers can see more patients without feeling rushed. This isn’t about working people harder. It’s about ensuring everyone uses their full skillset.

Supply chain management deserves more attention from practice owners. Join group purchasing organizations for better pricing. Standardize commonly used supplies. Implement basic inventory controls. These steps typically reduce supply costs by 15-20% annually.

Patient experience drives profitable growth by turning satisfied patients into your best marketing channel. They return for ongoing care, refer friends and family, and leave positive online reviews that attract new patients. The patient experience you deliver today determines your marketing costs tomorrow.

What Profitability Metrics Should You Monitor?

Tracking the right numbers lets you spot problems early and make data-driven decisions.

Collection Rate measures how much of your net collectible revenue you actually receive. Best-in-class practices achieve 95%+ collection rates. Below 90% signals serious revenue cycle problems that need immediate attention.

Days in Accounts Receivable shows how quickly you convert services into cash. Target 35 days or less. Above 50 days suggests billing inefficiencies or payer issues requiring immediate attention.

Provider Productivity tracks revenue per provider or visits per provider per day. Compare your numbers to specialty benchmarks. Significant gaps indicate opportunities to optimize provider time and workflow efficiency.

Operating Expense Ratio calculates total operating expenses as a percentage of revenue. Healthy practices maintain this between 60-75%. Lower percentages mean better profitability and stronger practice value.

Revenue Per Visit shows average revenue per patient encounter. Declining revenue per visit might indicate coding problems, payer mix shifts requiring contract renegotiation, or service mix changes affecting profitability.

Action Item: Pull these five metrics monthly. Set up automated reports from your practice management system to track trends over time.

How Does Profitability Impact Your Practice Value?

If you’re thinking about selling your practice or bringing in partners, profitability directly determines your valuation.

Buyers typically pay 4-8 times EBITDA. Improving your EBITDA by $100,000 can increase practice value by $400,000-$800,000. That makes profitability optimization one of your highest-leverage activities when preparing to sell. Learn more about how to value a medical practice in 2025.

Consistent revenue matters as much as revenue size. Buyers value predictable profitability. Demonstrating consistent EBITDA growth over three years strengthens your negotiating position significantly. They want to see that your profitability isn’t a one-time fluke.

Operational transferability affects multiples significantly. Can your practice maintain profitability after you leave? Practices with systematized operations, strong management teams, and profitability that doesn’t depend solely on the owner’s relationships command premium valuations because buyers see lower risk. Our practice value enhancement strategies guide covers how to build this transferability.

What Profitability Mistakes Cost Practice Owners Money?

Avoid these common pitfalls that erode margins and reduce practice value.

Ignoring payer contract reviews costs you money every month. You signed those contracts years ago. Your patient volume has grown. Your quality metrics have improved. But you’re still accepting the same rates. Schedule contract reviews every 2-3 years minimum.

Tolerating revenue cycle inefficiencies creates compound problems. A 2% increase in claim denials, slightly longer A/R days, and decreased collection rates each seem minor. Together they create significant profitability drag that accumulates over time.

Warning: Small revenue cycle problems compound quickly. A practice losing 3% to denials and collecting 92% instead of 96% loses $180,000 annually on $3M in revenue.

Underinvesting in staff development drives costly turnover. Recruitment expenses, training time, and lost productivity add up quickly. Well-trained, engaged staff members drive profitability through efficiency, quality, and patient satisfaction.

Letting overhead creep happens when practice owners get busy and don’t scrutinize expenses. Small increases across multiple categories accumulate into substantial overhead growth that erodes margins year after year.

How Do You Actually Implement These Strategies?

Successful profitability enhancement requires systematic implementation, not sporadic efforts. Start by analyzing your data through financial statements, practice management reports, and key metrics. Identify where you’re losing money or leaving revenue on the table. Areas showing the largest gaps compared to industry benchmarks deserve priority attention. Our benchmarking practice financials guide helps you understand where you stand.

Focus on high-impact changes rather than trying to fix everything at once. Select 2-3 initiatives that will deliver the most significant profitability improvement with reasonable implementation effort. Successfully completing a few major initiatives beats starting many projects and finishing none.

Engage your team in the process. Your staff members see operational inefficiencies and patient concerns that impact financial performance. Creating ownership at all levels drives better results than top-down mandates.

Monitor progress monthly through metric reviews and quarterly profitability assessments. This lets you adjust strategies that aren’t delivering expected results and accelerate those that are working well.

Consider professional guidance for complex profitability challenges. Healthcare consultants and M&A advisors provide objective assessments and specialized expertise that accelerates improvement efforts and maximizes results.

Are You Ready to Improve Your Practice Profitability?

Improving practice profitability doesn’t happen overnight. But systematic attention to revenue optimization and cost management delivers measurable results that compound over time.

Whether you’re planning to sell your practice in the coming years or simply want to maximize your return on ownership, these profitability enhancement methods position your practice for financial success. The most valuable practices demonstrate consistent profitability through efficient operations, strong revenue cycle management, and strategic positioning.

With private equity investing heavily in healthcare, top-tier practices are commanding premium valuations. Optimizing your practice for value today can have a massive financial payoff when you’re ready to sell.

If you’re exploring ways to maximize your practice value or preparing for a potential sale, SovDoc specializes in helping practice owners optimize profitability and achieve premium valuations through healthcare M&A advisory services. Connect with an expert now.