Selling a specialized medical practice like yours in a dynamic market like Phoenix requires more than just a “For Sale” sign. It’s about understanding market trends, accurately valuing your life’s work, and navigating a complex process to protect your legacy. Curious about what your practice might be worth in today’s market?

Market Overview

The decision to sell is often tied to market conditions. Right now, the outlook for neurological rehabilitation is strong, both nationally and within Arizona.

A Growing National Trend

The U.S. neurorehabilitation market is not just stable; it’s expanding rapidly. Valued at approximately $700 million in 2023, it is projected to more than triple, exceeding $2.4 billion by 2033. This significant growth attracts a wide range of buyers, from private equity firms to large healthcare systems, who are actively looking to invest in well-run practices. This trend signals a period of high demand for specialties like yours.

The Phoenix Landscape

Here in Phoenix, the demand is clear. The city is home to major, well-respected centers like the Barrow Neurological Institute and Dignity Health. While this means there is competition, it also confirms a robust and mature healthcare ecosystem with a deep need for neurological rehabilitation services. For an independent practice owner, this presents a unique opportunity. A well-positioned practice can attract buyers looking for a strategic entry or expansion into this thriving local market.

3 Key Considerations for Your Phoenix Practice

A strong market is a great start, but a successful sale depends on the specifics of your practice. Buyers are looking for more than just profitability. They are buying a sustainable business. Here are three areas they will scrutinize.

-

Define Your Unique Niche. In a market with large players, what makes your practice stand out? Perhaps you use advanced technology like robotic therapy or virtual reality tools. Maybe you have a unique specialization in a specific condition or have built an outstanding reputation within a certain patient community. Clearly articulating this value proposition is critical.

-

Showcase Your Referral Network. Who sends you patients? A diverse and stable base of referral sources is a major asset. Buyers see this as a sign of a healthy, integrated practice with predictable patient flow. Documenting these relationships and patient volumes from each source provides concrete evidence of your practice’s standing in the Phoenix medical community.

-

Organize Your Operations. A potential buyer wants to see a practice that runs smoothly. This means having a clear staffing structure, well-maintained equipment, and organized financial records for the last 3-5 years. A practice that is easy to transition into is far more attractive and can command a higher value. Preparing this information in advance prevents surprises during due diligence.

