The market for dermatology practices is booming. With buyer demand intensifying and valuations reaching historic highs, 2025 presents a critical window of opportunity for practice owners.

But in this competitive landscape, only well-prepared practices will command premium valuations.

Key Stat: Large dermatology platforms are commanding 12-15x EBITDA multiples, with over 35 private equity-backed buyers actively competing for acquisitions.

This guide breaks down what drives value in today’s market and how you can position your practice to achieve an exceptional outcome.

How Are Dermatology Practices Valued?

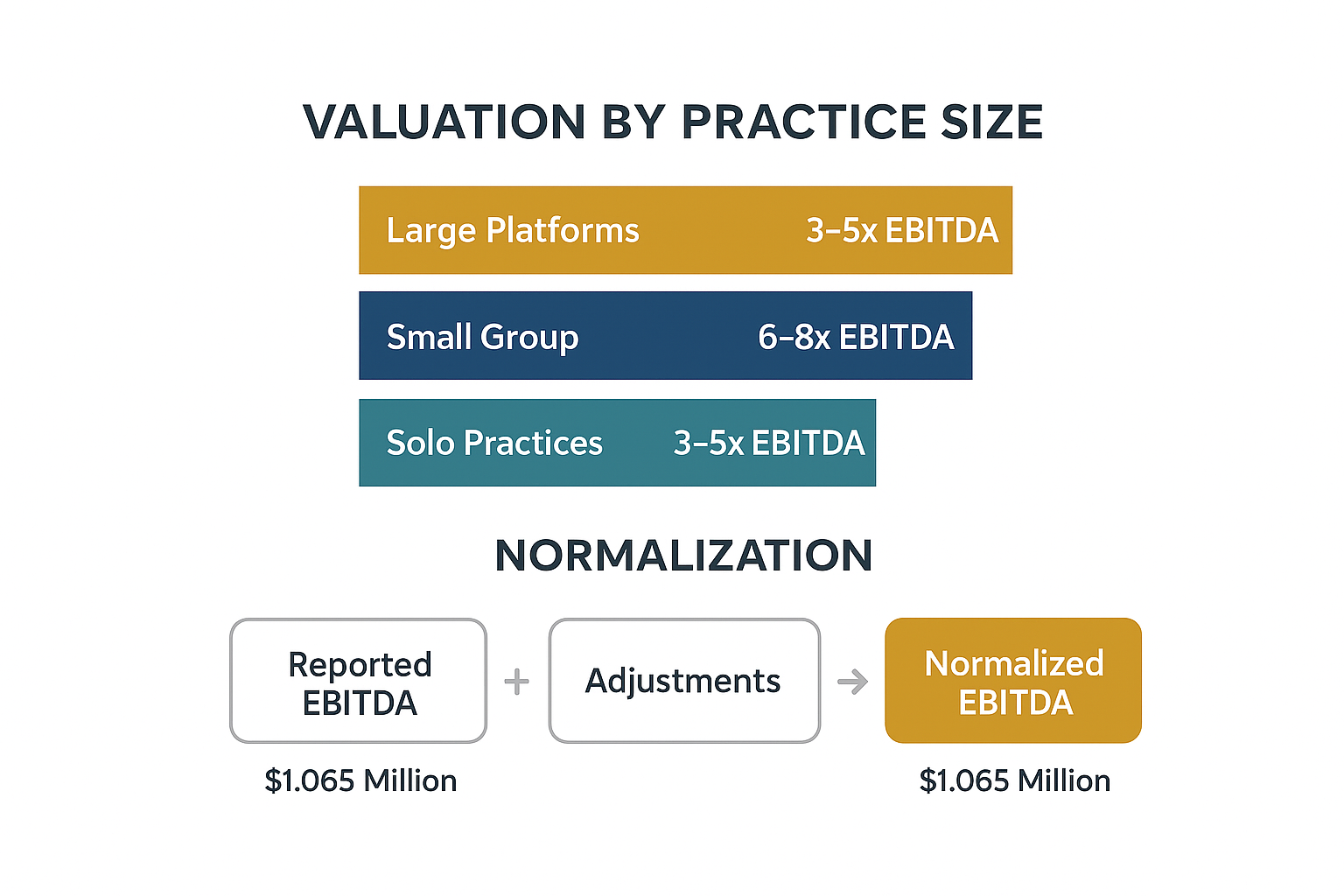

Valuation isn’t a mystery; it follows a clear formula based on size, profitability, and operational maturity. As explained in our complete guide on how to value a medical practice, the gold standard is a multiple of your Normalized EBITDA(Earnings Before Interest, Taxes, Depreciation, and Amortization, adjusted for one-time expenses and owner-specific costs to show true earning power).

The valuation multiples assigned by buyers break down by medical specialty and, most importantly, scale. Here is how valuations typically differ by practice size:

| Practice Size | Typical EBITDA Multiple |

| Solo Practice | 3-5x |

| Small Group Practice | 4-7x |

| Large Integrated Platform ($10M+ EBITDA) | 12-15x |

The Power of Normalization: A practice with a reported EBITDA of $1.065 million can achieve a normalized EBITDA of $1.202 million after adjustments—significantly increasing its final valuation by unlocking hidden value.

Your Revenue Mix is the Foundation of a Premium Valuation

Your service mix is a foundational element of a premium valuation. Buyers analyze the stability of medical dermatology, which provides a recurring revenue base generating approximately $1.3 million per full-time physician at a 24.9% operating margin. In contrast, cosmetic dermatology commands premium valuations due to its higher, self-pay characteristics, producing an impressive $1.8 million per FTE with a 27.1% operating margin.

The 2025 Market: Who is Buying and Why?

Despite a slowdown in other healthcare sectors, dermatology M&A remains robust, with 77 transactions in 2023—up from 54 in 2021. This reflects the trends seen in recent PE acquisitions in healthcare and underscores why private equity is investing so heavily in healthcare.

