Selling your oncology practice in Vermont requires understanding a unique and evolving market. With a trend toward consolidation, the opportunity for a successful exit has never been more significant. However, a premium valuation depends on more than just good timing. It requires strategic planning long before you decide to sell. This guide provides insights to help you navigate the process and realize your practice’s full value.

Market Overview

The healthcare market in Vermont is experiencing a significant shift. Understanding these dynamics is the first step toward a successful sale.

A Consolidating Landscape

Like the rest of the country, Vermont is seeing a move away from physician-owned practices toward hospital and health system employment. For independent oncology practice owners, this is not a threat. It is a clear signal of demand. Acquirers are actively looking for established practices to expand their footprint, creating a favorable environment for sellers who are properly prepared.

A Niche, In-Demand Specialty

With only about 67 oncologists in the entire state, your practice represents a rare and valuable asset. Buyers, whether they are regional health systems or private equity groups, understand that acquiring an existing, trusted oncology practice is far more efficient than building one from the ground up. This scarcity gives you leverage, provided your practice is positioned correctly.

Key Considerations for Your Practice

Beyond broad market trends, a potential buyer will look closely at the specific operations of your practice. The strength and diversity of your referral networks are critical. They demonstrate stability and a sustainable patient base. Your payer mix also plays a large role. A healthy balance of commercial insurance versus government payers can significantly affect valuation. Finally, consider how dependent the practice is on you as the owner. A practice with associate physicians and well-defined operational systems is often seen as less risky and, therefore, more valuable to an acquirer. Addressing these areas before a sale is a key part of preparation.

Market Activity and Buyer Interest

Buyer interest in the Vermont oncology space is strong, but it is also specific. Both strategic acquirers like health systems and MSO-backed financial buyers are looking for well-run, profitable practices that can be integrated smoothly into a larger platform. The timing for a sale can be the difference between an average outcome and a premium one.

We see that today’s buyers are prioritizing a few key things:

- A Stable Foundation: Practices with a consistent patient base, proven referral streams, and strong community reputations are highly attractive.

- Operational Health: Buyers want to see clean financial records that clearly show profitability. They also look for efficient scheduling, billing, and administrative systems.

- A Path for Growth: A practice that can demonstrate clear opportunities for future growth, either through adding ancillary services or expanding its catchment area, will command a higher valuation.

The Sale Process

Selling your practice is not a single event. It is a multi-stage process that requires careful management. It begins with a professional valuation to understand what your practice is truly worth. Next, we use a confidential process to identify and approach a curated list of qualified buyers without alerting your staff, patients, or competitors. Once interest is established, the buyer will conduct due diligence, a thorough review of your financial and operational records. This is often the most challenging phase and where many deals encounter problems if not managed correctly. The final stage involves negotiating the terms of the sale to ensure they align with your financial goals and personal legacy.