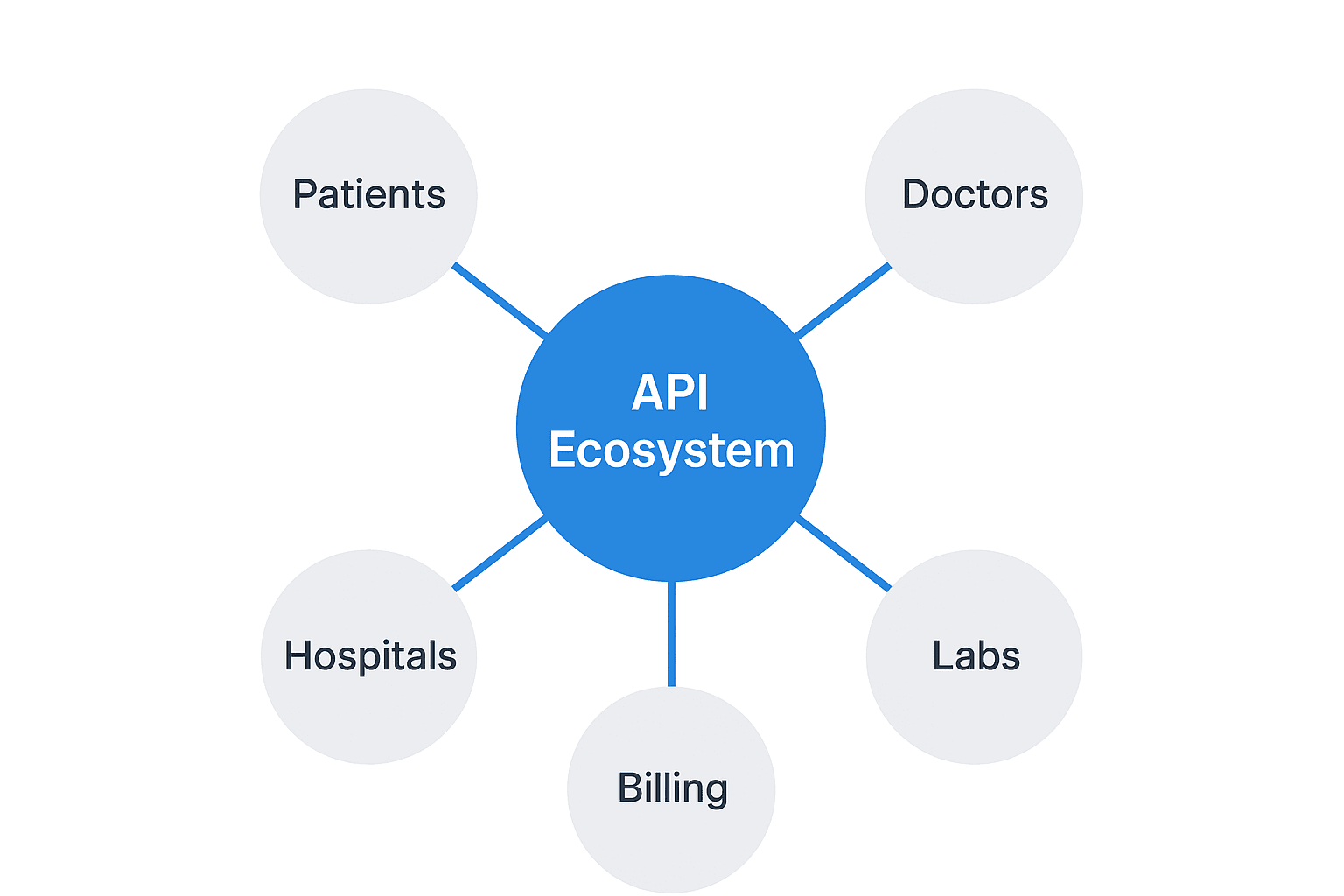

Understanding Market Activity and Buyer Types

The buyers active in the Phoenix area are diverse, each with different goals. Understanding who they are can help you position your practice effectively. We are seeing two main categories of buyers showing significant interest in neurological rehabilitation practices.

Strategic Acquirers

These are often larger local or regional healthcare groups and hospital systems. Their goal is to expand their service lines or geographic footprint. When they look at your practice, they are not just buying your cash flow. They are buying your location, your patient list, and your team’s expertise to integrate into their existing network. Selling to a strategic buyer can be a great option for owners who want to see their practice become part of a larger clinical mission.

Financial Buyers

This category is primarily made up of private equity (PE) firms. A PE buyer is focused on the business fundamentals: profitability (specifically Adjusted EBITDA), operational efficiency, and potential for growth. They are looking for well-managed practices that can serve as a “platform” to acquire other, smaller practices. A partnership with a PE firm can provide significant capital for growth and often allows the selling physician to retain some ownership and continue leading clinically.

The 4 Stages of a Practice Sale

Selling your practice is a structured process. While every deal is unique, the journey generally follows four key stages. Understanding them can help you prepare for what lies ahead.

-

Preparation and Valuation. This is the foundation. It involves collecting financial and operational documents, identifying your practice’s strengths and weaknesses, and getting a professional valuation. This is also the stage where we help owners “normalize” their earnings to show the true profitability of the business to a buyer. The work you do here directly impacts the final sale price.

-

Confidential Marketing. You don’t put a sign on the door. A proper sale process involves creating a confidential information memorandum (CIM) that tells your practice’s story. This is presented to a curated list of qualified, pre-vetted buyers who have signed non-disclosure agreements. The goal is to create a discreet, competitive environment.

-

Negotiation and Due Diligence. Once you receive offers, the negotiation begins. After you sign a non-binding Letter of Intent (LOI) with a preferred buyer, they begin their formal due diligence. This is an intense review of your financials, operations, and legal standing. This stage is where many deals fall apart without proper preparation.