The buyer landscape, often driven by healthcare roll-up strategies, is composed of two main groups. The first is private equity “platform” buyers, which are PE groups making their first major investment in dermatology to build a new, scalable platform from the ground up. The second group consists of established dermatology platforms, which are larger, existing groups looking to expand their footprint by acquiring “add-on” practices.

Who Pays the Most? Private equity groups seeking a “platform” practice often offer the highest valuations and most favorable deal structures, including 70-90% cash at closing and significant rollover equity opportunities.

Geographically, buyer demand is highest in Sunbelt states and suburban major metropolitan areas. Markets with growing and aging populations, high disposable incomes, and favorable commercial payer mixes are especially attractive.

Key Forces Driving Practice Sales in 2025

A confluence of factors is creating a strategic urgency for independent practice owners to consider a sale. These include the increasing squeeze from regulations, a significant staffing challenge, and rising competition from new market entrants like retail clinics and medical spas. Furthermore, the motivations for selling have evolved beyond retirement, with many younger owners seeking strategic partners to de-risk and accelerate growth.

How to build a High-Value Practice

The highest valuations don’t happen by accident. They are the result of strategic preparation across several key areas, including optimizing operations, perfecting financials, investing in smart technology, preparing for M&A early, and defining a clear strategic position in the market. Each of these practice value enhancement strategies is a pillar for maximizing your outcome.

Start Now: The ideal M&A preparation timeline is 5-7 years before a potential sale. This gives you the runway to properly prepare your medical practice for sale by optimizing every aspect of the business.

Don’t Wait for Opportunity, Create It

The dermatology M&A market in 2025 offers a powerful combination of strong buyer demand, attractive valuations, and compelling industry tailwinds.

However, achieving a premium valuation requires understanding exactly what buyers are looking for and strategically preparing your practice to meet that criteria. With strategic execution and expert guidance from the right M&A advisory team, 2025 could be the optimal time to achieve your financial and professional goals.

Ready to understand the true value of your practice? The market is moving fast. SovDoc specializes in healthcare M&A, providing expert guidance to ensure practice owners achieve optimal outcomes. Contact us today for a confidential, no-obligation valuation consultation to start the conversation.