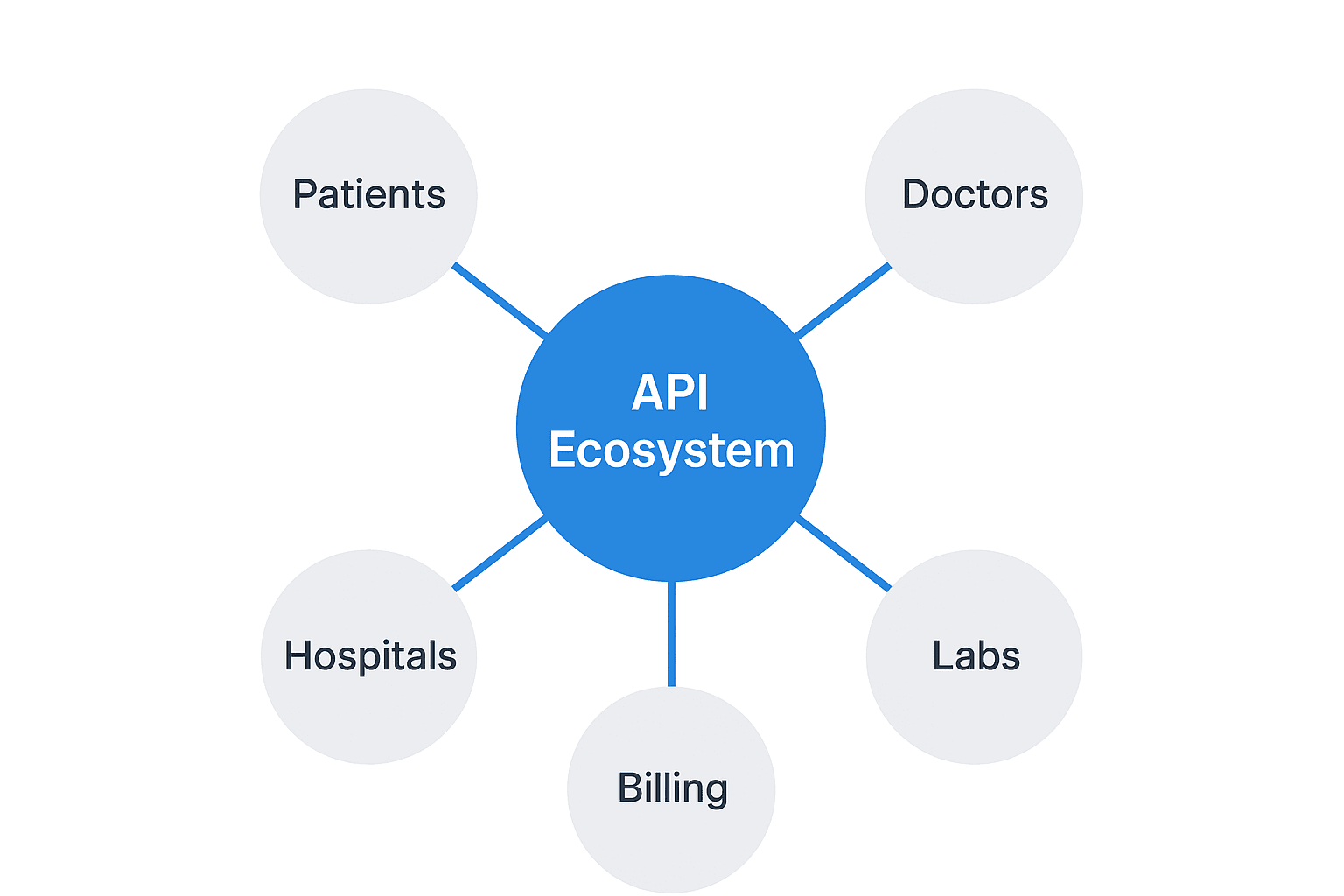

How Your Practice Is Valued

A common mistake is valuing a practice based on a simple percentage of revenue. Sophisticated buyers do not think this way. They value your practice based on its profitability, specifically its Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This figure represents your practice’s true cash flow, adjusted for any owner-specific or one-time expenses. That Adjusted EBITDA figure is then multiplied by a number, the “multiple,” to arrive at your practice’s enterprise value. This multiple is not fixed. It changes based on risk and opportunity.

| Factor | Impact on Valuation |

|---|---|

| Provider Model | Multi-provider practices command higher multiples than solo-physician models. |

| Payer Mix | Strong contracts with commercial payers are valued more than heavy government reliance. |

| Growth Profile | A documented history of growth and a clear path for future expansion increase value. |

| Referral Sources | Diverse and stable referral networks reduce perceived risk for a buyer. |

Post-Sale Considerations

The day the deal closes is a beginning, not an end. A successful transition plan considers what happens after the sale. Will you continue to work in the practice, and for how long? How will your dedicated staff be treated and retained under new ownership? Great care should be taken to find a partner who respects the culture you have built. The structure of your deal is also critical. An earnout may provide future payments based on performance, while rolling over a portion of your equity can provide a second financial benefit when the new, larger entity is sold again years later. Protecting your legacy and financial future requires thinking about these details from the start.

Frequently Asked Questions

What makes the Vermont oncology practice market unique for sellers?

Vermont’s oncology market is unique due to its consolidation trend with only about 67 oncologists statewide, making these practices rare and valuable. Buyers are actively seeking established practices to expand, creating favorable selling conditions for prepared owners.

How should I prepare my oncology practice for sale to maximize its value?

Preparation involves strategic planning focusing on strengthening referral networks, diversifying payer mix, having associate physicians, and implementing robust operational systems to lower perceived risks for buyers and increase valuation.

What key factors do buyers in Vermont look for when acquiring an oncology practice?

Buyers prioritize a stable foundation with consistent patient flow and referrals, clean financial records demonstrating profitability, efficient operations, and clear growth opportunities such as expanding services or catchment area.

How is the value of an oncology practice in Vermont determined?

Value is based on Adjusted EBITDA, which is the practice’s true cash flow adjusted for one-time or owner-specific expenses, multiplied by a market multiple. This multiple varies based on provider model, payer mix, growth profile, and referral sources.

What should I consider after selling my oncology practice?

Post-sale, consider your role transition, staff treatment under new ownership, deal structure including earnouts or equity rollover, and choose a partner that respects your practice culture to protect your legacy and financial future.