-

Closing and Transition. This final stage involves finalizing the legal purchase agreement and planning for a smooth transition for your patients, your staff, and yourself. A well-defined transition plan is key to protecting your legacy and ensuring the continued success of the practice.

How Your Practice is Valued

A common question we hear is, “What is my practice actually worth?” The answer is more complex than a simple rule of thumb. Sophisticated buyers don’t look at your tax returns. They look at your practice’s true earning power, a metric called Adjusted EBITDA.

This starts with your net income and then adds back interest, taxes, depreciation, and amortization. More importantly, it also adjusts for owner-specific expenses that a new owner wouldn’t incur, like an above-market salary or personal car lease. This paints a much more accurate picture of profitability.

That Adjusted EBITDA is then multiplied by a specific number, or “multiple,” to determine the enterprise value. This multiple isn’t random. It’s determined by several key factors.

| Factor | Lower Multiple | Higher Multiple |

|---|---|---|

| Provider Reliance | Dependent on a single owner | Associate-driven, multi-provider |

| Growth Profile | Stable, but flat growth | Clear path to expansion |

| Payer Mix | High concentration with one payer | Diverse mix of commercial payers |

| Practice Scale | Smaller, single-location | Multi-site or larger revenue |

A comprehensive valuation is the foundation of a successful strategy. It ensures you don’t leave money on the table.

Planning for Life After the Sale

The moment the deal closes is not the end of the journey. A successful exit strategy includes a clear plan for what comes next. How you structure the sale today has major implications for your future. Here are a few things to consider.

-

Your Financial Future. The structure of your sale directly impacts your after-tax proceeds. Planning for this in advance is critical. Working with an advisor to structure the deal in a tax-efficient way can make a significant difference in your net outcome.

-

Your Ongoing Role. Do you want to walk away completely, or would you prefer to stay on for a few years, focusing only on patient care? Some deals, particularly with private equity, involve “rolling over” some of your equity. This means you retain a minority stake in the new, larger company, giving you a potential “second bite at the apple” when that company sells again in the future.

-

Your Legacy. A smooth transition is vital for the continued wellbeing of your patients and staff. A well-designed transition plan, negotiated as part of the deal, ensures continuity of care and protects the team you built. This is a key part of ensuring the practice you spent your life creating continues to thrive.

Frequently Asked Questions

What is the current market outlook for neurological rehabilitation practices in Phoenix, AZ?

The neurological rehabilitation market is strong both nationally and in Phoenix. The U.S. market was valued at about $700 million in 2023 and is expected to more than triple to $2.4 billion by 2033. Phoenix has a robust healthcare ecosystem with major centers like Barrow Neurological Institute, indicating high demand and opportunities for independent practices.

What are the key factors buyers consider when purchasing a neurological rehabilitation practice in Phoenix?

Buyers focus on three main areas: 1) Unique niche or specialization of the practice, such as advanced technology or outstanding community reputation. 2) A strong and diverse referral network indicating a steady patient flow. 3) Well-organized operations including clear staffing, maintained equipment, and thorough financial records for the past 3-5 years.

Who are the typical buyers of neurological rehabilitation practices in Phoenix?

There are two primary types of buyers: Strategic acquirers (like local healthcare groups and hospital systems) who want to expand their services and geographic reach, and Financial buyers (mainly private equity firms) who look for profitable, efficient, and scalable practices to grow through acquisitions.

How is the value of a neurological rehabilitation practice in Phoenix determined?

Practice value is based on Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which reflects true earning power after adjusting for owner-specific expenses. This figure is multiplied by a market-determined multiple influenced by factors like provider reliance, growth potential, payer mix, and practice size to arrive at enterprise value.

What should practice owners plan for after selling their neurological rehabilitation practice?

Owners should plan for their financial future by structuring the deal tax-efficiently, decide their ongoing role—whether to fully exit or stay engaged clinically or financially—and ensure a smooth transition plan is in place to protect their legacy, patients, and staff continuity post-sale.